Changes in economic data may affect Fed policy and liquidity for Bitcoin going into 2024. On the other hand, there’ll be a shift in the way BTC trades pre-ETF approval and post-ETF approval.

So, what do the rest of 2023 and early 2024 have in store for Bitcoin and the rest of the crypto market?

Let’s dive in.

Key takeaways

- On economic data: Inflation is falling, and the labour market is cooling slightly, but there are potential liquidity risks in 2024 that could lead to quantitative easing – bad short term, but could trigger QE, which could be good for risk assets.

- On Bitcoin, we may continue to see positive price action pre-Bitcoin ETF approval, and we’ll likely get a sell-the-news pullback in the immediate short term after the approval.

- ETH is still relatively undervalued and likely to see significant upside. ETH futures and options signal front-running by institutions.

- What’s in store for altcoins? Indexes suggest that big caps are overextended; a correction may be ahead. Mid-caps and small-caps may still have more room to run before slowing down.

- Final take: We expect Bitcoin and the rest of the market to continue to have positive price action up until early January. But following this, expect the market to pull back from February through April.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Let’s start with the economic data

Markets have been buoyant recently on inflation data coming down, along with a labour market and a consumer that is still holding up.Headline inflation last came in at 3.2% YoY and 0.0% MoM, which the markets celebrated seeing a 0.0% MoM print. However, Core inflation remains at double the Fed’s 2.0% mandated target at 4.0% YoY and 0.2% MoM.

But the trend in both headline and Core inflation is lower and has been for several quarters now, even though headline inflation has remained sticky in the 3.0% area.

In the same period, the labour market has weakened very slightly but far less than expected when you consider the Fed has raised rates by 500 basis points.

Non-Farm Payrolls (the number of jobs added in the US) have remained above 150k (jobs added per month) for the most part. This month’s reading came in at 199k, stronger than the 183k consensus.

However, of the 199k jobs added, 77k were in health care and 49k in government. When assessing if the jobs market is strong, you do not want to see the majority of job gains come from these sectors.

