- There has been heavy accumulation from the smaller wallets and the largest wallet cohort, but the largest wallets have begun to de-risk.

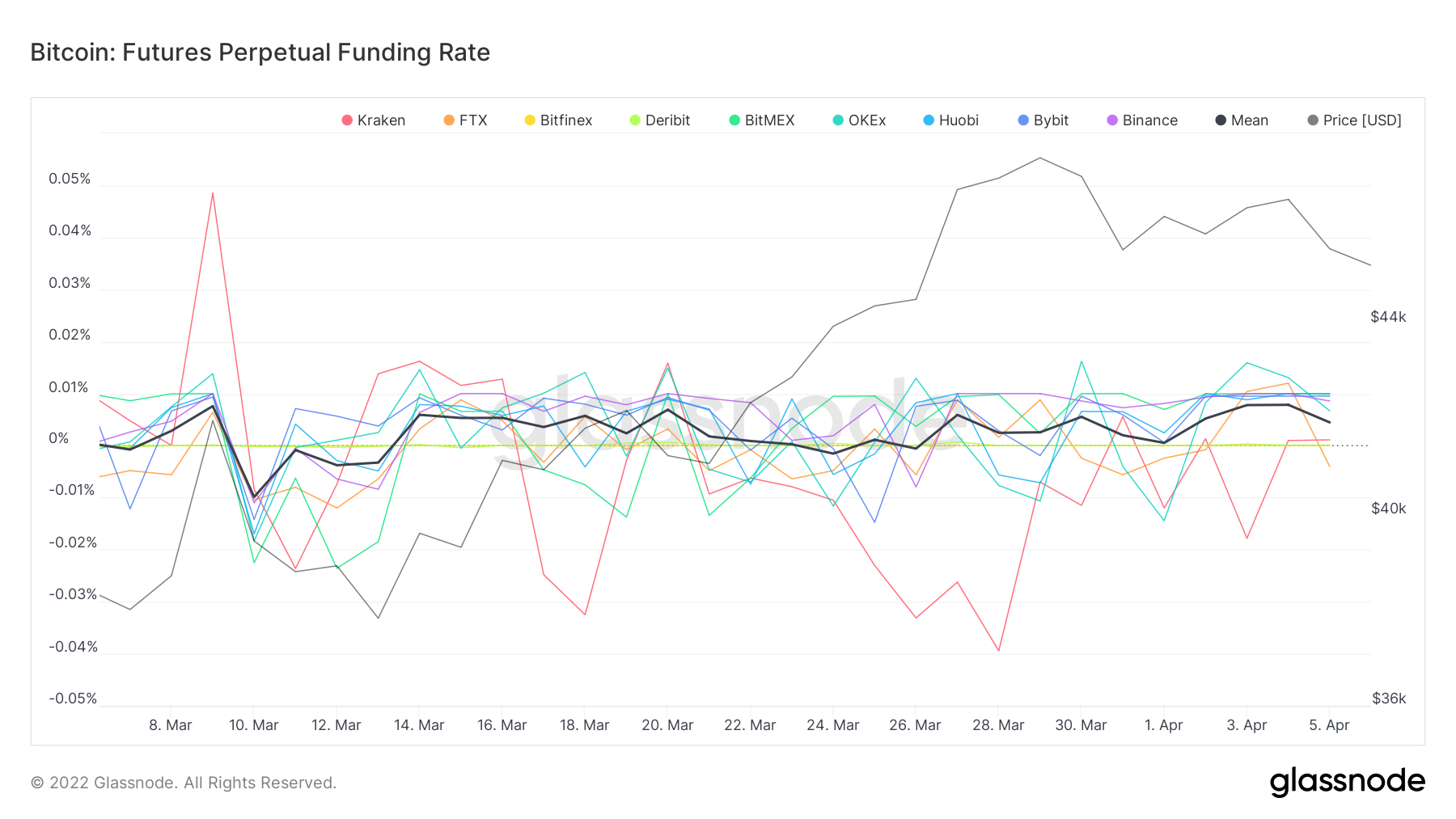

- Funding Rates suggest the futures market is not currently over-heated and therefore there is not currently a high chance of a leverage flush out.

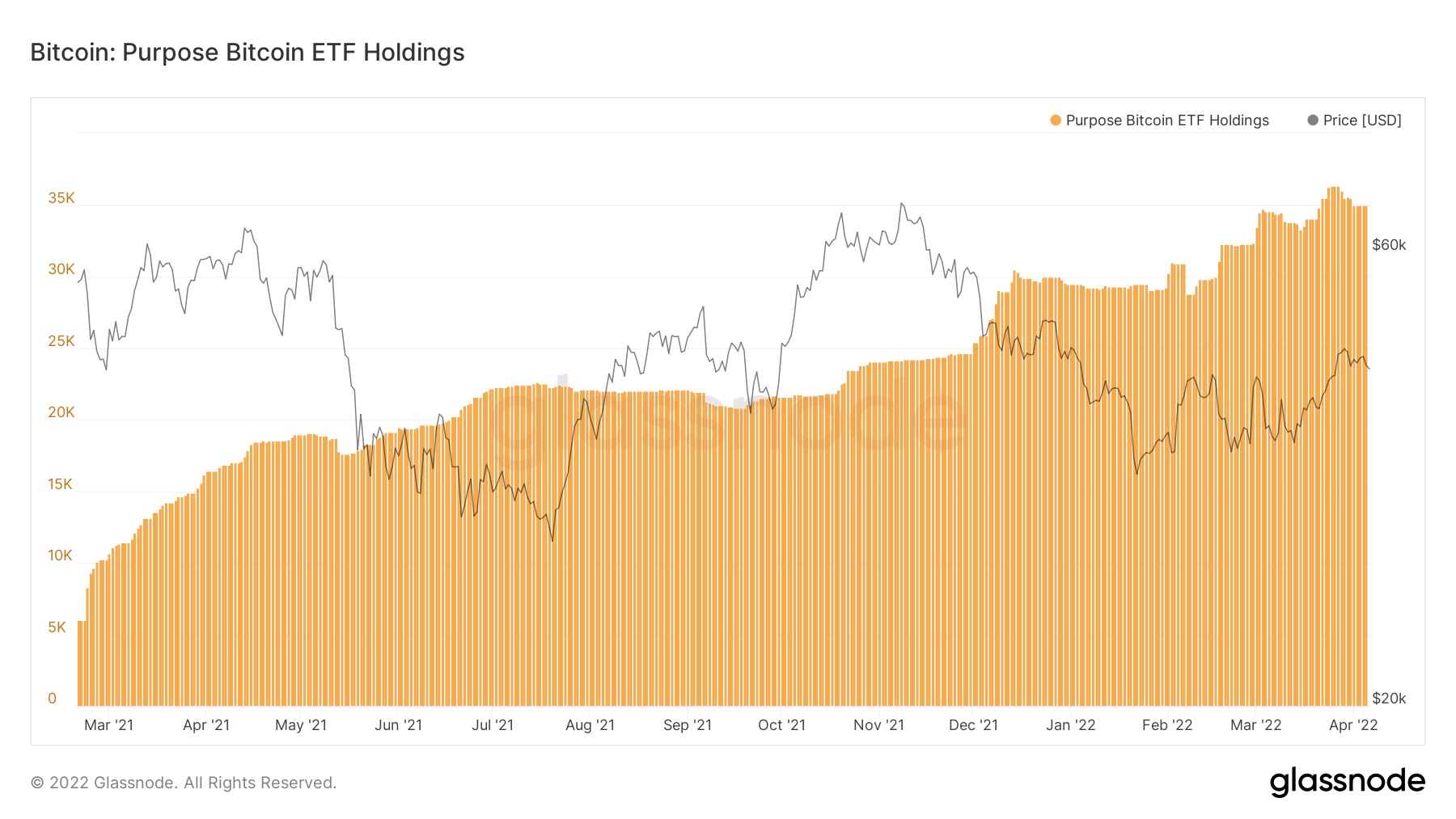

- The Purpose Bitcoin ETF has seen significant inflows of Bitcoins over the past few weeks.

Macro:

In the last few weeks, markets have rallied since the FED gave greater clarity on its position on inflation and how it would combat this. This has meant that the markets believe a 0.5% raise in interest rates will be likely at the FED meeting in May, but prices seem to mean that the markets have not yet priced this in. However, the key information the markets will be looking for is if and how the FED suggests a plan for normalising its Balance Sheet. If J Powell (FED Chairman) announces a plan to begin selling Balance Sheet assets rather quickly, this will likely be taken negatively by the markets. What will also be important is the rate at which the FED sells these assets. An aggressive approach will likely significantly harm risk-on assets such as crypto. BUT, for the time being, until the meeting in May, the markets will likely try to continue the rally as investors maintain a risk-on approach.

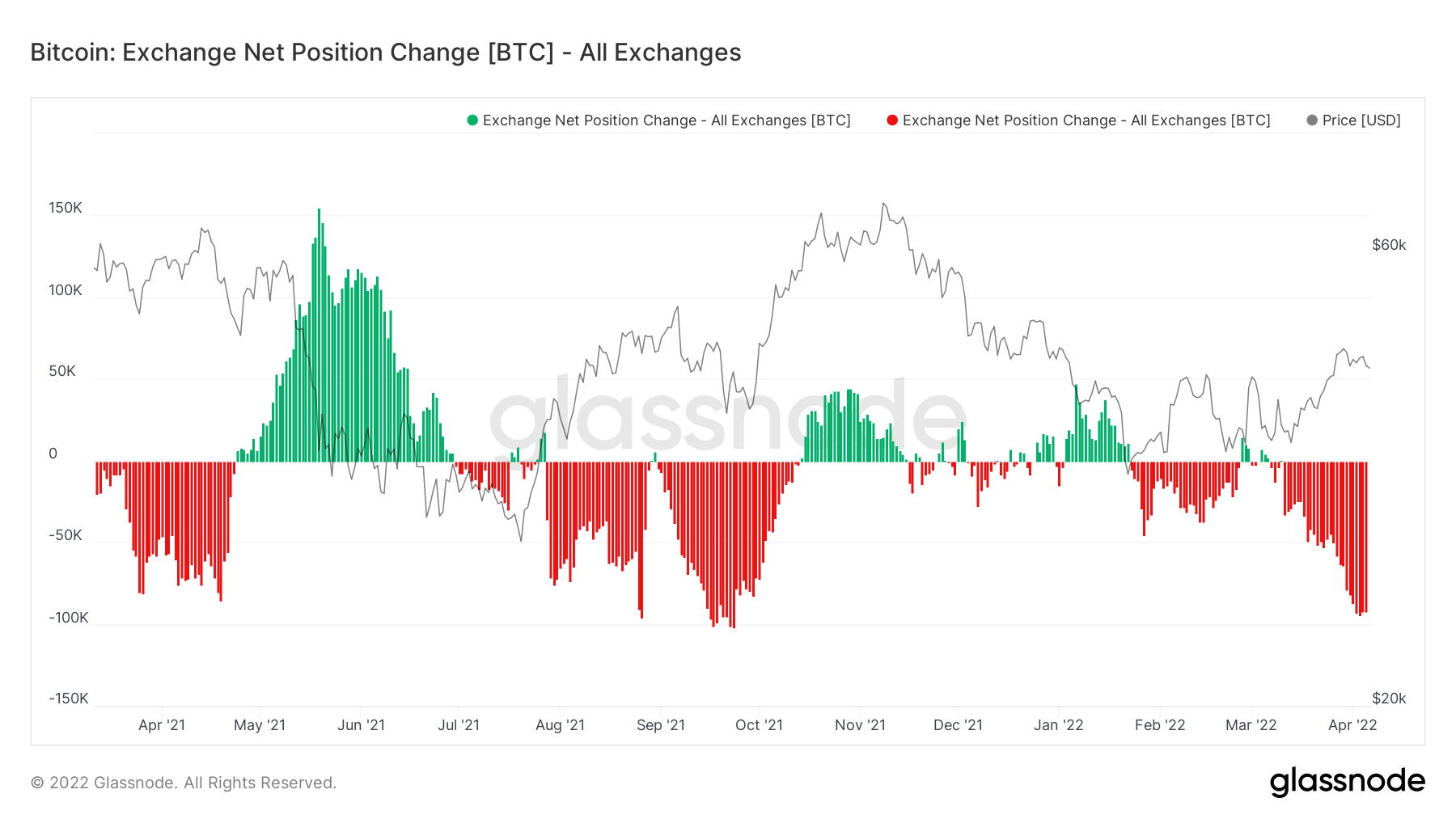

Metric 1 – Exchange Net Position Change

We will begin by investigating the Exchange Net Position Change for Bitcoin and Ether. We can see in the chart below that there have been relatively large Bitcoin outflows from Exchanges. In terms of a bullish market, this is excellent to see as it suggests that investor sentiment to accumulate is high.

Bitcoin – Exchange Net Position Change

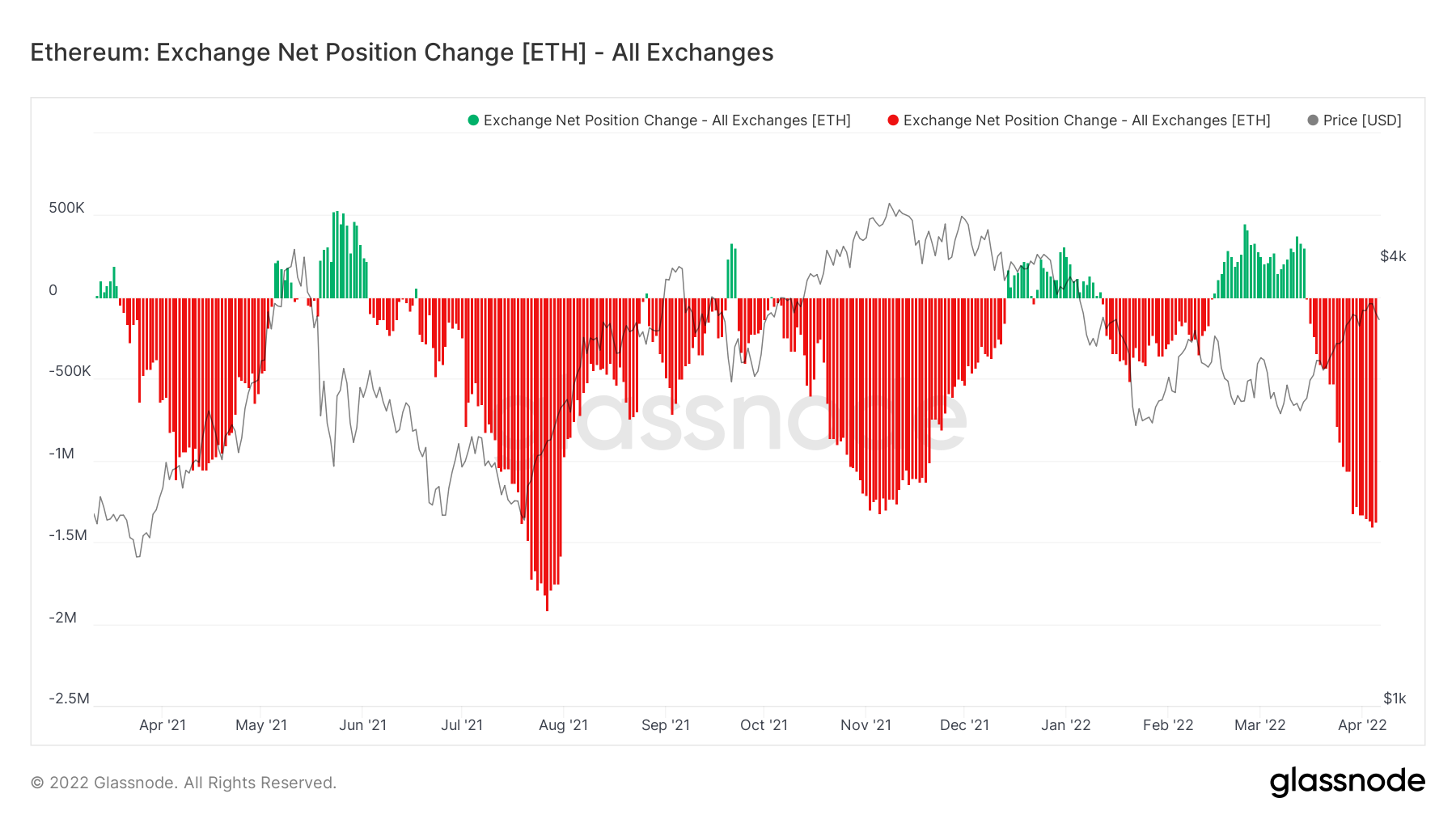

If we now revert our attention to the Exchange Net Position Change for Ether, we can see the net outflows of Ether from Exchanges have been considerable (large red spikes). Again, this reflects a positive sentiment amongst investors to be accumulating Ether at these prices, possibly with the view that in a few months’ time when Ether merges, it should become deflationary.

Ether – Exchange Net Position Change

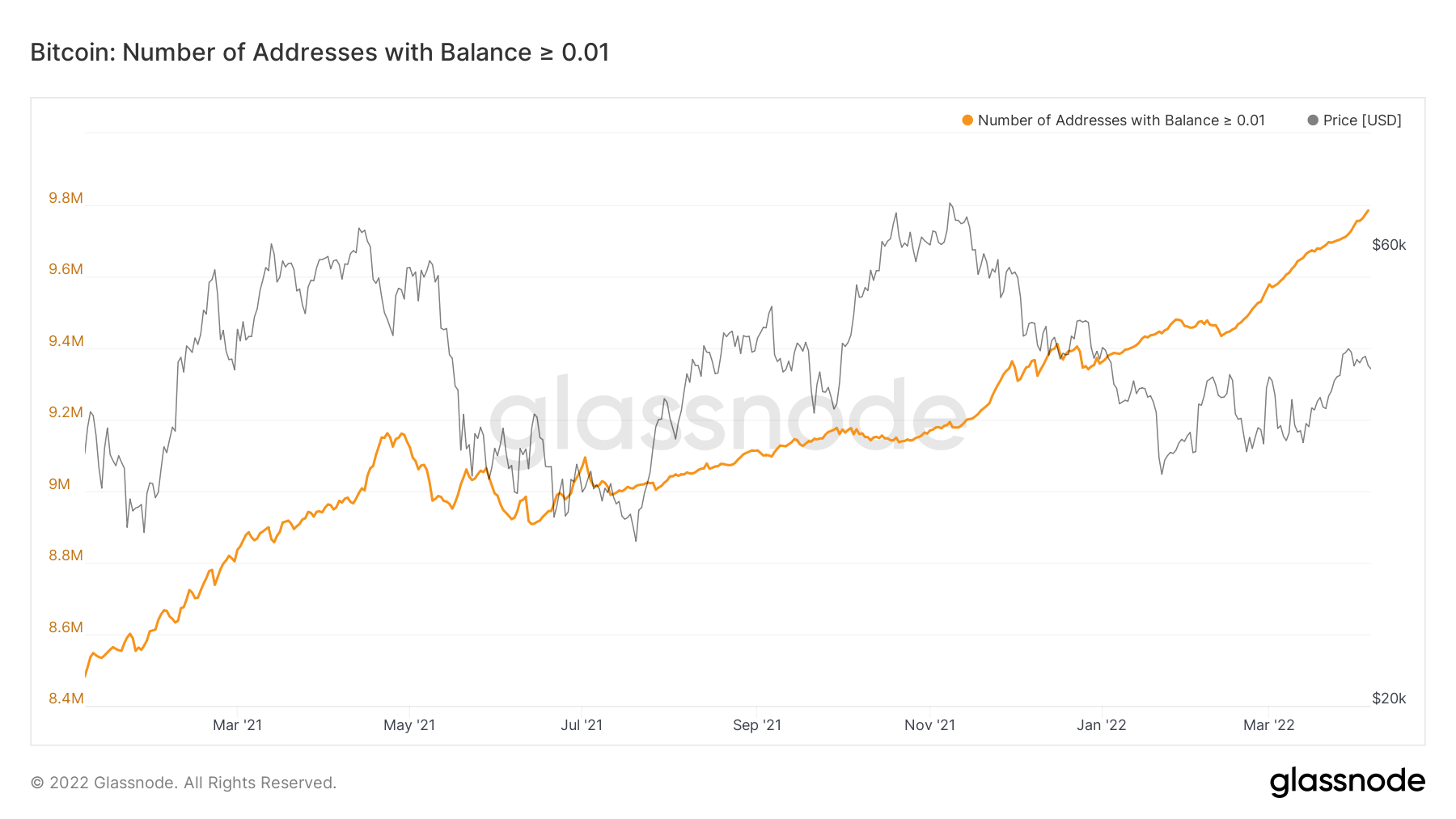

Metric 2 – Addresses

The second metric we’re going to assess is the address cohorts. This categorises addresses into their relative cohorts depending on how many Bitcoins they hold. Below, we will list a number of graphs showing the wallet cohorts and if the number of wallets in those cohorts are either increasing or decreasing.

Bitcoin – Addresses with Balance > 0.01 Bitcoin

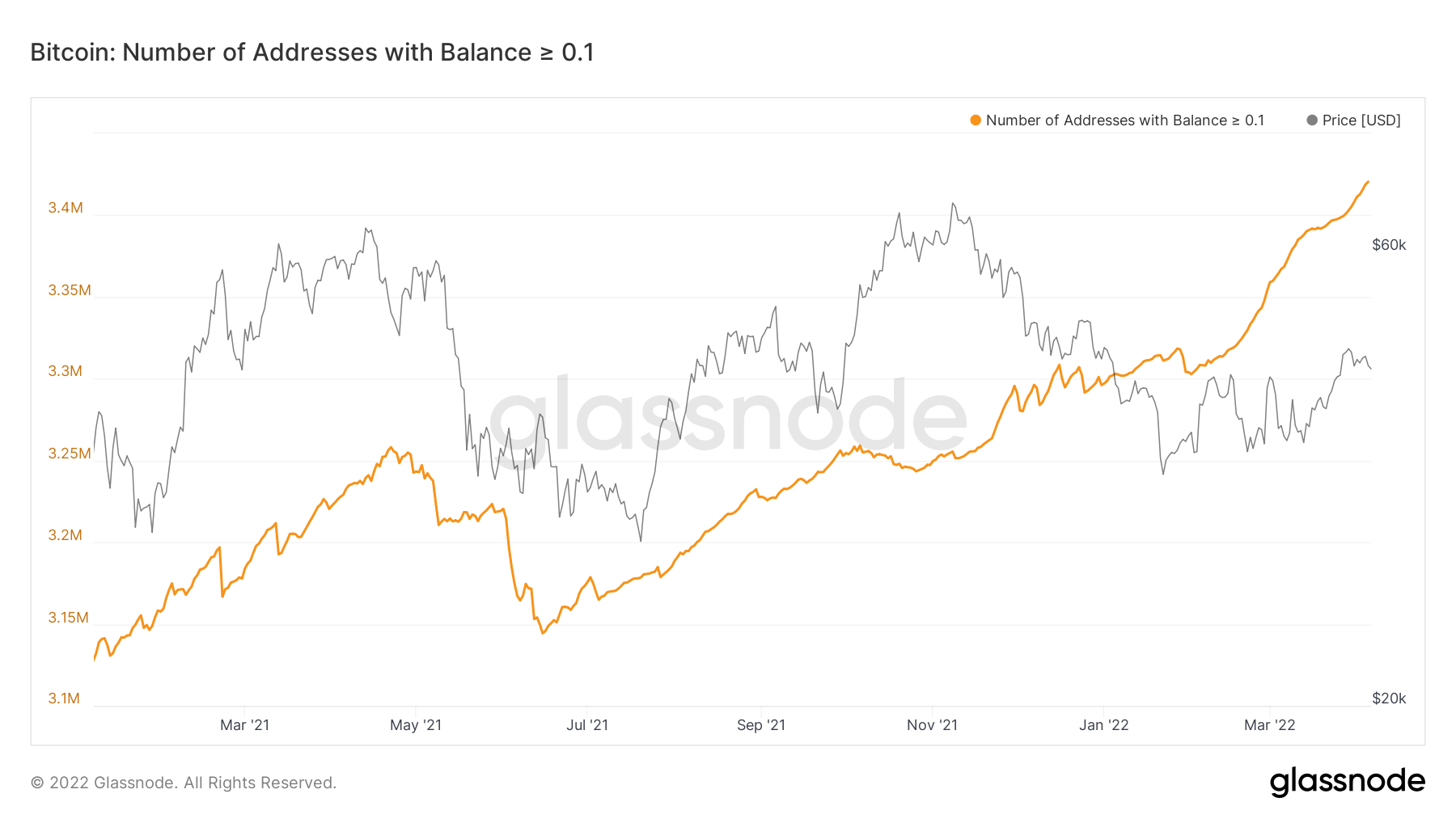

Bitcoin – Addresses with Balance > 0.1 Bitcoin

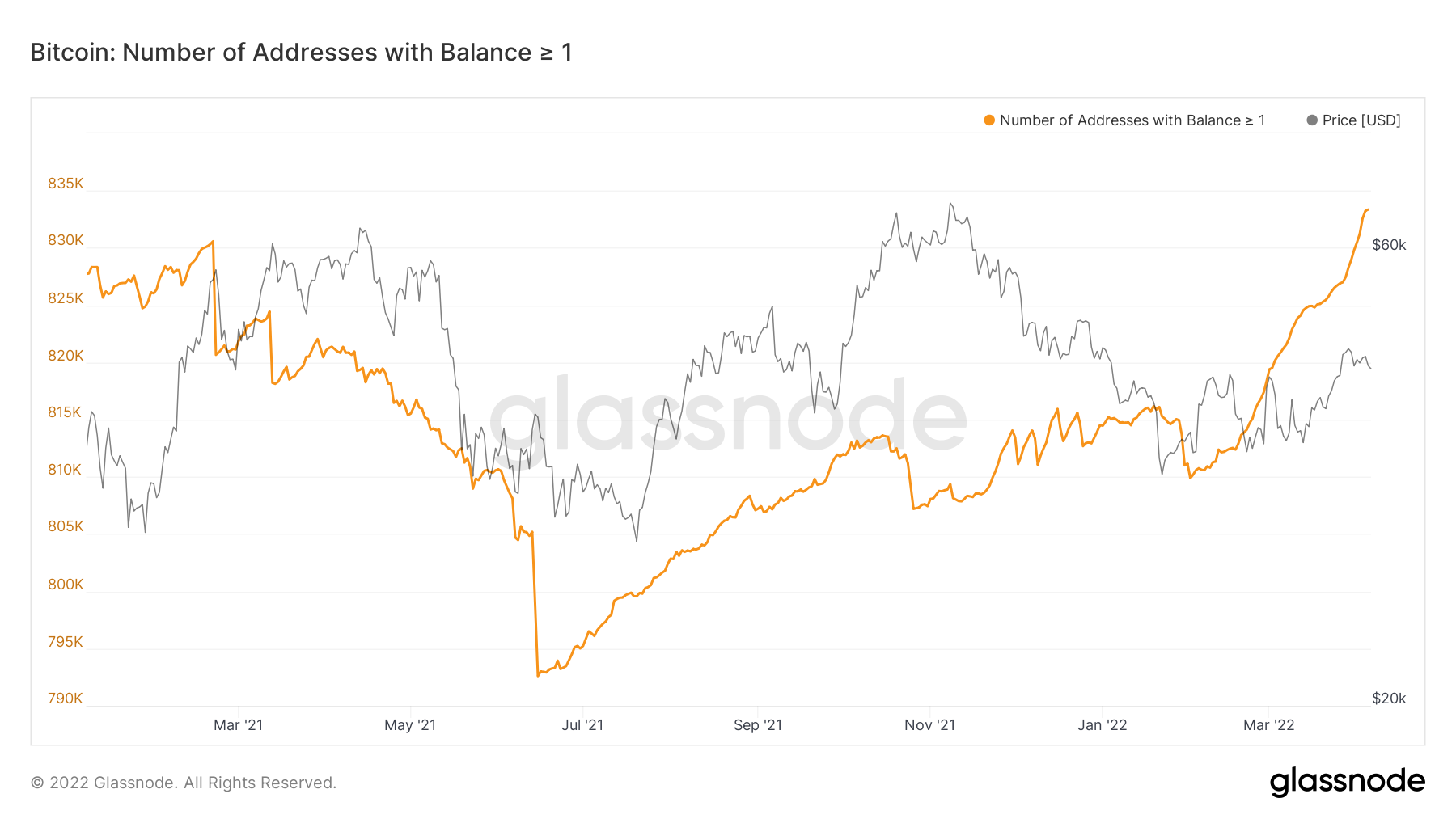

Bitcoin – Addresses with Balance > 1 Bitcoin

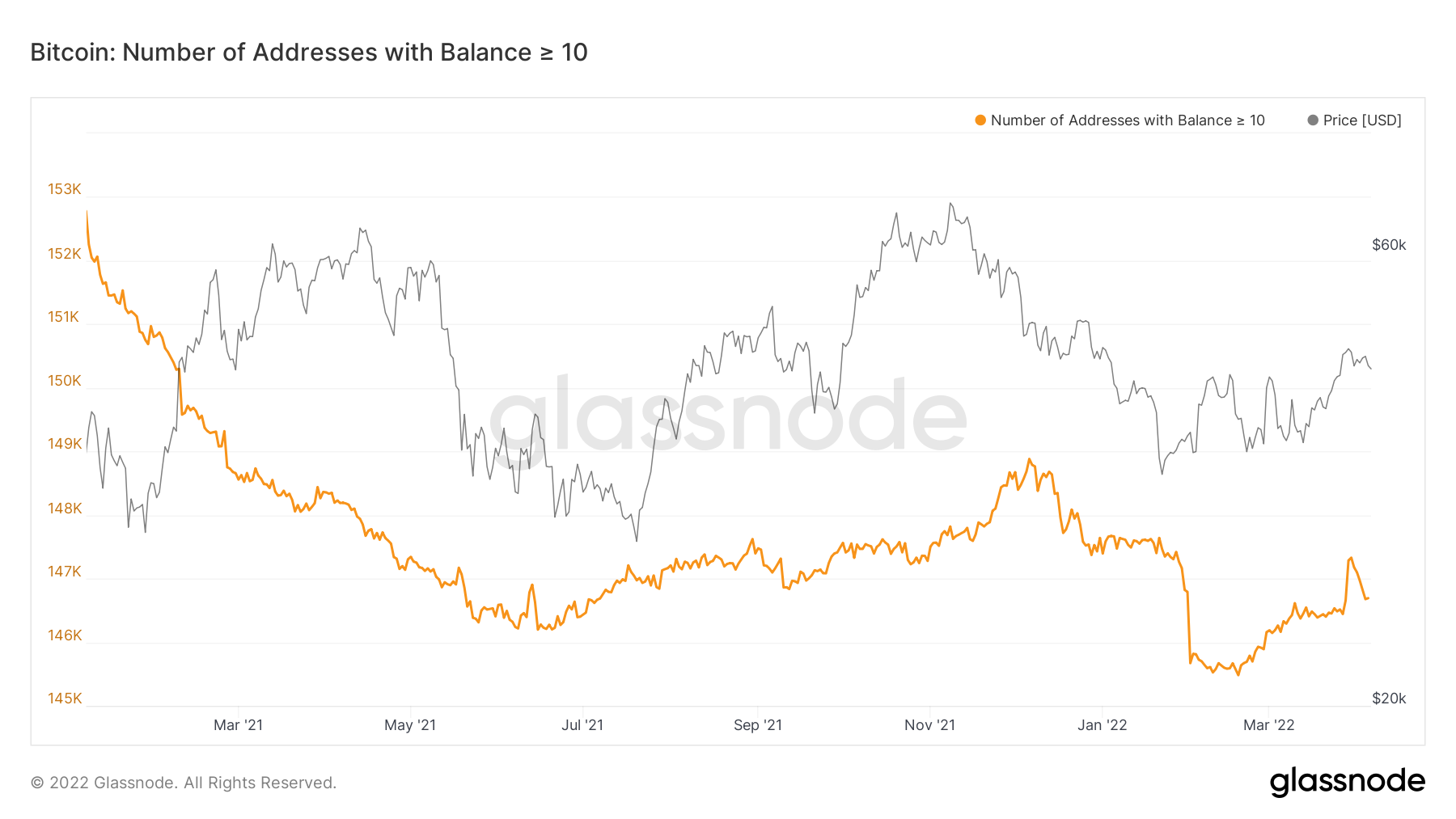

Bitcoin – Addresses with Balance > 10 Bitcoin

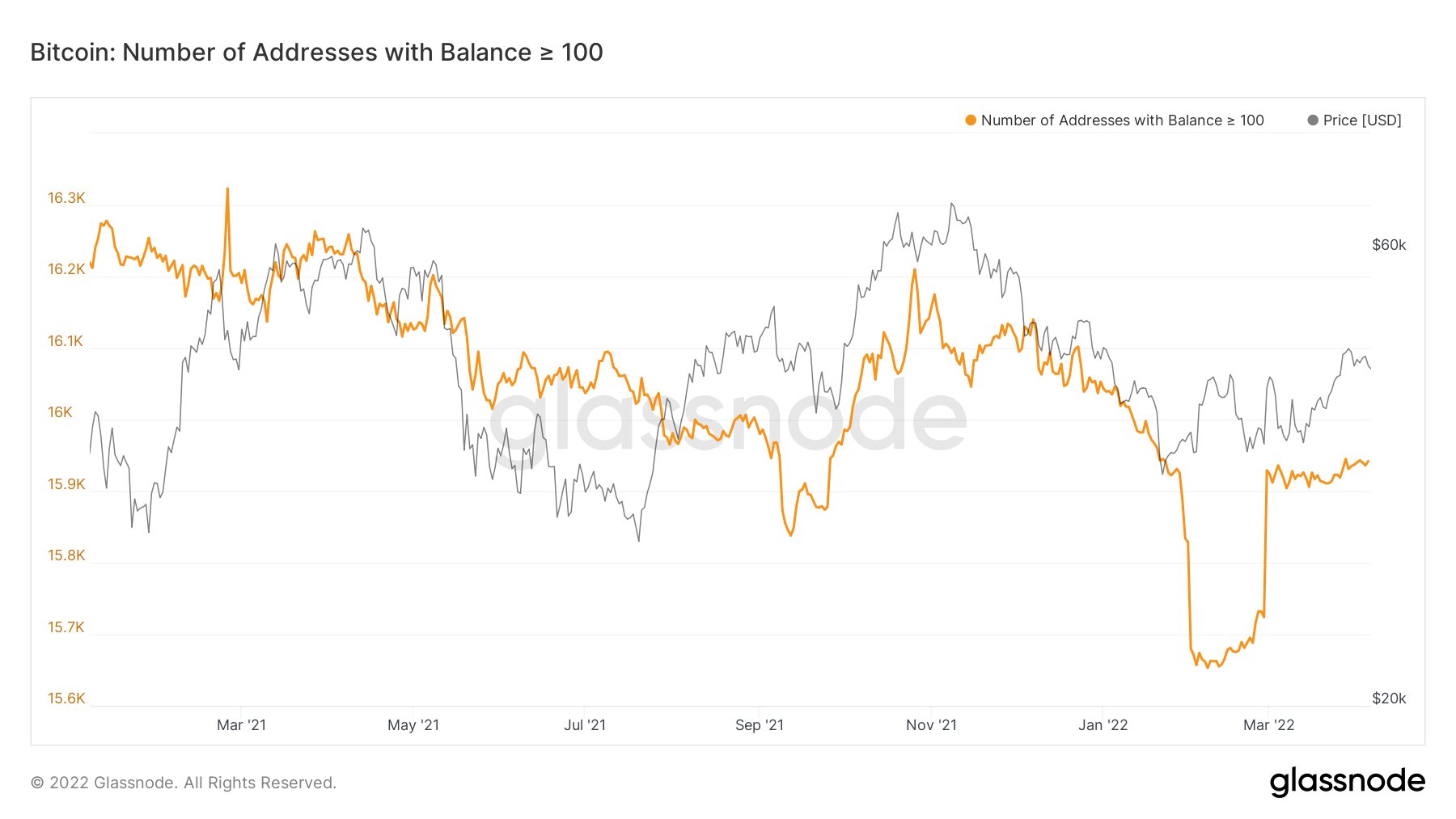

Bitcoin – Addresses with Balance > 100 Bitcoin

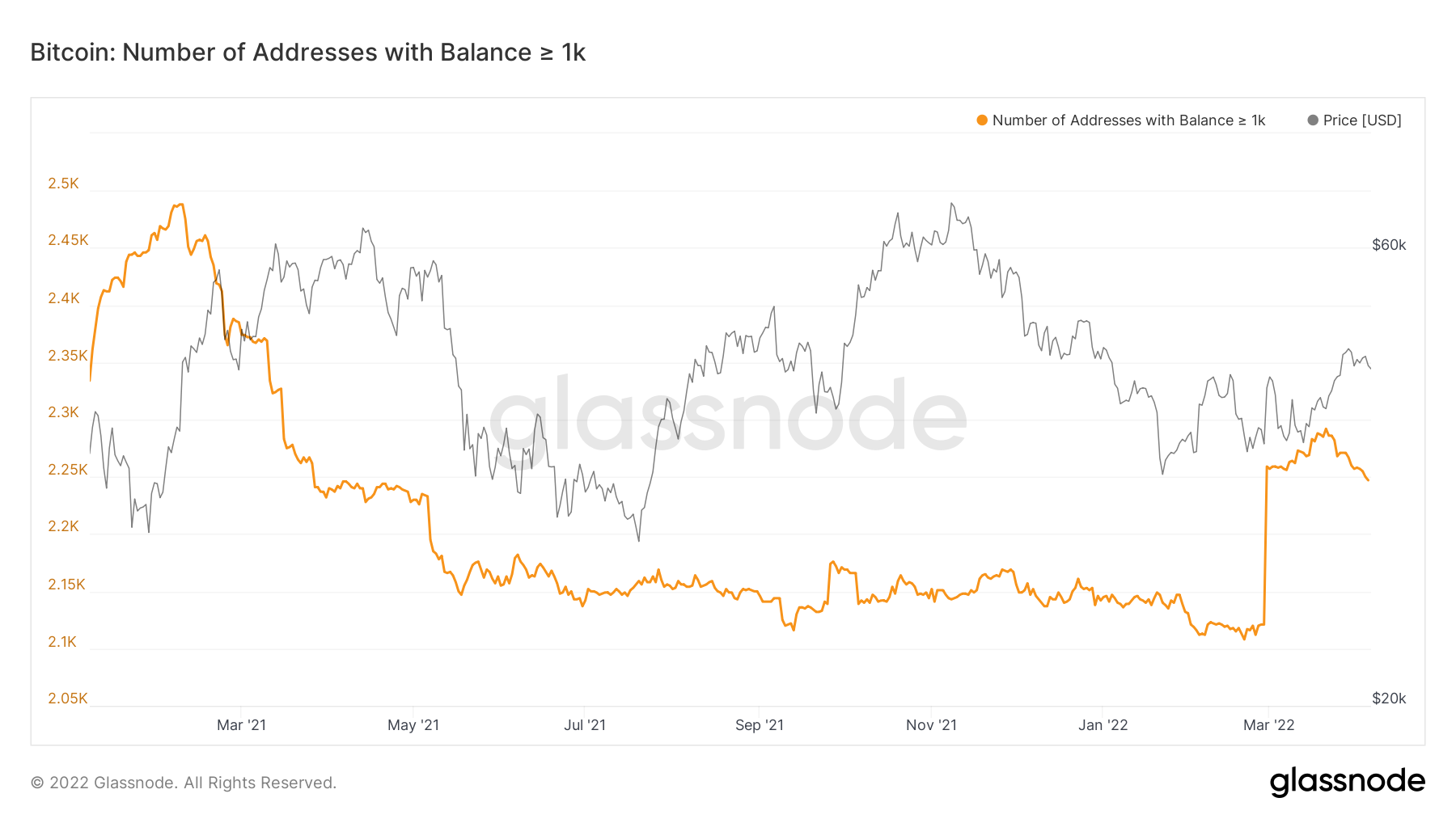

Bitcoin – Addresses with Balance > 1,000 Bitcoin

We can see from the above, that the addresses with less than 10 Bitcoin (any wallets holding more than 0.01 Bitcoin, 0.1 Bitcoin and 1 Bitcoin), have seen tremendous increases in numbers. This suggests more and more wallets are now holding between 0.01 Bitcoin and 10 Bitcoin. However, if we look at the cohorts of addresses that hold more than 10 Bitcoin (any wallets holding more than 10 Bitcoin, 100 Bitcoin and 1,000 Bitcoin), have seen decreases in overall numbers. This suggests that the small wallets have been accumulating heavily over the past few months, yet the bigger wallets have not been doing the same, in fact they’ve been staying relatively level. The one anomaly was the wallet cohort of Addresses holding more than 1,000 Bitcoin (Whales), over the past week or so they increased significantly, showing accumulation from this cohort, yet in the past few days, these wallets have decreased again, suggesting these investors have risked back off.

NOTE: The large increase on the cohorts of wallets with balances greater than 100 and 1,000 Bitcoins (the large line up on the last day of March) is an organic value, so it is not a misprint. However, the data provider did confirm that this was a cross transfer from some Exchanges. So effectively, these Exchanges create more cold storage wallets, and transfer coins out. This is something that needs to be known and to know that it is organic but the meaning behind it isn’t what we would hope for – of course we would rather this be an influx of new money buying big, but not the case.

Metric 3 – Funding Rates & Futures Estimated Leverage Ratio

The above two metrics outlined in the title are different metrics, but they are all inter-linked. The Funding Rates allows us to see if the market is currently over-heated in terms of the amount of leverage being taken out by investors. An over-heated leverage market can force quick flushes in either direction, so this is something to be wary of when prices have gone up consistently for some time. We can see below that the Funding Rates have stayed close to 0 or even very slightly negative. This is usually not the case when the market is very bullish. When the market is bullish the Funding Rates may be anywhere from 0.02% to 0.08%. For now, we’re nowhere near this, so in terms of a potential leverage flush out occurring, it can be suggested chances are not high.

Bitcoin – Futures Perpetual Funding Rate

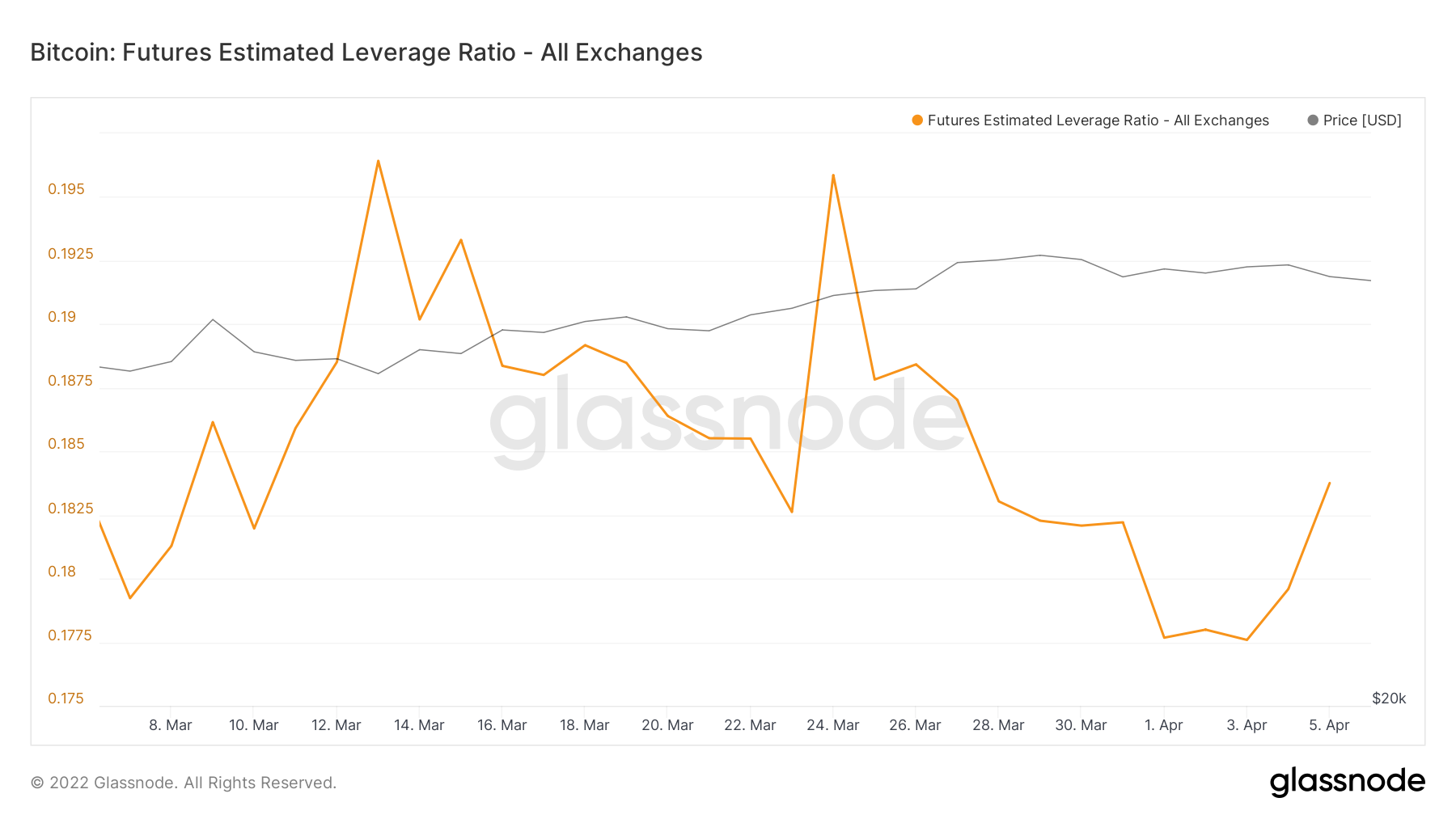

If we now turn our attention to the Futures Estimated Leverage Ratio, we can see the value is 0.183. This is reasonably positive, as a value under 0.2 usually suggests the leverage ratio to Spot is at a healthy rate and not too over-heated, so again another positive sign in terms of current open Futures positions in the market.

Bitcoin – Futures Estimated Leverage Ratio

Metric 4 – Purpose Bitcoin ETF Holdings

The last metric to be covered in this week’s report is the Purpose Bitcoin ETF Holdings. This metrics tracks the number of Bitcoins currently in the Purpose Bitcoin ETF. We can see from the graph below that the number of Bitcoins in the ETF has increased significantly over the past few weeks, however it has decreased very slightly over the past few days, a potential signalling of an imminent risk-off approach. Overall, a large increase in the number of Bitcoins in the ETF is bullish, we just may need to continue tracking this metric going forward.

Bitcoin – Purpose Bitcoin ETF Holdings

Summary

After investigating the above metrics along with a number of other data science models, we can conclude a few things. Firstly, the past few weeks have seen price rallies in many crypto assets as the FED gave more clarity to markets and almost gave the “green light” to risk-on assets for the time being. This saw accumulation from the smaller wallets and the largest wallet cohort increase, however, the median to big wallets were not accumulating so heavily. The reason for this is that the next FED meeting is in May where it is expected there will be a rate hike of 0.5% and the FED will outline a plan to reduce the Balance Sheet. Depending on the aggressiveness of this plan, risk assets will likely be negatively impacted if the plan outlined is aggressive. Due to inflation being so high, the likelihood of an aggressive Balance Sheet normalisation is increasing, and it is possible that investment managers are noting this, hence we have not seen them build big positions (accumulating). For now, prices have rallied but momentum may decrease the closer we come to the meeting in May. An aggressive FED will be bad for risk assets and may be a “sell the news” event.