How FED's 50bps rate cuts will Impact risk assets, Bitcoin, and crypto market

As the FED pulls the trigger on its first 50bps rate cut, the crypto world braces for a new wave of momentum. Could this be the spark that ignites Bitcoin's next leg up? Dive into our analysis to discover how this pivotal move reshapes the markets.

In today’s report, we’ll explore:

- The FED’s bold 50bps rate cut and why it wasn’t the expected 25bps. How the new Dot Plot and unemployment forecasts align with a "soft landing." What the rate cut means for Bitcoin and risk assets moving forward. Why the Nasdaq’s breakout could signal the next big crypto rally. Our take on the immediate short-term price action for BTC and altcoins.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Breaking down yesterday

Yesterday, the FED made it's first Interest Rate cut of this cycle having held the FED Funds rate in restrictive territory at 5.50% for well over a year. They reduced the rate from 5.50% to 5.00%, despite 90% of economists surveyed by Bloomberg expecting just a 25bps cut (rather than the 50bps we got). Alongside this, there was also dissent from FED member Bowman, who voted for just a 25bps rate cut.As many of you will know, we had called for the 50bps cut. This was due a number of articles from FED mouthpieces being released at the back end of last week where the journalists suggested that 50bps was in play.

This was also a FED blackout period (where they don't speak publicly) - so to get a message out to the market, FED mouthpiece journalists were used. Now, why would the FED go down this path without the intention of then cutting by 50bps? This wouldn't have made sense, and so this is what tilted us to thinking that a 50bps was the more likely outcome.

Looking at this objectively, with the labour market having weakened more considerably since June (the FED's last Dot Plot), the FED probably should have cut rates by 25bps at the July Meeting. Yesterday, Powell suggested that the FED could well have cut by 25bps at the July Meeting if they had had the jobs data that came out just a few days after the meeting, prior to the meeting.

Therefore, Powell's messaging yesterday was key. He made this quite clear and suggested that 50bps rate cuts isn't the new normal. This therefore pulls the market back to pricing in 2 x 25bps cuts for the remainder of the year, 25bps cut in November and 25bps cut in December.

