Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

A weaker Dollar, A stronger Bitcoin: The macro repricing begins

May 2025 marked a sharp pivot in U.S. policy and a structural repricing in global markets. The U.S. Dollar Index (DXY) fell 8.3% year-to-date by May's end, driven by the Trump administration's aggressive economic agenda, informally dubbed the "Big Beautiful Bill." This included $3.8 trillion in deficit spending and targeted trade policy manoeuvres to weaken the dollar and boost exports. Early in May, a U.S. court ruling blocked Trump's 145% import tariffs, prompting a brief rally in equities and crypto. But by mid-month, an appeals court paused that ruling, leaving tariff uncertainty hanging over markets. On May 30, Trump escalated further, doubling steel tariffs to 50%, while Treasury Secretary Scott Bessent confirmed stalled negotiations with China, adding to the growing sense of volatility.

What's next

Gold, Bitcoin, and ETH all outperformed in May, but now technicals are breaking down. With inflation data and rate expectations in flux, June could flip the script. We’re not guessing—we’re already positioned.- Federal Reserve: Held rates steady on May 7.

- CPI: Released on May 13, came in at 2.3% (below forecasts).

- PPI: Released on May 15, confirmed easing headline inflation, but sticky core inflation.

- GDP (Q2 estimate): Released on May 30, contracted by 0.2%.

- Jobless Claims: Reported on May 22, reached 240,000 with continuing claims at multi-year highs.

- Personal Income: Released on May 31, grew by 0.8%.

- Personal Spending: Released on May 31, rose only 0.2%.

Markets reacted cautiously. Equities held near record highs, with the S&P 500 pinned close to 5900, but momentum slowed. U.S. 10Y and 30Y yields rose as deficit concerns loomed, with markets now expecting two rate cuts in the second half of 2025.

Bitcoin was the clear leader. It surged from $93K on May 1 to a peak of $111K by May 22, before consolidating below $105K on strong ETF inflows. Gold also moved higher, reinforcing the hard asset demand narrative.

The Bitcoin 2025 Conference (May 27-29) in Las Vegas added to the momentum, with Vice President JD Vance championing stablecoin legislation and a national Bitcoin reserve. Globally, Pakistan's Bitcoin reserve announcement signalled that this wasn't just a U.S. phenomenon-it was a worldwide pivot. Domestically, however, security risks took centre stage: a chilling Bitcoin kidnapping and torture case in Manhattan underscored the dark side of crypto's allure, while Coinbase's data breach rattled investor confidence. These vulnerabilities remain a persistent threat, and we'll be diving deeper into them in an upcoming security-focused piece.

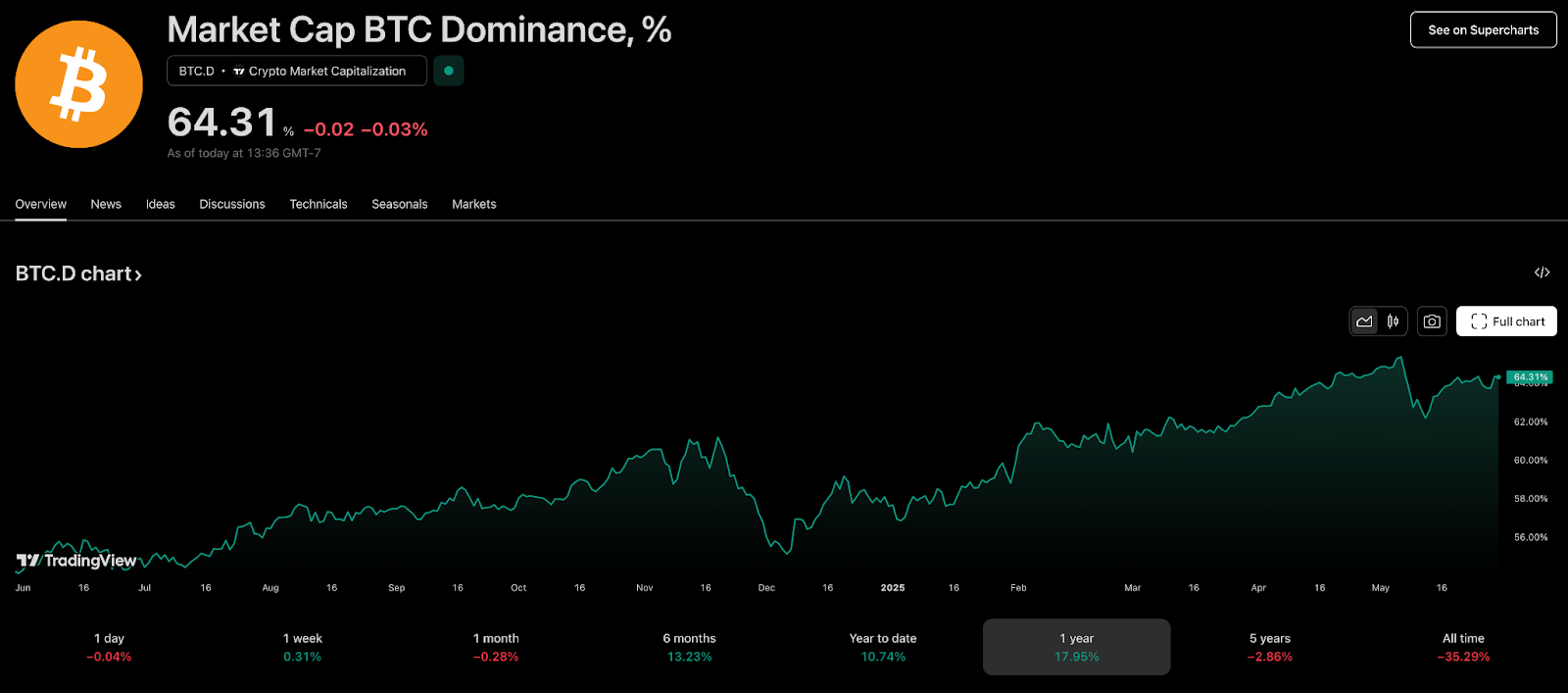

Despite crypto's strength, technical breakdowns emerged by month's end. Bitcoin and SOL lost key uptrend lines, while TOTAL3 was rejected at $930B and eyes $784B as the next support. Bitcoin dominance rose to nearly 65%, a typical marker of early rotation. Equities failing to build on the good news furthered the cautious undertone.

