Overview

Mumu the Bull, a symbol of bullish market sentiment, has gained some attention as a meme coin that represents the mascot of bullish markets. In a broader market that has seen retracement and consolidation over recent months, Mumu is poised to potentially perform well as the market sentiment turns positive. The identity of Mumu as the "Bull Market mascot" aligns well with its anticipated role in the upcoming market cycle.Token distribution analysis top 10 wallets:

The top 10 holders of Mumu display a relatively decentralised distribution of the token, with exchange wallets and liquidity pools holding the largest shares. This distribution suggests that a significant portion of Mumu is held in trading and liquidity contexts, which may impact market liquidity and price stability.~Excluding liquidity pool: Removing the Raydium Liquidity Pool, which holds 1.25%, the remaining significant holders own between 1.06% and 2.56% of the supply.

~Average holdings: The average holdings of the top 9 wallets, excluding the Raydium Liquidity Pool, is approximately 1.94% per wallet.

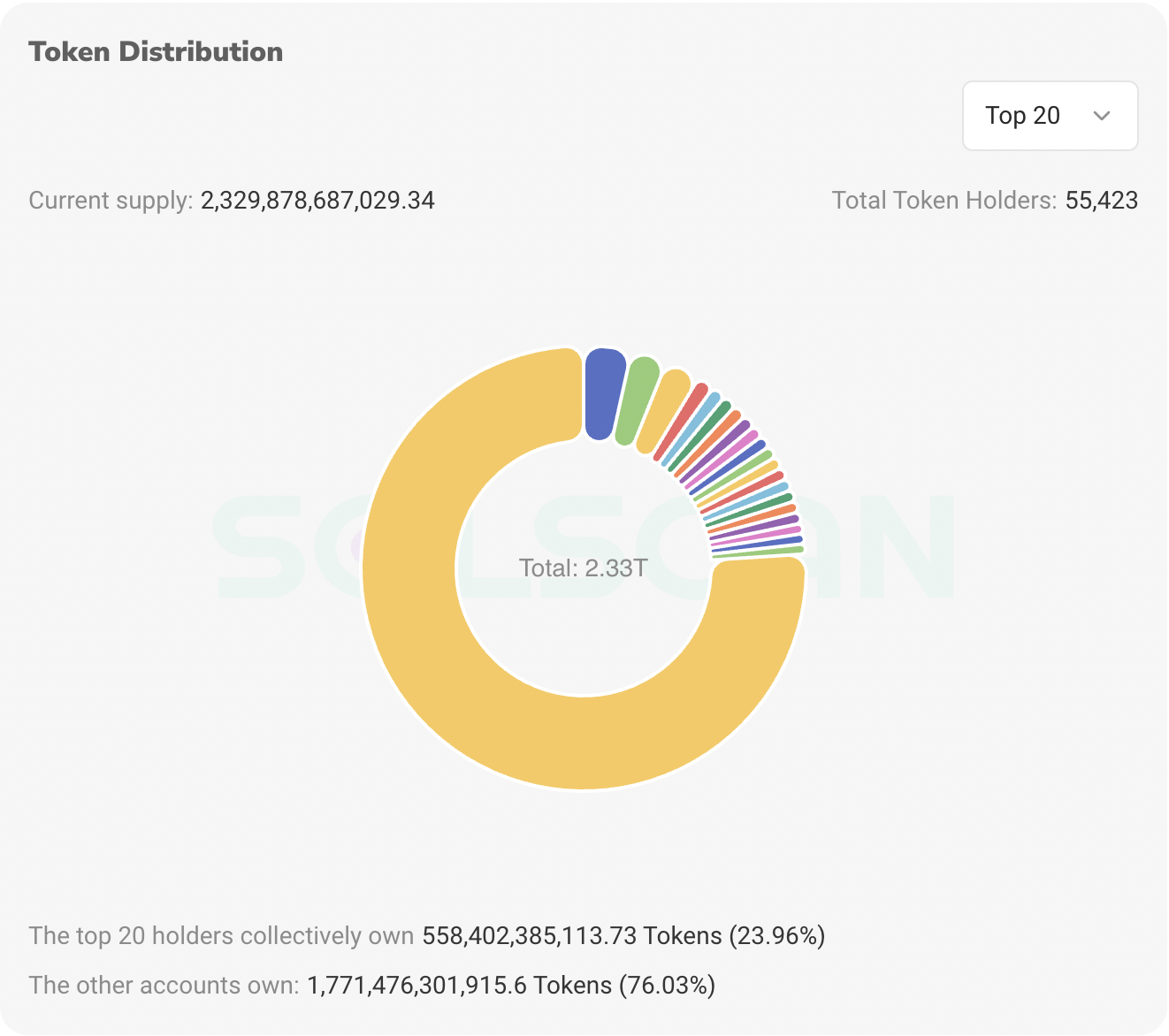

Top 20 Wallets:

The top 20 wallets collectively own 23.96% of the total supply, reflecting a higher concentration of tokens among a small number of holders. However, the average holding is relatively modest, suggesting that no single wallet controls an overwhelming portion of the supply.~Total holdings: 23.96% of total supply.

~Average holding: Approximately 1.20% per wallet.

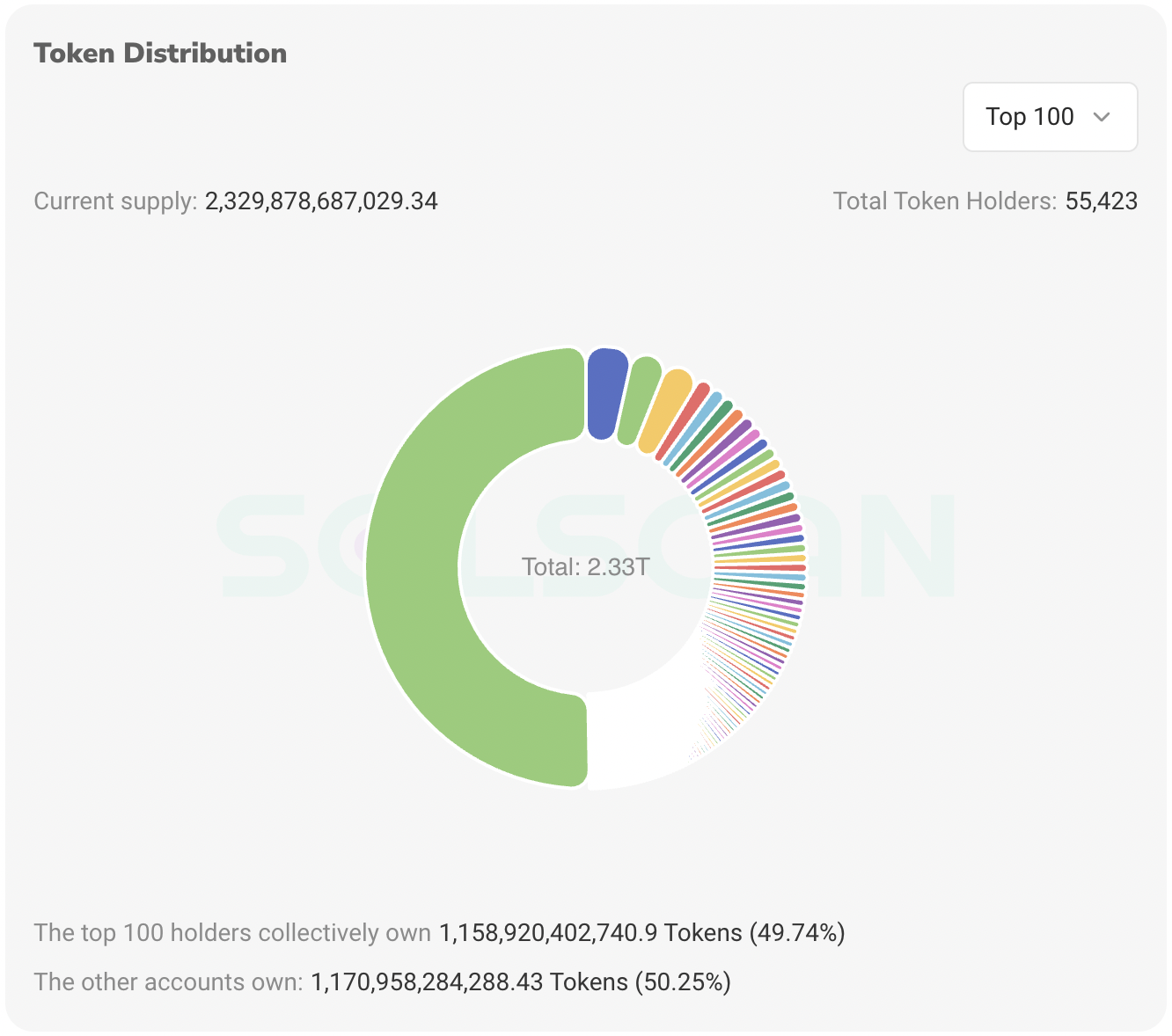

Top 100 wallets:

The top 100 wallets hold 49.74% of the total supply, with an average holding of 0.50% per wallet. This spread indicates a decent distribution of ownership, which is generally positive for the token's price stability and long-term growth.~Total holdings: 49.74% of total supply.

~Average holding: Approximately 0.50% per wallet.

Holder count vs. Market cap analysis

The relationship between holder count and market cap over the past 30 days provides insight into market sentiment and accumulation patterns. Despite the broader market's retracement, Mumu has seen an increase in both holder count and market cap, signalling growing interest and potential accumulation.Market cap growth: Increased from $84 million to $90 million.

~Holder count growth: Increased from 54,000 to 55,500.

~Interpretation: The market cap has seen a 7% increase over the last 30 days, while the holder count has grown by 2.7%. This simultaneous increase in market cap and holders suggests growing interest and accumulation of $MUMU, potentially setting up for future price action.

Historical price action analysis

Post-launch, Mumu experienced a consolidation period lasting 120 days, during which the token oscillated between a $10 million and $70 million market cap. This period of consolidation was marked by significant dips and quick recoveries, indicating strong buy-side interest.~Consolidation period: 120 days within a $10 million to $70 million market cap range. ~Significant dips: Dips of 88%, 78%, and 72%, each followed by quick buybacks, demonstrating bullish sentiment.

~Breakout: After consolidating below $70 million, Mumu broke out, rallying more than 1000% and establishing a new all-time high at $820 million. This breakout affirmed Mumu's potential as a strong performer in bullish market conditions.

Current market outlook

Mumu has been following an uptrend, as indicated by the white trendline, even after retracing from its ATH. The token's resilience, combined with its approach toward the $70 million accumulation zone, presents a potentially favourable setup for accumulation and long-term gains.~Uptrend support: The white trendline has provided consistent support, indicating strong buying interest.

~Accumulation zone: The $70 million market cap area is identified as a strategic zone for dollar-cost averaging (DCA).

~Resistance levels: Key resistances at $112 million, $163 million and $252 million market cap. ~Bullish potential: A breakout above $252 million, sustained by strong support, could signal a continuation toward higher levels, including a potential retest of the ATH.

Cryptonary's take

Mumu the Bull represents a promising play within the meme coin space, particularly with its strong narrative as the mascot of bullish markets. With the broader market showing signs of consolidation, Mumu's historical performance and current positioning suggest that it could perform well in the next market cycle.

Strategic accumulation in the identified zones could offer significant upside potential, though investors should remain vigilant of market dynamics. However, it's important to note that Cryptonary has no financial interest in $Mumu.

This analysis is provided purely for educational purposes, and Cryptonary has not invested in this asset. The high-risk nature of meme coins remains, and we advise investors to exercise caution and conduct thorough research before considering any involvement.