Market Chaos - Big Moves Are Happening

Markets are in freefall, but opportunity awaits. Inflation, FED decisions & BTC levels, here's what you need to know! After what has been a mental week in markets, let's dive into some key components we're watching and then what our outlook is going forward.

Here are the topics we'll cover today,

- Data this week and next

- Market context

- Levels we're watching

- Cryptonary's take

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Data this week and next:

The key data we're watching out for this week is Inflation data (out on Wednesday 12th) and the Michigan Consumer Sentiment and Inflation expectations (which is out on Friday 14th).Even though markets are now focused on the growth element of the economy, due to the uncertainty around the new administration's policies that has seemingly sped up the slowing in growth that we were already beginning to see, the market still has a close eye on inflation.

Last month's inflation numbers came in hotter. The consensus for this Wednesday's prints is for the numbers to come in slightly lighter than last month's numbers.

On Friday, we have Michigan Consumer Sentiment and Inflation Expectations. Consumer sentiment came out last month really positively (a positive consumer opinion about the economy going forward).

It'll be interesting to see if that continues considering the high level of uncertainty around the new Trump administration policies. In recent survey data, Trump was still held in a very positive light, so there's still a good chance that Consumer Sentiment will remain strong/positive.

Last month, the Inflation Expectations came out much hotter than expected, 4.3%, rather than 3.3%, and it's expected to come in high again at 4.4%.

Next week, the major event is the FED Meeting on Wednesday 19th. Our expectation is that J Powell will deliver a FED that's still on pause, and he'll likely be non commital on future rate cuts.

Our feeling is that the FED will remain on pause in March and may even strike a hawkish/resilient tone, i.e., not looking to cut soon. However, we do see the growth data continuing to weaken.

This may then set the FED up at the May meeting to forward guide rate cuts for the June or maybe July Meeting. But we're expecting the first cut to come at June or July's FED Meetings. We'll go into this topic much more early next week.

Market context:

Over the last fortnight, the markets have been in free fall, with it becoming quite extreme in the last week. To put this into context, this is the performance of BTC (Bitcoin), SPX (S&P500) and NDX (Nasdaq) over the last 7 and 14 days (trading days).BTC:

- 7 days = -16.45%

- 14 days = -19.80%

SPX:

- 7 days = -5.9%

- 14 days = -8.4%

NDX:

- 7 days = -7.4%

- 14 days = -12.4%

BTC:

For SPX (the S&P500), this is the most oversold it has been since October 2023, although the Yen Carry trade unwind of August 2024 also came close.

SPX:

For the NDX (the Nasdaq), this is the most oversold it has been since January 2022.

NDX:

The above shows us how sharp and extreme the move has been in the short term. However, that doesn't mean we can't go lower (price-wise). After all, we saw Bessent come out and say, "There is no Trump put", i.e., Trump won't come in and change his stance just because the markets are going down.

Our thinking is that they're actually getting exactly what they want. This is a move down in the US10Y Yield, which will allow Powell to cut rates at the front end, and that'll allow Bessent to term out the debt (that's coming to maturity) over the coming 12 months. Then, through deregulation, the economy will transition to private sector-led growth rather than excess government spending led growth.

So, it's possible we will have a small relief rally in the short term if Wednesday's inflation print comes in light. This would likely just be a mean reversion rally (relief rally).

However, the markets' issue isn't inflation; the issue is policy/tariff uncertainty whilst growth is slowing at quite a fast rate, and the liquidity set up in the US isn't too positive, whilst we're seeing there be a pick up in Europe (this is capital flight issue now as well).

It's a strong mix of other factors, likely meaning any short-term relief rally is only that, just a relief rally.

Due to this rapidly changing environment, we have seen over the last month, the market is now pricing for 3.1 interest rate cuts this year now rather than 1.5 cuts. And, if the data continues to trend how it's trending, perhaps we move closer to 4 cuts. That's 4 x 25bps cuts.

That would spur risk assets in the second half of the year. However, if the cuts come because of an outright recession, then risk assets will likely go lower on the first rate cut. But as the cuts speed up, risk assets will likely pick up.

At the moment, Bond Spreads aren't suggesting outright recession, and rather just growth fears. We can see this in the Bond Spreads line (pink line) moving up slightly.

Notice that every time Bond Spreads pick up/move higher, the S&P (risk assets) puke. That's what we're seeing now. But as we said, Bond Spreads are just suggesting growth scares currently rather than an outright recession.

An outright recession would be shown on this chart, with Spreads spiking up substantially. This will be one of the main indicators we watch going forward.

Bond Spreads against the S&P500:

Levels we're watching:

This is a tricky job, and it's not an exact science, but there is some science to it, so let's have a look.Firstly, we're playing the timeline of events, just as much as we're playing price here. So, with reciprocal tariffs going on in early April, there's still more turbulence for the market to go through here.

