Risk-off sentiment fuels broad market sell-off

Markets remain jittery as BTC struggles to recover, Nvidia pulls back despite strong earnings, and TradFi pivots to safety. With stagflation concerns rising, let’s dive into the latest market shifts and their impact on risk assets.

In this report:

- This week's data.

- Nvidia earnings.

- TradFi flight to safety & ETF flows.

- Cryptonary's take & playing the timeline.

Disclaimer Text: Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

This week's data

Thursday and Friday (today) were the days when we saw more significant data releases. Yesterday, we had GDP, Jobless Claims and PCE Prices. GDP came in at a consensus of 2.3%, which is a meaningful move down from 3.1% (the prior reading).When looking at the price index part of GDP, we saw an uptick to 2.4%, which was above the 2.2% consensus and the 1.9% prior reading. However, this aspect was settled slightly today, with the Core PCE Price Index MoM printing 0.3%, a number that was in line with expectations.

So, inflation is somewhat sticky, or components within it are at least. However, it is at the 2 percent level. However, growth is slowing alongside this, so that's likely the biggest concern for markets currently.

This setup is potentially stagflationary (although technically, inflation isn't running away here), particularly as we expect the uncertainty in the market to be the cause for growth to slow further in the coming months.

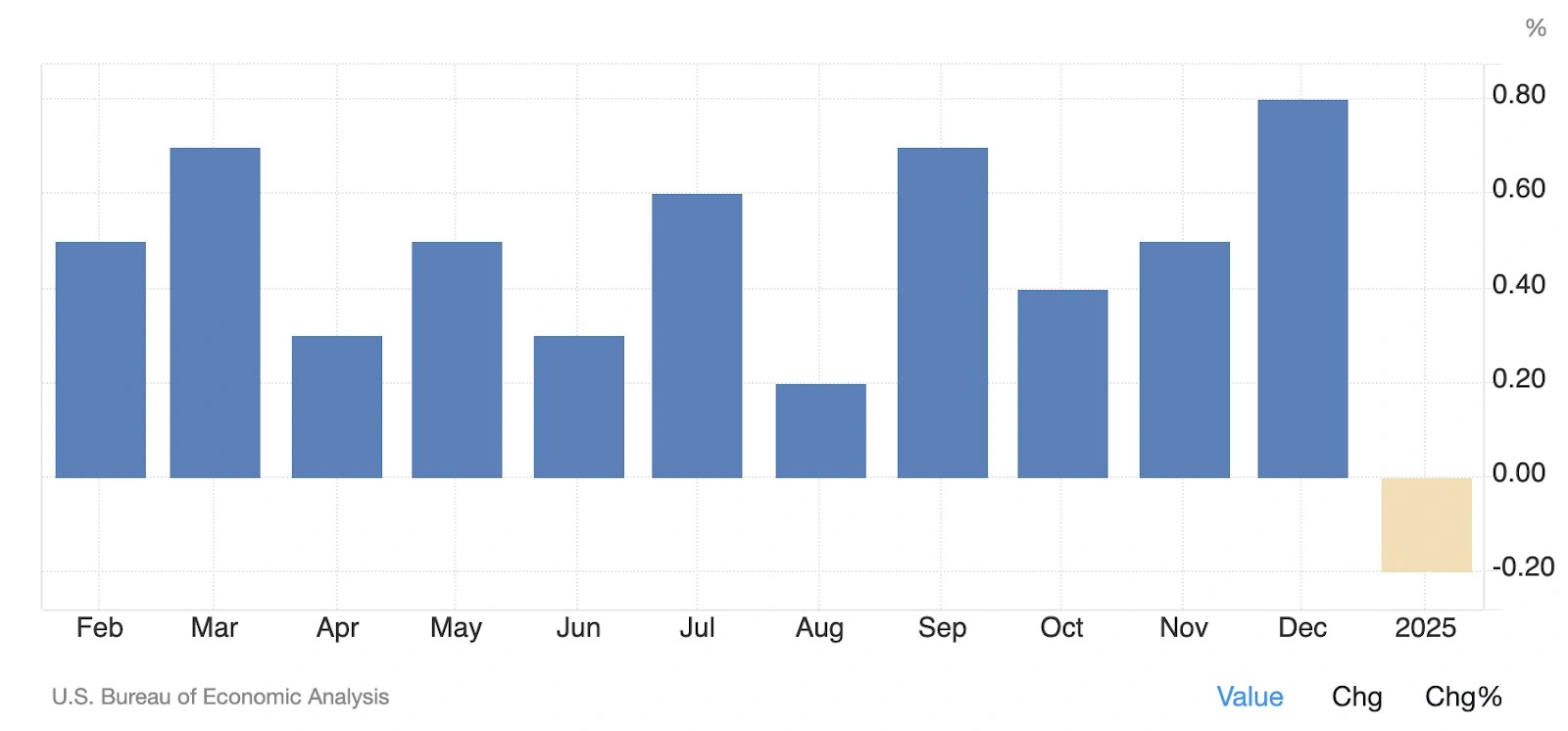

We have also just seen that in today's data. Personal Spending came in at -0.2%, down from +0.8% just a month ago. The inflationary component can be questioned more.

Is this a front running of tariffs ie, buy up now, and therefore need to buy less in the upcoming months when tariffs are in affect? Potentially, there are some nuances around the prices component.

Personal Spending MoM:

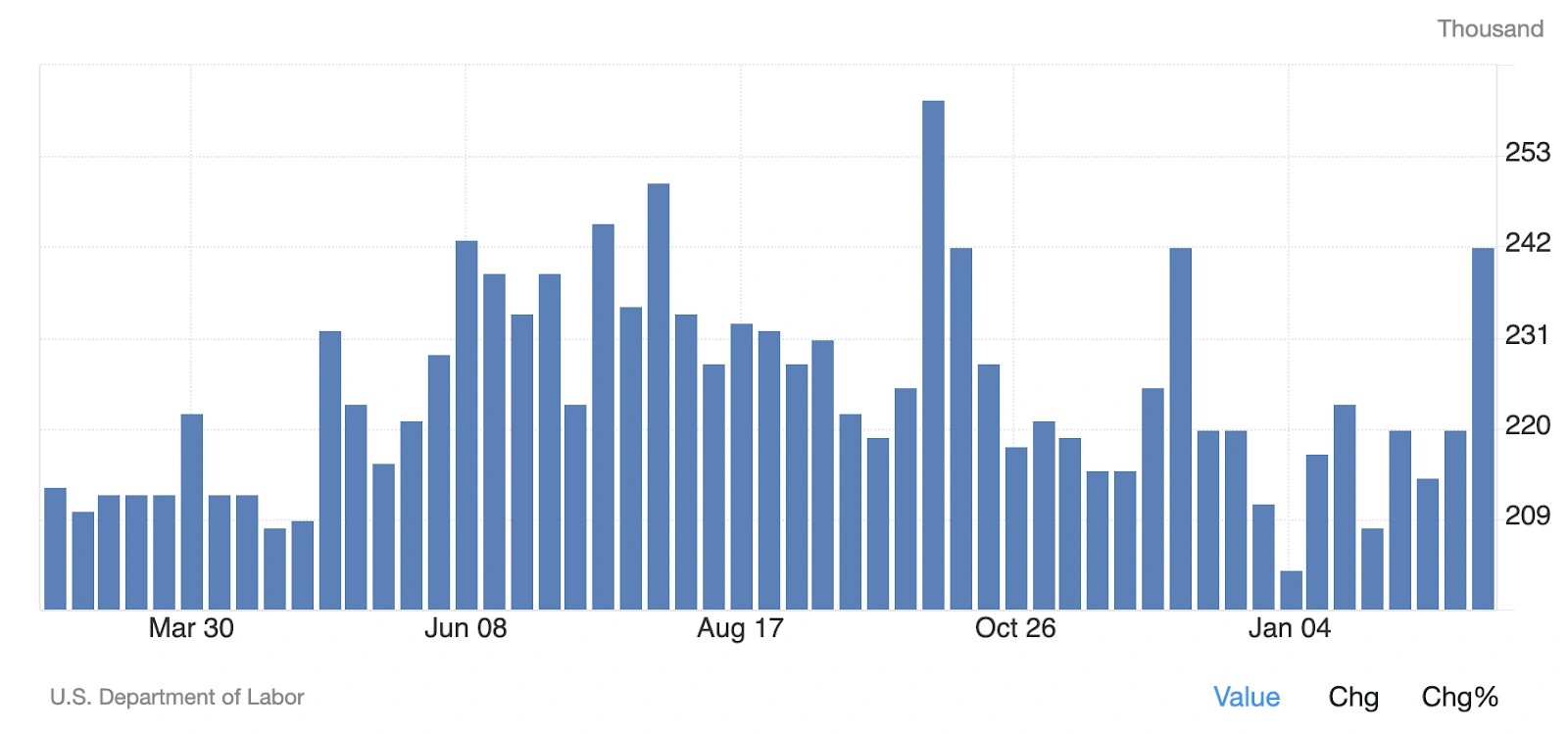

Alongside the above, Jobless Claims ticked up for the first time since early December. We'll be tracking Jobless Claims and if this is the beginning of a new uptrend in Jobless Claims as a precursor to a more material decline in the labour market.

Initial Jobless Claims:

Nvidia earnings

On Wednesday, the market eagerly watched Nvidia's Earnings release for any signs of a slow down, and therefore another reason to sell down risk. Numbers wise, it was good Earnings call. Nvidia reported record quarterly revenue and yearly revenue. However, despite projecting continued growth into 2026, Nvidia is expecting growth to slow.Following the Earnings release, the share price bounced slightly, but Thursday's session saw Nvidia pull back to new local stock price lows, as the general market risked-off.

So, even on a relatively positive Earnings release, Nvidia couldn't go higher, let alone lift the entire market higher, and it actually probably helped push the wider market (Big Tech and the Index) lower.

This doesn't suggest a poor outlook going forward for Nvidia or Big Tech (which has been correlated to Crypto), but it does show how jittery the market is, and even small catalysts are driving a market sell-off whilst there is so much uncertainty around the new administration's policies.

Nvidia 1D Chart:

TradFi flight to safety

Over the last week, we've seen a flight to safety in the TradFi markets. This is seen by:- $DXY up.

- $US10Y Yield down.

- $SPX down.

- $NDX down.

Crypto has not been immune to this risk-off period, and we've seen BTC decline approximately 17% since Monday's session.

BTC 1D Chart: BTC has seen an approximate 18% decline over the last week from the breakdown to the bottom. Price is now very slightly off of the bottom.

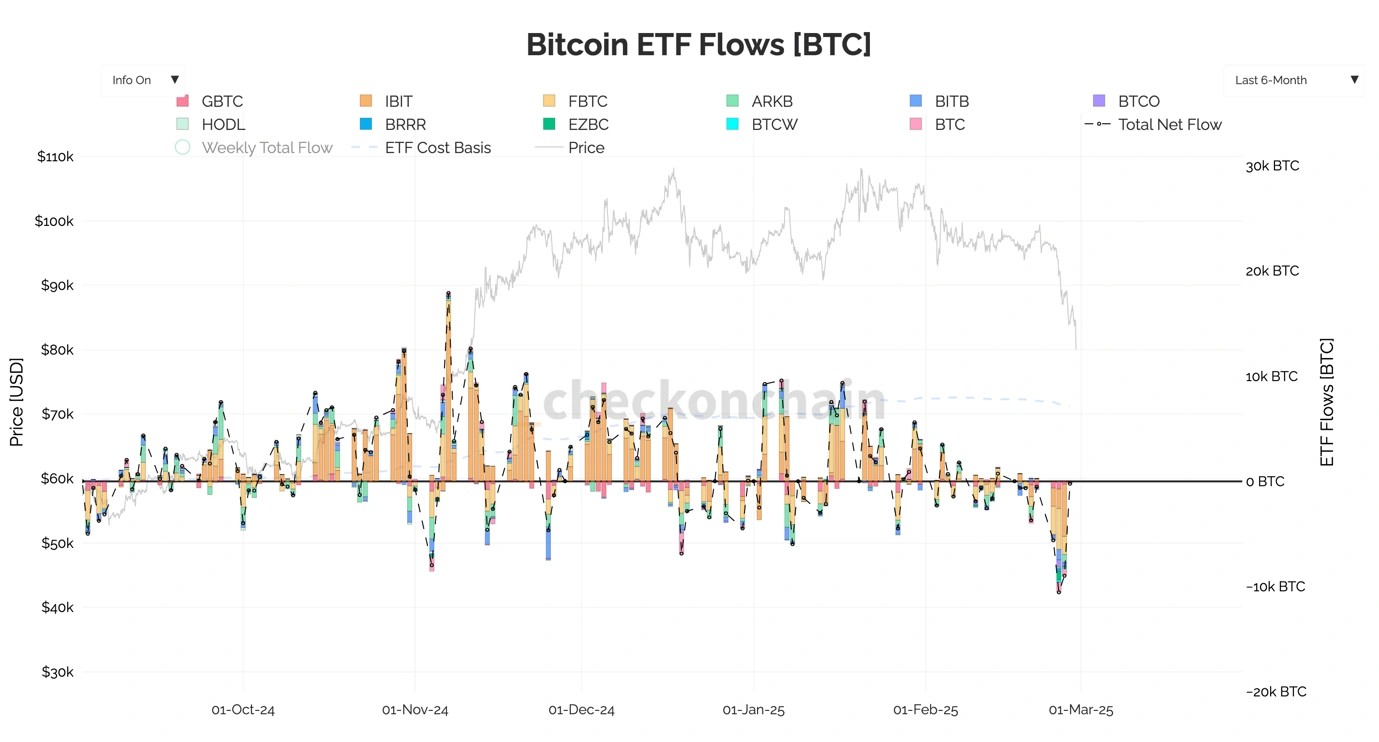

We can also see the risk-off sentiment reflected in the ETF flows. What we, and the market, potentially thought was stickier purchases - less likely to sell and more likely to hold for the long term.

However, we can see that the selling from the ETFs has been the heaviest it's been in the last 6 months. And, notably, it has come from IBIT and FBTC - this was supposed to be the 'stickier' flows.

ETF Flows - larger net outflow:

Cryptonary's take

From the macro perspective, the outlook remains not great. We have huge uncertainty around Trump policies (tariffs), whilst we're seeing a slowing in growth and inflation data points showing stickiness - stagflation.We first saw this concept lightly addressed in some of the FED speak yesterday (Thursday). We expect tariffs/policies, the uncertainty, and therefore, the slowdown that they're causing to still take more time. Therefore, we expect risk assets, and in particular, those at the furthest end of the risk curve (Crypto), to continue to struggle.

In the short term, Bitcoin and other majors are extremely oversold, so it's possible we will see a small relief rally in the coming days. However, over the next few months, we still expect Bitcoin and the majors to move lower and Alts to just slowly bleed down. Get the latest Bitcoin price prediction—dive into our detailed analysis to stay one step ahead!

In terms of buying back in. We don't expect this to be the case in the coming weeks. Even though prices are down substantially, we're also playing against the macro timeline. We'd like to see more of the uncertainty removed, and therefore, the vision going forward will become clearer.

On the other side of the uncertainty is when we'll be looking to bid again. So, we're just not playing against prices, but we're playing against the macro timeline. The less uncertainty and the more clarity we get, the more likely we are to begin risking back on again.