Market Pulse

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

What happened?

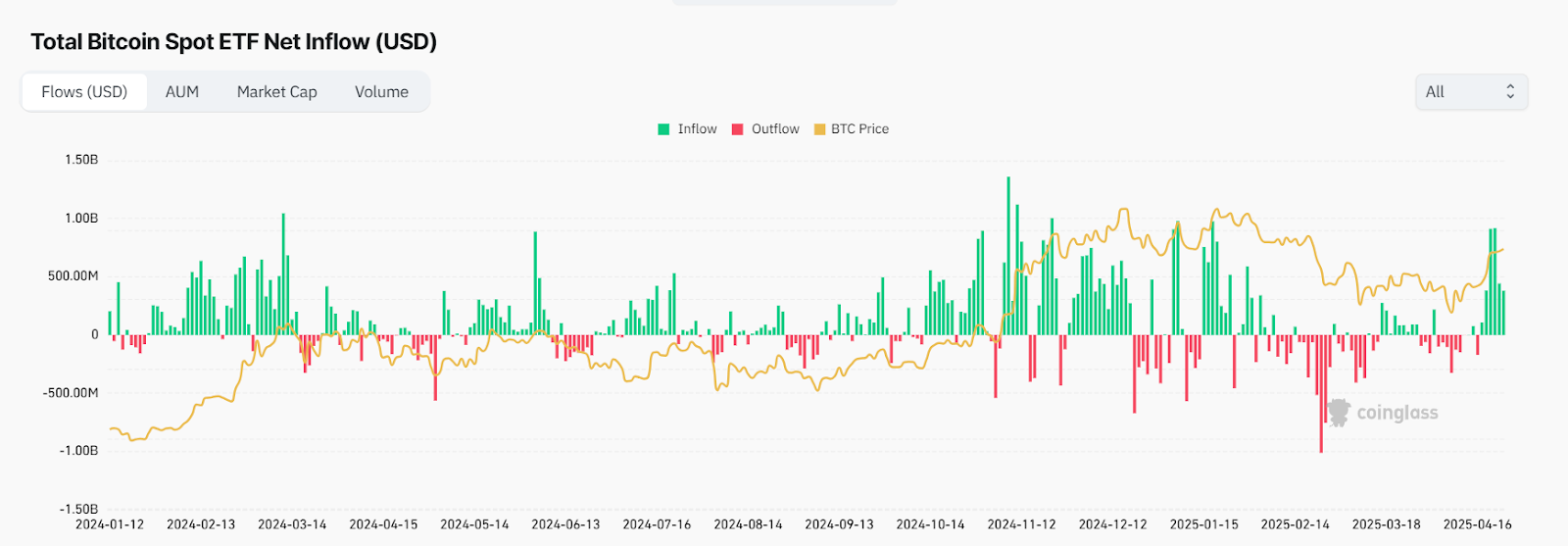

Strategy, under the leadership of Michael Saylor, has continued its aggressive Bitcoin accumulation strategy, acquiring 15,355 BTC for approximately $1.42 billion at an average price of $92,737 per Bitcoin. As of April 27, 2025, Strategy now holds 553,555 BTC, acquired for a total of ~$37.90 billion at an average price of ~$68,459 per Bitcoin, solidifying its position as the world's largest corporate Bitcoin holder.Bitcoin ETF flows: Along with Strategy buying BTC, ETFs have also picked up, averaging around $500m daily with cumulative inflows of $3.14b in the last 10 days. BlackRock (iShares) currently leads the pack with 588,687 BTC ($55.62b) in holdings.

Cryptonary's take

As a result of these two factors, we have seen Bitcoin rise roughly 25% from the bottom, reclaiming key levels and driving FOMO among market participants. Our take? We believe having someone like Saylor constantly bid BTC is a good thing for the price in the short term.However, for a sustainable rally in BTC, Saylor alone and moderate ETF inflows aren't enough in our opinion. Stimulus and liquidity are the real kickers that are going to take BTC into a new ATH. Therefore, long-term investors should remain patient and not FOMO into range highs.

In the short term, however, it is possible BTC can still move slightly higher as it is holding a key area of support. For more details, check out our latest Market Update and Market Direction reports.

Peace!

Cryptonary, OUT!