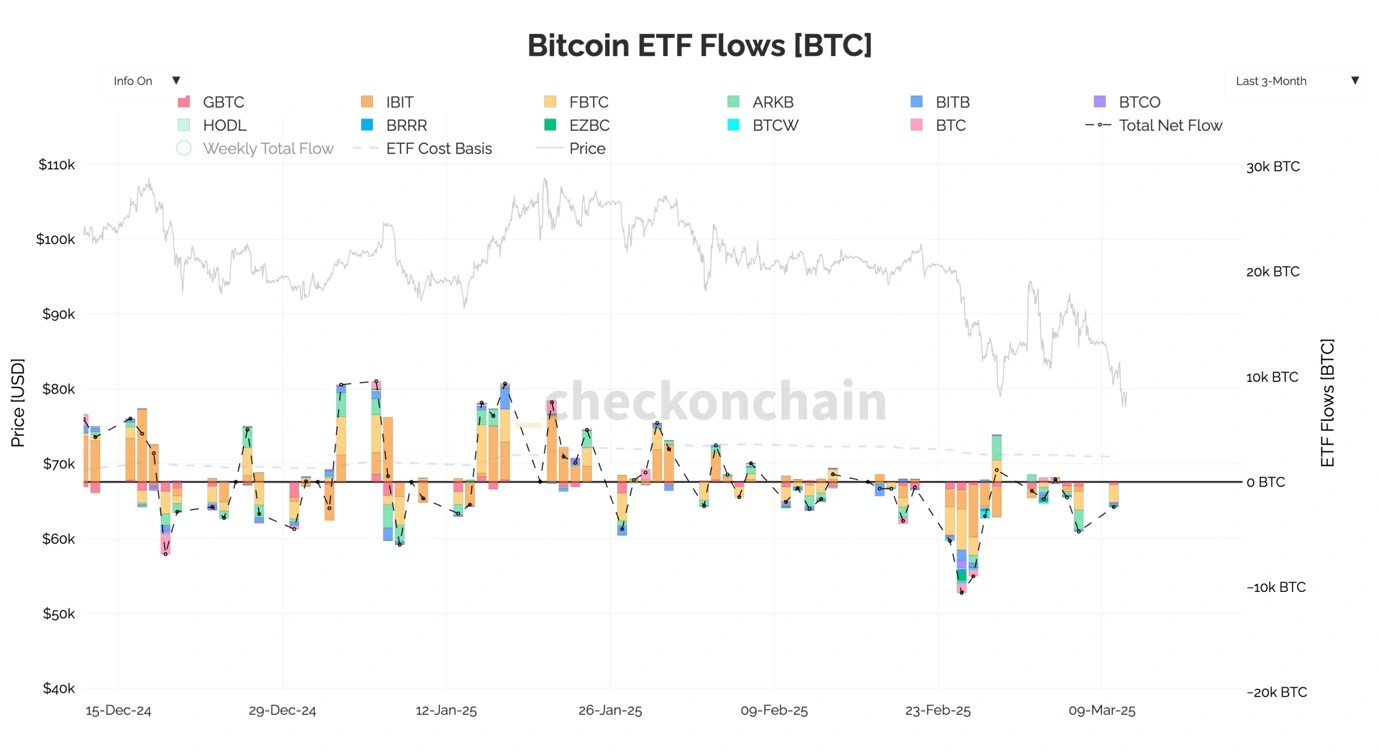

Before we get into levels for BTC, one chart we're watching is the ETF Flows. The first thing we're looking for is for ETF outflows to slow and then stop so that the netflows are 0 or as close to 0 as possible.

That may be an indication that the selling is done. For this, we'll watch the simple metric of 'ETF Flows'. We can see from this metric now that selling has begun to slow in terms of overall selling size, but it's still a lot of outflows.

Bitcoin ETF Flows:

In terms of areas of interest (price wise) that we're looking for, this is more of an estimation. However, we can identify some key levels.

