Disclaimer: This is not financial or investment advice. You are responsible for your own capital decisions.

March madness: Let's unpack

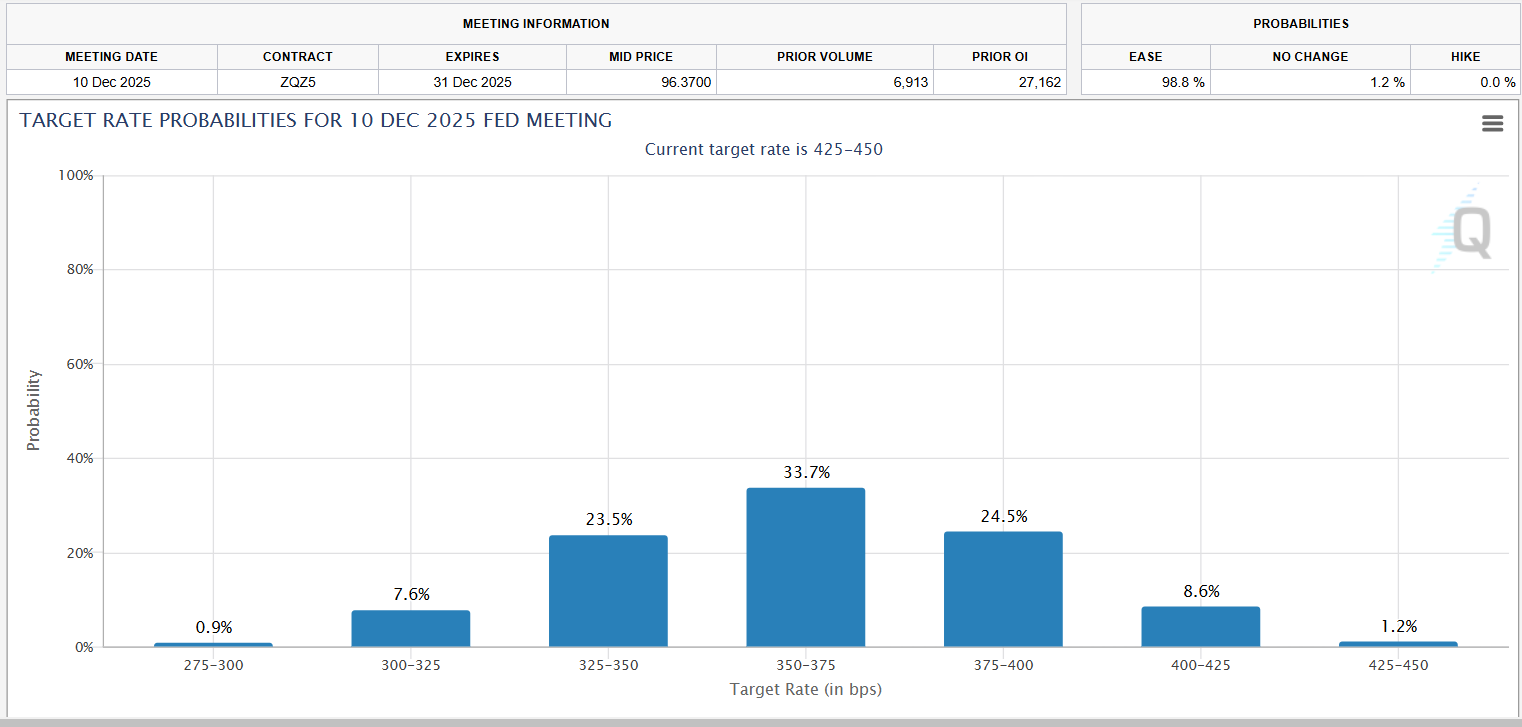

March brought one of the most volatile stretches we've seen in recent quarters. Markets were pulled in both directions as policy headlines clashed with renewed inflation fears, creating bursts of optimism followed by sharp retracements. While some expected conditions to stabilise after February's correction, macro uncertainty has only intensified.At the center of the volatility: Trump's shifting tariff rhetoric, with an April 2nd deadline for implementation now looming. Markets are grappling with two core questions - will the tariffs actually be implemented, and if so, will they stoke inflation enough to delay or reduce the Fed's willingness to cut rates? Neither answer is clear yet. The market has started to price in added risk, including the possibility of delayed Fed cuts. As of late March, futures are reflecting just under two rate cuts for 2025 significant downshift from earlier expectations.

