- Tomorrow's Fed Meeting.

- Dot Plot and the Summary of Economic Projections.

- Cryptonary's Take.

Tomorrow's FED meeting

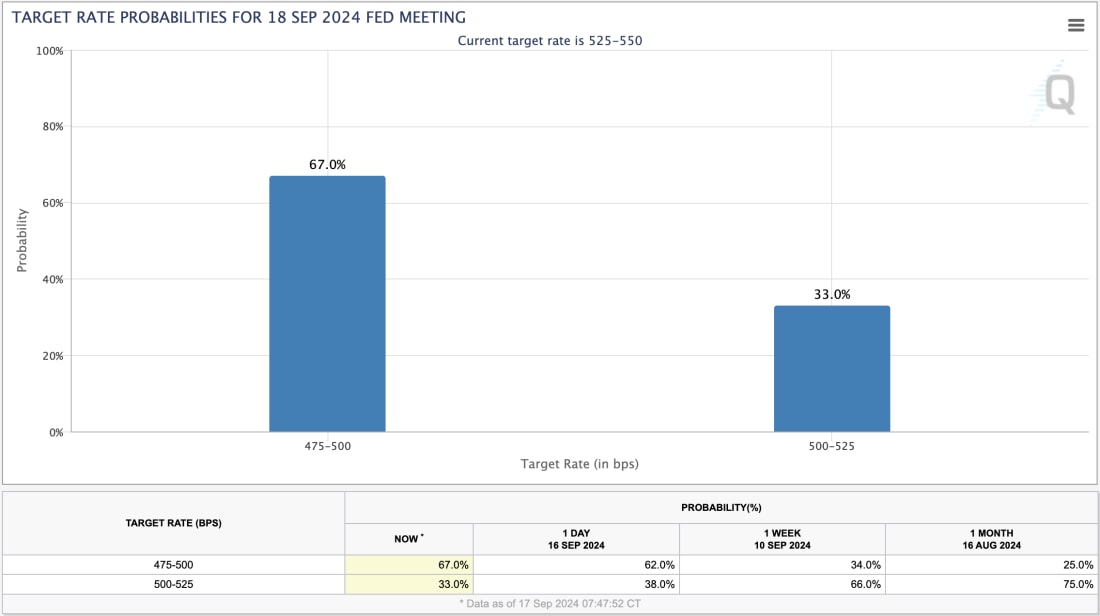

Firstly, there was one data point this week that we had out before we head in to the FED Meeting. That was Retail Sales, that came in at 0.1%. The prior was 1.0%, and the forecast was -0.3%. So, the consumer is slowing down, but is still spending. This supports the slowdown, but not recessionary argument.The reaction to this from the FED is basically more of the same; let's get these rate cuts going in a gradual manner, but it may be wise to get slightly in front of this as there's the chance the FED is currently behind the curve, hence the calls for the FED to go 50bps. The market is now pricing a 67% chance that the FED cut 50bps tomorrow, this is up from just 25% a month ago.

Target rate probabilities for 18th Sept FED meeting:

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Previously, the narrative around a 50bps cut wasn't positive, as it was being interpreted by traders that 50bps might mean the FED is worried and that the normalisation we're seeing is potentially being seen as weakening in the FED's eyes. However, that narrative has now changed. The market recognises that there is a moderation in the data and with the Inflation data continuing to come down, and a FED Funds rate at 5.50% remaining unchanged, this is actually net tightening, if the rate stays high.

Therefore, with the FED potentially slightly behind the curve, a 50bps rate cut would actually likely put the FED back on the right path. So, we believe that the FED will do 50bps tomorrow and the market will likely react positively to it, as just plain and simple, it's the right move.

The question then becomes, how the market reacts to a 25bps rate cut? Well, we think this would be a policy mistake and would represent the FED not willing to admit a policy mistake back in July, when they probably should have cut rates by 25bps. We believe that the market now just wants the FED to make the right move, which is probably to do 50bps.

What's also important is the FED's forward guidance, the new Dot Plot and the Summary of Economic Projections. In terms of forward guidance, the market wants clarity from the FED and Powell in the Press Conference. This would likely come in the form of an updated Dot Plot that shows a gradual easing cycle with the FED Funds rate finishing somewhere between 2.5% and 3.5% by the end of 2025.

This clarity should be emphasised by Powell in the Press Conference, where he should clearly lay out the FED's thinking and plans for the next few Meetings. In the Summary of Economic Projections, we expect the FED to show an increased year end Unemployment Rate. In the FED's last SEP, they expected the Unemployment Rate to finish the year at 4.0%, and it's now at 4.2%.

It'll be Powell's job to calm the market if the FED end up releasing a new SEP that shows the Unemployment Rate increasing more substantially between now and year end. That has the potential to scare the market, especially if it is higher than 4.5%.

Cryptonary's take

The market has been waiting a long time for the FED to begin cutting Interest Rates, and tomorrow, we'll get it. We're also on the side that we believe the FED will come and meet the market where it is now and cut by 50bps. We also side with the argument that we think risk assets will like a 50bps rate cut, rather than be scared that there is something more to it.We also expect a dovish Powell, which we think can help risk assets extend gains and end up closing a very positive week. This is despite the fact that the S&P os at all-time highs. We believe 50bps and dovish messaging will help Small Caps and Crypto the most, so we're expecting strong positive performance over the next 72 hours. We will reassess again then.

Personally, I (Tom) am risk on going in to the Meetings having put the USDT in my trading wallets back to work - mostly in to SOL and 'Blue Chip' Meme coins.

The risk to our thesis for the next few days is that Powell can't get the committee onboard with 50bps and they end up cutting by just 25bps. We, and we also think the market, would see this as a policy mistake, regardless of how dovish their messaging is.

A really exciting 48 hours ahead of us.

LET'S GO!!!!! We're expecting BTC to retest $63,400.

BTC: