How Fed rate cuts and China’s stimulus are shaping Q4 market momentum

Recent shifts in global policies are setting the stage for what could be a pivotal moment in the markets. The FED’s subtle hints at upcoming rate cuts and China’s unexpected $142 billion stimulus injection are sparking renewed optimism across risk assets, including crypto.

As investors gear up for a potentially bullish Q4, the big question is whether this momentum will hold. With major policy changes in play and U.S. elections on the horizon, there’s a lot at stake. Let's dive into how these developments could drive the next big market moves and what it means for your investment strategy.

In today's report, we'll cover:

- Important macro data.

- FED Speak is opening the door for more Interest Rate cuts.

- Chinese stimulus.

- 'Blue Chip' Meme's leading.

- Cryptonary's Take.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

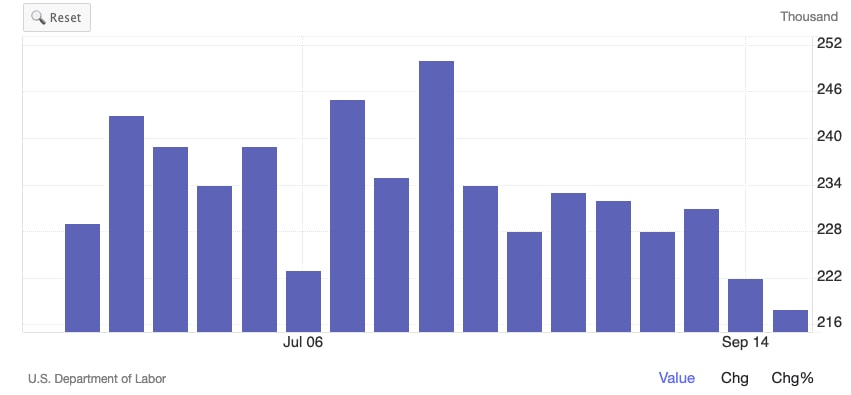

Today's data

Today, the key data points were the GDP Growth Rate and Initial Jobless Claims. GDP came in at 3.0%, well above the prior figure of 1.6% - revised up from 1.4%. This is positive for risk assets as stock prices (risk assets) benefit from a growing economy, and 3.0% is strong in the US.Jobless Claims came in at 218k. The market now has a close focus on the labour market, as a weakening labour market is likely to mean a 'hard landing' (recession). Jobless Claims would be a key signal for this as it shows the number of people claiming unemployment benefits is increasing. However, we can see below that jobless claims have been down-trending over the last few months, i.e., there have been FEWER people claiming unemployment benefits. This shows that the labour market is still more than hanging in there, and therefore, risk assets are responding positively to this.

Jobless claims:

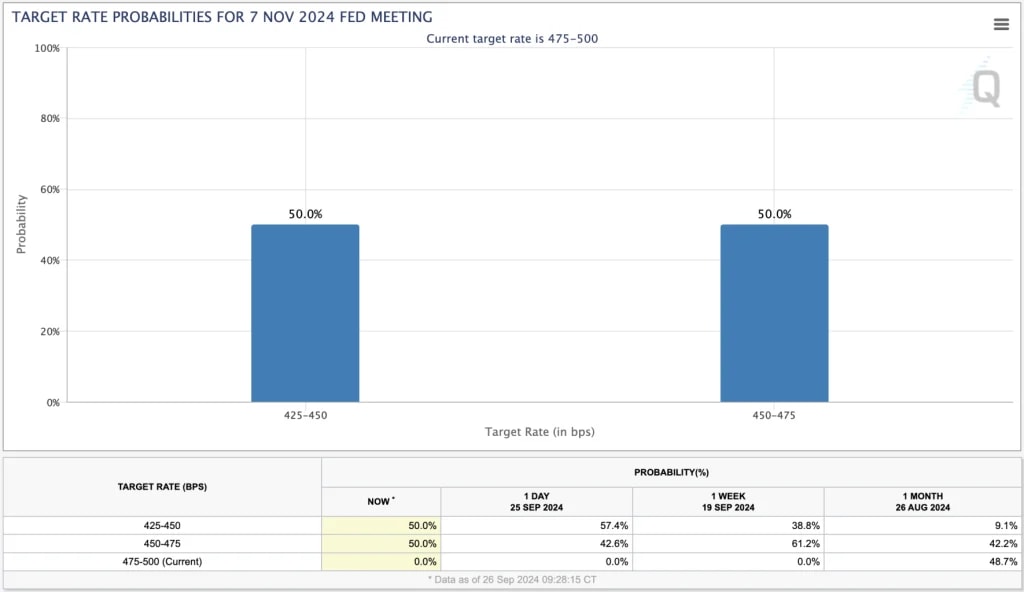

Fed speak opening: the door for more rate cuts

Today, Chair Powell gave Opening Remarks (via pre-recorded video) at the US Treasury Market Conference. This was merely just an introduction, and there wasn't any mention of monetary policy that has been left to other FED speakers this week. On Monday, we had FED members Bostic, Kashkari and Goolsbee speak. All 3 voted for a 50bps cut at last week's FED Meeting, although on Monday, they didn't commit to more 50bps rate cuts at future meetings. However, we have had remarks that the FED 'doesn't want to be behind the curve' and that the current rate is restrictive.With the rate still at 5.00% and inflation closer to 2.5%, the r star (neutral rate) is essentially 150-250bps lower. And, with the labour market showing significant signs of cooling, it does make sense for the FED to potentially front-load rate cuts in a similar way to how they front-loaded rate hikes in 2022. This has led to the market now beginning to price in another 50bps of rate cuts at the November meeting at a 50% chance, having been at a 38.8% chance a week ago and a 9.1% chance one month ago.

Target rate probabilities for the 7th Nov Fed meeting:

Chinese stimulus

Markets have been watching China closely over the past year. This is due to it being somewhat un-investable as it slows, and the government is unwilling to stimulate a slowing economy. With China in danger of missing its official growth target for this year, markets began to expect that the government may look and need to do something more substantial to stimulate the economy and their markets.Over the past few days, this is exactly what has occurred. The Peoples Bank of China has announced monetary and fiscal stimulus, with an injection of $142 billion of capital into the top banks and the poorest households given handouts. Alongside this, the messaging was also that if needed, the PBoC can do more, with the aim of this being to stabilise and stop property prices from falling further, boost its markets and provide necessary fiscal expenditures. This is quantitative easing (QE) from the world's second-biggest economy (or rather, their central bank). This is a huge, multi-month liquidity injection, which risk assets have, of course, reacted extremely positively to.

The summary of this is simple; liquidity is rising, and going to continue rising. This is a COVID-like stimulus from the PBoC - very positive for risk assets over the coming months.

'Blue Chip' meme's leading

If we now turn away from the macro and into the Crypto weeds, we can see that the risk-on sentiment has been reflected in Crypto. Bitcoin itself is breaching the $65k level, which is above the well-known resistance of the short-term holder cost basis at $64,300, a key level to reclaim back above. However, has this risk appetite extended out to the furthest end of the risk curve, and have these assets caught a more meaningful bid? Yes!If we look at the OG Meme, $DOGE, we can see that on the 3D timeframe, it has broken out of the multi-month downtrend and is clearing above a key horizontal level at $0.104. It's likely in the coming weeks that $DOGE can head up to $0.137, and then back to $0.22 in the coming months. But, and potentially more importantly, this can give life to the rest of the Meme space, particularly with risk appetite improving.

$DOGE 3D timeframe:

Moving slightly further out along the risk curve and what might be an even better gauge of the shift in risk appetite, is how $WIF is moving.

Looking at the 3D timeframe, the reclaim above $1.60 was really important, and we can see this by how the volume dramatically increased upon that reclaim. This was then enough to fuel a move up to the next major horizontal level at $2.20. This may be a short-term stumbling block (next few days), but the momentum is positive. We may see a retest of $1.95, but WIF looks prime to breakout of its major downtrend line and get a full bullish reversal. A breakout of the downtrend line (red line) would be the confirmation of this.

$WIF 3D timeframe:

Cryptonary's take

Our thoughts here are that the best course of action is to not try and get too clever with this. If we break this down into its simplest form, we have had two major policy changes over the last eight days. First, the FED is suggesting they're behind the curve and looking to front-load Interest Rate cuts. Then secondly, China unloading a large amount of monetary and fiscal stimulus, with more to come if needed. This is a very net positive for liquidity and therefore risk assets respond kindly to this, hence we have seen increases in the Index's and risk appetite also broadening out.Now, we do still have the US elections in just over a month's time, which may slightly subdue risk appetite, and the market is somewhat vulnerable to downside surprise in any key labour market data point. But, whilst we're at the beginning of a new easing cycle, we take the approach that remaining invested is the right approach. For now, we still maintain the barbell strategy, but we'll perhaps look to broaden out once we're beyond the US elections - assuming the data comes in positively over the coming weeks in between.

Our expectation here is that Q4 is likely to be very bullish for crypto, potentially not just for the majors and the 'Blue chip' memes but also for all/most crypto assets.

Buckle up!

Cryptonary, OUT