And if that wasn't enough to rattle traders, the crypto world threw its own curveball into the mix.

March 3-7: Crypto reserve hype and the rapid unwind

The tone was set early, when Trump posted on Truth Social about plans for a potential U.S. "Crypto Reserve" that would include BTC, XRP, ADA, and SOL. The announcement hit on Sunday, March 3rd, triggering a sharp rally across crypto markets-particularly in altcoins.

Then Monday hit-and poof, the whole rally vanished. Thanks, tariffs…

On Monday, March 4th, the administration confirmed that a new wave of tariffs would take effect April 2nd, reintroducing inflation risks and economic uncertainty into the conversation. BTC cleanly rejected the $95K level and reversed lower. Risk assets followed. We also saw:

- Weak consumer spending data

- Falling sentiment

- A sharp Q1 GDP downgrade from the Atlanta Fed to -2.8%

The sequence raised red flags. A weekend rally on vague headlines, followed by a macro rug-pull the moment U.S. markets opened, led many to question the timing. Whether intentional or not, the setup came off as manipulative-especially considering the lack of detail or follow-through behind the original "reserve" post.

March 7: Crypto summit disappoints

By the time the Crypto Summit arrived on March 7th, expectations were running high. Many were hoping for tangible policy announcements, clear frameworks, or even capital deployment.What followed was underwhelming, offering few actionable takeaways.

The tone toward Bitcoin was broadly positive, but there was no commitment to outright purchases, no strategic frameworks laid out, and nothing that justified the prior weekend's rally. Investors were left with speculation and recycled talking points. The market faded the event almost immediately-validating the "sell the news" thesis we had positioned for in advance.

March 12-14: Inflation data and repricing risks

Inflation prints released on March 12th came in slightly softer than February, but still too elevated to support imminent rate cuts. Two days later, Michigan's Inflation Expectations came in at 4.4%, well above the Fed's comfort zone. Inflation expectations remain unanchored, and that adds another layer of uncertainty heading into Q2.March 19: FOMC plays it safe

At the March 19th FOMC, Powell left rates unchanged and avoided offering forward guidance. The tone was cautious-neither dovish nor hawkish-but certainly not enough to shift market sentiment.By this point, the drawdown was broad-based:

- BTC: down 20% from March highs

- S&P 500: down 8%

- Nasdaq: down 12%

- Memecoins and thin alts: down 40-70%

Hyperliquid: A stress test in real-time

Hyperliquid's Hyperliquidity Provider (HLP) vault took a brutal one-two punch in March 2025, revealing deep vulnerabilities in decentralised perpetual futures markets. What began as a high-leverage ETH liquidation morphed into a coordinated attack exploiting protocol design-exposing flaws in risk management, liquidity handling, and governance. Let's dig deeper…

ETH liquidation Hit - March 12

On March 12, a whale opened a massive long position totaling 175,179 ETH (valued at $335.6M) with 50x leverage on Hyperliquid. The trader then withdrew $17M in USDC margin, reducing collateral and triggering liquidation. The position was absorbed by the HLP vault, which lost $4M unwinding it, while the trader pocketed $1.86M in profit. Hyperliquid clarified this wasn't an exploit-just a user gaming the system within its rules. Still, the event left the vault with bad debt, directly impacting community liquidity providers (LPs) and raising questions about the platform's resilience.Protocol response: In the wake of the ETH hit, Hyperliquid moved to tighten its risk controls. On March 13, they slashed maximum leverage-dropping ETH from 50x to 25x and BTC from 50x to 40x-to limit exposure on large positions. By March 15, a new margin rule took effect: withdrawals from open positions now require a 20% margin coefficient, targeting the exact tactic the whale exploited. These changes aim to prevent liquidations from dumping outsized losses onto the HLP vault, though some argue they're a belated fix to a predictable flaw.

JELLY Incident - March 26

Days later, a more sophisticated attack targeted JELLY, a low-liquidity Solana-based memecoin listed on Hyperliquid. On March 26, the attacker executed a multi-step strategy:- Step 1: Opened two large long positions ($4M combined) and a $6M short on JELLY perpetuals.

- Step 2: Aggressively bought JELLY on decentralized exchanges (DEXs), spiking its price by 400%-500%.