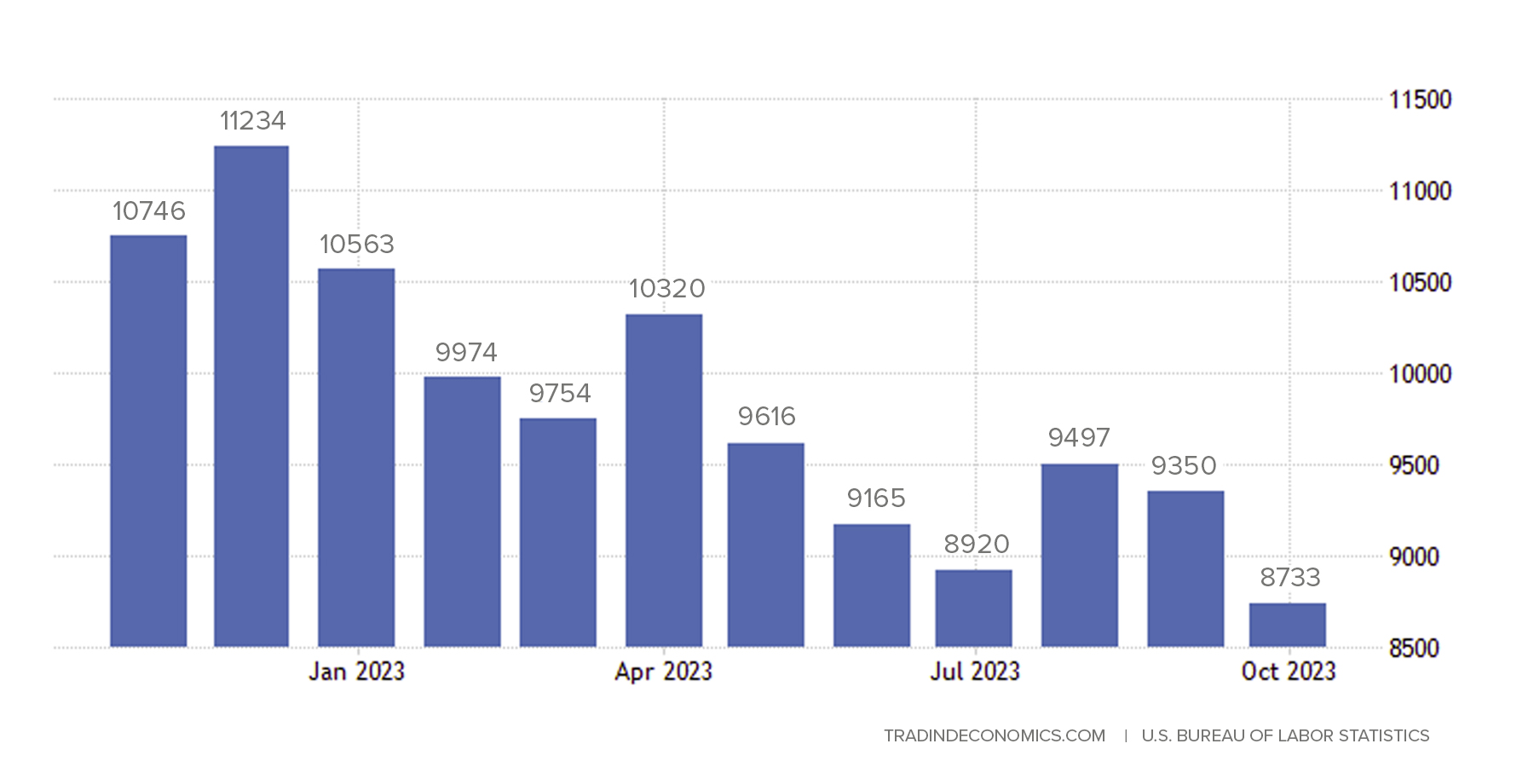

Alongside this, the Unemployment Rate fell to 3.7%, well below the 3.9% consensus. This was a far better figure than expected, and it was due to more participants coming back into the labour market.Nonetheless, we are beginning to see a slowdown in the labour market in the JOLT’s Job Openings. This came in on Tuesday (05/12/23) at 8.733m, well below the 9.3m consensus.

Now, the markets reacted relatively positively to this number as it was essentially taken as “goldilocks” – not low enough that employers are desperately shutting up shop and not high enough that not enough tightening has been felt and the Fed may have to do more. The labour market is coming down but at a slow and steady pace.

