Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Jobs data beat; July cut now off, September still in play.

- Market repricing dovish expectations; Equities holding, DXY up.

- BTC ETFs flows remain strong, price stable at $110k.

- TOTAL3 holding support and pressing into resistance, rotation toward Alts could follow.

-

-

Topics covered:

- Macro Data and its Effect on Markets.

- Tariffs and an Extended Deadline.

- Crypto Indexes.

- Cryptonary's Take.

Macro Data and its Effect on Markets

This week, we're relatively light on the macro data front, so attention will be on the Jobless Claims on Thursday, and then the FOMC Minutes that are out on Wednesday. However, neither data point is expected to be market moving, with the market more focused this week on the tariff deadline, and its now new extension.Last week, we did have the release of more important data, and markets have reacted on the back of that. Firstly, we saw JOLTs Job Openings come in much higher than forecasted, suggesting that there is an increased appetite amongst employers to hire workers again. Then, last Thursday, we had a far stronger than anticipated labour market report, with 147k jobs added (the forecast was for 100k), and the Unemployment Rate ticked down to 4.1%, whereas it was forecasted to move up to 4.3%.

Now ,this labour market report wasn't as strong as the headline numbers made out, as most of the job gains came in the public sector, with the private sector seeing declining job growth.

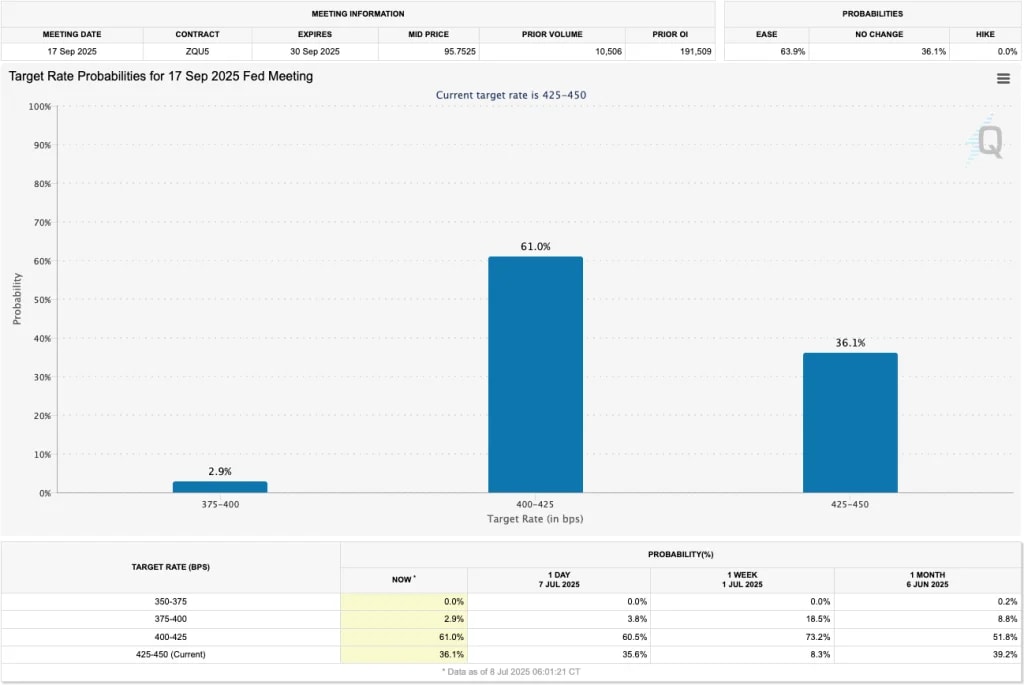

This stronger than expected labour market report suggested that the FED don't need to cut rates immediately (i.e, the July Meeting), and the odds for an Interest Rate cut in September also decreased. Before this labour market data, the odds for an Interest Rate cut in July were at 19.1%, and at 78.0% for September's Meeting. Now, the odds for a July cut have dropped to 4.7%, and September is at 61.0%. Interestingly, the odds for the FED to not cut in July or September are at 36.1%.

CME Odds for an Interest Rate Cut at September's FED Meeting:

To summarise the above; stronger labour market data has pushed Interest Rate cuts out slightly further, essentially taking the potential for an Interest Rate cut in July, off the table, and reducing the odds of an Interest Rate cut at Septembers Meeting. Although, there is still a 61.0% chance that the FED cuts in September.

In response to this, the Dollar (DXY) has bounced slightly, and Bond Yields have climbed higher, however risk assets (Equities) have continued to climb higher.

US2Y Yield 1D Timeframe: The US2Y Yield pops 20bps higher off due to decreasing odds of a July Interest Rate cut.

Tariffs and an Extended Deadline

In recent days, the Trump administration have pushed the tariff deadline date from July 9th (tomorrow) to August 1st. They have also stated that they'll be sending letters to countries in a bolshy last push to get them to the negotiating table, or that country risks having the April 2nd tariff rate put back on them. The market initially reacted positively off the back of the deadline date being pushed to August 1st, but since then, there hasn't been too much reaction to tariff news. The market is somewhat looking through the changing tone out of the administration, and it now seems that the market has come to grips with the fact that a 10-20% tariff rate will be implemented, and any aggressive tone is a negotiating tactic.One aspect we must be wary of is that if the tariff deadline can be pushed back once, why can't it be pushed back twice? This is important as it extends the runway for trade deals, and therefore the FED might not get the clarity that they're looking for in the short-term. The result of this might be the FED remaining on pause for longer, or they may pivot and just work with the data that they've got/are getting, and they might revert to tariff impacts as being transitory and therefore choosing to look through it. It'll now be critical to pay close attention to the FED speak over the coming weeks to see what stance they're leaning towards following the extension of the tariff deadline date.

If the FED choose to work with the data they've got, and look through the tariff impacts, then they'll likely begin cutting Interest Rates in September (maybe October worse ways), and this'll be very positive for risk assets. However, if the FED choose to remain on pause for longer (as they wait for the impacts of tariffs to show up on the data), then this could be a substantial headwind for risk assets. And with the Nasdaq currently trading at a 28x multiple, valuations are somewhat elevated. Although, as we move into Q2 Earnings in the next weeks, Earnings expectations are low, and therefore it's a low bar for them to beat. This might be a tailwind for Equities, however, it will need to be supported by a FED that chooses not to extend their pause just because the tariff deadline date has been pushed out again.

Crypto Indexes

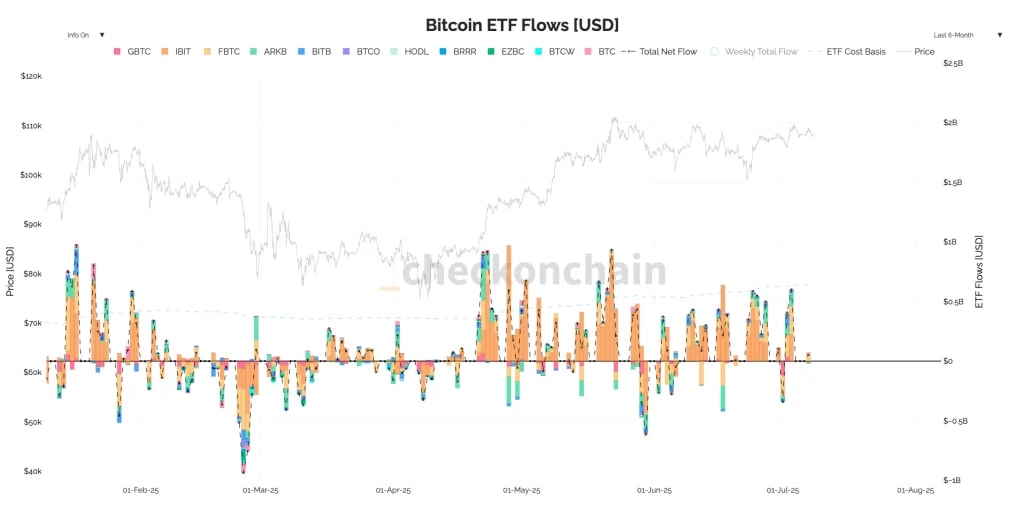

We'll now dive into some key Crypto Indexes to get a better gage on where the Crypto market stands. For that, we look at ETF flows, Bitcoin dominance, and TOTAL3 (total market cap excluding BTC and ETH's market cap). We continue to see positive Bitcoin ETF flows which has helped keep price squeezed into the $110k level.BTC ETF Flows:

We've also recently seen Bitcoin dominance hit a new cycle high of 66.0%, although it has broken below its local uptrend line in the last days. In this environment, you'd then expect Alts/Meme's to be bleeding, seeing as BTC dominance has moved higher. However, TOTAL3 held the $784b to $807b support zone very well, and it's now pushing for a breakout of its downtrend line. If it can breakout and then reclaim the $880b horizontal level, this will likely set up a bullish leg higher in the coming weeks, meaning Alts and Meme's could outperform.

BTC Dominance 1D Timeframe:

BTC dominance breaking its uptrend while TOTAL3 pushes higher signals early signs of Alt rotation.

TOTAL3 3D Timeframe: Note: TOTAL3 is on the 3D timeframe (more zoomed out) than the BTC Dominance chart above, which is on the 1D timeframe.

Cryptonary's Take

The market was looking increasingly bullish going into last week, however, the stronger than expected jobs data has somewhat stalled the rally in Crypto as the market prices for Interest Rate cuts to be pushed out slightly. This potentially sets up a choppier period over the coming weeks, even if it's still possible that Majors can breakout in that time. The rest (Alts and Meme's) will catch up upon greater confirmation from FED members that Interest Rate cuts are coming. It's possible that Powell uses Jackson Hole (mid-August) to guide to cuts in September.The tariff deadline day extension also adds some uncertainty in terms of how the FED are going to behave around it. Are they going to begin working with the data they're getting, or are they going to continue to remain on pause until they get greater clarity on the tariff situation? We'll be paying close attention to the FED speak over the coming weeks for more signs on how the FED are interpreting an extended tariff deadline date, and what that might then mean for potential Interest Rate cuts. Remember, Powell himself has stated that the FED would likely be cutting now if it wasn't for the tariffs and their potential effects.

For now, we continue to build our positions by adding our favourites (BTC, ETH, SOL, HYPE and AURA) on meaningful price pullbacks, with our intention being to be fully allocated by mid-August (Jackson Hole). This is the working plan for now, and we'll adapt it and our strategy depending on the economic data and the upcoming FED speak. But, all-in-all, we remain incredibly positive when we look out over the next 12 months as we expect 5-7 Interest Rate cuts to come and fuel a major bull market.

Peace!

Cryptonary, OUT!