Market Direction

As the crypto market continues to evolve, navigating the landscape requires precision and insight. Today, we will explore Bitcoin’s relief rally, market dynamics across the majors, and our favourite memes, WIF and POPCAT, and also get an update.

Let’s dive in!

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC

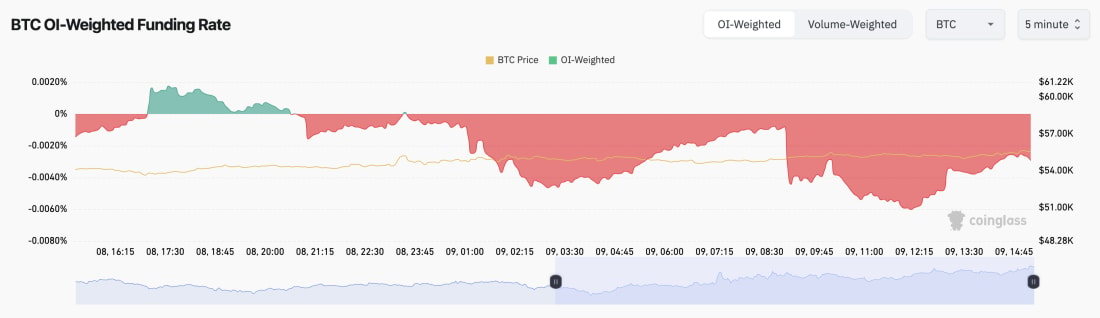

- In BTC terms, open interest has increased slightly over the past few days, and the funding rate has turned substantially negative.

- Traders are now paying a premium to be Short here. This provides the setup for a slight furthering in the relief rally that we're seeing.

Technical analysis

- Prices across the board moved down meaningfully last week. For BTC, price found support and bounced from the major horizontal support we have had outlined for many months at $52,800.

- Price is now below the grey support box ($56,500 to $58,000), which will now likely become the new resistance.

- Beyond the grey box, $60,300 will likely act as a resistance for price in the short term.

- BTC is currently squeezing into a local downtrend line. A breakout of this could see price get back up to and retest $58,000, although we're not confident that it will get back above this level in the short term.

- To the downside, we expect the $48k to $52k area to be a large area of support.

- BTC has put in a bullish divergence (lower low in price but higher low on the oscillator). This can help push BTC up to $58k.

Cryptonary's take

Over the coming days, we expect risk assets (Bitcoin included) to have a continuation of the relief rally. However, we expect this to stall around or just shy of the $58k level. We expect a move back down to the low to mid $50k following that. The next few weeks will likely see substantial volatility, and we think we'll see BTC trade between $52k and $58k during this period. We're not necessarily on board with the view that Bitcoin will materially break down below $48k, as we see some calling for it on Twitter. If BTC were to re-visit the late $40k, we would be strong buyers in that zone.ETH

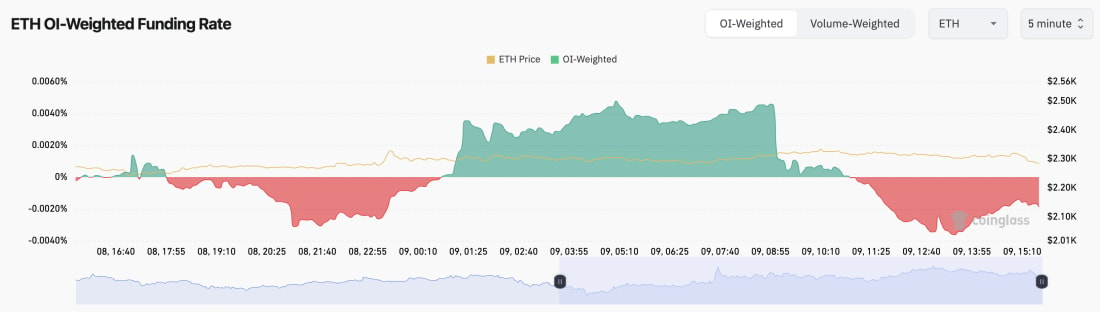

- ETH's Open Interest has remained relatively flat, suggesting that traders aren't looking to aggressively trade ETH here.

- ETH's Funding Rate flip-flops between slightly positive and slightly negative, indicating indecision amongst traders.

- Overall, this is a healthier setup. ETH's funding rate is less negative than that of BTC, while open interest hasn't ramped up. From a mechanics perspective, ETH is arguably an attractive long at these prices, while the leverage market has seen a major flushing out.

Technical analysis

- ETH has also fallen below its grey support box (between $2,330 and $2,470).

- ETH did find support at our major horizontal support line of $2,150, though.

- ETH has also put in a bullish divergence (lower low in price and higher low on the oscillator), with the higher low being put in just above oversold territory.

- If ETH can break out from its local downtrend line, it's possible ETH could retest the $2,550 local horizontal resistance.

- Beyond $2,550, the major horizontal resistance is at $2,875.

Cryptonary's take

Despite the fact that we're still relatively wary of the market over the coming weeks, ETH looks as if it's either at or close to a bottom here. ETH has been down just shy of 50% from its highs this cycle, while we've also seen a major resetting in the leverage market. Price is currently sitting on top of a major support zone between $1,900 and $2,150. If ETH does revisit this area, this is likely a good price to bid with a 12-month view.SOL

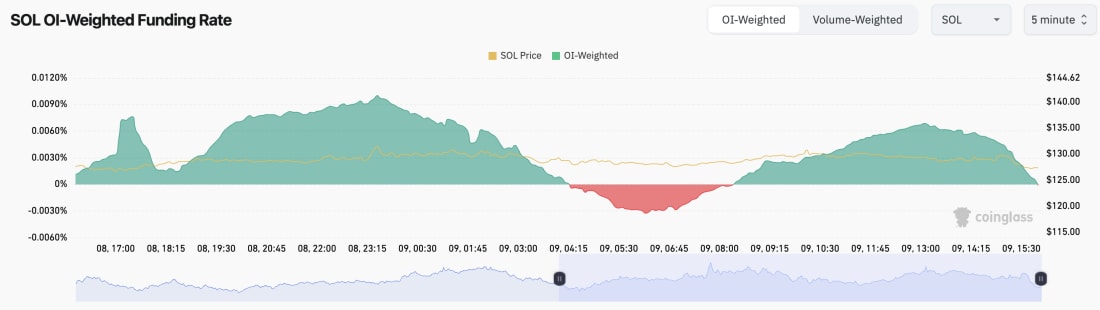

- SOL's Open Interest has increased in the last few days while the Funding Rate has flip-flopped between slightly positive and slightly negative.

- There has been more willingness amongst traders to Long SOL in recent days.

Technical analysis

- SOL is still in its major downtrend. However, it has continued to hold the horizontal support zone between $120 and $131.

- SOL looks to be in a precarious position. It has retested the $120 to $131 region many times now while mostly putting in lower highs.

- However, SOL has put in 3 bullish divergences (lower low in price, higher low on the oscillator) in a row. This should be enough for price to be able to reclaim above $131 and attempt a retest at $140.

- If price does break down below $120, the next major support is at $103.

Cryptonary's take

Having retested the support many times, we would be wary of SOL in the near term for a potential breakdown. However, if price were to drop below $120 and retest anywhere near $103, we would be strong bidders of SOL. But, we must consider that sentiment is currently very low, so it wouldn't be wise to turn bearish on SOL at the potential lows or close to them. Therefore, we advocate holding our SOL Spot bags and just adding to our bags if SOL dips to anywhere between $103 and $120. We still believe that we'll see SOL well above $500 in 2025.WIF

- WIF is currently beneath its local uptrend line whilst it also remains in a larger, multi-month downtrend.

- WIF also remains beneath its major horizontal level at $1.60. In order to see bullish momentum return, WIF needs to comfortably reclaim this level.

- Above $1.60, the next major horizontal resistance is at $2.20, with a local level at $1.96.

- To the downside, if WIF were to lose the late $1.30s, then a retest of $1.20 is likely, although we'd expect there to be strong demand at this level ($1.20).

Cryptonary's take

WIF is currently compressing into a tight range despite achieving significant volumes; this may result in a volatile breakout at some point in the near future. Unfortunately, we don't have a strong conviction on the direction as of yet. For this reason, we are remaining in Spot positions (for the long-term), and we'll look to add to our bags if price does dip down to $1.20. Other than that, for now, we're just sitting patiently and not looking to take a lot of action.POPCAT

- Honestly, the price action is quite impressive, considering how much the majors (BTC, ETH, and SOL) have pulled back.

- Price has broken below the support area of the low $0.50s, but it is now looking to reclaim above that.

- However, price is now running into the resistance of the underside of the uptrend line and the downtrend line.

- If price can break out, then the near-term target is $0.66; beyond this, it's $0.77.

- On the downside, if price breaks down, we'd expect it to retest $0.40; however, this would be a level we'd bid.

Cryptonary's take

In short, POPCAT is one of the plays that has held up the best and that we think can be a major winner in the next larger move higher for crypto. We'd be looking to hold spot positions and add to Spot positions around $0.40 if the price revisits this level.Overall, we're confident in POPCAT going into year-end and 2025.