JOLT’s Job Openings

Potential risks to the markets

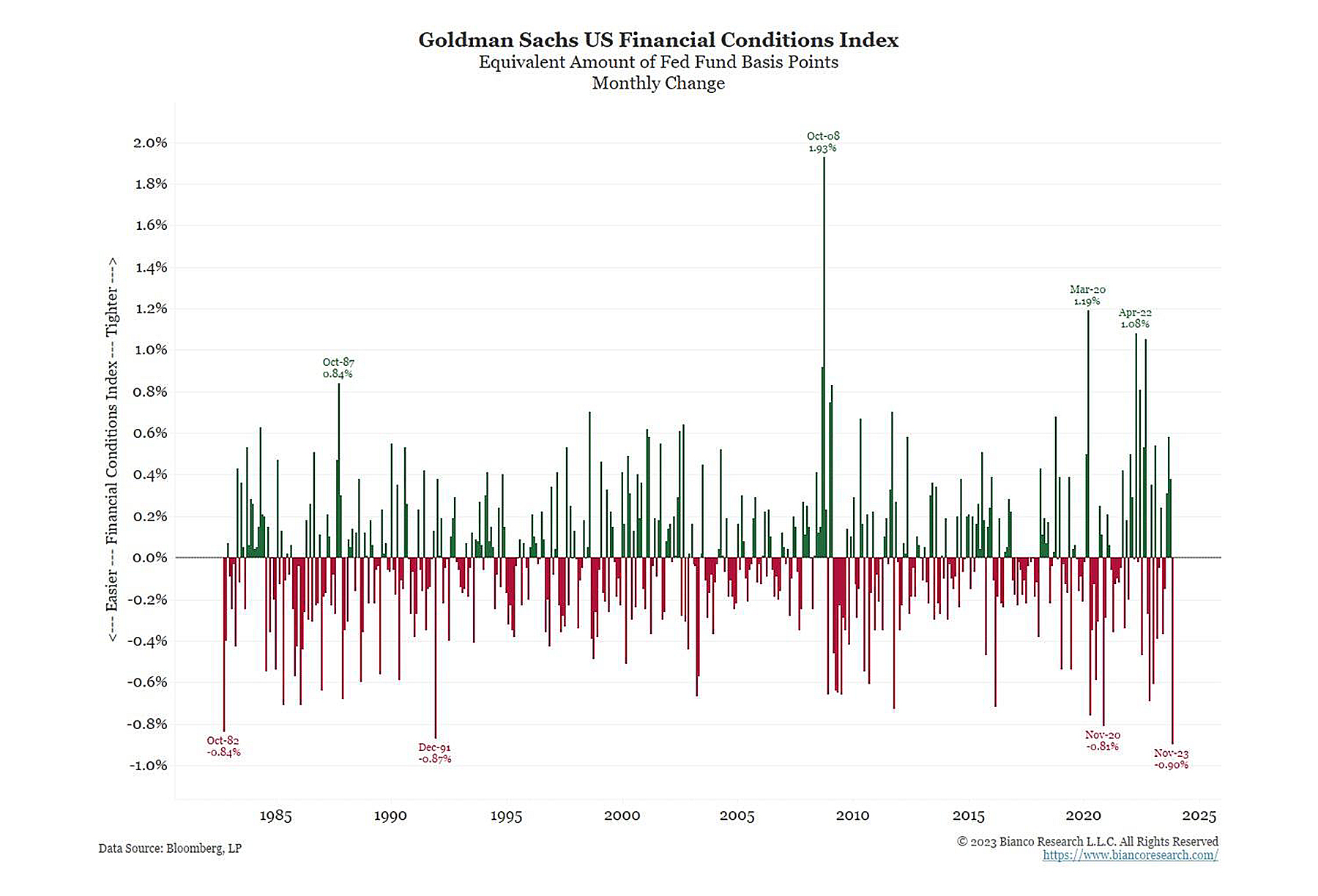

Perhaps one of the biggest risks to markets currently, besides inflation rearing up again, which it looks like it’s not going to for the time being, may be the overall easing in financial conditions.Fed policy

In November, financial conditions massively eased, with this easing being the equivalent of a 90 basis point rate cut. See below.

If financial conditions continue to ease, this may force the Fed to turn more hawkish again. It’s unlikely we’ll see another rate hike, but it may be the case the Fed talks the market back and remains “higher for longer”, which is currently being priced out with the market pricing in a 55% chance of a Fed rate cut by March.

With the recent labour market data also holding up, the Fed has more room to remain “higher for longer” also.

Liquidity (Repo markets)

