If not, armageddon. But we expect approval, so let's prepare for that.

Sentiment and setup going into the event

Previously, we felt that the market had gotten too ahead of itself, and most of the good news around an approved ETF was already mostly priced in.However, in the last week to 10 days, we've seen a large leverage flush out, so positioning is now better, even though leverage is piling on again following the flush out. Alongside this, many large Twitter influencers weren't calling for it to be a "sell the news event", whereas now a fair few are.

So, the "sell the news" event we originally thought would be is now becoming more of a consensus trade rather than a contrarian opinion. This, now, puts us in more off the "sell the news" view than it keeps us on it.

But we are edging more towards BTC pumping on approval and then holding at a higher range while altcoins do well. Additionally, it was originally touted that the ETF vehicles would take 4-8 weeks to set up and begin taking inflows. Recent filings by applicants show this is not the case, and if approved tomorrow, trading can begin as soon as Thursday this week. This is not the setup we had originally planned for.

The above so far suggests that the next week or two can be really positive for BTC and the rest of the space as buyers of the ETF pile in. How much do they pile in, though?

How much do investors pile in early on?

Upon approval, you may see smaller money in brokerage accounts buy the ETF products, but which issuer? Now, that's a different conversation.However, the feeling is that the big boys will not immediately buy the BTC ETF when it's up 75% since mid-October and up 17% since January 3rd - we are talking about Bitcoin's price here. But, there is likely to be pressure on wealth managers (from their clients) to begin building a position.

This may see some small inflows, but you'd expect the initial positioning to be more majorly bought up if BTC does dip back into the $38k to $43k region.

The smart money doesn't rush; they'd rather miss the opportunity than rush and potentially not have done enough homework.

Plus, all institutional players that could have got in probably already have via other products: Coinbase or Microstrategy shares, BTC options and futures, or BTC itself.

This is something to really consider.

How do we expect this to play out?

It's really difficult to say, but we think because trading can start on Thursday, and you're going to see applicants/issuers wanting their ETF to be the one that gets the volume, you're going to see a load of trading.Whoever gets the volume will be the winner in the long term.

Greyscale looks like it can be the winner because they're turning up to the fight with an absolute tonne of volume because of their already existing GBTC product.

But they will be charging 1.5% for their ETF; other applicants are mostly between 0.2% and 0.4% in fees.

So, it'll be a phenomenally interesting battle over the coming weeks.

How are we positioned?

Honestly, we feel like we don't have too much of an edge for BTC in the coming weeks.Expect a pop on approval and price to then trade in a range - maybe between $44k and $48k for a few weeks.

We are unsure if we see prices north of $50k, even on approval news. We think in 1-2 months, we see a deeper pullback for BTC pre-halving.

Therefore, for now, we continue to hold our Spot bags of BTC and ALTS.

But we will continually assess the dynamics and keep an eye on off-loading some of our altcoin bags - the ones that have run heavily over the past few months.

In terms of the assessment, we will be looking at on-chain metrics to see if the smart money (largest wallets) is doing any selling.

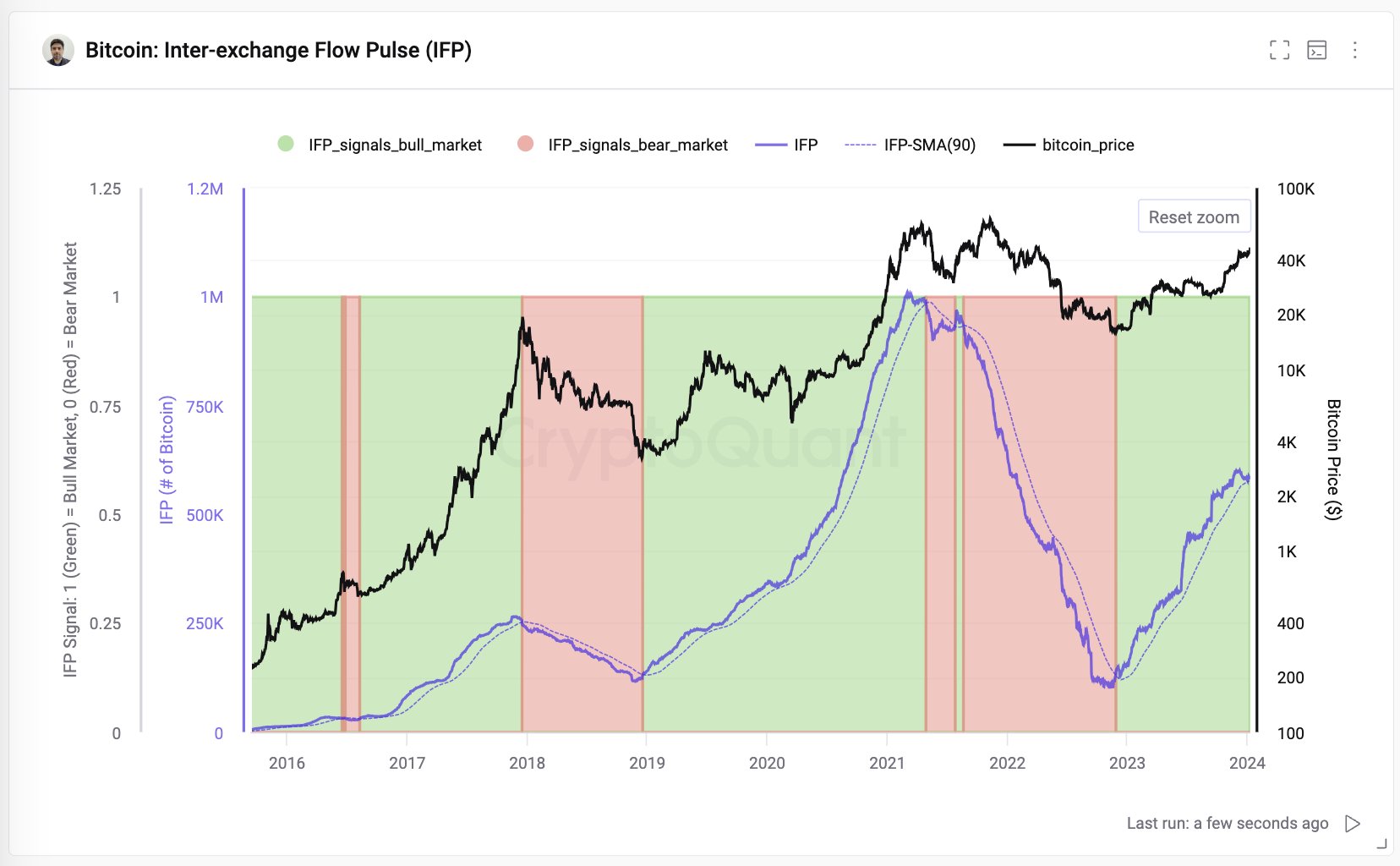

One of the metrics we will be assessing is the below.