May was not a fleeting rally - it was a structural repricing. Bitcoin and gold surged as hard-asset hedges in a landscape of deficit spending and policy turmoil, setting the stage for a new chapter driven by fundamentals and hard truths, not euphoria.

Ethereum's quiet comeback: Pectra Upgrade & ETF inflows

At the start of May 2025, Ethereum was trading near $1,794, marking a steep decline for the year. By the end of the month, ETH had climbed to $2,540, gaining over 40% in a strong recovery.This turnaround was driven by the successful mid-May launch of the Pectra upgrade, the largest hard fork in Ethereum's history. Pectra combined 11 updates to expand Ethereum's scalability and staking capacity, including:

- Smart account wallets that enable gasless transactions

- A raised staking cap from 32 to 2,048 ETH for larger validators

- Doubled Layer-2 data capacity to support decentralised applications

Institutional demand supported this momentum. Coinbase's addition to the S&P 500 mid-month, despite disclosing a data breach, reinforced Ethereum's role as a trusted platform for compliant smart contract ecosystems.

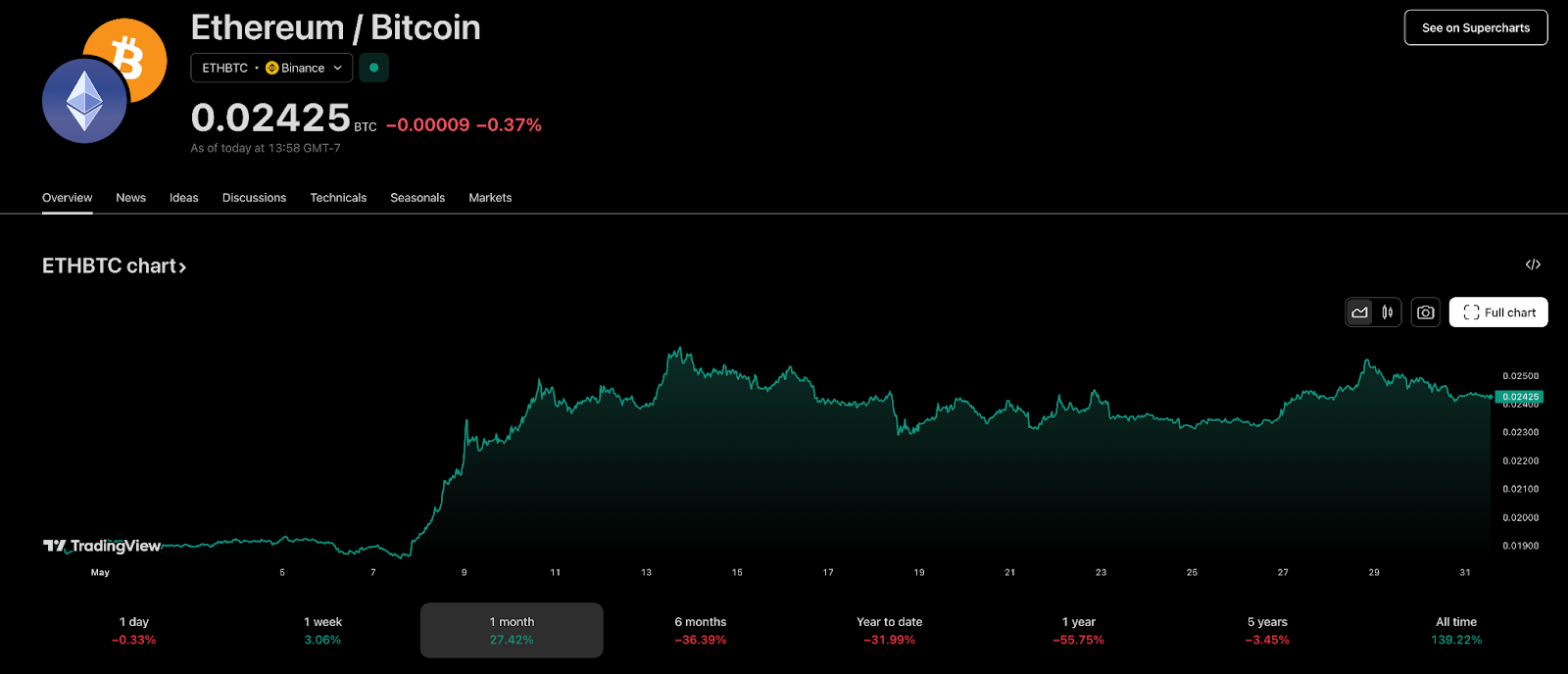

Technically, ETH peaked near $2,700 mid-month before consolidating to $2,540 by month's end, as shown in the attached charts. On a relative basis, Ethereum also strengthened against Bitcoin, with the ETH/BTC pair climbing from 0.019 in early May to a mid-month high of 0.025 and closing at 0.0242.

Despite this strong performance, ETH remains down roughly 32% year-to-date in dollar terms. Still, the rebound in both dollar price and the ETH/BTC ratio suggests that capital is beginning to rotate back into Ethereum, reestablishing its narrative as the go-to platform for programmable money in the crypto ecosystem.

Smart yield: Passive income edge and accumulation strategies

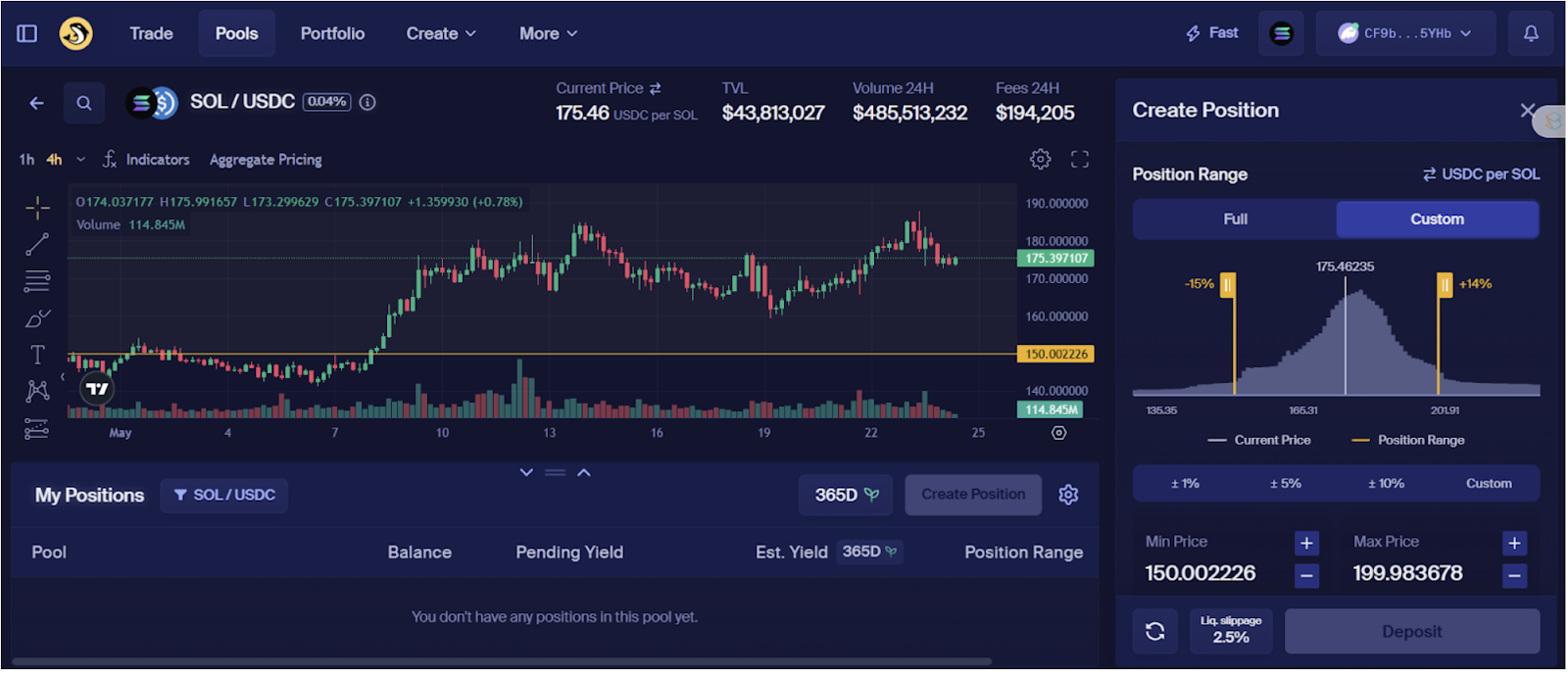

Amid the macro uncertainty of May, a potent yet under-the-radar opportunity gained traction: DeFi’s passive income engines. Unlike traditional investments, DeFi yield strategies (particularly concentrated liquidity provision) are changing the game for crypto investors.Notable Solana protocols like Orca and Kamino let providers earn trading fees by strategically narrowing the price ranges where they allocate capital. This approach turns volatility into a steady income stream, reshaping how to earn in crypto.

For example, setting a SOL-USDC pool range between $150 and $200 can produce daily returns of 0.17%, adding up to an impressive 62% APY. This strategy doesn’t fight volatility—it uses it to your advantage. Instead of simply collecting yield, you’re actively increasing your exposure to the underperforming asset (like SOL if it drops) and locking in profits when prices rise.

