Will prices continue their downward trend or force the Fed's hand? And speaking of the Fed, officials are out in full force with speeches that could shape rate hike expectations.

Plus, we've got a potential government shutdown and debt ceiling debacle brewing in Washington. Fun times! But the story generating the most buzz is undoubtedly Bitcoin's charge toward $40k amid growing optimism for ETF approval.

Of course, with all those leveraged bets piling up, you have to wonder if there's more pain ahead should that approval fail to materialise. Let's dive in!

TLDR

- Inflation data on Tuesday will likely move markets if it diverges from consensus forecasts.

- Fed speakers could shift rate hike expectations with hawkish commentary.

- Risk of government shutdown looms if debt ceiling/funding deal not reached.

- Bitcoin faces resistance at $38k as the market awaits an ETF decision amid high leverage.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

Macro data to watch this week

This week’s key data is the Inflation data that’s out on Tuesday. The consensus is for a decline in all the data points:- Core Inflation Rate YoY; Previous 4.1%, Consensus 4.0%

- Core Inflation Rate MoM; Previous 0.3%, Consensus 0.3%

- Inflation Rate YoY; Previous 3.7%, Consensus 3.3%

- Inflation Rate MoM; Previous 0.4%, Consensus 0.1%

What we also have a focus on this week is the plethora of Fed-speak. Fed Chair Powell was noticeably more hawkish last week, indicating the Fed is willing to do more if the data remains strong and inflation remains sticky. The higher-for-longer narrative is likely to stay for a long while. Yet, this is simply because if the FED decides to cut rates, that will be seen aiding the Democrats’ election campaign going into the November 2024 Presidential Election. The Fed will likely not cut rates in the first half of 2024 – except if something majorly breaks in the economy or the markets. However, there are hugely differing views amongst top Wall Street firms on rate cuts.

Possible government shutdown + U.S. credit rating downgrade

Once again, this week’s topic is the potential for a U.S. government shutdown come Friday - assuming a deal doesn’t get done. We’re currently just a month from the last time this happened, and the House Speaker at the time, Speaker McCarthy, lost his job due to a loss of confidence over how late a deal was agreed upon. New House Speaker, Johnson, will have a tough battle getting a deal passed that Republicans and Democrats can agree on.Alongside this, the U.S. Credit Rating was downgraded by Moody’s. For now, the markets have brushed this off, as we see U.S. Bond Yields down 0.1% to 0.3%.

Will a Bitcoin ETF be approved this week?

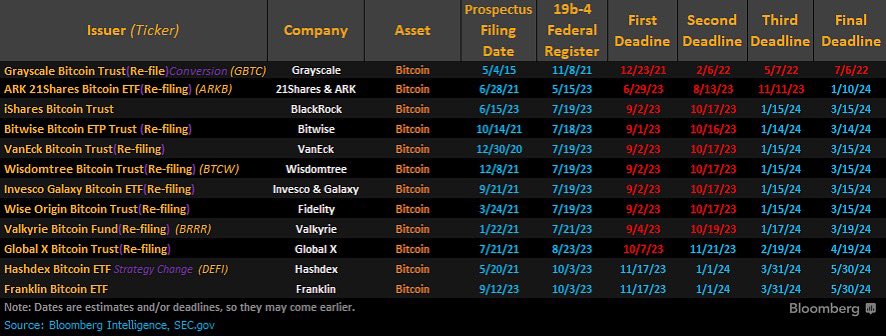

There is a window for several Bitcoin ETFs to be approved this week. However, it’s more likely that many of them get approved simultaneously. The likelihood is that the ETFs won’t be approved this week and will likely be pushed into the end of the year.

Cryptonary’s take

While prices have moved higher drastically in the past 4-6 weeks, the market is overheating. We’re seeing in BTC, along with many major altcoins, that funding rates and open interest are both very high. This shows a high amount of leverage, with a significant bias to be long.On the one hand, you have a build-up of leverage like this, and on the other hand, you have BTC initially rejecting at a major horizontal resistance of $38,000. When you pair this with the hype/positive news of ETF approvals, much of this is now priced in.

So, for prices to go meaningfully higher from here - considering how overheated the market is - it’s likely we’ll need a Spot Bitcoin ETF approval to get this. However, we’re unsure that it will come this week. There is a feeling in the market that it will come this week. Say it doesn’t. BTC has initially rejected into the main resistance at $38,000, and the leverage market is very frothy. This is a recipe for a more meaningful move lower.

Initially, we’d be looking for BTC to test the local support of $35,600.

As always, thanks for reading.

Cryptonary, OUT!