Key resistance rejected the price spike as shorts began to circle, smelling blood in the water. SOL partied like it would never end, but the lights are now flickering. A painful correction likely awaits, so strap in for some turbulence.

TLDR

- Solana is extremely overbought on all key timeframes with correction overdue.

- Initial rejection from $63 resistance shows profit-taking kicking in.

- High open interest and reducing funding rate point to shorts piling in.

- There is an urgent need for a consolidatory period before SOL can take off again.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Technical analysis

From a technical perspective, SOL is beginning to look a little top-heavy here. In the two weekend’s daily candle closures, we saw that price spiked into the $63 - $64 area and rejected back into the last $50’s. This indicates some clear profit-taking and is likely a relatively wise decision in the short term.There is around $56, but the next major support beneath that is $48.67. We may see the sellers of SOL in the low $60’s re-buy SOL in the last $40’s to early $50’s.

The RSI is frightening. The daily, 3D, and weekly timeframes are all well into overbought territory, yet we haven’t seen any bearish divergences put in. However, we would suggest some caution here because of how overbought SOL is.

SOL 1D

Market mechanics

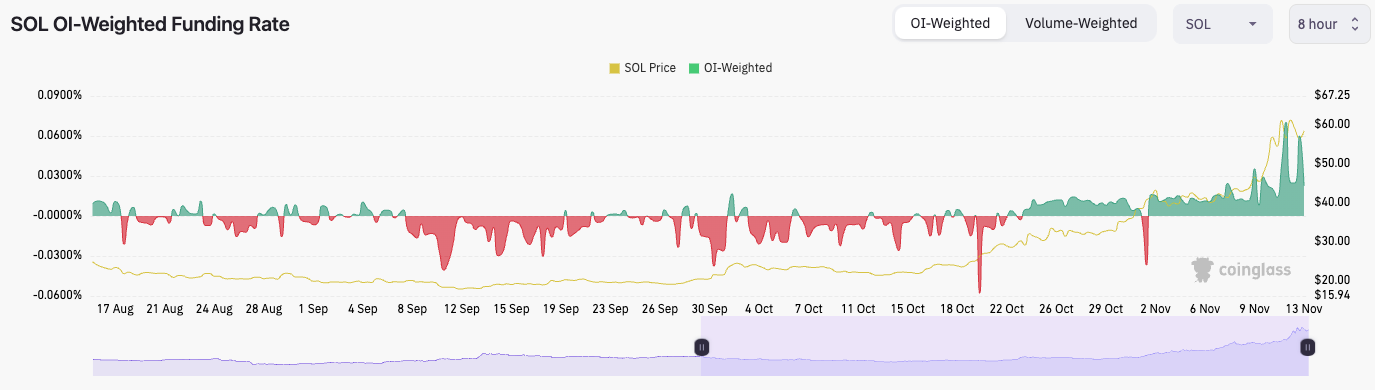

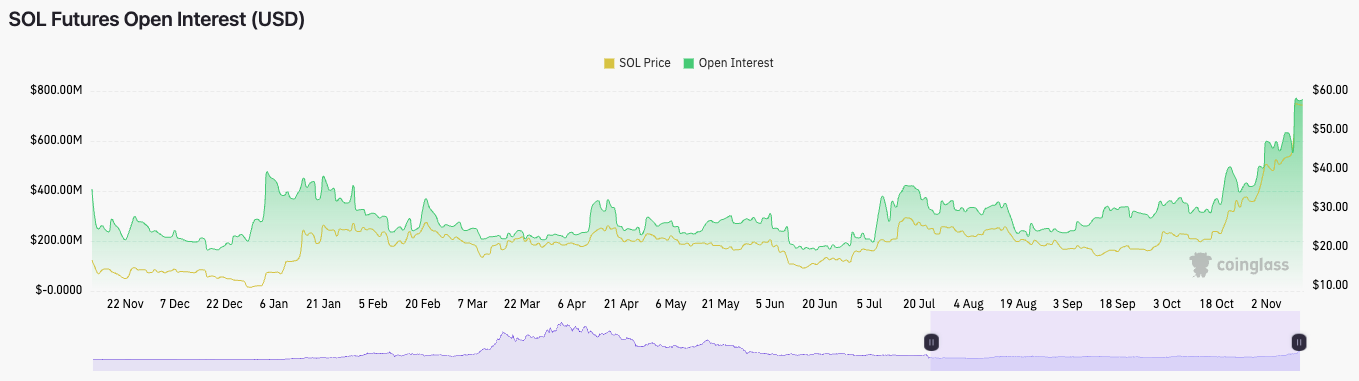

The funding rate for SOL is ok. It’s come down from phenomenally positive levels but does remain quite high at an OI-weighted funding rate of 0.0227%.The open interest, however, is the concern. It remains very high. This suggests that as the funding rate has come down over the past 8-16 hours, but with open interest remaining very high, shorts have begun to join the party, and there is now a more even balance between longs and shorts, with retail dominating the longs.

Cryptonary’s take

SOL has been a phenomenal performer recently, and of course, it could have a further leg higher.However, the technicals suggest that SOL is now very top-heavy and needs a pullback and a consolidatory period before it can move more meaningfully higher again. We’re beginning to see this in the futures market. Open interest remains high, shorts have begun to join the party, but longs remain dominant. Also, the long/short ratio suggests that retail is on the long side.

We would exercise caution here. If SOL moves lower, we will add to our long-term spot bags beneath $49.

Again, if an ETF is approved this week, this can be the anomaly that sends the market higher in the very short term.