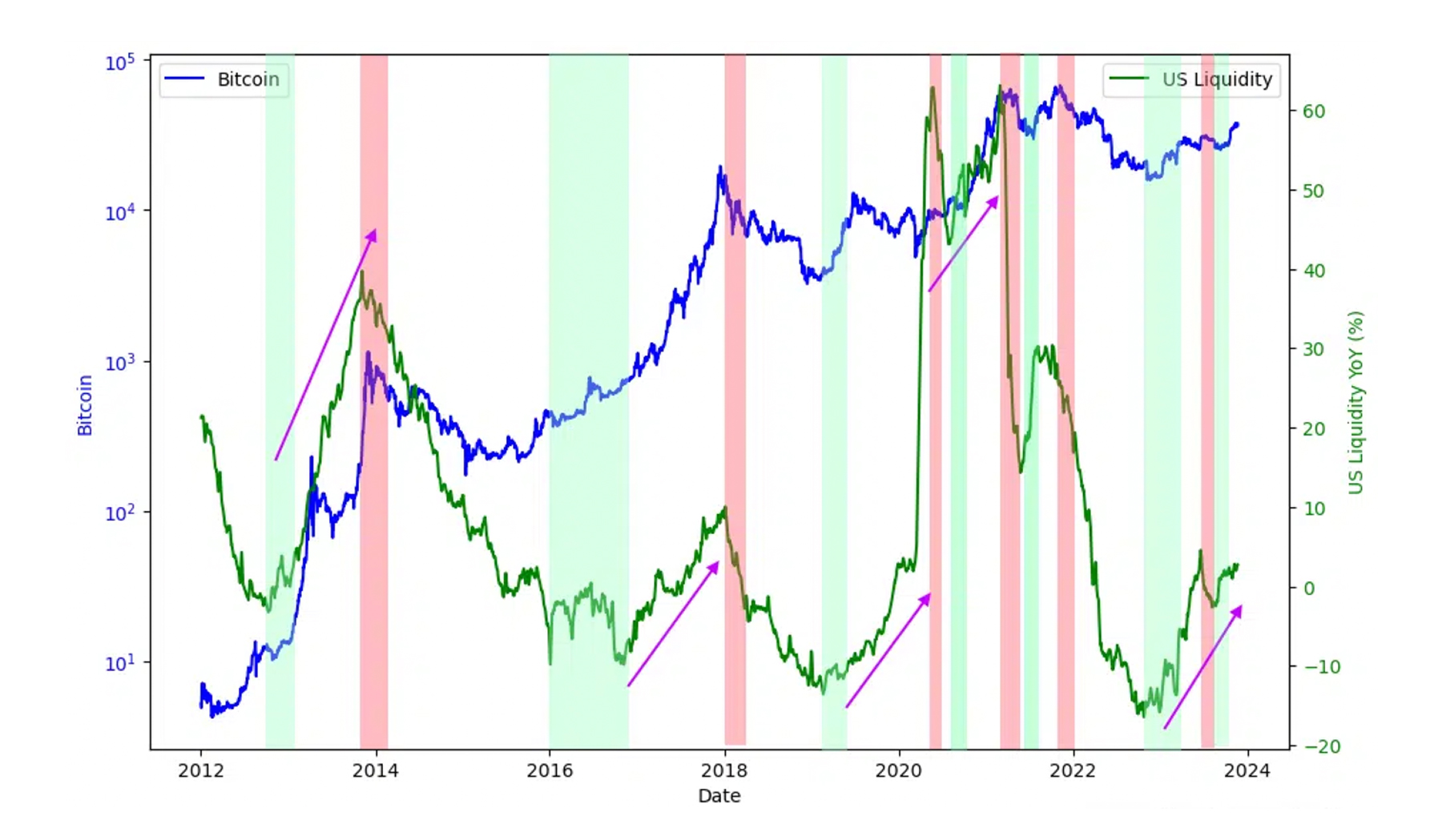

Another macro issue that may be a risk to markets is liquidity. The crypto markets are highly correlated to liquidity, as shown below.Bitcoin Price Against US Liquidity YoY % Change

Source: Capriole Investments

We know from our last Monthly Report that liquidity is net positive even though the Fed is running down its balance sheet – QT (quantitative tightening). But as we outlined previously, the Reverse Repo (RRP) is running down at a greater rate than the Fed’s Balance Sheet is running off at – hence, net liquidity is positive. However, this may come to a crunch point in the first months of next year.The Reverse Repo Program has a minimum constraint level estimated to be around the $700b mark. In November, the RRP fell below $900b; by December 1st, it was at $765b.

The decrease to $765b was so large that the SOFR (the Secured Overnight Financing Rate, which is the cost/rate of borrowing cash overnight, collateralised by Treasuries) increased by six basis points overnight to 5.39% – this is the largest move in its history. This spike higher was likely due to several reasons but it indicated that there was less cash in the system and more US Treasuries being used as collateral.

The recent pressure on Repo highlights that there may not be enough cash in the system to backstop Repo. It would then be up to the banks to lend cash, who likely will not be able to as they’re currently using the BTFP to provide them with more adequate liquidity, which they need to stay solvent. This situation means they don’t have that excess cash. It would see Repo rise as the RRP falls to $0. This would force the Fed to end QT and most likely swiftly begin QE.

Now, more liquidity is positive for Crypto. However, if there are liquidity issues in the early months of the year (from the RRP depleting down to $0 and QT finally having its intended effect), the markets could experience some major pullbacks. In that case, the Fed will have to step in (that’ll be the point that they begin QE) to resolve the issue. We may see the Fed/Treasury engage in some form of Yield Curve Control in the future. However, they’ll do anything not directly to call it that.

Summary of the liquidity situation

The early months of 2024 may see markets pull back more significantly if there are liquidity issues with the Repo markets. The Fed will then have to stop QT, as RRP depletes to $0 and can no longer be the component that provides the liquidity.How are we trading Bitcoin pre and post-ETF decisions?

