TLDR:

- Inflation data came in softer than expected, with both CPI and PPI lower than forecasts. However, rate cuts are now more likely to be pushed out.

- Markets rallied on the de-escalation of tariffs, but uncertainty remains. Companies like Walmart may pass on tariff costs to consumers, which could be inflationary and delay rate cuts further.

- Key resistance levels are being tested, particularly in BTC ($105k) and equity indices (S&P at 6000, Nasdaq at 21,500-22,000), with slowing BTC ETF inflows raising caution.

- Cryptonary suggests patience, highlighting two scenarios: a choppy summer with selective opportunities or a more significant economic slowdown. Waiting for a meaningful pullback is recommended before re-entering.

- This Week's Data.

- Is The Market Setup For More Immediate Upside?

- Cryptonary's Take.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

This week's data:

This week, the key data releases were Inflation on Tuesday and then PPI and Retail Sales yesterday (Thursday). Inflation on Tuesday came in softer than expected, and this was also seen in PPI on Thursday, which came in at -0.5%, well below the 0.2% forecast. Thursday's data saw Retail Sales remain positive (0.1%, above the -0.1% forecast), whilst Jobless Claims also remained contained at 229k.The markets responded positively to these data releases off the back of lower inflation, and the job market is still holding up. However, this picture does allow the FED to remain on pause (not cut rates) for more time, meaning that rate cuts are now looking hugely unlikely for the June Meeting and the July Meeting.

The September FED Meeting is still on the table for a cut, but we'd have to see a material deterioration in the macro data in order for the FED to cut rates.

What's next

Everyone's watching the price, but we're watching something else entirely. Here's the signal we're waiting on before acting.Is the market set up for more immediate upside?

Ultimately, the tariff rates we likely end up with will be higher than what the market initially expected at the beginning of the year, and yet the market is now at the same level we saw at the beginning of the year (S&P and the Nasdaq).Recently, major tariff de-escalation has resulted in a rip higher in markets, and this has been fuelled by spot buying, along with shorts being squeezed, whilst overall market liquidity remains low.

But, uncertainty does remain until final trade deals are done, and we have yet to see the full effects of the tariffs. For instance, Walmart suggested recently that they can "no longer continue to bear the costs of the tariffs, and they may need to pass through the costs". This essentially means they're looking to raise their prices and pass their additional costs onto the consumers.

And, if Walmart are saying this, other corporations will look at this and feel more comfortable that they can do the same. This is inflationary, and it would once again push rate cuts further out, should this materialise.

These effects are still on the horizon, and with the level of uncertainty still somewhat elevated, corporates are unlikely to aggressively push ahead with hiring and expansion plans, which could result in an economic slowdown being more likely.

These are the risks for the market currently, and we should be very aware of these as markets move into their range highs:

- BTC at $105k.

- S&P at $6000.

- Nasdaq at $21,500 to $22,000.

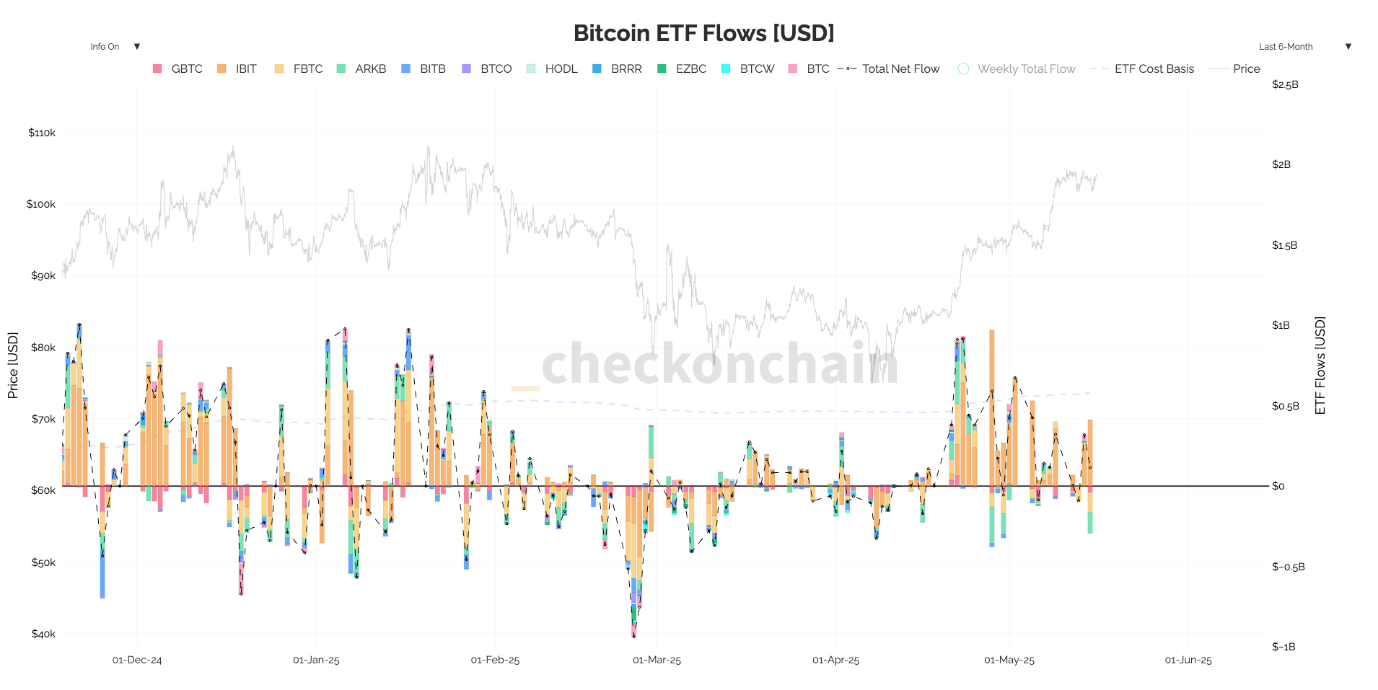

Alongside this, we've seen very positive BTC ETF flows over the last month; however, as the price has gone higher, ETF inflows have begun slowing down substantially.

BTC ETF inflows (by number of BTC):

When we assess the market from a risk-on and a risk-off perspective, and how aggressive we should be in either of those views, the key charts we look to gauge this are BTC.D and TOTAL3.

We covered this in our last update, but currently, we're placing substantial emphasis on these charts. We're looking for those breakouts in order for us to get more materially risk-on and just generally improve our comfort level in buying back into this market.

Below, we can see that BTC.D (Bitcoin Dominance) has bounced from its uptrend line, which still suggests that we're in a Bitcoin-dominant environment.

BTC.D 3D timeframe:

If we then look at TOTAL3, this chart is still in a local uptrend, but the key level we want to see price reclaim is that major horizontal resistance at $930b; this would be a much clearer risk-on signal. But for now, the chart has fallen to this level.

If the chart can't reclaim the $930b horizontal resistance, and so far, it does suggest this might be the case, then this would be the confirmation that this is a bear market rally.

BTC.D and TOTAL3 are the two key charts we're really watching closely.

TOTAL3 3D timeframe:

Cryptonary's take

In the last few trading days, we've seen the markets' attention pull back from tariffs and re-focus back to inflation, which might be dangerous to do, as we're still unsure of the effects of tariffs and where they'll actually land.The positive is that we've seen a meaningful de-escalation, but the market is likely wrong to be so swiftly moving on from this and pricing in such a positive outcome.

We know for Crypto, one of the main drivers of positive price action is increased liquidity (rate cuts), and the de-escalation in tariffs has slightly reduced the level of uncertainty and therefore the market is now pricing for rate cuts to be pushed further out - to the point that summer rate cuts are now quite unlikely.

So, the de-escalation is positive and has led to this relief rally, but it does push the liquidity injection (rate cuts) we're looking for further out.

Therefore, where are we at here?

Scenario 1:

It's possible that the market remains choppy throughout the summer, assuming the data holds up. Under this setup, we'd look to accumulate on meaningful price dips - we gave these levels in our last update. And in this environment, the far end of the risk curve can perform (memes/alts, etc), so we would place a strong focus there, and look to take advantage of potential plays there. This would assume that BTC remains high, and range-bound between $90k and $105k. A breakdown below $90k, and 'Scenario 2' becomes much more likely.

Scenario 2:

However, it's also possible that the level of uncertainty that still remains results in a more substantial economic slowdown, and risk assets might then reprice much lower because of this over the coming 2-3 months.

Our job now is to constantly be reassessing this, and to try to make these key judgements at these decision points, which would be the meaningful price pullbacks. Right now, we'll wait for a meaningful pullback, and that'll be our decision point as to whether we buy back in or not.

This is a phenomenally tricky market, and sometimes doing nothing is the right move, despite how inclined some of you may be to be actively trading. In the long run, remaining patient in the tricky times will really pay. There are times when you can bet the house, and when that time is here, we'll be doing so. But, in the trickier periods, the best move is usually to maintain capital and keep a full stack that you can then put to work in the 'easier' times. We don't expect to need to be patient for long, but right now, we do feel that patience is the best course to take.