- Step 3: Forced the short into liquidation, which Hyperliquid's HLP vault absorbed due to its size.

- Froze the attacker's accounts, limiting withdrawals to "reduce-only" orders.

- Force-closed the JELLY market at $0.0095-far below the DEX price of $0.50-neutralising the attacker's unrealized gains and netting the HLP vault a $700K profit over 24 hours.

- Delisted JELLY perpetuals entirely, halting the attack.

But here is the fun…

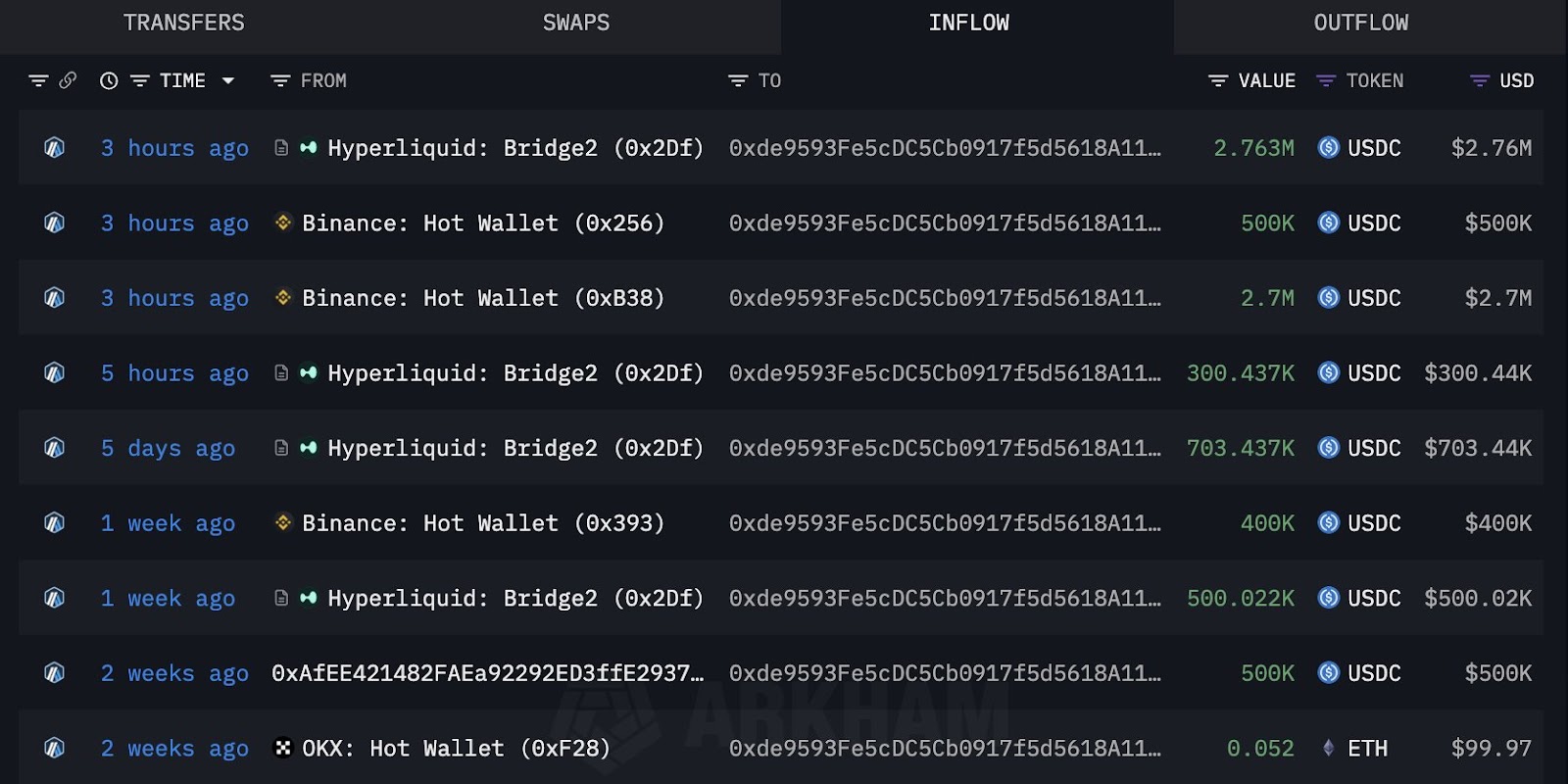

The plot thickened when Binance and OKX listed JELLY perpetual futures shortly after Hyperliquid's delisting. Blockchain analysis tied the attacker's wallets to funding from these centralised exchanges (CEXs), fueling speculation of a coordinated pile-on. Whether opportunistic or malicious, the listings amplified pressure on Hyperliquid at a vulnerable moment.