We have seen in recent weeks that the SEC has had increasing correspondence with ETF applicants to make the necessary adjustments to their filings. The SEC wouldn’t be doing this if they then planned on rejecting the applications.So, we think that the SEC will approve the ETF applications in early January.

We must note that if the ETFs are approved, they will take 4-8 weeks to set up before there can be capital inflows. Following this, salespeople will be out selling the ETF products.

Therefore, we see the ETF approvals as a short-term sell-the-news event following the initial pump on the day. The crowd will expect new capital to immediately inflow, which it likely won’t, at least not through the ETFs. However, eight weeks later, it’s likely capital will begin inflowing.

Therefore, we may see a more meaningful correction in Q1 24 following the ETF approvals, particularly if liquidity issues overlay this in the macro markets. We see prices likely in a nice uptrend from April onwards – assuming there are no black swan events.

We do see price action as likely being positive until the ETFs are approved.

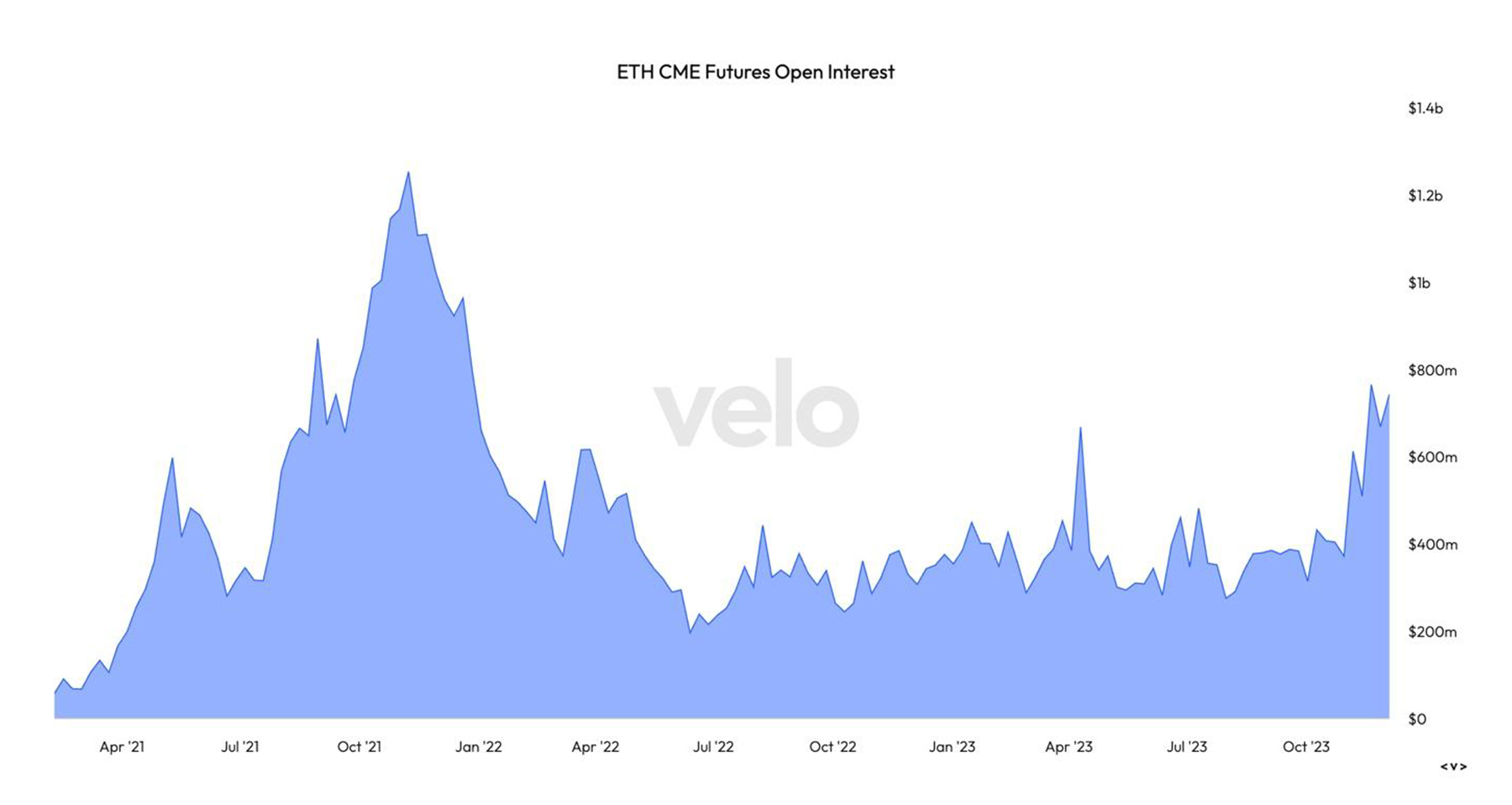

Is TradeFi now front-running ETH?

