Is TradFi front-running Bitcoin ahead of big bullish catalysts?

In investing, patience pays. But TradFi doesn't wait - they chase profits by moving between assets. Amid tech earnings rollercoaster and surging bonds, it seems like they're eyeing Bitcoin.

Maybe TradFi's onto something.

TLDR 📝

- Big tech earnings whipsaw S&P, while Amazon surprises positively.

- Juicy 5% bond yields lure investors despite the looming supply influx.

- TradFi front-running Bitcoin's bullish catalysts with increased trading activity.

- TradFi interest signals need to up Bitcoin and major altcoin exposure in the coming weeks/months.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

S&P struggles as Amazon attempts to save Big Tech

This week has seen the majority of Magnificent 7 (Amazon, Alphabet, Apple, Meta, Microsoft, Nvidia, and Tesla) release their Q3 earnings. As of yesterday, Alphabet, Tesla, Meta and Microsoft had reported negative earnings, which saw all the stocks slide on Thursday, wiping out $386 billion for the above 4 companies’ valuations.However, Amazon reported Earnings on Thursday evening, which came in well above expectations, whilst CEO Andy Jassy also mentioned how the consumer is still spending. Following this, tech stocks have been able to bounce from their lows in Friday’s (today - 27/10) session. Amazon is the most notable of these, up 8.6% on the day. However, the S&P is struggling to bounce with Big Tech. This is despite the chart forming a bullish divergence very close to oversold levels, which should have helped fuel a bounce.

S&P Chart

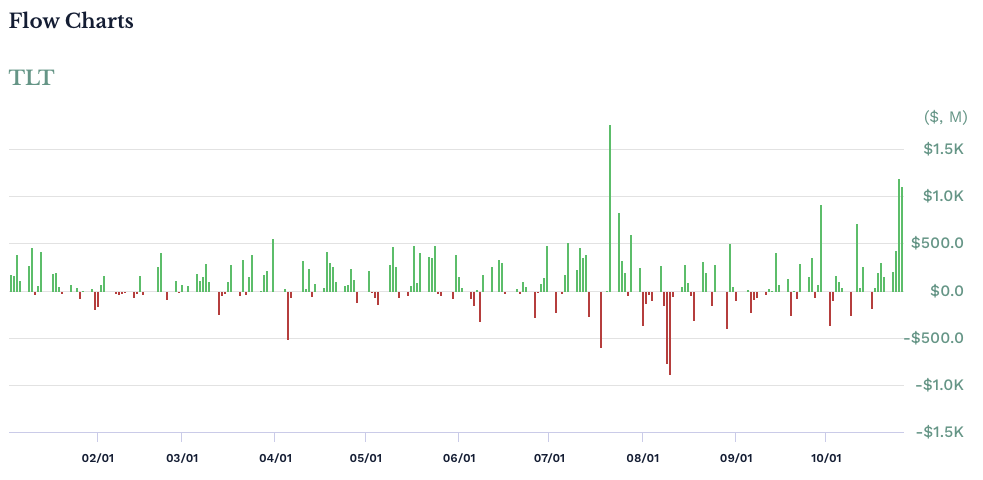

The sell-off in equities over the past week or so may be due to investors wanting to take advantage of opportunities elsewhere. Hence, they sell down their stock positions to move that capital into other assets. One of these assets is most likely long-duration bonds. The below chart is the flows into or out of TLT - iShares 20+ Year Treasury Bond ETF.

TLT Flow Chart

The above shows that in the past few days, there were massive net USD inflows into the TLT ETF. With long-end bonds now offering close to, and even slightly north of, 5.00% yields, they have become more attractive to some investors at these levels. This is despite Treasury Secretary Janet Yellen suggesting there will be a meaningful increase in bond issuance over the coming months.

Increased Bond issuance should mean current bonds sell-off and yields go higher, which is not attractive for an investor to buy into. Alongside this, the Japanese are selling record amounts of U.S. Treasuries. They have already sold several hundred billion dollars worth and still have over $1.1 trillion worth remaining on their balance sheet. Again, increased supply should make buying bonds less attractive, even though it would push yields higher.

But with current yields at 5.00% (give or take), some investors are beginning to take on some duration risk - hence, we see the large TLT ETF net inflows.

We must closely examine the relationship between bonds and equities in the coming months to see if there’s a slowdown. However, the consumer seems strong and is still spending, as we saw with ‘Personal Spending MoM’ coming in at 0.7% today, well above the 0.5% consensus.

The reason we will continue to track this is to assess if Bitcoin continues to trade as a ‘safe-haven’ asset as it has done in the prior weeks or if it reverts back to a risk asset. We fear that if it reverts to a risk asset, this may mean it trades meaningfully lower in the coming months. However, this may be prevented if investors continue buying BTC to front-run the ETF approval. Arguably, they’ve already affront-run ETF approvals and the Bitcoin halving in April 24.

Now, to the big question!

Is TradeFi front-running the bullish Bitcoin catalysts? 📈

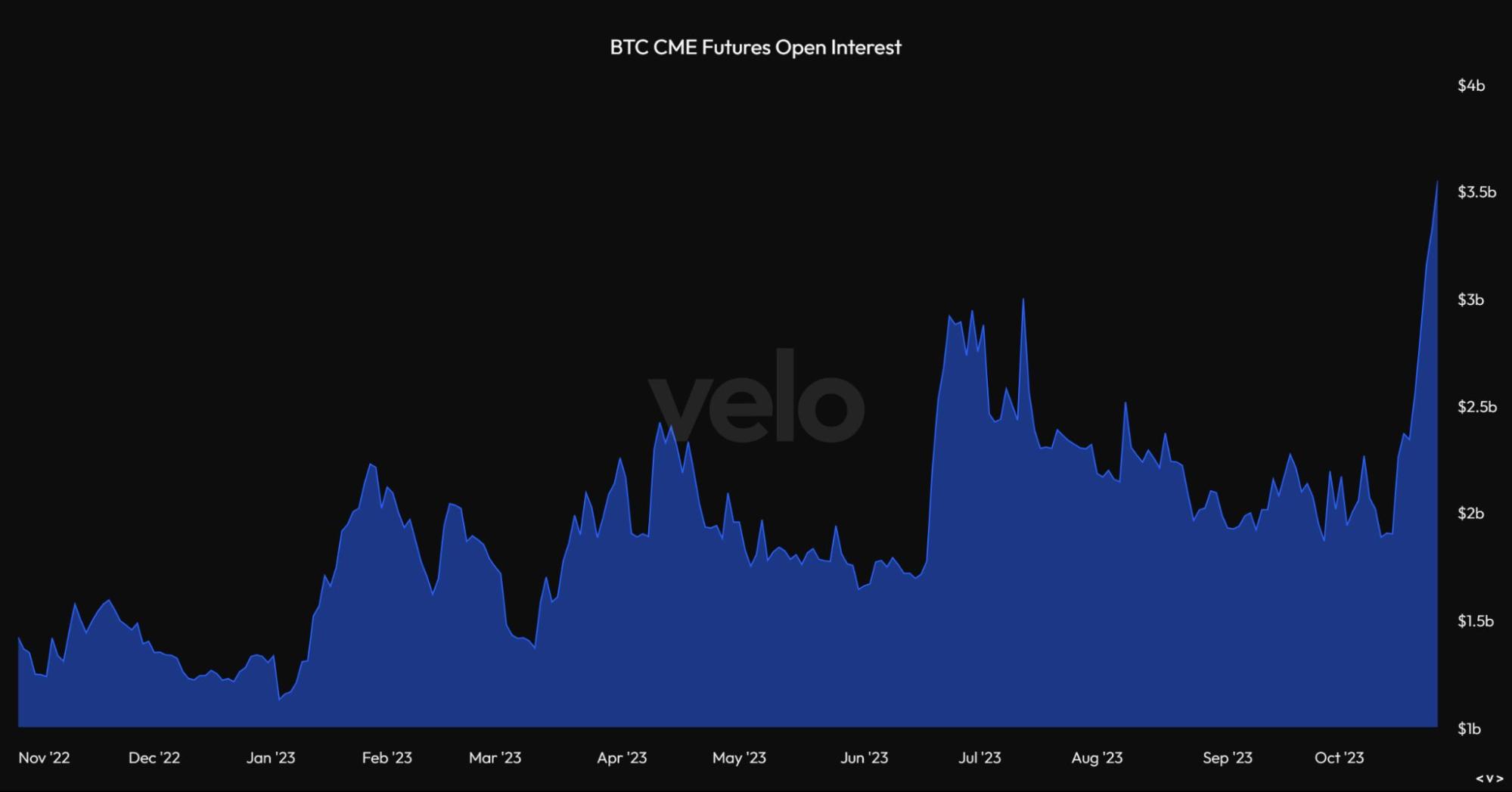

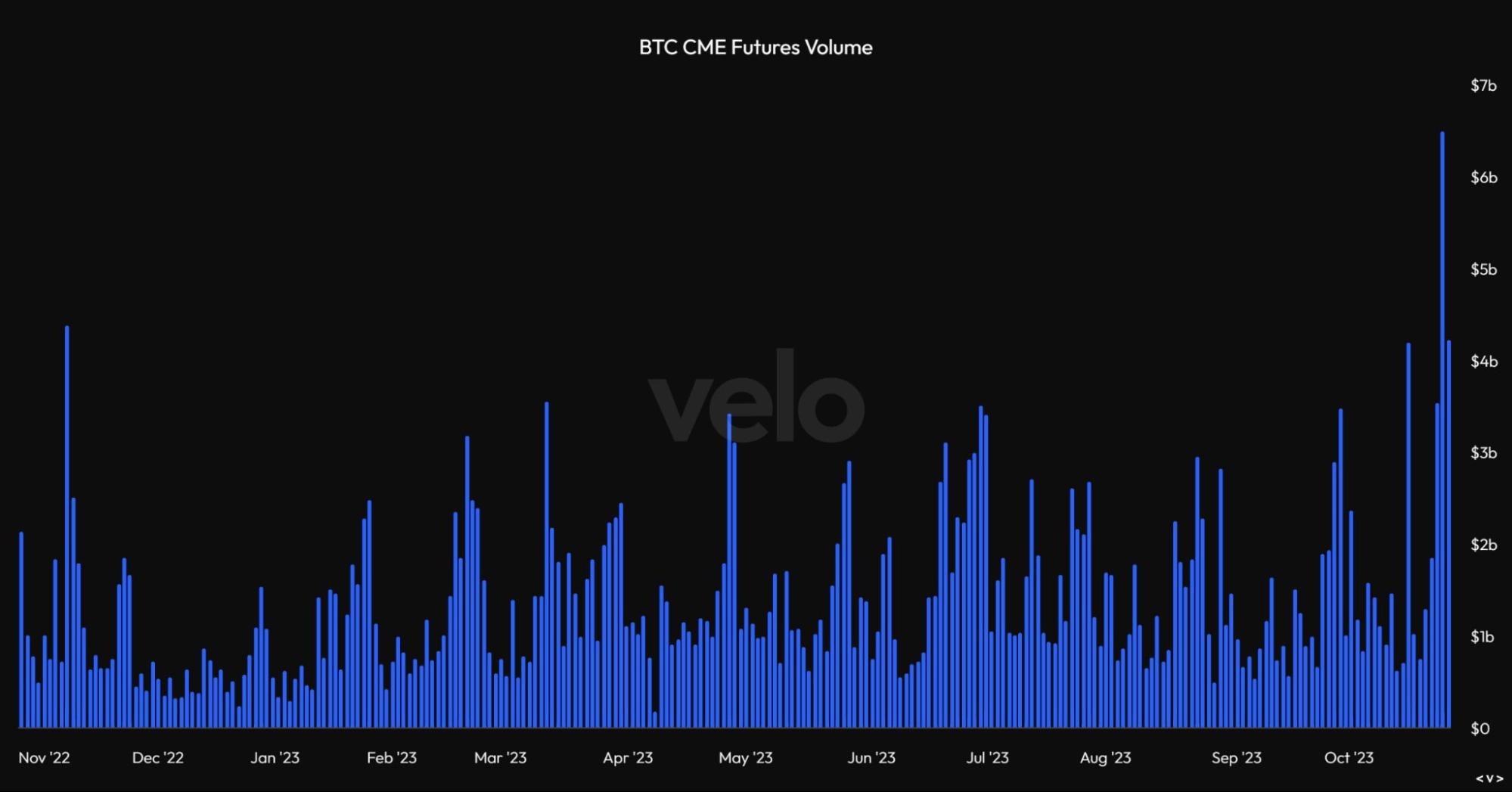

The TradeFi guys will usually trade BTC via CME, with many of them very experienced in the Options market. So, this is a popular way for them to trade/bet on Bitcoin’s price action. In the chart below, we can see that the CME Open Interest and Futures Volume have risen massively since the news leaked about the potential ETF approval.BTC CME Futures Open Interest

BTC CME Futures Volume

Looking at the options market, we can see the open interest and volume in options since the ETF news leaked has been monstrous.

Total BTC Options Open Interest

Options Volume

Positioning your portfolio in response to TradFi’s interest in BTC 💼

Long story short, TradeFi is here, and they’re playing. If anything, they’re front-running the bullish catalysts for Bitcoin, not just the possible ETF approval but also the Bitcoin halving in April 2024.We should, therefore, be looking to increase DCA exposure into Bitcoin and other major coins - particularly ETH, in the coming weeks/months. Yes, it’s still possible that we will get weakness in the economy and markets in early 2024, but any weakness should be DCA’ed into.

The aim is to increase exposure to BTC and major altcoins in the coming weeks/months and look to be close to fully allocated before the halving in April 2024. Of course, we have to continue weighing up the macro and maintain a level of ammunition (USD) on the sides to buy up any potential panic within markets in the coming quarters.

Cryptonary’s take 🧠

But, essentially, the main aim is to be increasing our allocations. Our conservative targets for BTC and ETH in the next bull run (to the top at some point in 2025) are $100,000 (for BTC) and $8,000 (for ETH), respectively, although we emphasise that we feel these are conservative targets. Regardless, they offer fantastic multiples against the current prices, but we’d love even more to DCA into anything sub $30,000 for BTC and sub $1,660 for ETH.As always, thanks for reading.

Cryptonary, OUT!