The fallout was stark:

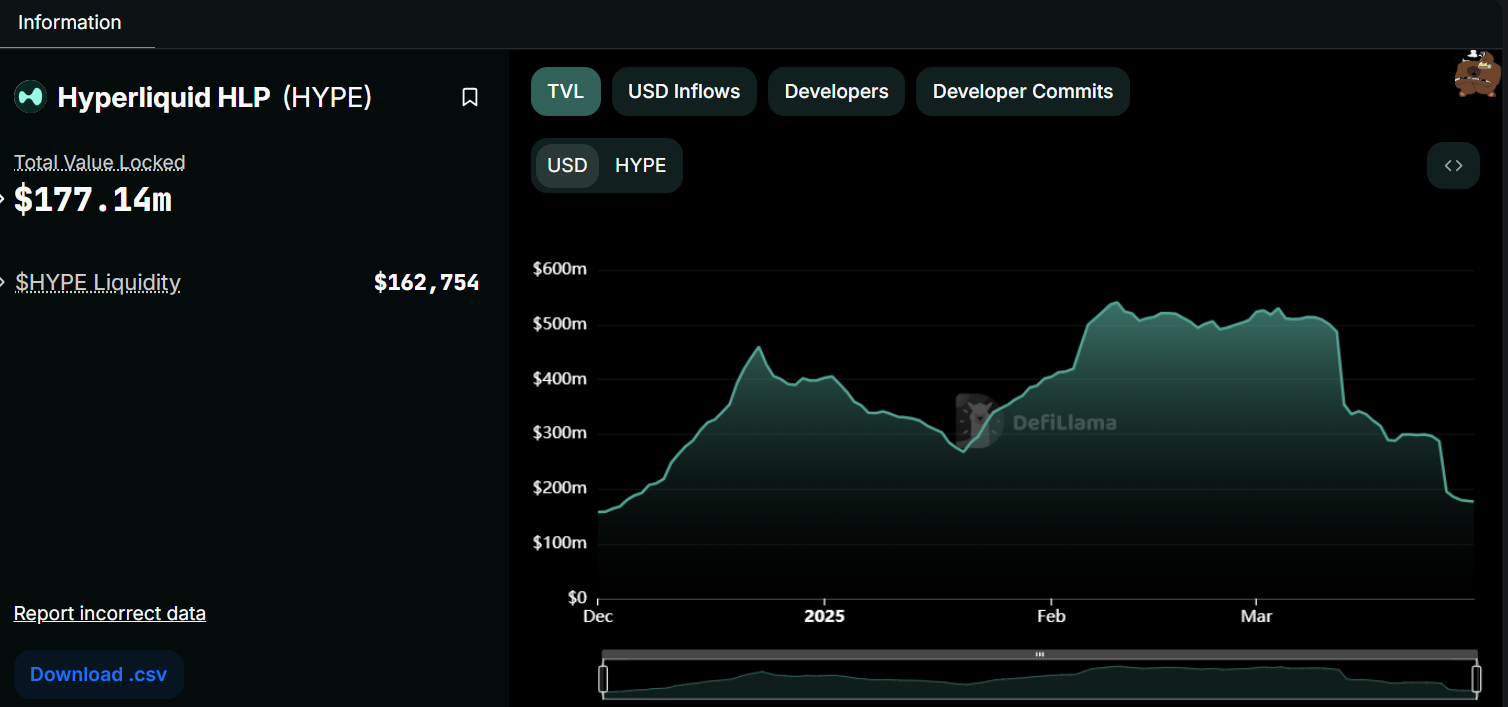

- HLP total value locked (TVL) plummeted from $540M in February to $180M - $195M by late March, per DeFiLlama.

- The HYPE token dropped 10% in 24 hours post-incident, with trading volume surging 443% as panic set in.

- User confidence took a hit, with 28 whale wallets withdrawing $65M in USDC.