In recent months, we’ve seen that TradeFi has front-run the Bitcoin ETF with CME Futures Open Interest and Options Open Interest increasing dramatically. We’ve also seen the Grayscale Bitcoin Trust (GBTC) Premium narrow down to -10% from close to -50% a year ago.These are investment vehicles commonly used by TradeFi participants. The increased volumes indicated that TradeFi is far more active than previously and is front-running the ETF approvals.

We’re now beginning to see a similar scenario for the ETH ETF approvals which have a deadline for next summer.

ETH CME Futures Open Interest

Of course, there was huge volume in mid-2021 when the market was topping, and we now see that volume return.

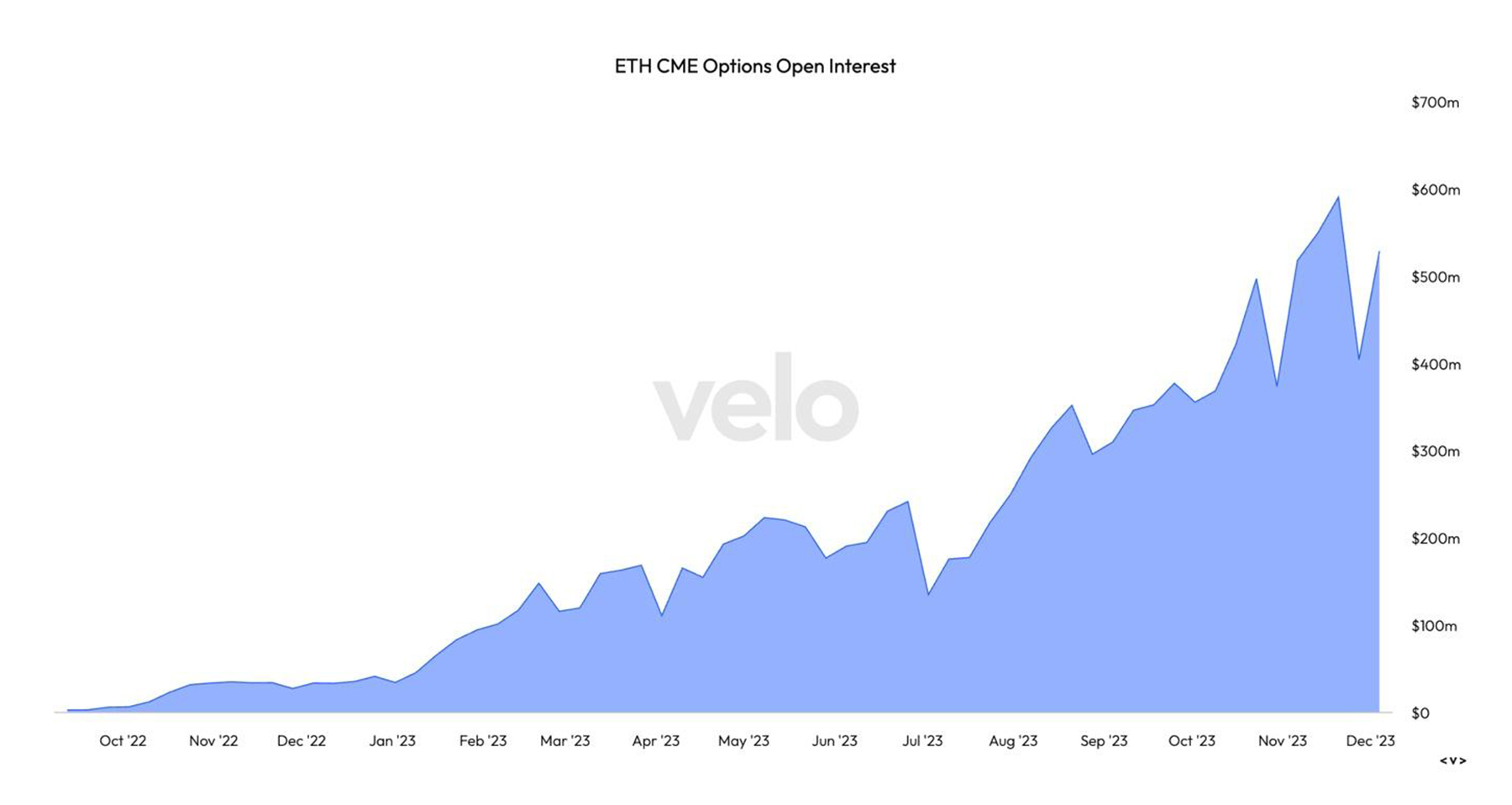

ETH CME Options Open Interest

Options are a common vehicle used by TradeFi to trade BTC and ETH. We can see that in the last months, Options' Open interest has reached all-time highs.

What we note as a key difference between the ETH and BTC ETFs is that the demand is likely far greater for BTC ETFs than ETH ETFs. That’s simply because ETH can be staked to earn a good yield, whereas this is not the case for BTC. Why buy the ETF for ETH and earn no yield when you can buy Spot ETH, stake it, and earn 5% annually?

Despite ETH’s 15% increase in the past weeks, ETH is still relatively undervalued and likely to see a substantial upside in the coming month and the long term. Anything close to $2,100, ETH should be aggressively DCA’ed into. We noted in our last Monthly Report that many participants risked being underexposed to ETH. Since then, ETH is up 15%.

Indexes

In this last section, we will look at the Indexes of coins. These have been categorised into: Large Caps Index, Mid Caps Index and Lower Caps Index.These indexes are a weighted basket of coins. Market Cap has determined the weighting. The bigger the coin's Market Cap, the greater the weighting of that coin against the other coins in that basket.

We will now look at the Big Caps Index and the Mid Caps Index on the 3D timeframes to assess their TA setups. We will then look at the Lower Caps Index on the 1D timeframe as there is less data from this basket due to it comprising more new coins.

Large caps index

Big Caps Index 3D

Made up of SOL, AVAX, DOT, LINK, MATIC

The Big Caps Index has seen a substantial upside recently but is approaching a key zone of resistance between $43 and $50. It’s tripled in the past 60 days. We also note that the RSI is phenomenally overbought. The structure is positive for further upside. However, it does suggest there may be a correction in the short-term (next few months).

Mid caps index

Mid Caps Index

Made up of ATOM, UNI, KAS, APT, RUNE

The Mid Caps Index hasn’t moved up as aggressively as the Big Caps Index but is now approaching a key resistance area at $9.14. This would also suggest some caution should be warranted in the coming weeks – it takes us right into the ETF decision. The ETF decision may be the short-term local top.

Lower caps Index

Lower Caps Index

Made up of: ARB, AAVE, FTM, LDO, RNDR

The Lower Caps Index has performed similarly to the Mid Caps Index. However, the Index is high and looks like it could push higher. Unfortunately, we wouldn’t trust the lower caps to drive the market, although they may continue to perform well in the coming weeks – pre-ETF approvals.

Cryptonary’s take

We expect Bitcoin and the rest of the market to continue to have positive price action. This is especially valid with the market currently in a new bull market, less than a month from the approval of BTC ETFs, and less than five months out from a new BTC halving.However, it’s possible that in Q1 24, there are some liquidity concerns and/or the Fed has to remain tighter than the market is currently pricing. Liquidity is expected to remain positive until potentially the end of January – when RRP is predicted to be close to fully depleted.

Therefore, we see the market continuing to move higher or remain at its highs in the next month, particularly with the strong narratives of the ETF approvals in early January.

However, following this (February, March and even April time), we could see the markets pull back more meaningfully as markets price back out the rate cuts it’s currently priced in.

It’s also possible we have a liquidity crisis in early 2024. If this were to happen, markets would sell down meaningfully. Yet, this would cause the Fed to step in, which would be bullish for risk assets. But of course, the pullback/crash before this would see prices decline meaningfully in that short period.

Ultimately, if there are any meaningful pullbacks in Q1 24, we would be DCA buyers of most major coins, with our DCA buys becoming more aggressive the lower prices go – assuming our theory is right overall.