Explore the latest Injective (INJ) crypto analysis and predictions

-

- Injective (INJ) price prediction: Is $18.80 the key level for bullish trades? (August 14, 2024)

- Injective Protocol (INJ) price prediction today: Will it break $18.80? (August 9, 2024)

- Injective (INJ) price prediction: Can it hold above $15? (August 7, 2024)

Injective (INJ) price predictions

2025 price prediction

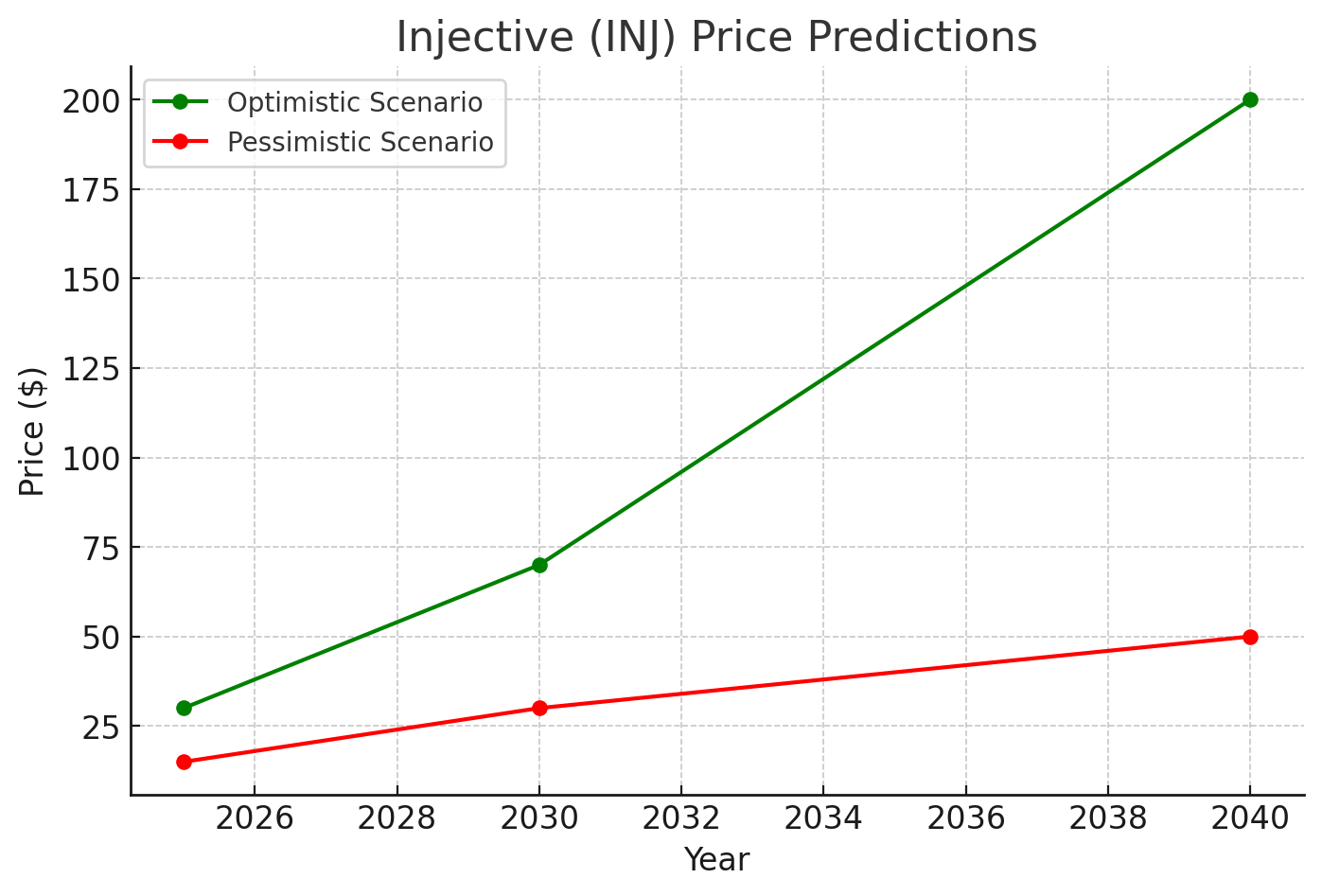

Optimistic scenario ($30.00 - $50.00):In an optimistic scenario, Injective (INJ) could reach between $30.00 and $50.00 by 2025. This growth could be driven by various factors, including increased adoption, technological advancements, and its unique position in the decentralized finance (DeFi) space. If Injective continues to innovate and expand its ecosystem, it could see significant growth, especially if it gains more traction in the broader cryptocurrency market. The current price of $20.64 suggests there is substantial potential for upward movement, particularly if key developments align with market expectations.

Key drivers:

- Increased adoption and innovation in DeFi

- Strong community support and engagement

- Strategic partnerships and integrations

- Growing awareness and market presence

In a pessimistic scenario, Injective (INJ) might only see modest growth, reaching between $15.00 and $20.00 by 2025. This could occur if the project faces significant competition, struggles with adoption, or fails to secure critical partnerships. Other challenges might include declining interest from the community or unfavorable market conditions, which could limit the coin's price appreciation.

Key drivers:

- Stiff competition from other DeFi projects

- Slow adoption and integration

- Decline in community engagement

- Negative market sentiment or conditions

Optimistic scenario ($70.00 - $120.00):

By 2030, if Injective (INJ) has established a strong foothold in the DeFi ecosystem, it could potentially reach values between $70.00 and $120.00. This would be driven by ongoing technological advancements, deeper integration into various applications, and sustained community support. If Injective manages to expand its market share and maintain its relevance, its price could see substantial growth over the next decade.

Key drivers:

- Continuous technological development and innovation

- Integration into diverse DeFi applications

- Strong market presence and adoption

- Viral growth and positive sentiment

In a less favorable scenario, Injective (INJ) might see its price stabilize between $30.00 and $60.00 by 2030 if it faces challenges in maintaining relevance or competing with newer projects. Issues such as declining community interest, regulatory challenges, or market saturation could slow down its growth, leading to more conservative price appreciation.

Key drivers:

- Loss of community interest and engagement

- Increased competition from newer DeFi projects

- Regulatory hurdles

- Market saturation

Optimistic scenario ($200.00 - $400.00):

Looking towards 2040, Injective (INJ) could potentially reach a valuation of $200.00 to $400.00 if it continues to evolve and remains a key player in the DeFi space. This growth would be fueled by its integration into mainstream financial applications, ongoing technological improvements, and strong community-driven developments. As DeFi becomes more ingrained in the digital economy, Injective could benefit from widespread adoption.

Key drivers:

- Mainstream adoption and integration into financial systems

- Continuous technological improvements

- Strong and active community support

- Stable global economic conditions

However, if Injective (INJ) faces technological obsolescence or is outpaced by newer, more advanced DeFi projects, its price might settle between $50.00 and $100.00 by 2040. Challenges in maintaining relevance and dealing with competition could limit its long-term growth.

Key drivers:

- Technological obsolescence

- Decline in market relevance

- Regulatory challenges

- Competition from more advanced DeFi projects

Factors affecting Injective (INJ) price

- Historical data analysis: Analyzing Injective's historical price data is essential to identify trends and cycles that could provide insight into future price movements.

- Market sentiment analysis: Understanding market sentiment towards Injective by monitoring social media, news, and community engagement helps gauge general mood and expectations.

- Technical analysis: By examining historical price charts and using technical indicators like Moving Averages (MA) and Relative Strength Index (RSI), predictions about Injective’s future price movements can be made.

- Fundamental analysis: Assessing Injective’s intrinsic value by looking at its use cases, adoption rate, partnerships, and market conditions helps determine its long-term potential.

- Economic factors: Global economic conditions, such as monetary policy and market trends, could influence Injective's price.

- AI-Based forecasting models: Utilizing AI models to analyze historical data and predict future prices can offer a range of possibilities with different probabilities based on patterns and correlations.

FAQs

What is Injective (INJ) and how does it work?Injective (INJ) is a decentralized finance (DeFi) protocol that enables fast, secure, and scalable trading of various financial products. It operates on its own blockchain, designed to enhance efficiency and security within the DeFi ecosystem.

What factors influence the price of Injective (INJ)?

Several factors can impact the price of Injective (INJ):

- Community support: Strong and active community engagement can drive demand for Injective.

- Technological advancements: Ongoing improvements and innovations can boost its utility and value.

- Market sentiment: General perceptions and discussions within the crypto community can lead to price fluctuations.

- Competition: The level of competition from other DeFi projects can affect Injective's growth potential.

- 2025: In an optimistic scenario, Injective could reach between $30.00 and $50.00, while in a pessimistic scenario, it might only rise to between $15.00 and $20.00.

- 2030: Injective could potentially be valued between $70.00 and $120.00 in an optimistic case, or between $30.00 and $60.00 if it faces challenges.

- 2040: If Injective continues to innovate and remain relevant, it could reach $200.00 to $400.00. If it faces significant competition or technological challenges, it might stabilize between $50.00 and $100.00.

Investing in Injective (INJ) carries risks due to the inherent volatility of cryptocurrencies. However, if Injective can maintain its popularity, successfully engage its community, and stay competitive, it could offer significant growth potential. It's essential to conduct thorough research, consider your financial goals, and understand the risks before investing in Injective or any cryptocurrency.