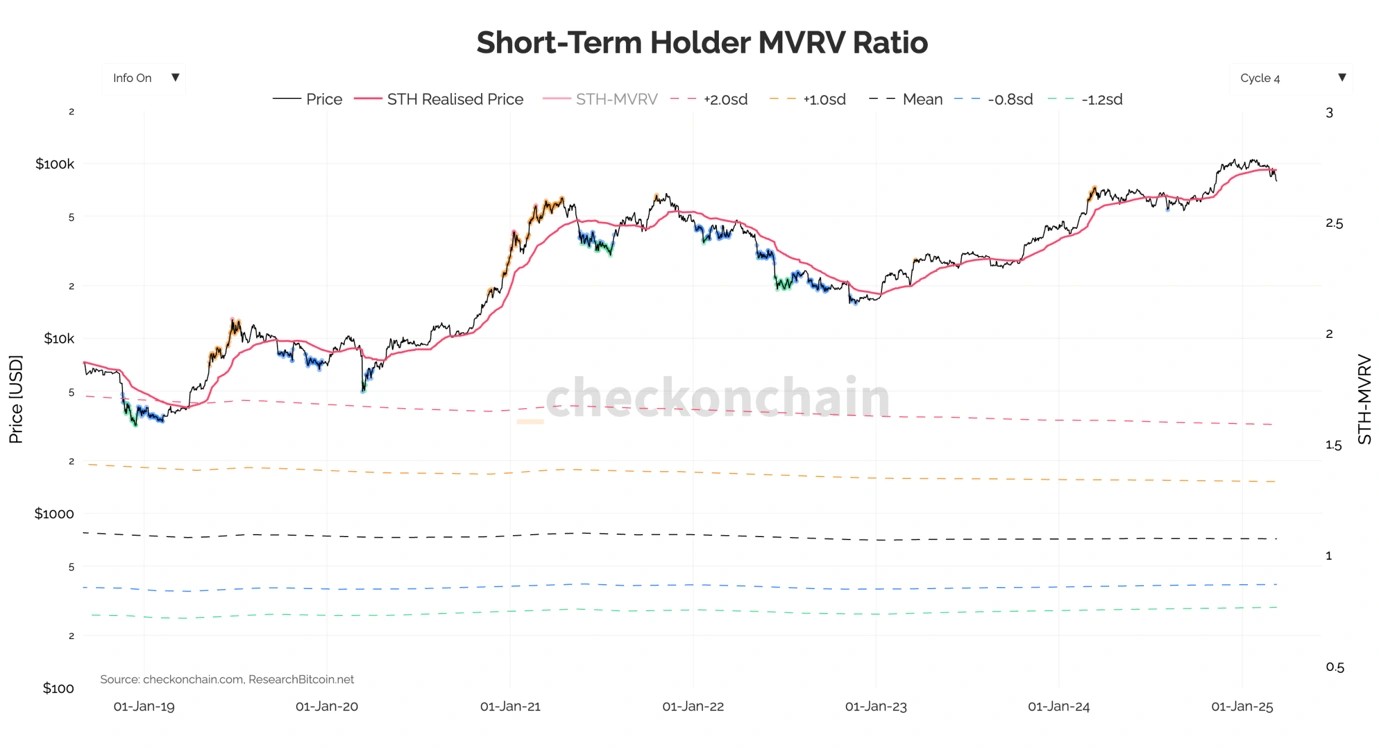

One of the best is the Short-Term Holder Realised Price. The current Short-Term Holder Realised Price is at $91,700. We can see in this chart, assuming we're still in a bull market, and we believe that we are (looking out over the next year), the value areas are -0.8 and -1.2 standard deviations below the current Short-Term Holder Cost Basis.

These levels will light up 'blue' and 'green' respectively. We expect these areas to be between the late $60k's and the mid $70k's.

Short-term holder realised price standard deviations:

So, late $60k's to mid $70k's is likely good value territory. But where are the bottom levels? One of the best metrics for bottom levels is the Electrical Cost (from Capriole).

The Electrical Cost is essentially calculating how much it costs efficient miners to mine Bitcoin, and it therefore suggests that Bitcoin is at least worth what it costs to produce. This price is currently sat at $56,900, and this price would represent deep value territory.

Bitcoin's electrical cost:

We don't expect the price to go as low as the Electrical Cost, so $56,900. However, if the Bitcoin price starts with a 5 ($50k), it's a screaming buy, a throw 'the kitchen sink' at its scenario. If BTC is in the low $ 60k, it's probably similar; you load up on it.

Mid to high $ 60k, it's a buy, we're confident of that with a long-term outlook. Between $70k and $78k, you probably want to be lightly building a position in BTC, where you're adding in more as we progress along the macro timeline - Trump's tariff deadlines, etc.

Cryptonary's take:

We're currently in one of the most chaotic market environments we've seen for some time, potentially since Covid. Ultimately, many of us de-risked at the right time, and we're watching this bleed out and knowing there's potentially huge opportunity ahead of us.Whilst we're playing price, we're also playing against the macro/Trump timeline. But, there may come a time in the not-too-distant future (next month or two) when prices drop to a point where they're so attractive that you might just have to 'close your eyes' and buy.

Then, close the laptop lid for a while. Be greedy when others are fearful. That doesn't mean. However, jump all in at once. Chip into the buys.

There are positive tailwinds later this year:

- Rate cuts, likely at least 3.

- Tariffs come off or are reduced following trade deals.

- Trade deals would allow other countries to stimulate (China).

If BTC goes to $70k and SOL to $100, that potentially sets up a relatively easy 2x in BTC and a 3x in SOL by year-end/Q1 2026. If we get that, what could memes/alts (coins at the furthest end of the risk curve) do in performance? Probably many multiples more.

Don't get caught up in the fear of today, but look at it as potentially providing a huge opportunity to buy the best assets at major discounts that can then put in good multiples over the coming 12 months.