Key Takeaway

The JELLY incident is a textbook case study in DeFi protocol risk. It laid bare weak guardrails around illiquid assets, fragile liquidation mechanics, and the tension between decentralised ideals and emergency intervention. This was no mere trade- it was a calculated stress test that pushed Hyperliquid's risk architecture to the brink, surfacing structural vulnerabilities in real time. As the platform rolls out upgrades- tighter vault caps, dynamic open interest limits, and an on-chain validator the question lingers: can Hyperliquid rebuild trust and fortify its defenses before the next attack? We will be watching…Trading desk review: March 2025

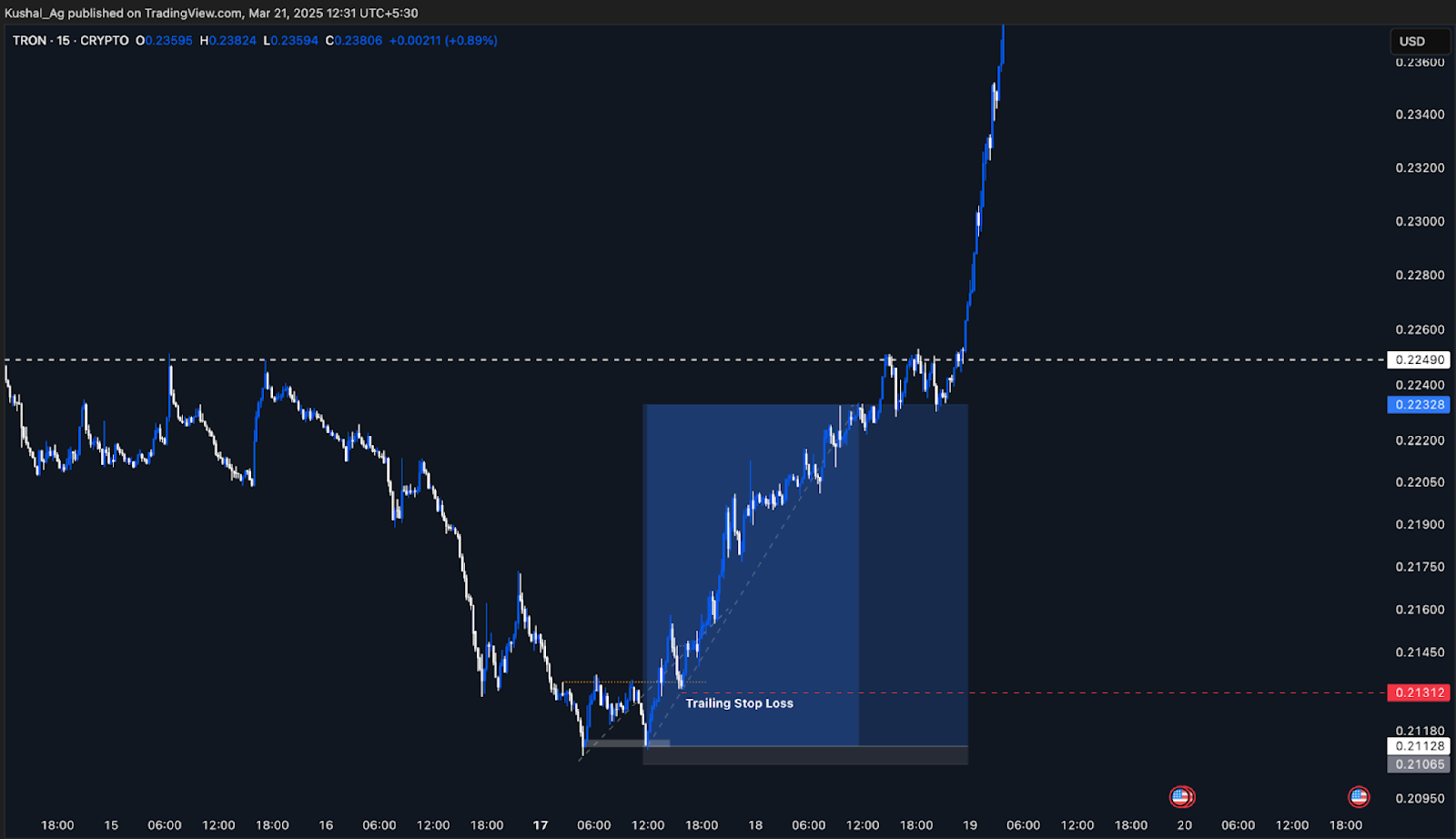

TRX (Long)