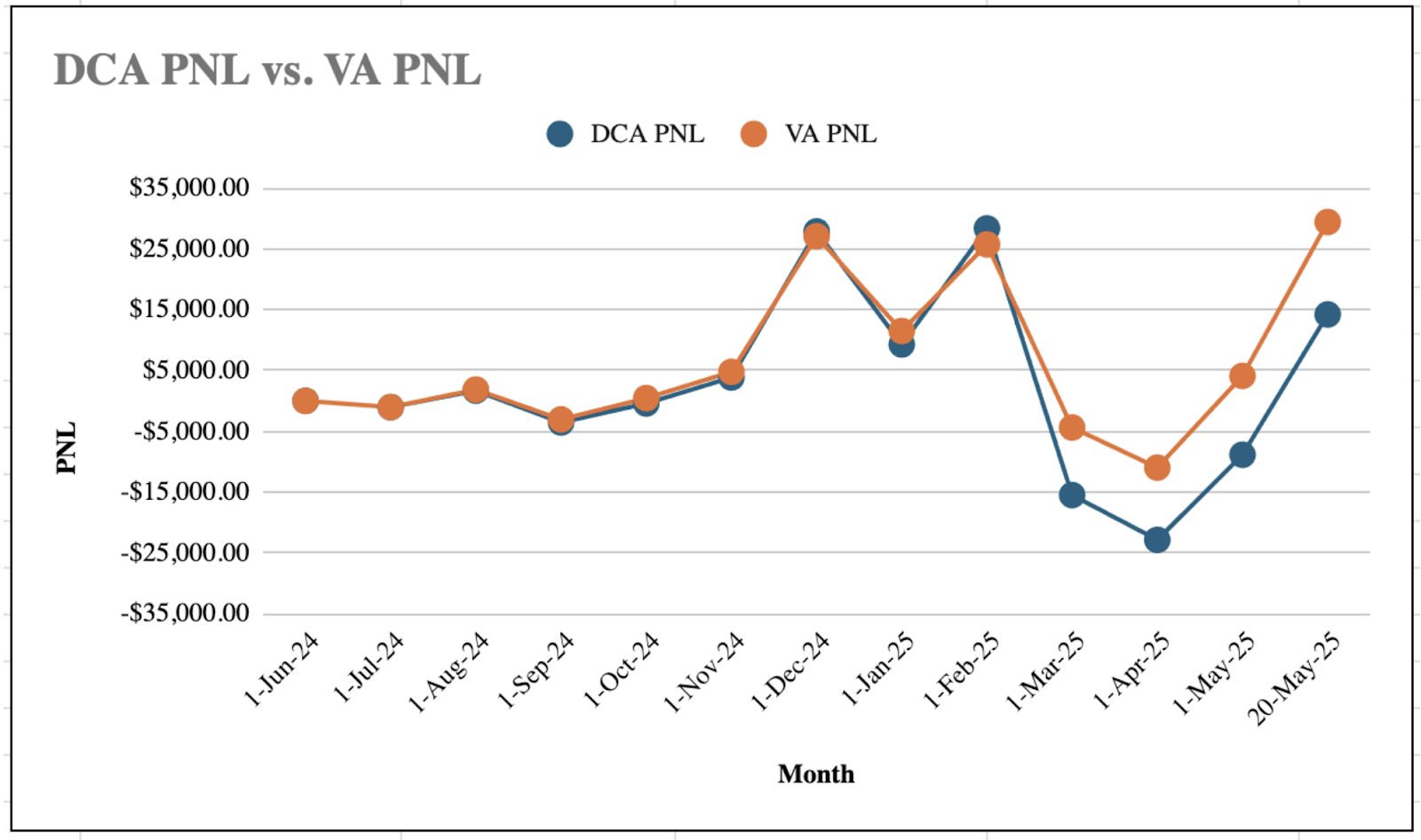

Yet yield alone isn’t the whole story. In May, our 12-month simulation showed that Value Averaging (VA) outpaced traditional Dollar Cost Averaging (DCA) by flexibly scaling buys to market dips. VA grew a $100,000 SOL allocation by 30.68%, compared to DCA’s 14.2%, highlighting the power of adaptive accumulation in volatile cycles.

Combining these approaches is where the real edge lies:

- Concentrated liquidity works in real-time, constantly shifting your exposure to maximise fees and position for long-term gains.

- Value Averaging or DCA ensures you keep buying systematically, compounding your exposure during market dips without second-guessing or missing out.

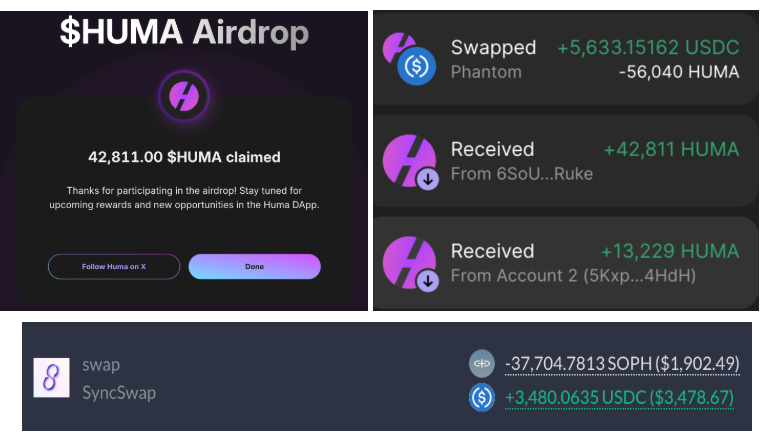

Airdrop W's of the month: SOPH & HUMA cash out

Building on the themes of smart yield and adaptive accumulation, May also saw two substantial airdrop wins that validated the power of being active in the DeFi ecosystem: SOPH and HUMA.

SOPH rewarded early adopters and active liquidity providers, recognising those who participated in its testnet, early farming programs, and Discord campaigns. The community-focused approach of the airdrop highlighted that active participation, not just passive holding, can unlock significant upside.

HUMA distributed tokens to users who had engaged with early staking, DeFi farming, and ecosystem integrations. This airdrop is particularly noteworthy for stablecoin-focused DeFi users, as HUMA is designed to be a programmable stablecoin reserve asset, and the airdrop itself rewarded those building real value in the ecosystem.

Our deep dive on HUMA breaks down why this airdrop is more than a one-time event-it's a signpost of the evolving role of stablecoins in on-chain yield and risk management.

Taken together, these airdrops highlight a critical reality: while passive income strategies like concentrated liquidity and Value Averaging create a solid core for any portfolio, active engagement in the right DeFi protocols can unlock exceptional upside through targeted airdrop allocations. Overlooking these low-hanging opportunities is effectively leaving risk-adjusted gains untapped. Many of our most engaged members are already navigating this space successfully and are more than willing to share insights. Don't hesitate to learn-this is the difference between staying on the sidelines and being among those who seize the next wave of opportunity.

Meme markets: Wild swings and growing opportunity

The memecoin sector saw a resurgence in May, adding $18 billion in weekly volume and lifting the total market cap by 36% to $70 billion. While still down 40% from its all-time highs of $127 billion, memecoins were the best-performing crypto sector for the month, outpacing even the AI, Layer-1, and DeFi categories. This surge reflects classic mean reversion: as Bitcoin hovered near record highs, traders looked for higher-beta plays and memes delivered.Most of the memecoin activity is concentrated on Solana and Ethereum, with Solana alone accounting for 15% of the sector's total market cap and nearly 40% of DEX trading volume in Q1. On Ethereum, 32 of the top 50 memes still dominate thanks to deeper liquidity. Yet, Solana's PumpFun ecosystem has been the breakout performer in the latest leg up, defying scepticism about its previous manipulation risks.

In terms of narrative, established players like FARTCOIN and PEPE captured most of the early rotation, leveraging big CEX listings to draw liquidity. But while these familiar names feel safe, their upside is increasingly capped. Newcomer memes, meanwhile, remain high-risk, high-reward lottery tickets. The challenge is finding the next breakout star-one with a strong community, sticky narrative, and potential for viral adoption.

Beyond price action, emerging categories like "Internet Capital Markets" (ICM) are tapping into the memecoin ethos, turning viral tweets and creator content into instantly tradable tokens. Platforms like Believe on Solana are leading this trend, though scepticism remains about whether it's genuine innovation or just another iteration of past hype cycles.

Despite the big gains in May, most meme prices are still down 70-80% from their peaks. This leaves the door open for future upside but also demands caution. As the market rotates from disbelief to euphoria, meme-driven FOMO has become a real risk.

As Warren Buffett famously advised, be fearful when others are greedy. We share that caution. While memecoins have reasserted themselves as crypto’s ultimate retail playground, we’re wary of chasing tops in an overheated sector. The best plays may still lie ahead, not in the current exuberance but in the coming pullbacks and chop that define early cycle rotations.

The rise and fall of James Wynn and what it means for hyperliquid

Address: 0x5078c2fbea2b2ad61bc840bc023e35fce56bedb6Track here: Hyperdash

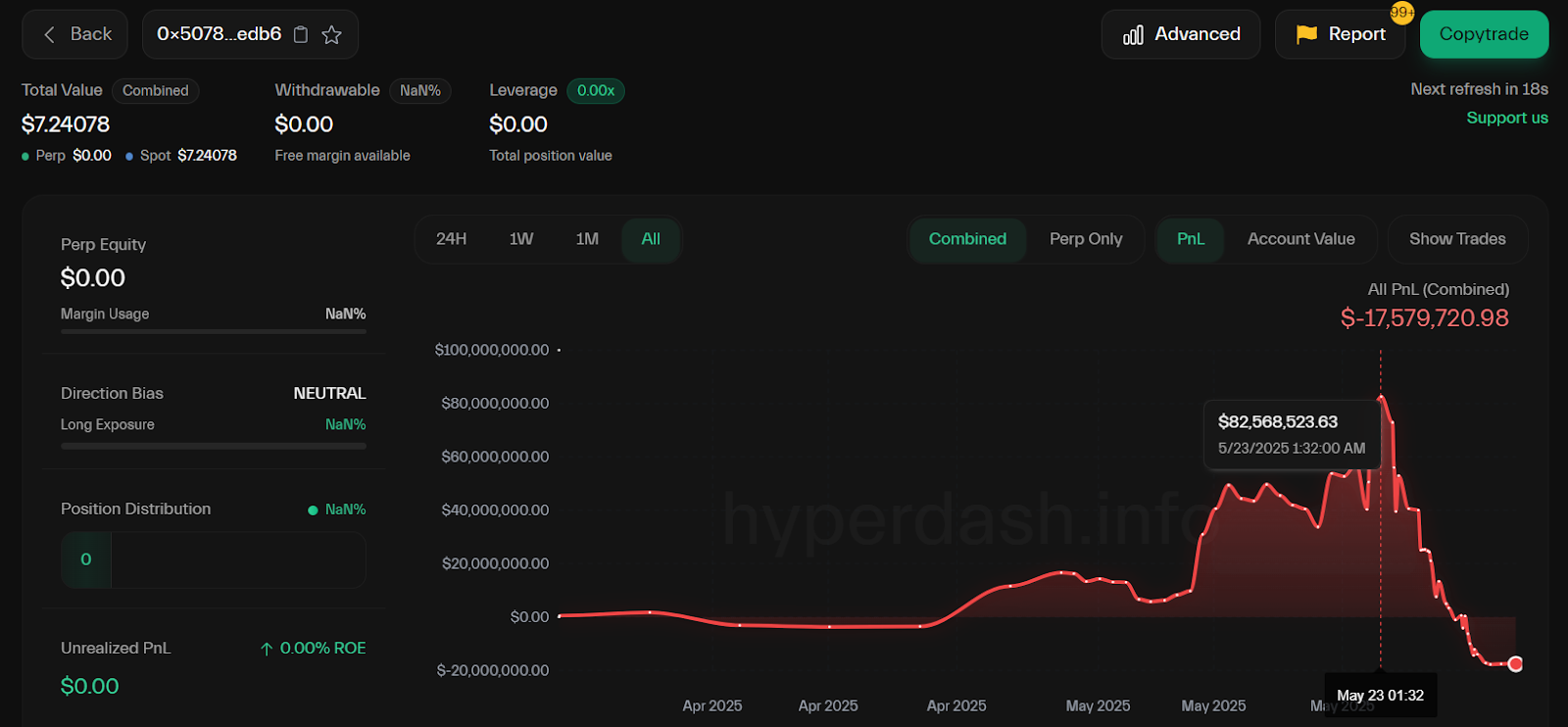

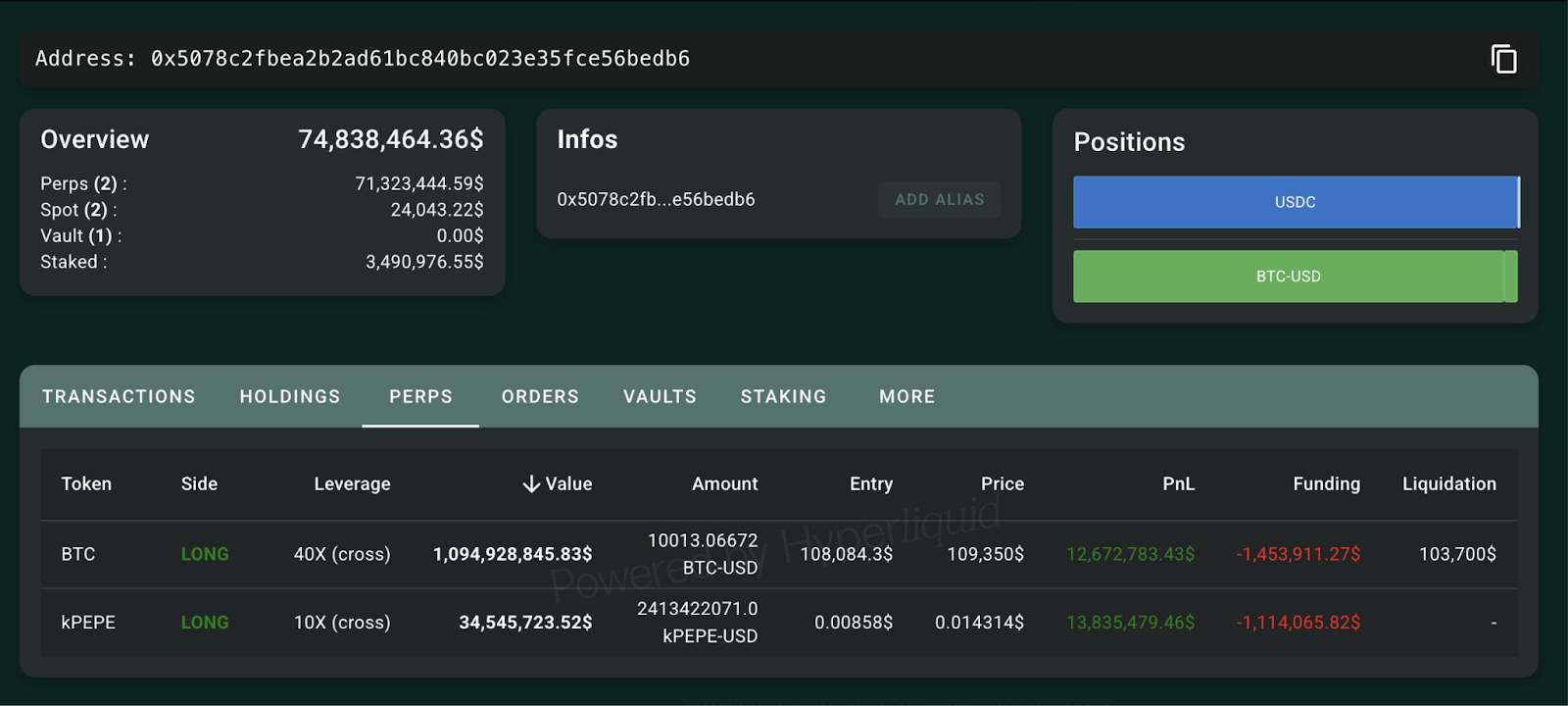

One of the biggest trading blow-ups in recent memory unfolded this May on Hyperliquid, as James Wynn's massive positions came crashing down. His wallet, which had been tracking an eye-popping portfolio that peaked near $100 million in PNL in mid-May, ultimately collapsed to a loss of over $17.5 million by month's end. These losses and subsequent liquidations were fully absorbed by Hyperliquid's systems, reinforcing the platform's ability to handle even the most violent market swings without downtime or major slippage-an impressive feat in the volatile world of perpetual futures.

What's striking is the scale and openness of Wynn's trading. For the first time, we saw a single on-chain position of over $1 billion in size, trading in real-time. It was a landmark moment that underscored the power of on-chain data for public scrutiny. Before gaining notoriety for these oversized trades, older Twitter posts suggest he made much of his fortune as an early PEPE investor.

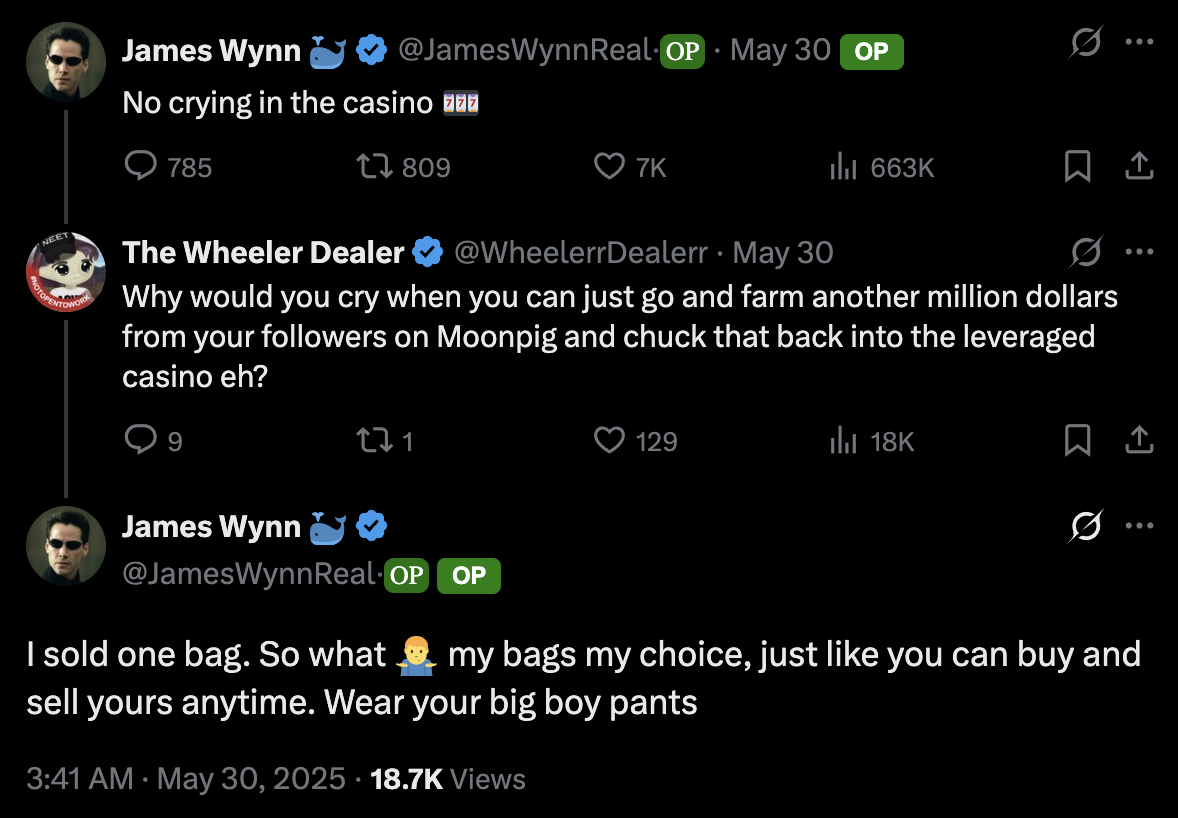

Yet now, he's pivoted to promoting low-cap memes like Moonpig. This move has sparked fresh criticism and fueled speculation about his motives. In fact, we warned our members who asked about Moonpig that there were red flags in its distribution. Messages circulating in crypto circles allege Wynn used his followers as exit liquidity, selling his own bags while the token dropped over 80% in the next week. These claims underscore the risks of influencer-driven trading and the dangers of chasing hype in these speculative environments.

Wynn's identity and tactics have become a topic of heated discussion. Some suggest he might be hedging these Hyperliquid trades on other platforms. Others-including prominent blockchain sleuth ZachXBT-have accused him of manipulative practices and even outright scamming. The true story remains murky, but one thing is clear: Hyperliquid's matching engine and liquidity depth have been battle-tested. These liquidation events didn't just highlight the risks of high-leverage trading. They showcased Hyperliquid's ability to process liquidation cascades in real-time without skipping a beat.

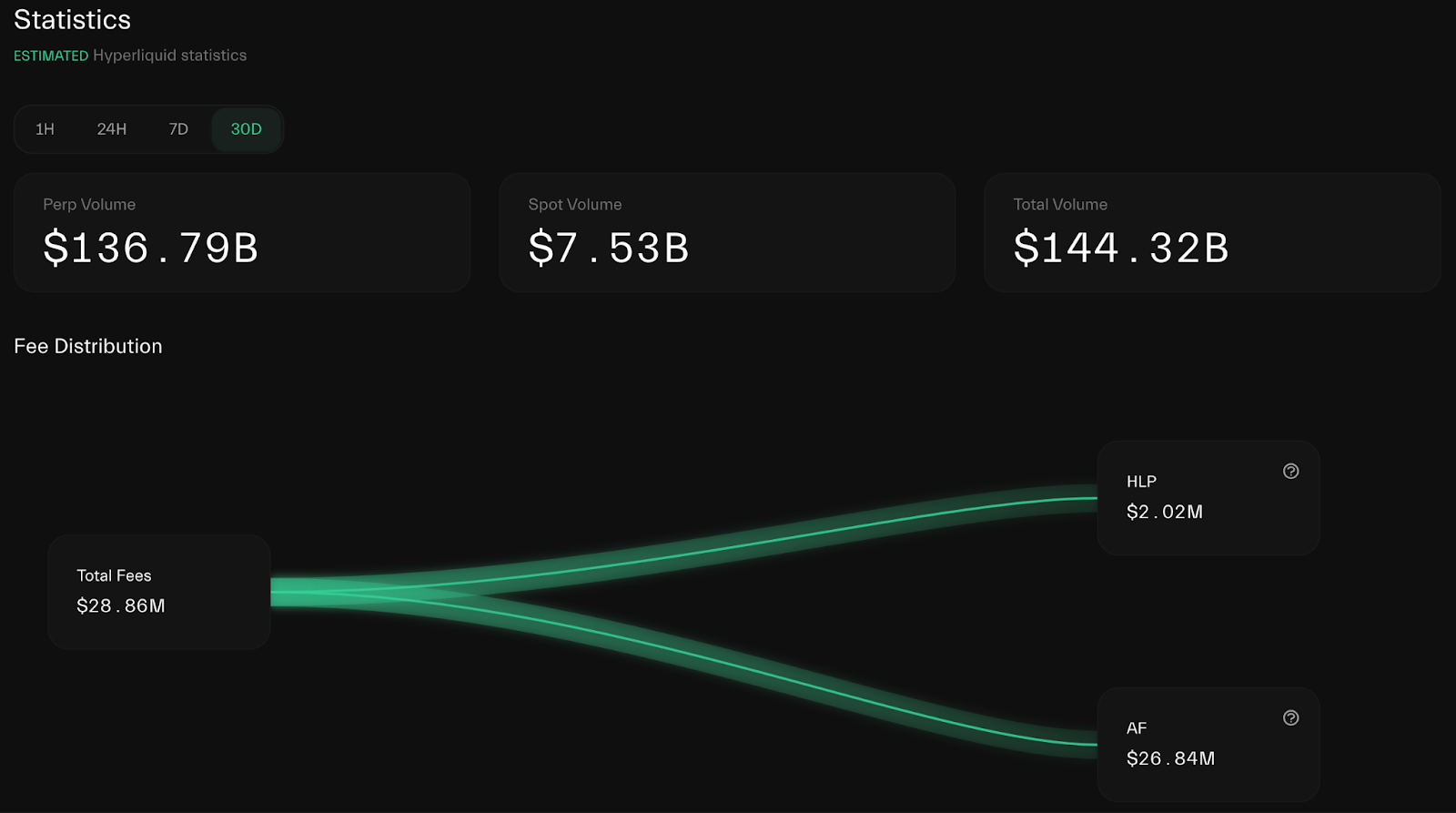

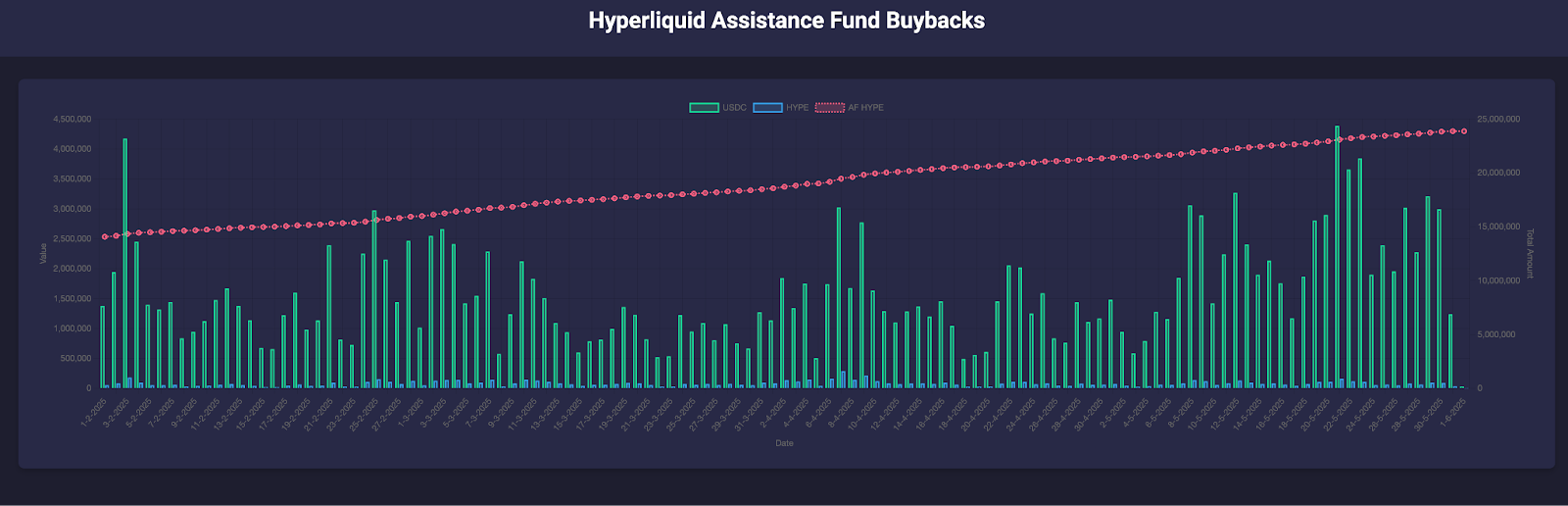

All this high-volume activity has had another, more structural impact: Hyperliquid is now earning millions in fees, with buyback programs reinforcing liquidity and cementing the platform's place as one of the most robust derivatives venues in the space.

For traders and observers alike, this is a story of caution and opportunity. James Wynn's collapse is a stark reminder of the risks of leverage in an unforgiving market. But Hyperliquid's seamless performance during this meltdown has positioned it as one of the most resilient venues for large-scale crypto derivatives trading, signalling to funds and serious traders that it's ready for the next wave of big money in crypto.

Cryptonary's take

May wasn't just a rally- it was a recalibration. Bitcoin and gold didn't surge on hope- they rose because the dollar cracked, tariffs loomed, and safe havens reclaimed their edge. Ethereum's rebound wasn't hype-driven either-it was a pivot back to real infrastructure, powered by Pectra's rollout and reinforced by institutional flows, including Coinbase's historic entry into the S&P 500.The difference between May and the early-year pumps? This move was grounded in macro forces, not retail euphoria. We saw yield strategies outperform, airdrops delivering risk-adjusted wins, and platforms like Hyperliquid proving they can handle even billion-dollar blow-ups in stride.

It’s not time to throw caution to the wind, though. Equity markets stalled, macro data remains mixed, and the bid for “risk” still has to contend with real structural headwinds. But if you’re paying attention, the next phase is already visible: patient rotation, selective exposure, and hard assets reasserting their place.

We’re not here to FOMO in, or fade real strength. We’re here to stay nimble, let the volatility pay us, and be ready for the next chapter. May poured the concrete—now let’s build on it.

Cryptonary, OUT.