Today, we share our thoughts on how the market will play out when the decision is announced and after the announcements.

And more importantly, we dive into our strategy for using the post-ETF market dynamics to our advantage.

Let's dive into it.

Quick market overview

In short, we think the market looks shaky now.The main reason the markets are currently going higher is the positivity around the expectation that Spot BTC ETFs may be approved this Friday or early next week.

Interestingly, this period looks similar to the summer of 2019, when BTC surged from $4k to $13k, retraced to $9k, and then Covid-19 dragged prices down to $5k.

Of course, we are not looking to sell Spot positions throughout the coming months, but we are also not looking to add fresh Longs or new buys either.

We will make new buys with fresh USDT in the coming months - more on that in a bit.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

What will happen after ETF approvals?

It looks extremely likely that the ETF will be approved.If/when it is, we may see BTC have a 5-10% candle higher. However, we see the $48k level as the potential local top - a 7% or so move higher from here.

If BTC goes up by an additional 7% or so higher on approval, then altcoins can do the same, if not slightly more.

However, we'd be extra cautious on the day of the ETF approval or the day after this. The reason is that BTC would be up a lot, yet we’ve not had a 20% correction since mid-August 2023. 4.5 months is historically an extremely long time to go without a 20% correction in crypto. In fact, 20% corrections are quite common in crypto bull runs.

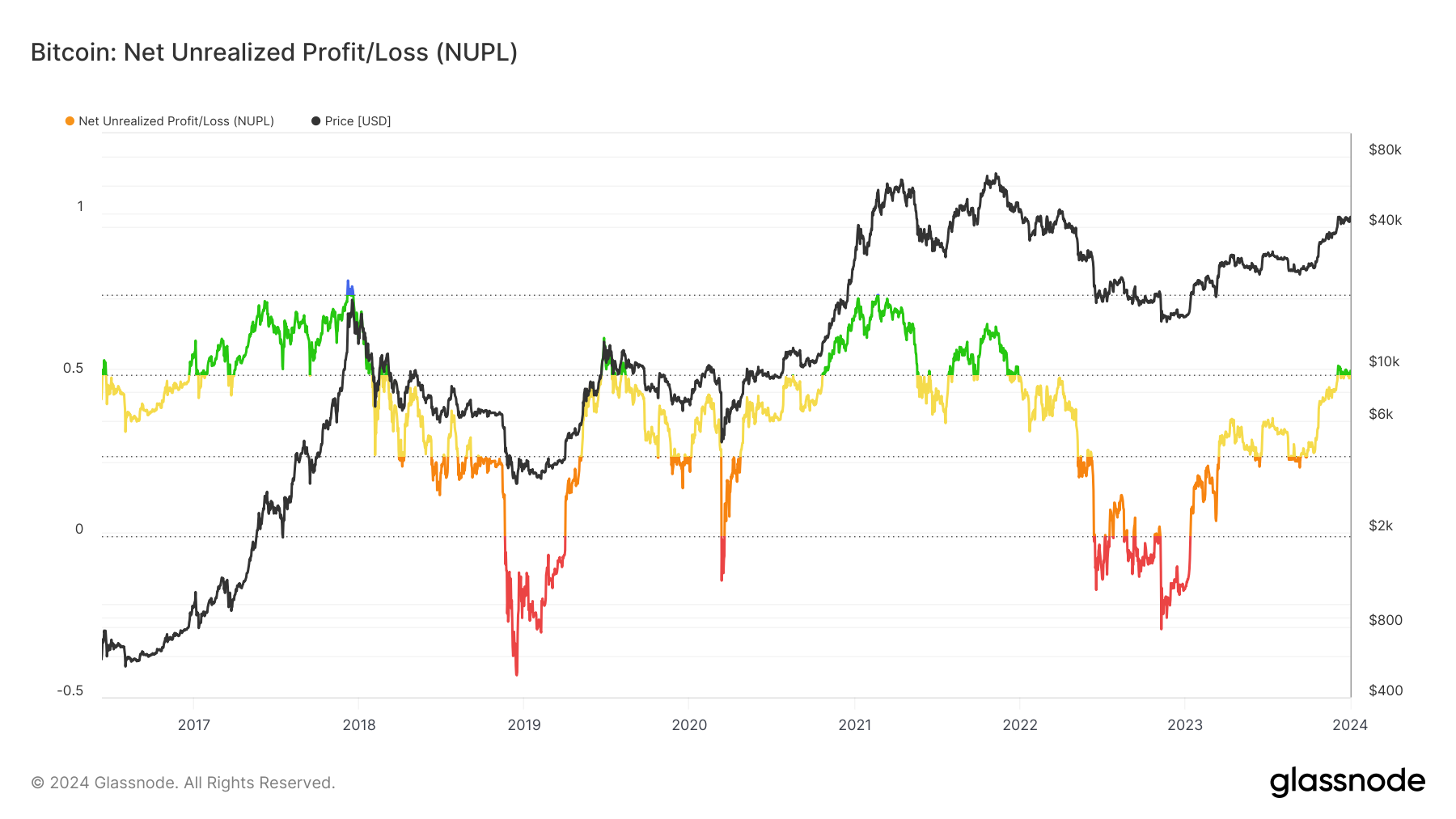

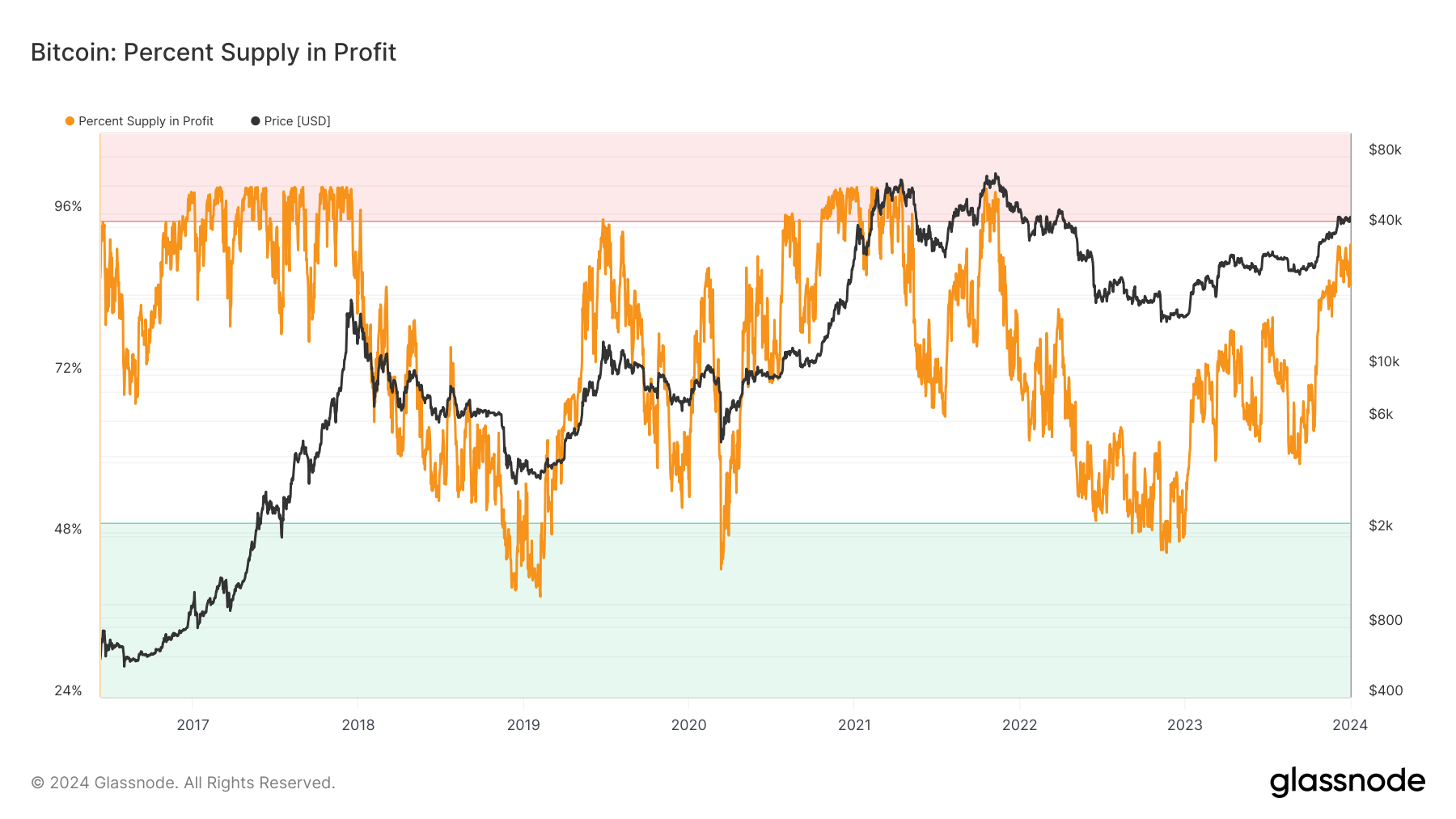

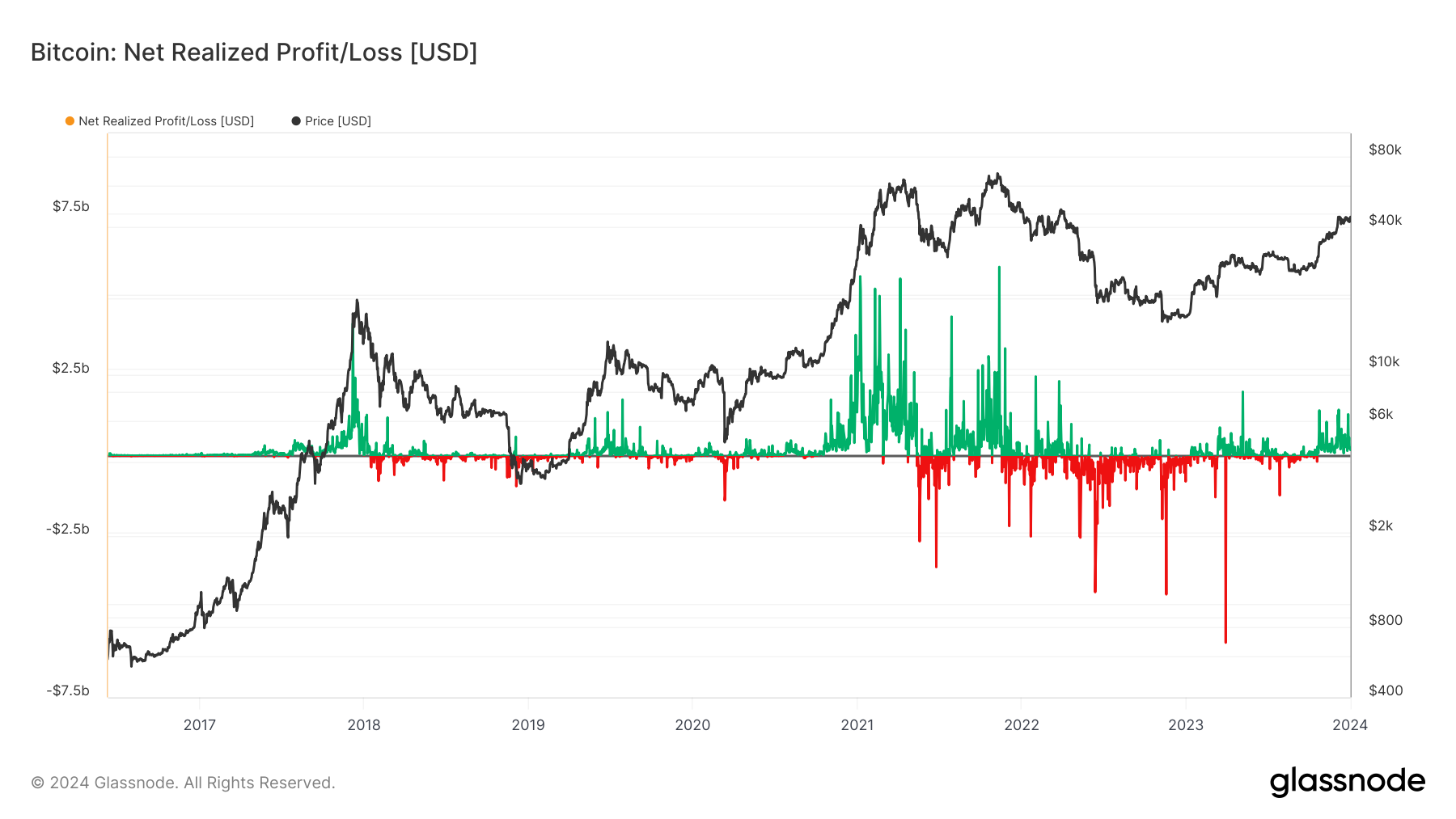

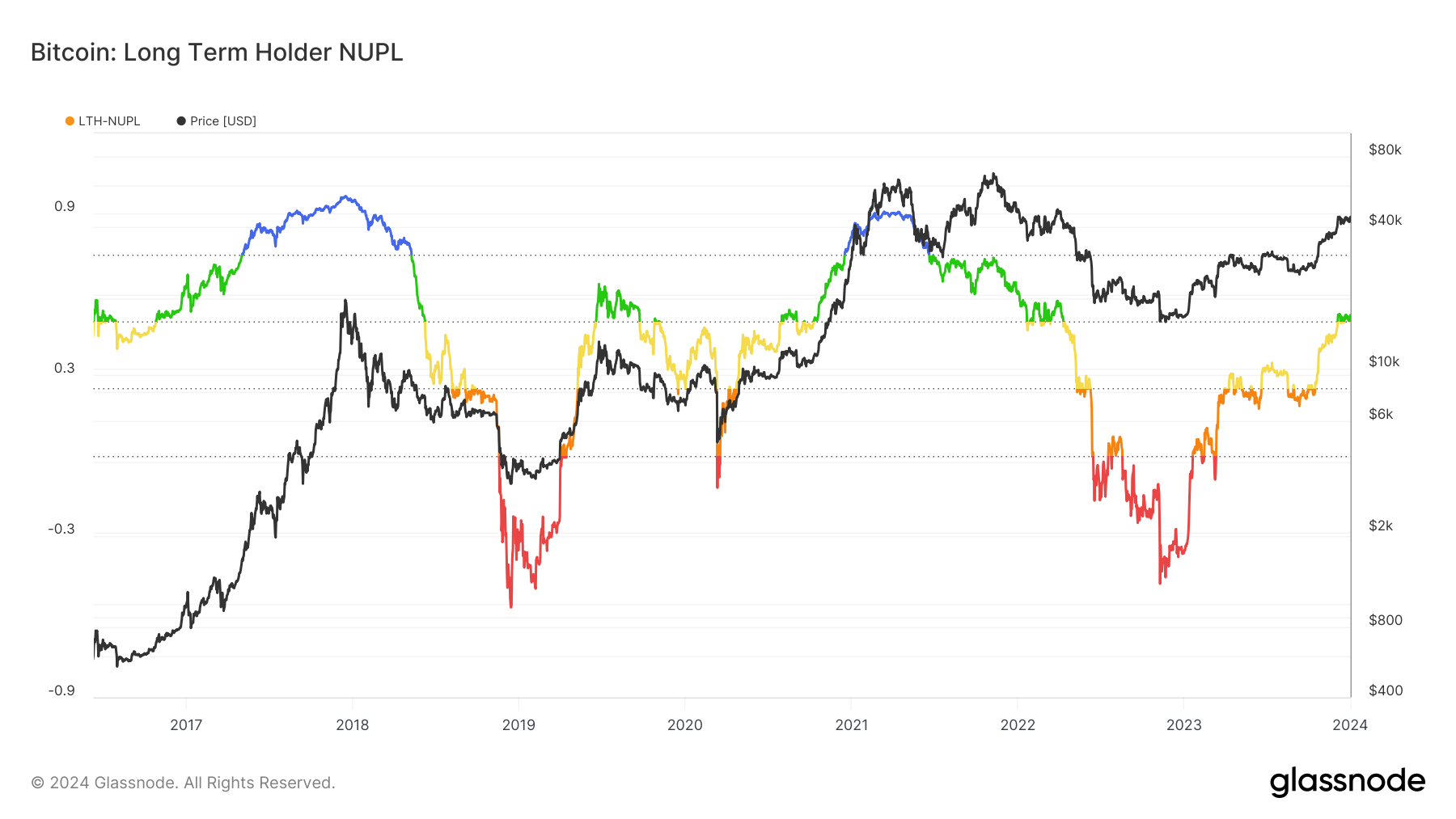

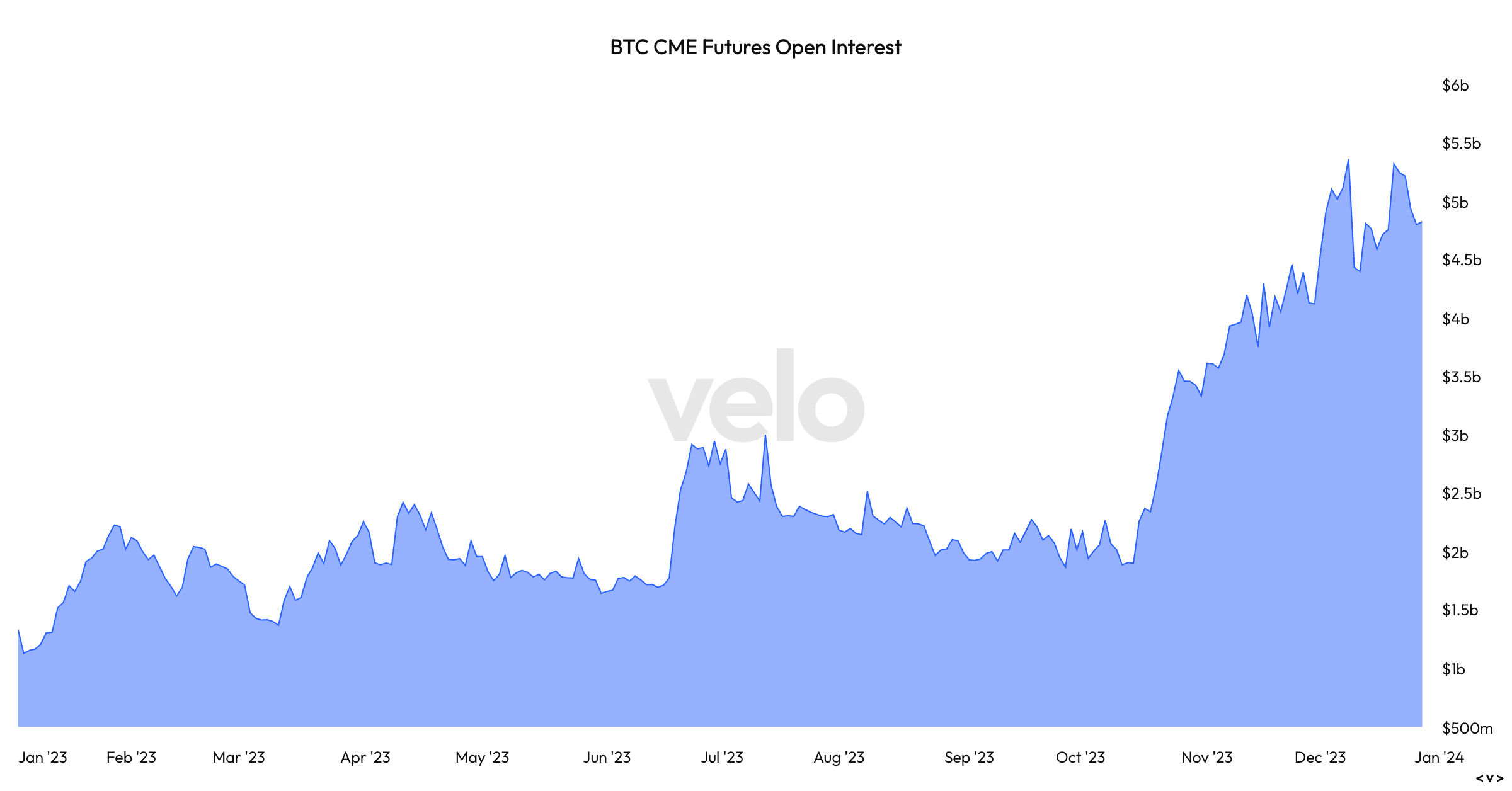

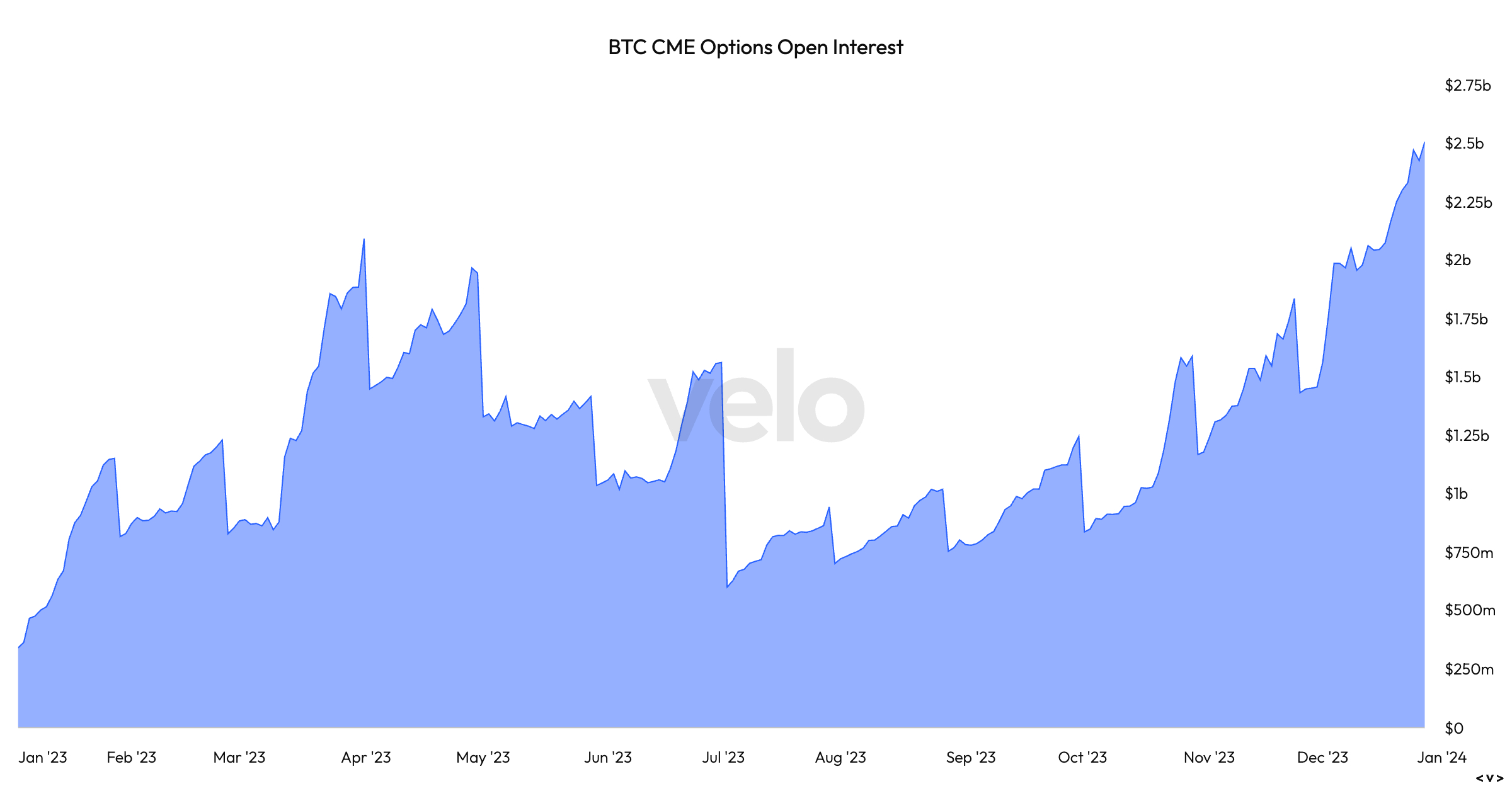

Alongside this, a lot of the on-chain metrics are close to overbought levels, which have been prior top areas in previous cycles pre-halvings. Additionally, we've seen TradFi majorly move into BTC in recent months, and they have used CME Futures as a main vehicle for this.

These TradFi traders will likely look to close out their Longs and book some profits. This is very likely because there are still nearly four full months to go until the next halving.

And when you look into the market mechanics, the market is generally just overheated here. The USD levels of Open Interest are very high, with Funding Rates now massively positive, having been so for a while.

For now, this high OI is being supported by a Spot bid, but will this be the continued case post-ETF approval? We can't see it. There will likely be a cool-down period following it.

But don't just take our word for it; see what that data says below.

On-chain metrics

Below are several graphs that show how similar today's on-chain setup is to the summer of 2019.

TradFi

Do we see this interest unwind once an ETF is approved and TradFi participants begin to profit book?

Cryptonary's take

We'll be super clear here. We are not looking to sell our Spot positions where we have good entries from low prices. However, we are also not planning to Long into the ETF decision.We will look to put fresh capital (USDT) to work in the coming months after we’ve seen a more meaningful correction in the market as a whole.

At that point, we will be targeting altcoins that have performed well recently and buying them on pullbacks.

Stay tuned for updates on the altcoins that will be making the list.

Bitcoin started 2024 with a strong move up, but what does the rest of 2024 have in stock for your portfolio?Check out Cryptonary's 2024 projections.