In this article:

- US Election.

- Impact on Markets.

- This Week's FED Meeting.

- Cryptonary's Take.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

US election

We have broken down the importance of today's Election results in prior updates, so today our focus will be on the details we're keeping a look out for throughout the day and then when we might expect a result.The likelihood is that the Senate will flip Republican, meaning a Trump win would be a sweep, and a Harris win would be a split government. Essentially, the voting comes down to 7 swing states. We have listed these states below and their poll closing times:

- Georgia - 7 PM ET (Midnight UK Time)

- North Carolina - 7:30 PM ET (12:30 AM UK Time)

- Pennsylvania - 8 PM ET (1 AM UK Time)

- Michigan - 9 PM ET (2 AM UK Time)

- Wisconsin - 9 PM ET (2 AM UK Time)

- Arizona - 9 PM ET (2 AM UK Time)

- Nevada - 10 PM ET (3 AM UK Time)

What we've seen in the early voting is that women have turned out strongly so far, and older women, who might have previously voted Republican, have swung towards Harris.

However, if the overall turnout is much stronger (than in prior elections), this likely favours Trump as he'll have been able to turn the 'undecided's', into decided, and likely voting for him.

Now, it's very possible that the election won't be decided by the early hours of Wednesday morning (US time). In the last two elections, we saw 2016 decided in the early hours of the next day, however, 2020 took until Saturday to be concluded.

If the election is super close, then it might also be contested. This would be the worst case for markets, as the uncertainty would drag on.

Impact on markets

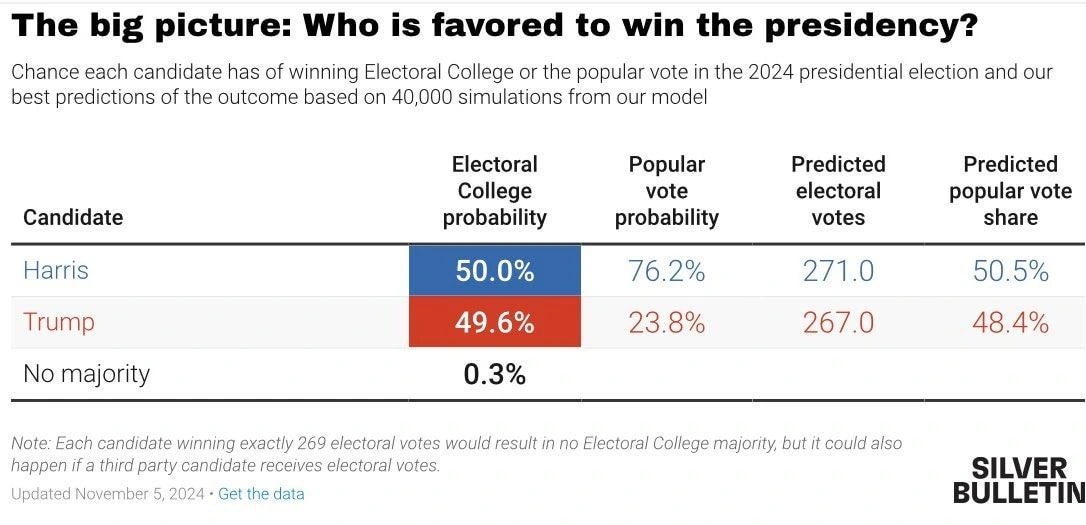

Currently, polls are extremely tight, with Nate Silver's (well-known pollster) most recent update showing that it's neck and neck.Nate Silver's final poll before the election:

However, prediction markets, with Polymarket being the more extreme right-leaning prediction market, are giving Trump a more meaningful lead. But, these markets are being pushed around (price-wise and therefore odds-wise) by just a few players. So, it's probably wise to somewhat look through this.

Current poly market pricing/odds:

Ultimately, this is close, and it'll likely come down to how strong the overall turnout is against the percentage of turnout that are females who vote. We've also got to be aware that it's possible that this won't be concluded by early Wednesday morning (US time). If this is the case, the uncertainty will continue, and markets will be unlikely to react well to this.

If we get a clear winner, regardless of who it is, I (Tom) think TradFi markets will react positively to it. Crypto will likely react negatively to a Harris win on the day, even if TradFi markets react positively.

In our opinion, a dip on a Harris win is a good buying opportunity. TradFi markets would likely respond well to a Harris win as it'll likely mean a split government ie, more of the same, uncertainty over.

A Trump win will probably be more positive for Crypto than it will for the TradFi markets. Overall, getting a clear winner and a conclusion to the event will be positive for the markets.

We've seen in prior examples that volumes pick up considerably on the conclusion of the event, and with the current positive macro backdrop that we have, this increase in volumes is likely to be positive for risk assets. The figure below shows that volumes rose by 21% on the day after the election, and 28% two days after.

Goldman Sachs US equity volume post-election relative to full year:

This week's Fed meeting

For the next few days, the election is the main driver for price action, so we'll keep this section on the FED Meeting shorter.Usually, the FED Meeting is the highlight of our every 6 weeks. However, the US Election outweighs it this week. This is also because it's widely expected that this FED Meeting should be somewhat smooth sailing.

The market is expecting the FED to reduce the Interest Rate by 25bps and suggest another 25bps cut for the December meeting. It's also possible that the FED will guide the market towards an end to QT, which would be positive for liquidity. This is something to watch for.

Cryptonary's take

Ultimately, both outcomes may be positive/provide great opportunity here as long as the Senate does flip Republican. That's because a Harris win would then see a split government which markets like. And, a Trump win is likely to be majorly positive for regulation and Crypto regulation.A Trump win will likely see its price just rocket higher, and it's possible that it is a move you just ape into. This isn't one of those events that can be "priced in"; it gets priced in as it happens, so watch for those swing states as they come in.

A Harris win with a Republican Senate I think can also provide a good opportunity. If we see a major dip in prices on that outcome, I do really think it's for buying. This is all to play for and super exciting if you ask me.

BTC:

We think regardless of the outcome today, we expect more of the same and for our arrows to continue playing out. A Harris win might delay major upside for BTC, but that's the point, delay.That's all we think it'll be. If Harris wins, we might see the price revisit the $63k area, if it does, we'd be buyers there, particularly if sub $60k is seen, although we really doubt that'll happen even if Harris wins. A Trump win will likely cause the BTC to teleport upwards.

We have stuck to this Bitcoin price structure since early August and we'll continue to stick with it for now. It's frightening how these arrows have played out perfectly as we plotted them. We put them in and have left them unchanged since early August - check back in prior Market Updates.

Huge, and exciting few days ahead. This is what people like myself live for. As I always say; let's see what we get.

Let's Go!