With these new S-1 filings, we see applicants reducing the fees for their ETFs in a "race to the bottom".

The goal here is for their ETF to become the most attractive and, therefore, see the larger liquidity flow.

Early on, whichever applicant gets the liquidity will be the winner.

From a mechanics perspective, Bitcoin looks clean and much better than it did a week or so ago. This is also the case for altcoins, mostly across the board.

Open Interest is lower, as is Funding Rates. The last few days of selling were enough to scare many traders off, and we may see prices go higher from here - aided by the ETF pump.

Technical analysis

- Price is attempting to break out from the $44,000 horizontal resistance. The local resistance will be the prior high of $45,900.

- $44,000 will need to hold as the new local support. If lost, price likely declines to at least $42,400.

- $40,900 remains the key horizontal support.

- The RSI is good (has reset) on the 12-hour and the 1D timeframes. However, the 3D is moving back into overbought territory while the Weekly remains overbought. We see this resetting more substantially in the coming months.

Cryptonary's take

As we go into the ETF decision, which looks like it'll be on Wednesday, Bitcoin may break out on this.However, this is not something we'd look to buy; if anything, we are looking to sell some coins into the ETF pump. This is because we think the market will be lower in 6 weeks or so once more macro factors come into play. We will explain this in tomorrow's market updates.

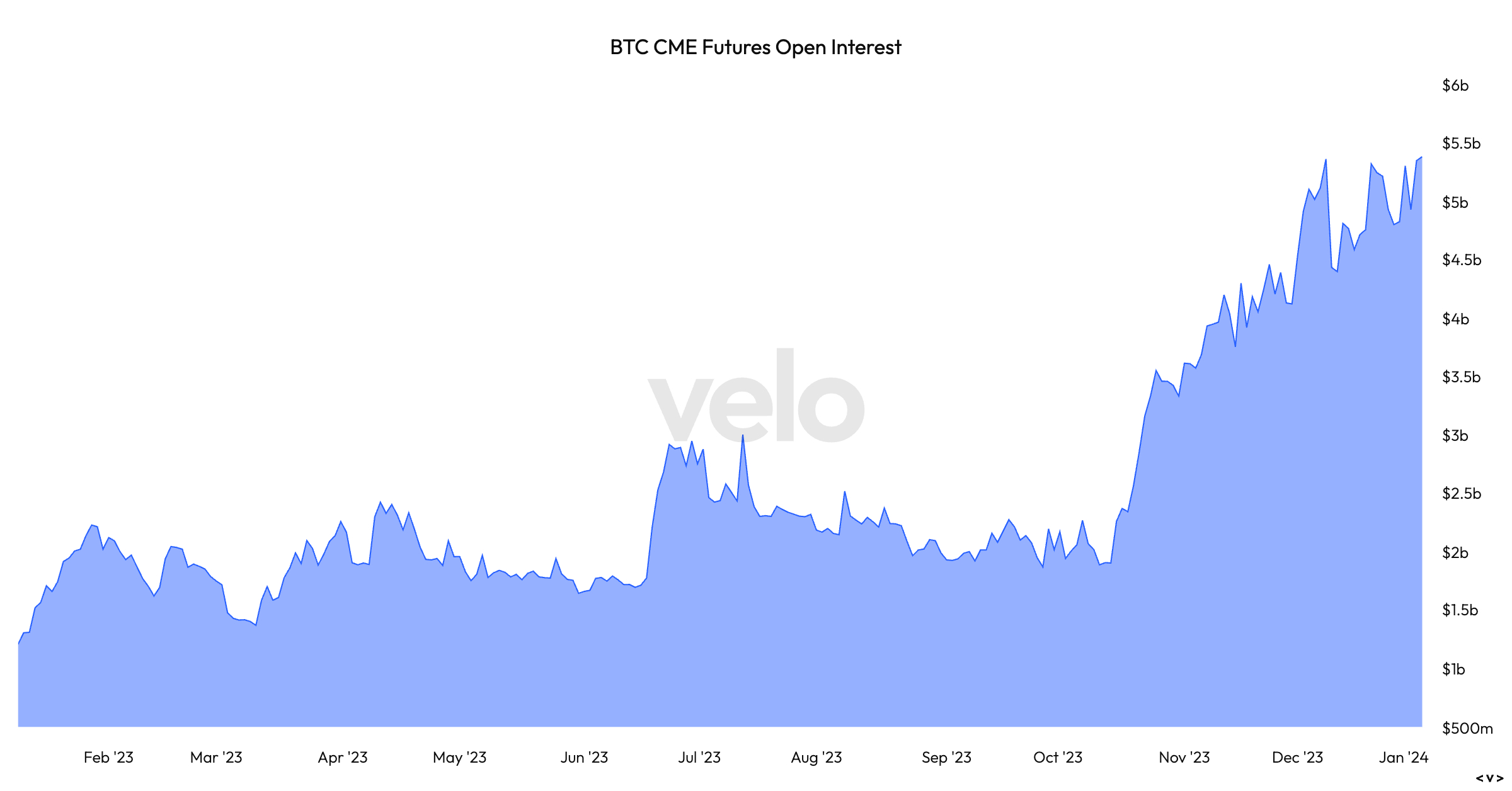

We also like the fact that the BTC CME Futures Open Interest has not come down drastically, meaning some TradFi participants haven't closed positions yet. When this metric moves materially lower, that'll be the time to consider selling some BTC potentially if you're less passive.

Because Bitcoin has been so strong, it's one of the few coins, perhaps along with ETH, that we won't look to sell into the ETF pump (assuming one comes). The coins we'll look to offload may be coins that have good rebounds, potentially something like SOL.