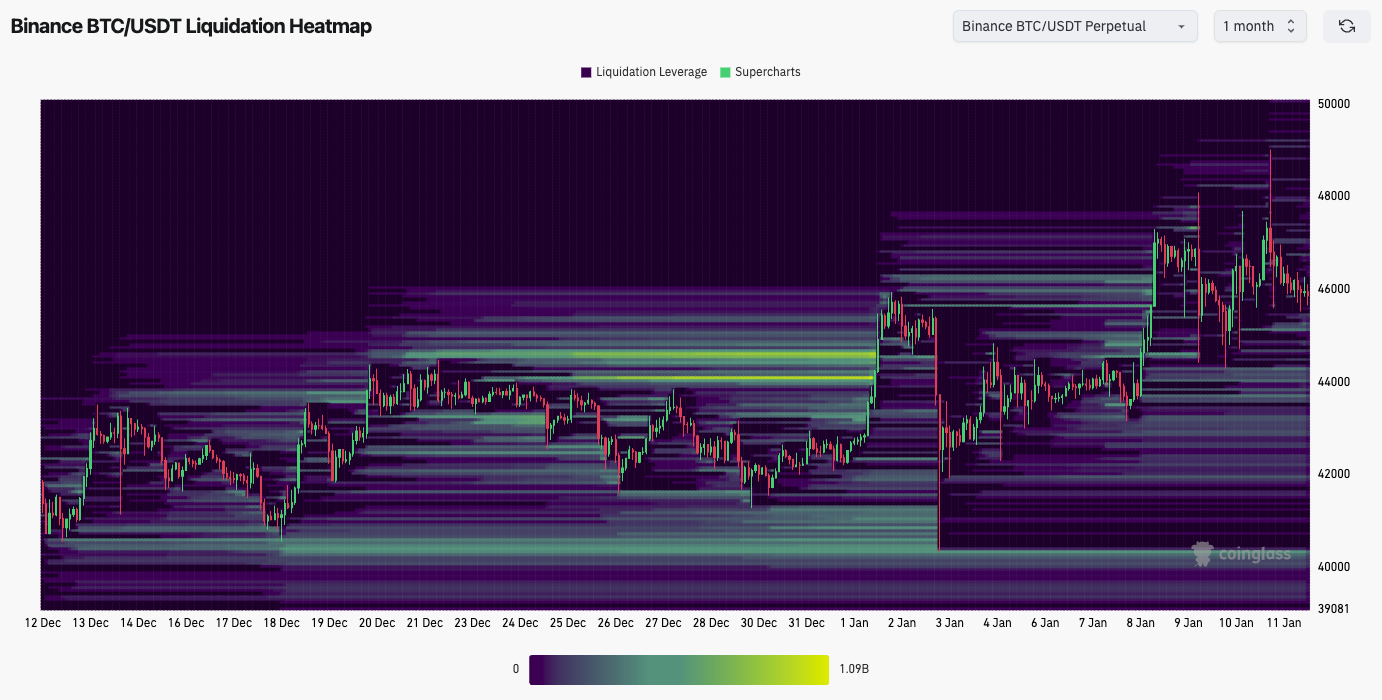

From a mechanics perspective, there are few major liquidation levels to watch out for, which is usually a good sign - see chart below.

Strong yellow/green colours indicate large liquidation levels.

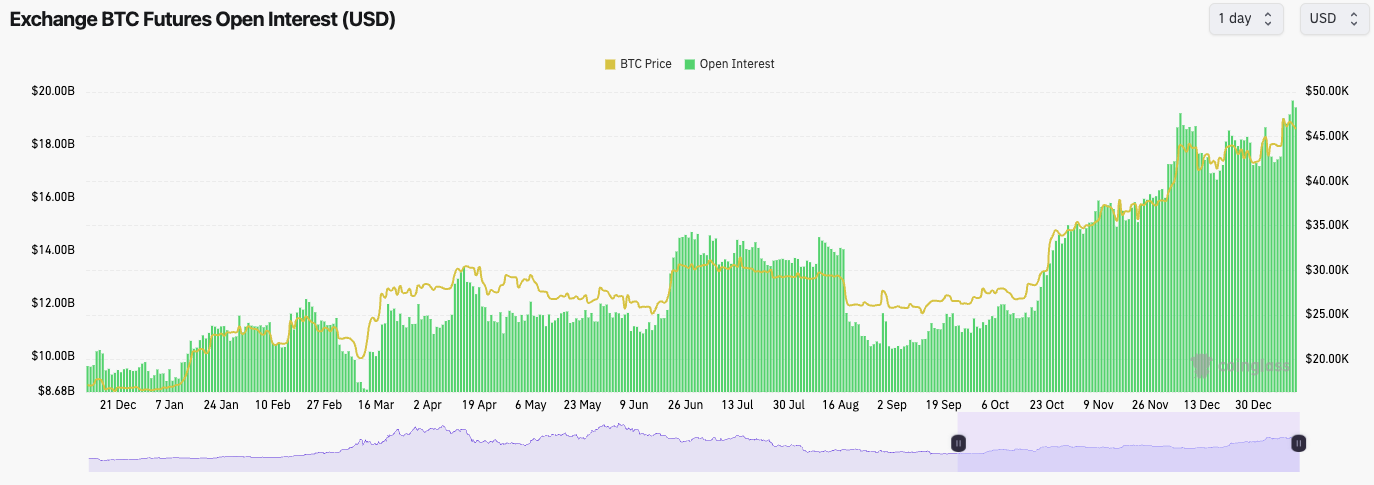

However, alongside this, Open Interest is up massively after yesterday's new highs. Fortunately, the Funding Rate has stayed relatively flat, meaning there is a lot of leverage, but not in any particular direction.

Technical analysis

- Price finally broke out of the $40,900 to $44,000 range it had been in for the past month.

- There is a local resistance at $47,100.

- Price will need to hold the horizontal support of $44k if it wants further upside. If not, $40,900 is probably the first downside target.

- The RSI on the 12hr and 1D have reset relatively well. However, the 3D and the Weekly remain overbought. Likely, a further reset is needed. However, this can be through a consolidation period rather than a major pullback. Keep that in mind.

Cryptonary's take

The trading activity from today and early next week will be crucial for BTC – we'll get a greater idea of what the ETF flows actually are.At a minimum, price will need to remain range-bound between $44k and $47k.

We’d expect price to grind higher over the next week for continued bullish momentum and to show underlying buying of the ETFs.

If price doesn't move higher, then we'd expect a more significant downside, particularly as some of the on-chain metrics are now beginning to turn, suggesting this may be a local top for the price.

Let's wait and see what the next few days bring!