New dot plot and unemployment rate forecasts

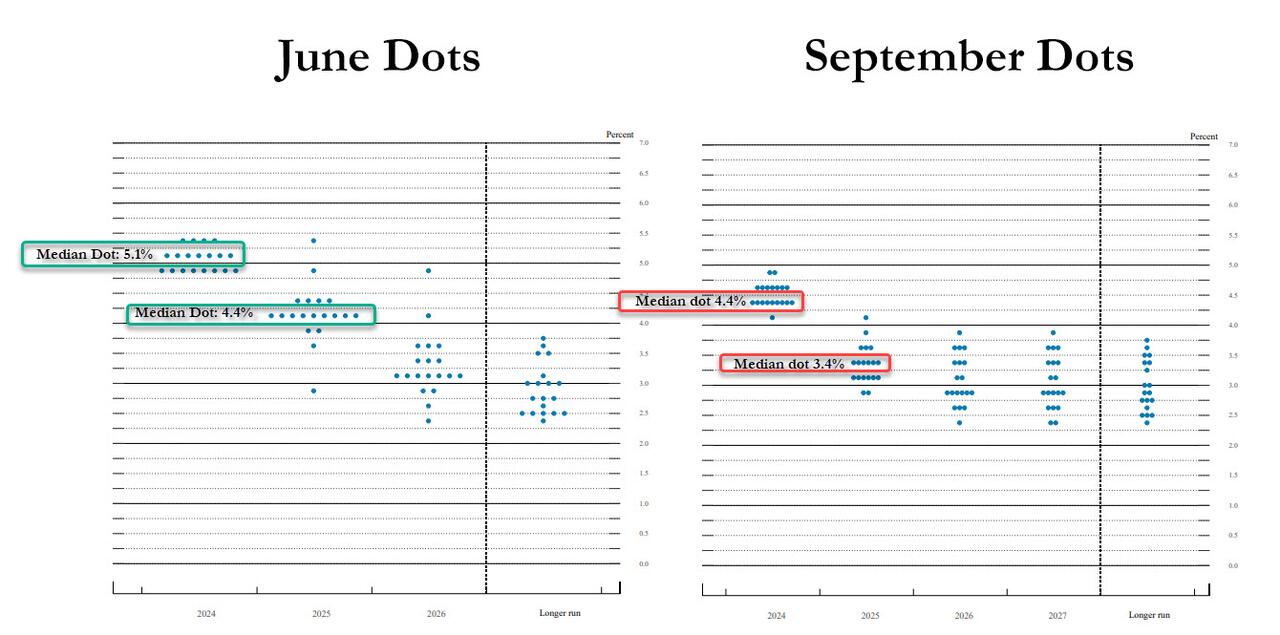

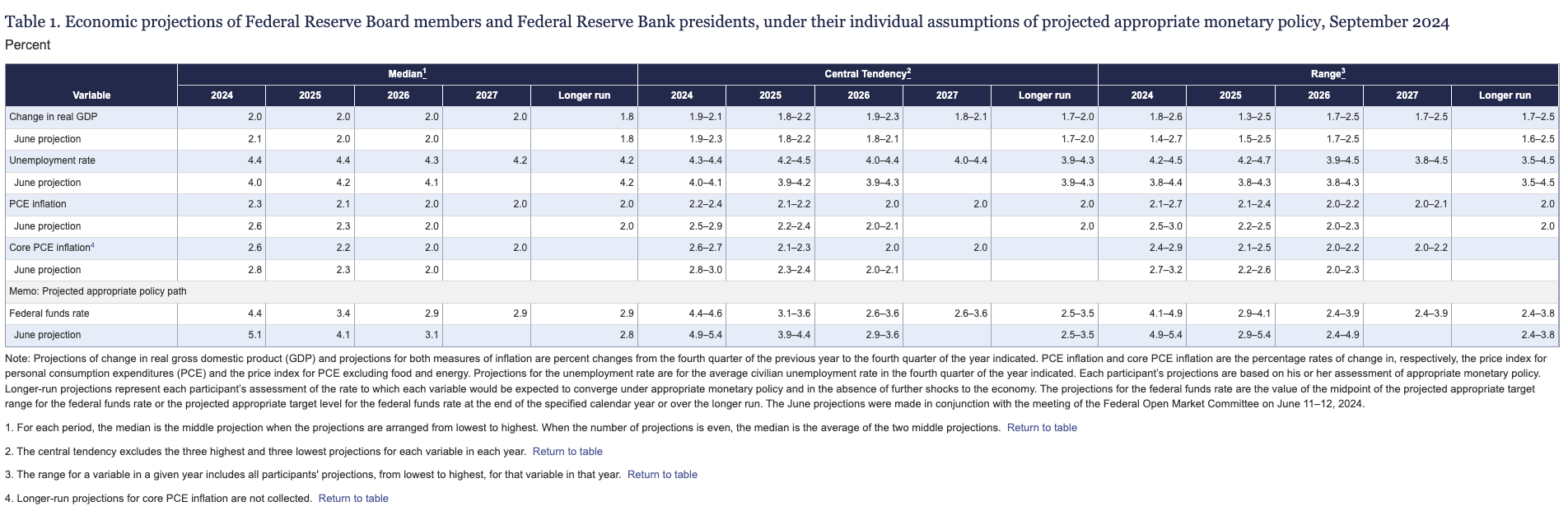

In the new FED Dot Plot, that was issued yesterday, FED members have suggested that they see another 150bps of cuts between now and year end 2025. So, this would look like 25bps in Nov, 25bps in Dec, and then 25bps in each quarter next year (2025). So, this isn't an aggressive easing cycle that takes rates below neutral. It is a gradual easing cycle that takes rates to slightly above neutral, which is in sync with a soft landing. A soft landing is better for risk assets - so good for us/Crypto. The below shows that the FED's projection for where the Interest Rate will be, is much lower now than the Dot Plot they released in June, but it is still in line with a soft landing.FED's June dots vs September dots  The key going forward is the labour market and the Unemployment Rate, although we have known this for some time. In the FED's newly released Summary of Economic Projections, the FED see's the Unemployment Rate at 4.4% at the end of 2024, and the end of 2025... yes, this is despite the fact it has increased from 3.8% in March to 4.2% just 5 months later.

The key going forward is the labour market and the Unemployment Rate, although we have known this for some time. In the FED's newly released Summary of Economic Projections, the FED see's the Unemployment Rate at 4.4% at the end of 2024, and the end of 2025... yes, this is despite the fact it has increased from 3.8% in March to 4.2% just 5 months later.

Updated SEP:

Note: the FED are forecasting the Unemployment Rate to remain the same at the end of 2024 and 2025 (4.4%)

If the Unemployment Rate does increase but not much past 4.4%, then this would be a soft landing, the key is if there is further weakening in the labour market. For that, we have the first data piece out today, which is Jobless Claims. This has just come out, and it's come in lower than forecasted at 219k. This suggests that the labour market is still holding up and we're not seeing job losses and therefore people claiming for unemployment. Again, this supports the soft landing narrative (good for risk assets).How risk assets are likely to react

Risk assets are likely to increase assuming the soft landing continues to look likely. The lowering of interest rates brings down the cost of capital and reduces debt service repayments. This is most beneficial for risk assets that have relied on debt, so not Big Tech, but Mid Caps. Therefore, we would expect the stock market to continue to move higher, but we'd expect the equal weighted S&P to outperform, alongside the Nasdaq and the Russel 2000. Bitcoin is a correlate to the Nasdaq so we'd expect Bitcoin to begin a multi week grind higher from the lows.Nasdaq:

Note: The Nasdaq is close to breaking out and above it's downtrend line.

Cryptonary's take

In the short-term, BTC has touched the underside of it's horizontal resistance at $63,400, but this is a move we had been expecting and one we called perfectly on Monday - check out the last market-direction we released. In the immediate term, we might see BTC pullback very slightly to say $61,800 before breaking higher and above $63,400 over the weekend. We would expect ALTS/Meme's to perform well over the next 3-5 days.BTC: