PCE, Yields, TOTAL3, BTC, Friday could flip the macro gameboard—are you watching?

Friday's data could be the first hard signal of a US slowdown. Rising Yields, falling DXY, and BTC strength on real demand set the stage. Markets are shifting- are you set up or sidelined?

TLDR:

- Macro data: Key US data this week could hint at a potential US slowdown.

- Yields & Dollar: US bond yields are rising due to fiscal concerns, but the drop is easing financial conditions.

- Bitcoin on-chain: BTC breakout is backed by strong ETF flows and low leverage, healthy rally.

- Cryptonary's take: An Alt rotation is possible if BTC holds, SOL and TOTAL3 are the key charts to watch.

- Data This Week.

- Yields & The Dollar.

- On-Chain Metrics.

- Cryptonary's Take.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Data this week

This week is a shorter week from a TradFi stance, with markets closed on Monday (May 26th) due to Memorial Day. However, we still have some key data releases this week, with some FED speak fluttering in and amongst it.Most of the more important macro data releases are on Friday, when we have Core PCE expected to come in at 0.2% (higher than the previous month), Personal Income to come in at 0.4%, and Personal Spending to come in at -0.1%.

If the data were to come in as forecasted, this would suggest that consumers are still earning, although they're beginning to rein in their spending. This would help point towards a potential future slowdown, although we'd need other data to corroborate it, which we're not conclusively seeing at the moment.

What's next:

US bonds are being dumped, yields are spiking, and BTC is rallying—this is the same setup we saw before the 2020 melt-up. Are you positioned before capital fully escapes TradFi?Yields & the Dollar

Over the last 1-2 months, one of the main macro stories (alongside tariffs) has been the fiscal situation in the US. We're continuing to see a disregard for bringing the US fiscal deficit into closer balance, meaning the US continues to raise debt to pay for itself, with the deficit continuing to widen.This has recently led to investors questioning just how safe a US Bond is as an investment (more from a capital preservation perspective), and hence we're seeing Yields increase as investors require greater compensation (higher Yields) in order to be willing to buy newly issued US debt.

This is known as an increase in Term Premia. Rising Yields are usually not positive for risk assets, as the benchmark rate is essentially increasing for risk assets to have to outperform that. Why buy risk assets when you can get 5.0% (virtually risk-free) just for buying Bonds?

However, Yields are rising due to market participants questioning the US fiscal path, and hence, as a result, we've seen this flock towards hard assets: Gold and BTC. This trend can continue, and we expect it to. Whilst Yields are rising for the above reasons, Gold and BTC can continue to perform (because it's a flight to hard assets), assuming the rise in Yields is orderly.

If we see a sudden disorderly rise in Yields, that can essentially put pressure on all assets short-term, even though it likely results in the Treasury/the FED stepping in with a new acronym, to provide liquidity and stabilise the markets.

Rising Yields should mean Financial Conditions tighten; however, we have been in a declining Dollar environment ever since the market began taking 'tariff talk' seriously.

As a result, the DXY has fallen by 10.1% since January 13th, 2025. This has meant that in despite of Yields rising, the falling DXY has kept Financial Conditions in 'easing' territory, which has helped risk assets to perform.

DXY 3D timeframe:

To summarise: traders are questioning the US fiscal outlook, which has resulted in a move away from US Bonds and into hard assets (Gold and BTC). This has also come alongside a declining Dollar (DXY) on the back of tariffs and uncertainty out of the administration, which has led to capital flight out of the US.

These trends are supportive of a continuation rally in both Gold and BTC, although we expect periods of consolidation in the short-term and along the way.

On-Chain metrics

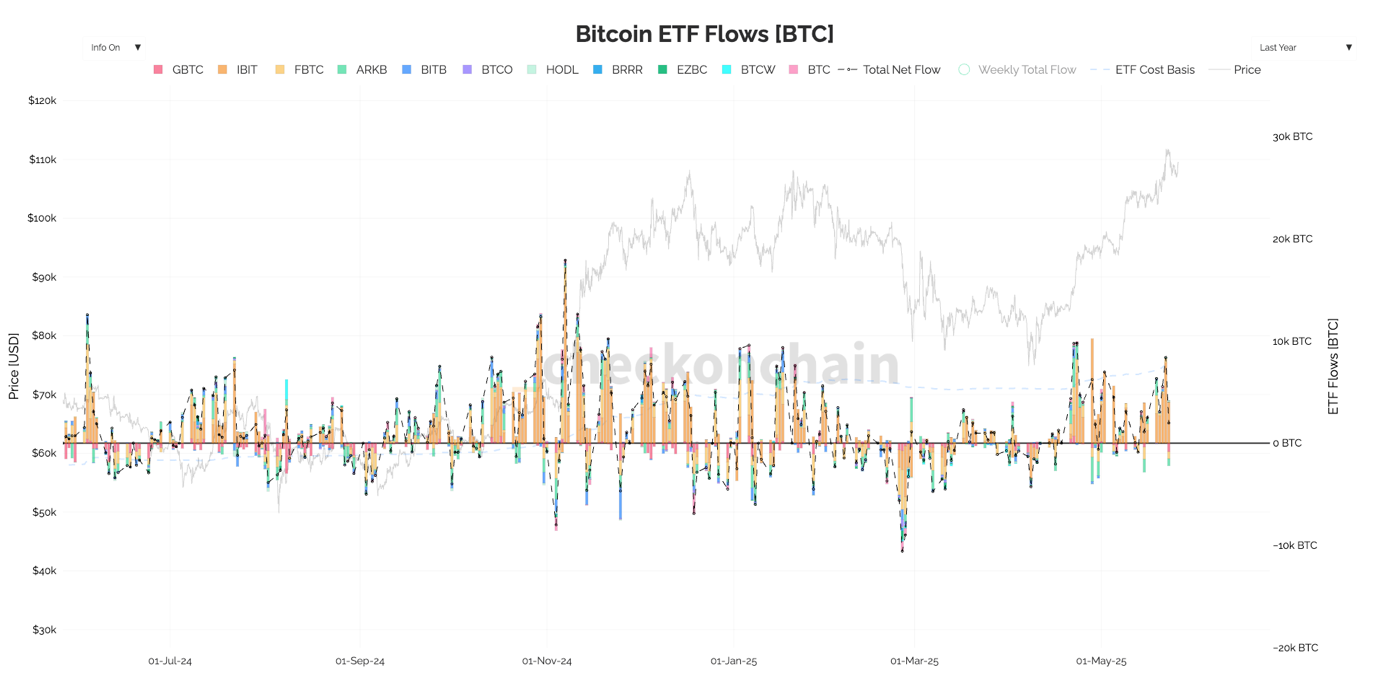

Recently, Bitcoin has broken out to new all-time highs, and when looking under the hood of this move, we can see that it has been supported by strong Spot buying (as seen in the ETF flows).

ETF flows (in BTC):

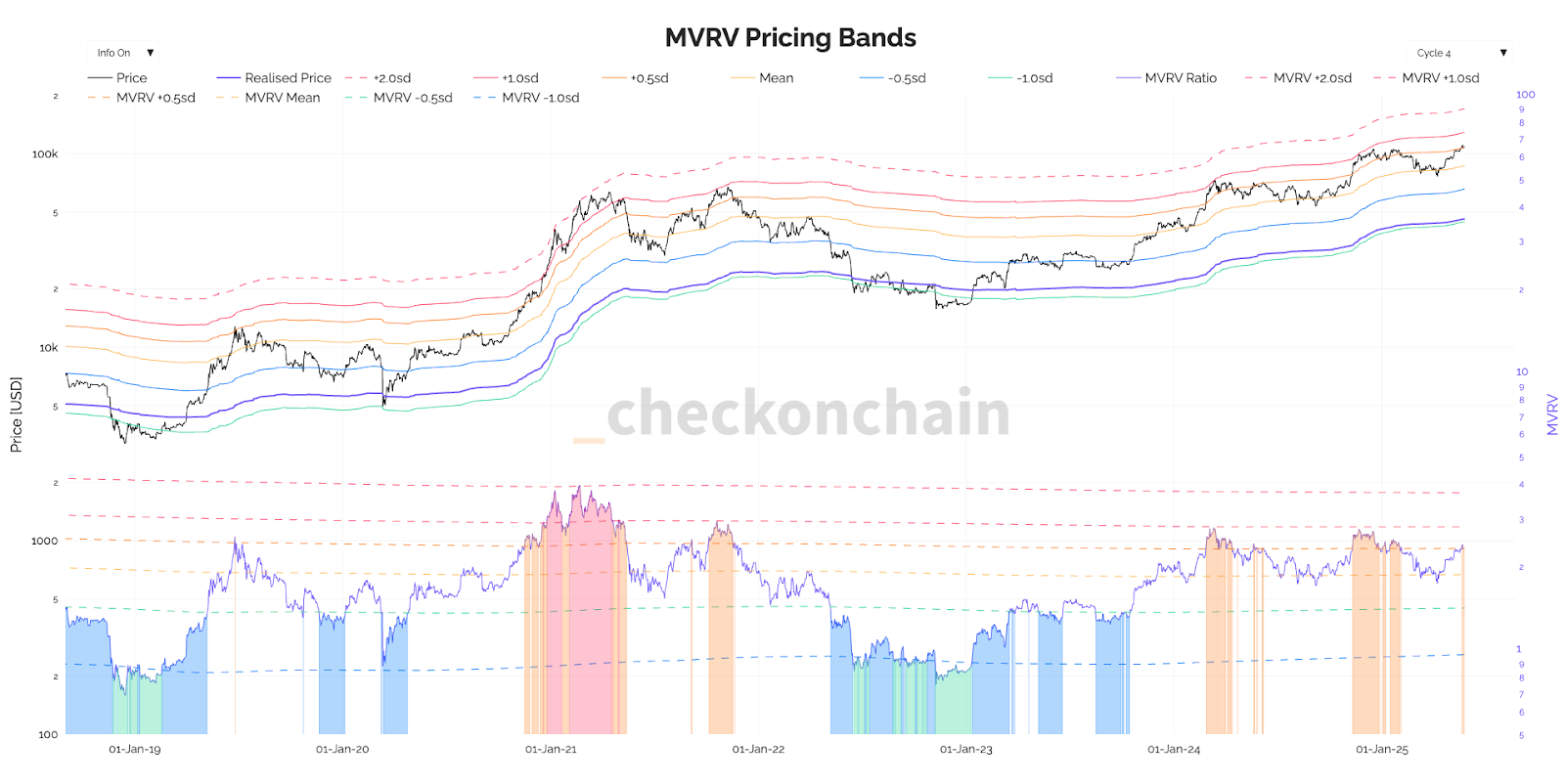

Alongside this, the MVRV Pricing Bands show that Bitcoin is now +0.5 standard deviations above its Mean MVRV, which is similar to prior all-time high breakouts. This is shown by the orange shaded area at the bottom of the graph, which can last for a number of months. Bitcoin has locally topped when it has run into the +1.0 standard deviation line (the pink line on the chart). That line currently sits at $128,000.

MVRV pricing bands:

But, with BTC breaking above all-time highs, we usually see the market become frothier with leverage, which can mean we see leverage flush outs in and amongst the heightened volatility.

We'd therefore expect to see Funding Rates at high levels, reflecting participants taking out that leverage, as is typical upon BTC all-time high price breaks. However, that's not what we're seeing. Funding Rates remain very subdued. This is healthy, and it doesn't suggest that this is an unhealthy breakout for BTC.

BTC perpetual futures funding rates:

Cryptonary's take:

The recent questioning around the sustainability of the US fiscal deficit has seen investors move out of Dollar assets and into harder assets, like BTC and GOLD. We expect that this trend to continue, as long as there isn't a disorderly move up in Bond Yields. In this environment, BTC can continue to perform well, but we have seen that the rest of Crypto has lagged behind BTC, despite some coins putting in good runs.This supports the 'hard assets' narrative, rather than this move higher being due to a general risk-on rally across the board. For instance, if we saw 2-4 Interest Rate cuts, everything would have moved higher, with Alts/Meme's likely outperforming as BTC.D (Bitcoin Dominance) dropped. But up until now, we haven't seen this.

However, a Bitcoin breakout of all-time highs has historically been what's kicked off the "Alt seasons" of the past, and that is possible again this time. For this, we're watching if TOTAL3 can break out of its horizontal resistance.

TOTAL3 3D timeframe:

We're also closely looking at other Majors to see if they can follow BTC. For instance, if SOL can breakout of $200 we'll likely see a resurgence in that eco-system that then fuels old winners to run, whilst new plays will also likely have their runs as well.