TLDR:

- Rate cuts less likely after softer inflation data.,

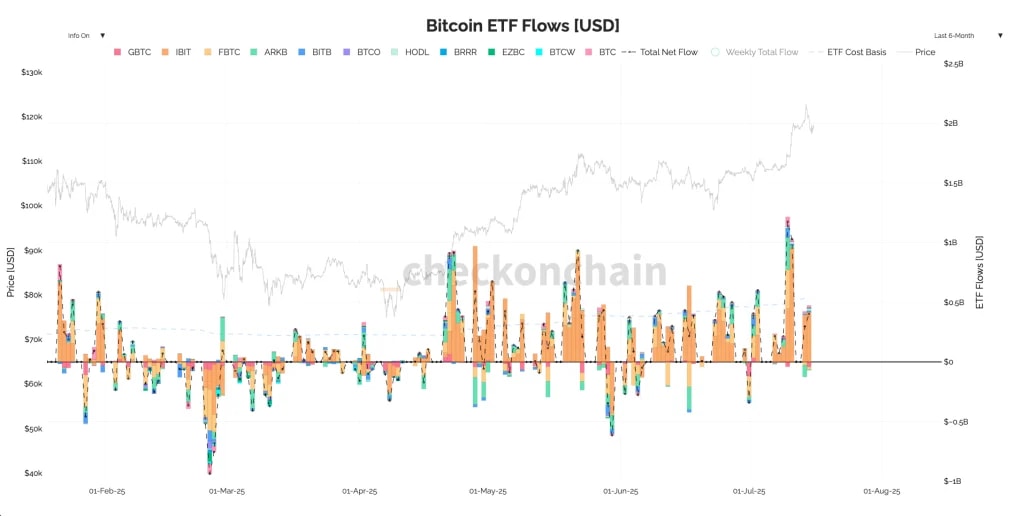

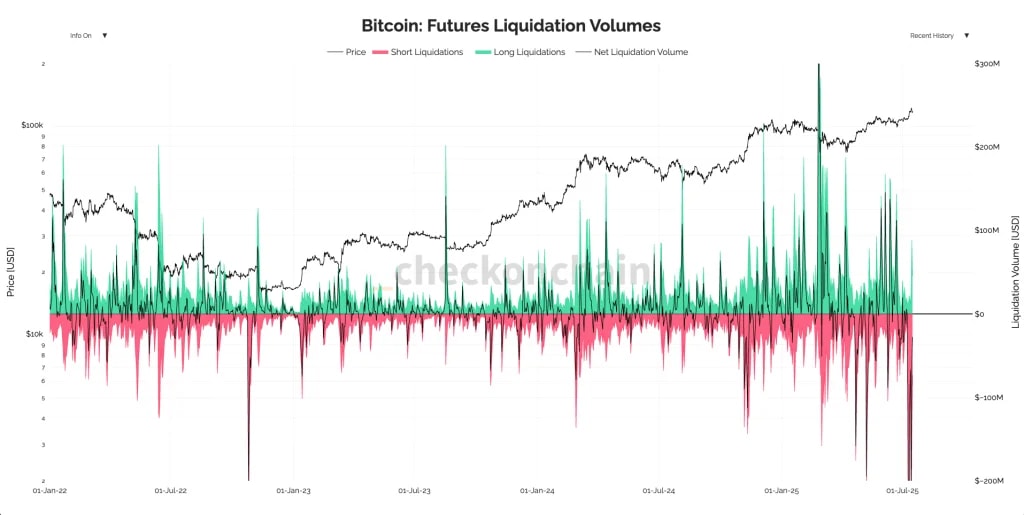

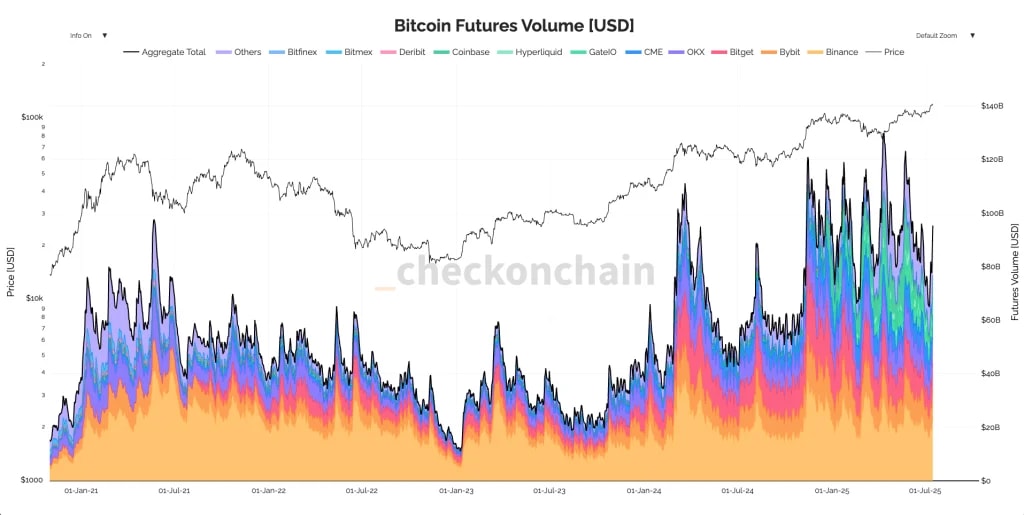

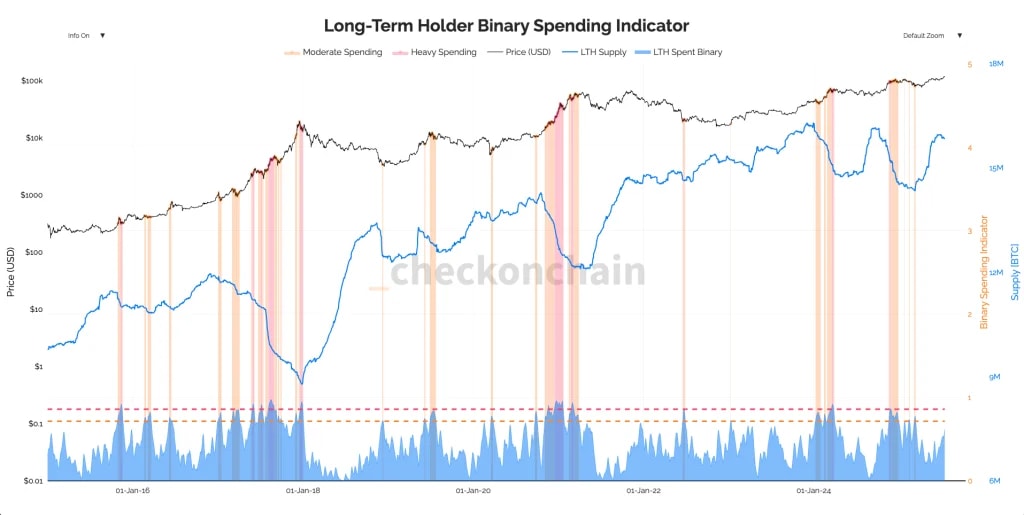

- BTC hits $123k, boosted by ETF inflows and short squeeze.,

- Altcoins gaining momentum, early signs of alt season.,

- Cryptonary bullish, eyes $150k+ BTC by year-end.,

- Data This Week and its Effect on Rate Cuts.,

- BTC's Breakout.,

- Cryptonary's Take.,

The result of this was an increase in Bond Yields, particularly at the front end of the curve. In plain English, this is the market reducing the odds of Interest Rate cuts in the near term. And in the last day, we've seen the odds of an Interest Rate cut at the July Meeting fall from 6.2% to now 2.6% - granted a cut in July was very unlikely anyway. However, the September Meeting was pricing a 65.8% chance of a rate cut at the September Meeting, and now following Tuesday's Inflation data, the market is now pricing just 50.8% (a coin flip) for a cut at the September Meeting.

Target Rate Probabilities for 17th September FED Meeting: