Market Update: Rates, Ceasefires & Crypto at Key Levels

Markets are shifting fast. Middle East tensions are cooling, the FED is turning dovish, and crypto majors are rallying into resistance as we head into a pivotal summer. However, here is why the next 12 months could actually deliver an euphoric phase for crypto. Let’s get into it.

TLDR:

- Jobs data points to a softening labour market, boosting rate cut expectations.

- Trump pressures FED; dovish signals and falling yields lift markets.

- BTC and equities strong at index level; broader rally expected with rate clarity.

- Cryptonary bullish, accumulating ahead of potential late-2025 euphoria.

- Majors are leading; Alts and Meme’s still lag for now.

Topics covered:

- Data This Week.

- Rate Cuts, Trump and the FED, and the Markets' Reaction.

- Indicators and On-Chain.

- Cryptonary's Take.

Data This Week:

This week is a shorter week in TradFi markets, with markets closed on July 4th (this Friday). Therefore, the jobs data that is typically out on the first Friday of every month, will now be out on Thursday (July 3rd). On Tuesday, we have JOLTs Job Openings data, with the forecast being for a small downtick to 7.1m from 7.39m. However, Thursdays' data is what the markets will be most focused on this week. The forecasts are that the Unemployment Rate might tick up to 4.3%, with the US adding around 100k jobs. If the forecasted numbers come in, this would be a continuation in the softening trend that we have been seeing in the labour market, and this would likely aid the argument for Interest Rate cuts in the coming months - assuming the inflation data doesn't spike higher. If the data comes out soft, we expect a positive market reaction, with strength across BTC and risk assets. This is due to the data being weak enough to induce Interest Rate cuts, but not weak enough that it suggests a breaking in the labour market/recession. This is a 'Goldilocks' Setup. The next set of inflation data is out two weeks today (July 15th), with next week being a quieter week in terms of macro data releases.US2Y Yield 1D Timeframe:

US10Y Yield 1D Timeframe:

$DXY 1D Timeframe:

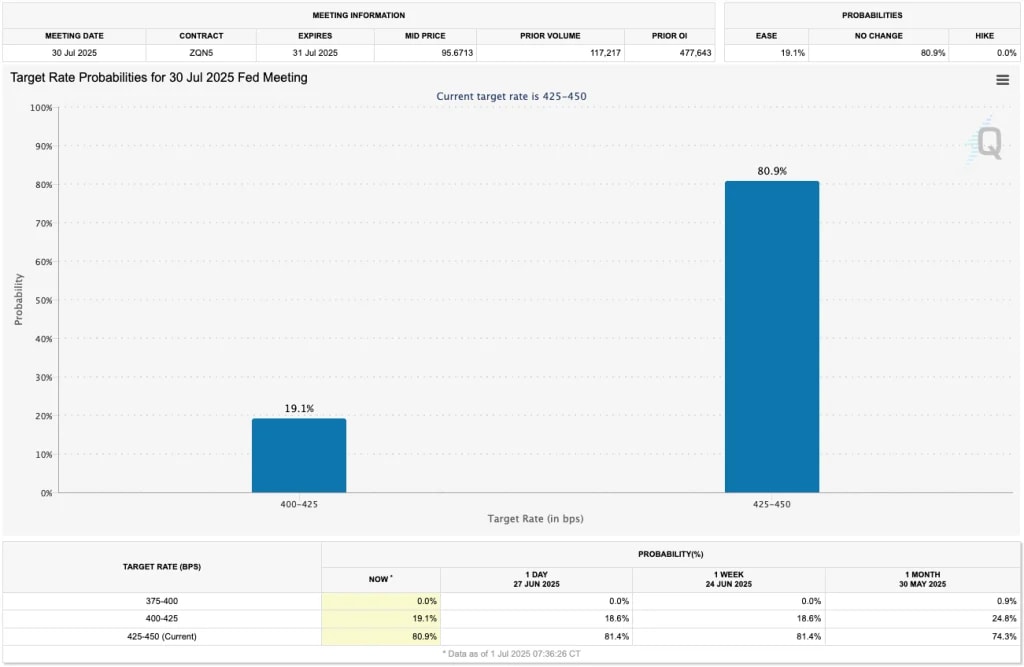

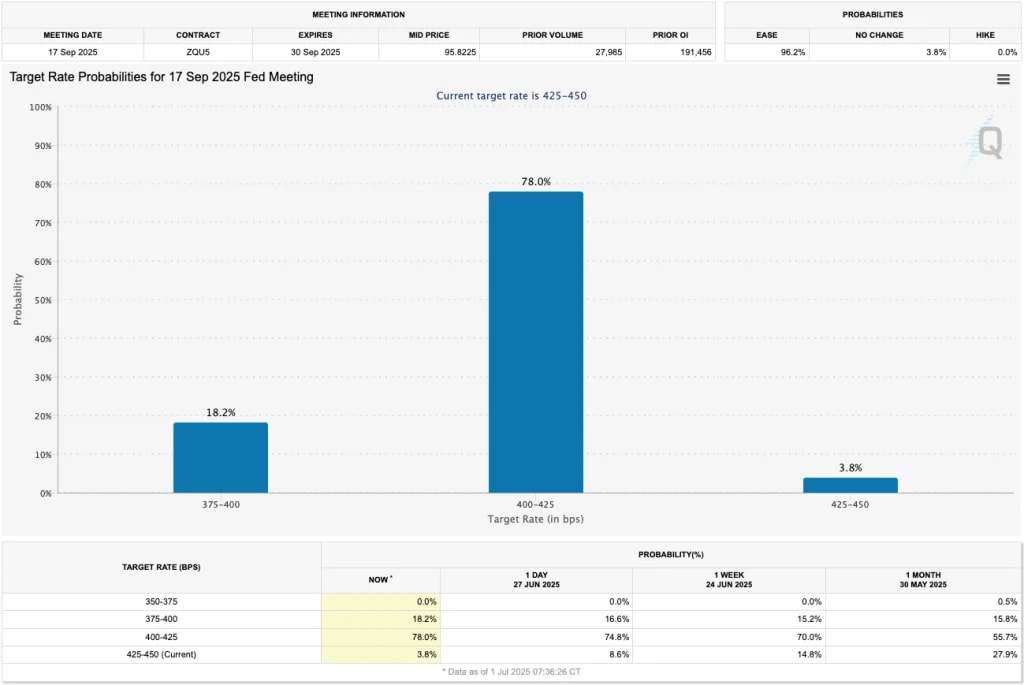

One outcome that is currently seen as very low odds now is that the data softens further in July, but not enough that the FED cut rates at the end of July FED Meeting. But then the data may more materially weaken throughout August and early September, potentially opening the door for the FED to reduce rates by 50bps at the mid-September FED Meeting. This would be double the size of a standard 25bps cut. This is currently a long shot, but it's a 15x payout on Polymarket should it materialise. And remember, this is what took place in 2024. The FED was slow at the wheel at the July Meeting, the data more materially weakened between July and September, and the FED cut by 50bps at the September Meeting. Full disclosure: I (Tom) have personally taken a position that we see 50bps of cuts in September, but either way, we expect the market to interpret any cut as risk-on Interestingly, the CME has the odds of a July Interest Rate cut at just 19.1% chance, with an 80.9% chance that the FED remains on hold. Whilst they have the odds of a 25bps cut in September at 78.0%, with odds of 18.2% that the FED cut by 50bps in September.

Target Rate Probabilities for 30 July FED Meeting:

Target Rate Probabilities for 17 Sept FED Meeting:

Indicators and On-Chain:

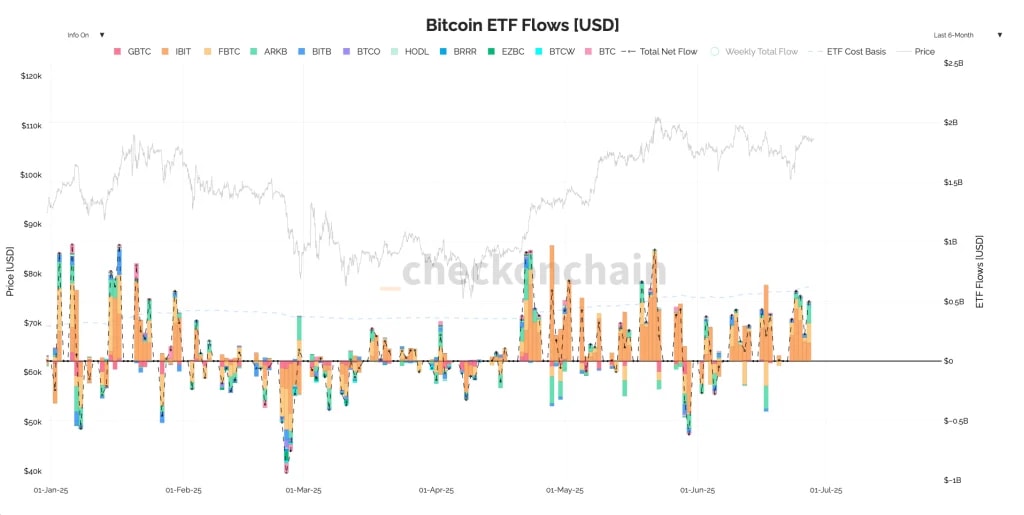

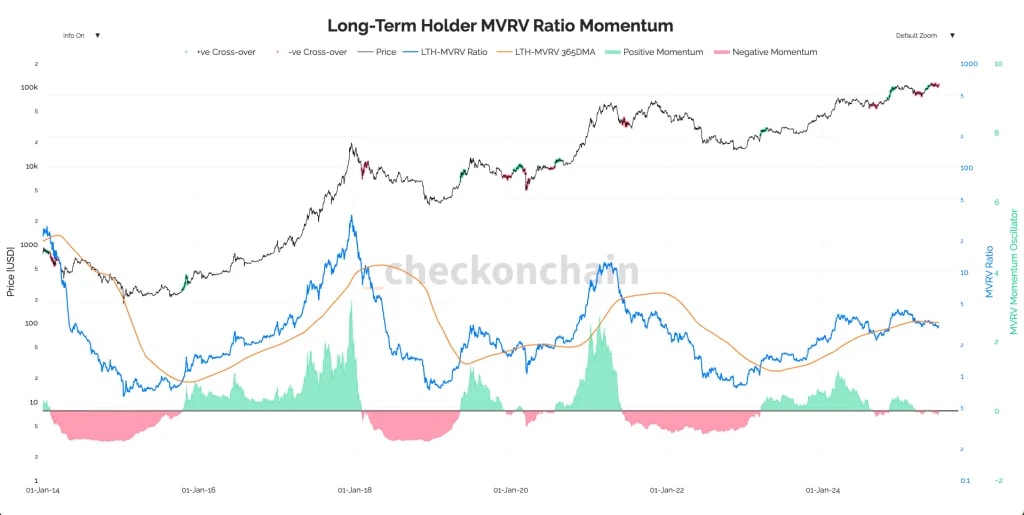

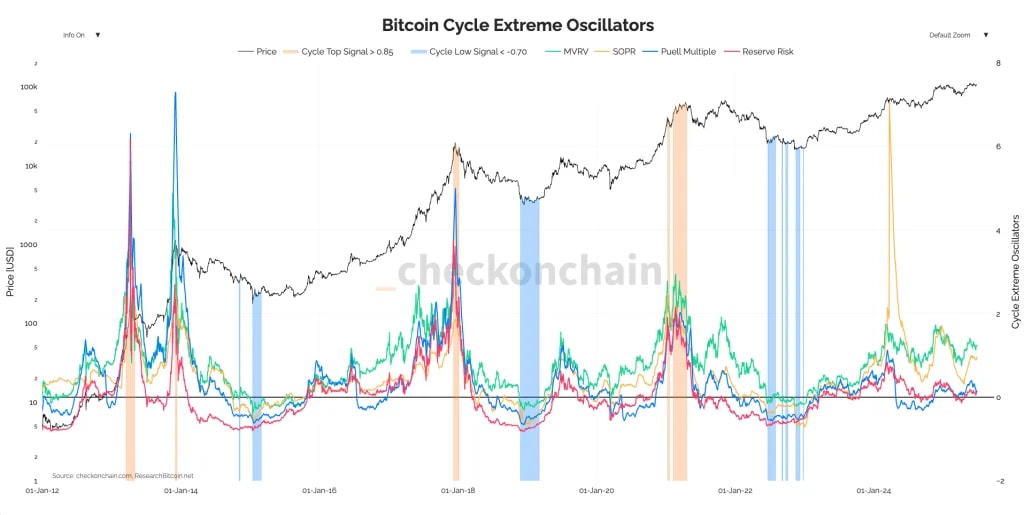

In the last few weeks, risk assets generally have performed well, however, it has mostly been at an Index level. We see this in BTC, with Majors, Alts and Meme's lagging slightly, and we see it in the S&P, where we're yet to see the breadth of stocks rally back to highs, despite the Indexes being at highs. Our expectation is that the rally will broaden out (into smaller caps, and into Alts/Meme's) once there's greater certainty over whether the FED is going to cut Interest Rates in either late Q3 or early Q4. In the meantime, we're continuing to see positive BTC ETF inflows, whilst on-chain indicators for BTC are subdued. These indicators show no signs of froth, and they suggest that we're mid-bull market, where the market is potentially just a few months away from moving into a 'euphoria' stage. We can see this in the 'Long-Term Holder MVRV Ratio Momentum' chart, which shows 'negative momentum'. But, in recent times, periods of 'negative momentum' have been followed by strong upward moves in BTC's price. Alongside the above, the 'Bitcoin Cycle Extreme Oscillators' (which is made up of several on-chain pricing models) is subdued. This suggests that there's much further upside to be had in the coming 3-9 months.

BTC ETF Inflows (in USD):

Long-Term Holder MVRV Ratio Momentum:

Bitcoin Cycle Extreme Oscillators:

If we then turn to Alts/Meme's, we look at TOTAL3. We can see it's still holding its bullish structure, and assuming the $784b to $807b horizontal ranges continue to hold (we expect they will), then this chart is primed for a breakout of its downtrend channel, and for price to push higher. The two key breakout levels we're watching are the main downtrend line (red line) and the horizontal resistance of $930b (white horizontal line). This bullish chart structure suggests that it's just a matter of time.

TOTAL3 3D Timeframe:

Cryptonary's Take:

In the last 6-8 months, we've had the following:

- The FED pause their rate cutting cycle.

- Israel/Iran escalate.

- Tariffs, and the worry over their impact.

- General policy uncertainty from the Trump administration.

We've now moved into Q3, where we have a ceasefire between Israel and Iran, slightly more clarity on policy, and less fear over the impacts of tariffs as the market digests the fact that tariffs will settle somewhere between 10 and 20%. Alongside this, the macro data is in softening trend that suggests that the US economy is slowing in some areas, whilst the inflationary impact of tariffs is looking like it'll be more subdued than initially expected. The FED are also expected to potentially look through it, and some members have suggested that they'll be prepared to begin cutting rates again, either in Q3 or at the beginning of Q4. And from there, the FED will likely cut rates more meaningfully, and rather than just deliver 1-2 Interest Rate cuts, it looks more like it'll be 5-7 cuts over the coming 12-15 months. In the coming weeks, we'll continue to add to our bags on meaningful pullbacks: BTC, ETH, SOL, HYPE and AURA, as our expectation is that the next 12 months will be very positive for Crypto. It's possible we see a 'euphoria' phase between Q4 2025, and the end of Q2 2026. We want to be well positioned for that, and hence we're looking to get risk-on now, and in the coming weeks.