- Direction: Long

- Entry: $0.2112

- Timeframe: Daily / 15m

- Stop loss: $0.2106 (0.3%)

- Take profit: $0.22-$0.2249

- Final exit: $0.223

- Leverage: 10x

- Gain: 57%

- Risk management: Tight 0.3% initial stop, trailed to breakeven ($0.2112) post-confirmation

TRX stood out in a weak market, maintaining structure while most altcoins broke down. After reclaiming the 200 EMA on the daily, a clean Point of Interest (POI) formed on the 15m chart, with additional confluence from BTC's liquidity sweep. Entry was taken at $0.2112 with a tight 0.3% stop placed just below structure at $0.2106.

Once TRX broke above $0.2135 and confirmed a shift in structure, the stop was trailed to breakeven, effectively removing downside risk. Partial profits were secured at $0.22, and the final exit was taken just below target at $0.223 to avoid potential front-running at resistance. While a small runner could've captured further upside, the trade was executed and managed with discipline-balancing precision entry, tight invalidation, and adaptive risk control.

CAKE (Short)

- Direction: Short

- Entry: $2.60-$2.80 (initial), re-entered at $2.40

- Timeframe: Daily / 4H

- Stop loss: N/A (initial trade closed early due to protocol risk)

- Take Profit: $1.75-$1.90

- Final TP zone: $1.42-$1.55

- Leverage: 3x

- Gain: 31.6% (initial trade)

Overview:

CAKE rallied over 100% in just a few days, largely driven by renewed meme speculation on Binance Smart Chain (BSC), where activity was spiking due to public support from CZ. As the main DEX on BSC, CAKE became a proxy bet for this uptick in attention. But structurally, the asset was still pressing into its long-term downtrend, and fundamentally, BSC lagged behind ecosystems like Solana and Base in speed, scalability, and user experience. In short, the hype wasn't backed by sustainable catalysts. Technically, repeated rejection wicks near $2.60-$2.80 added weight to the bearish case.

The trade was entered cautiously in the $2.60-$2.80 zone using the daily and 4H structure. Despite initial confirmation, it was closed early at $2.33 due to rising concerns around Hyperliquid protocol risk-locking in a 31.6% gain and preserving capital. Once the dust settled, a second entry was initiated at $2.40, with the same target zones in play.

As of now, CAKE is trading around $1.99 and continues to develop in line with the original thesis.

BTC (Short)

- Direction: Short

- Entry: $86,300-$91,700

- Timeframe: 4H / Daily

- Stop loss: Above $91,700

- Take profit (Target): $75,000-$77,000

- Final TP zone: $70,000-$72,000 (extended target)

- Current price: $82,000

- Leverage: 3x

- Unrealized gain: 17.25%

Following a brief relief rally from the high $70Ks, BTC climbed-as expected-into our Short Box between $86,300 and $91,700. Price advanced slowly on declining volume, with open interest rising and sentiment turning increasingly complacent. The zone, sitting just beneath the psychological $100K mark and the underside of prior structure, was identified in advance as a prime rejection area. It played out perfectly-price filled the box, and triggered our short entries.

From there, we initiated the trade with a clear downside bias. Persistent inflation, hotter-than-expected PCE data, and renewed tariff threats from the Trump administration added macro pressure. Bearish RSI divergence confirmed weakening momentum and increased the probability of a local top.

With BTC now trading around $82,000, the short remains active and firmly in profit. Immediate focus is on the $75K-$77K demand zone, with $70K still on the radar depending on how the market digests this week's catalysts-including the April 2nd tariff announcement, Wednesday's JOLTS data, and Friday's NFP print. If the reciprocal tariffs come in lighter than expected, that relief rally could prompt us to close the short. Fingers on the pulse this week.

Your edge: Tools and strategies to thrive

Now let's move to the most exciting part. Our app's finally here-and it's your ticket to staying ahead of the curve. Download it, dive in, and let's roll!After months of building, the new Cryptonary app is officially live - available now on web and iOS (Android coming soon). For the first time ever, all our research, analysis, portfolio tools, and community features are in one place. This is the most comprehensive crypto-native research platform in the industry - built from the ground up for serious investors. No more scattered updates across Discord or email - everything's now in one spot and moving fast.

Inside the app, you'll find major upgrades. The portfolio tracker has been fully rebuilt for a smoother experience. Our new CPRO community chats let you post ideas, set custom usernames, toggle portfolio visibility, and engage with others in real-time. We've also introduced push notifications, so you'll never miss a market update or high-conviction play again.

While Discord isn't going away just yet, we'll begin gradually transitioning new members and core content to the app. Going forward, the app will always get content first, before it hits any other platform.

We're just getting started. Two major features are already lined up for May:

- A gamified experience with streaks, badges, and leaderboards.

- A personalized feed based on your preferences and activity.

Yield farming & airdrop strategy: earning while you wait

In a range-bound market with few high-conviction opportunities, keeping idle capital productive becomes a competitive edge. For those positioned in stablecoins, two strategies stand out: earning passive yield or farming early-stage airdrops. The most effective approach? Do both simultaneously.High-yield stablecoin strategies

We recently outlined four yield strategies for stablecoins, categorized by lockup duration and liquidity preferences-allowing investors to tailor exposure based on their risk tolerance and capital needs.Pendle (Locked)

- Earn a fixed 13% APY on sUSDe with a 15-day lockup.

- Tokenize and sell yield streams via Pendle's permissionless platform.

- Solana-native vault hedged against market volatility.

- Averaged 31% APY over the last 90 days with a 3.5-day lock period.

- Multi-chain yield optimizer with 7-8% APY.

- Instant access to funds, auto-compounding returns.

- $250M deposited; APY around 8.9%.

- Accessible on Ethereum and Base, backed by robust DeFi infrastructure.

- Diversify across platforms and protocols to mitigate smart contract risk.

- Monitor APYs and performance over time-yields change frequently.

- Stay updated that security-yield farming carries no insurance.

Airdrop strategies using stablecoins

We've consistently identified early-stage airdrop opportunities across the DeFi ecosystem-and that work continues. In March, we focused on three under-the-radar protocols offering stacked incentives for stablecoin users.Ethereal

- A new DEX built on Ethena's delta-neutral USDe framework.

- Over $750M in deposits, but fewer than 20,000 users.

- Deposit USDe to earn both Ethereal airdrop points and 30x Ethena multipliers.

- Bonus strategy: Pendle YT pool boosts Ethereal points by 60% and Ethena points by 50x.

- A fully collateralized, yield-generating stablecoin (lvlUSD) backed by Polychain and Dragonfly.

- 115M TVL and only 13,000 users.

- Stake lvlUSD to earn 20x Level XP and Symbiotic points.

- Bonus: Pair with Pendle to boost exposure.

- An RWA-backed stablecoin protocol by Fortunafi.

- TVL: $130M with <4,000 participants.

- Stake srUSD into Level to stack Reservoir Points + Level XP.

- Offers 8% APY while farming multiple airdrops.

Why this matters now

With inflation proving persistent, rate cut timelines uncertain, and liquidity tightening across segments of the market, stablecoins remain a defensive positioning tool. But that doesn't mean capital should remain idle.By allocating across high-yield strategies and targeting underexposed airdrop opportunities, investors can:

- Earn real APY on stables.

- Stack multiple airdrops with minimal downside.

- Stay active in the market without overexposing to risk.

Cryptonary's take

March served as a full-scale reset, revealing just how fragile sentiment remains in the face of policy pivots, liquidity strain, and a lack of clear catalysts. From Trump's shifting tariff stance to underwhelming summit optics and persistent inflation readings, the macro backdrop delivered more noise than signal. The result? A market stuck in wait mode: reactive, uncertain, and lacking directional conviction.But in that chaos, there was clarity.

Our decision to de-risk in prior months, rotate into stablecoin yield, and sidestep and even short fakeout rallies has proven effective. While others chased narratives, we remained focused on capital preservation and positioning for high-upside opportunities.

Looking ahead to April and Q2, we expect volatility to persist. The April 2nd tariff deadline looms as a potential catalyst, particularly if it's softened or delayed. Rate cut expectations also remain in flux. While the Fed maintains a neutral tone, persistent weakness in consumer data could force its hand sooner than anticipated. Until then, markets are likely to stay range-bound and reactive.

In the meantime, our playbook doesn't change:

- Preserve capital.

- Stay liquid.

- Farm yield and airdrops while opportunities are asymmetric.

- Be ready to rotate when the macro tide turns.

Stay sharp.

Cryptonary, out!