While the $57 zone should offer stiff resistance on any bounces, SOL looks vulnerable to further downside without a catalyst like SEC approval for a Bitcoin ETF to boost the broader market.

TLDR

- SOL pulled back around 9% from recent highs, testing support around $47-49

- Its key resistance sits around $57; support levels are at $47-49 and $41-43.

- RSI overbought on multiple timeframes, so a consolidation is on the cards.

- SOL may be stuck in rangebound action between $42-49 until we get a catalyst like BTC ETF approval.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Technical analysis

As we suggested yesterday, SOL was looking relatively top-heavy, and we now find price down approximately 9% from yesterday’s update.The major support area below the current price is between $47 and $49. We expect this level to act as support, with spot buyers potentially coming in at this price point. Beneath that, $41 to $43 is a big area of support. To the upside, the resistance is at $57.

The RSI remains overbought on the daily, 3D and weekly timeframes, with the larger timeframes looking like they need a more meaningful pullback. Because of how strong SOL has been, we’ve seen higher highs in price and on the oscillator, so there aren’t any bearish divergences to be concerned about here.

SOL 12hr

Market mechanics

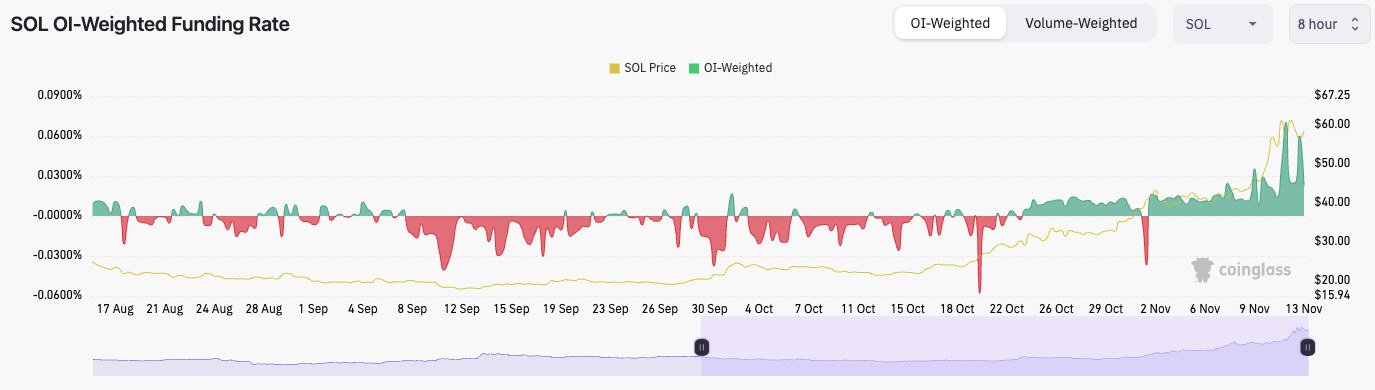

The funding Rate for SOL is back to healthy levels at 0.0114%. It’s come down from very positive levels.

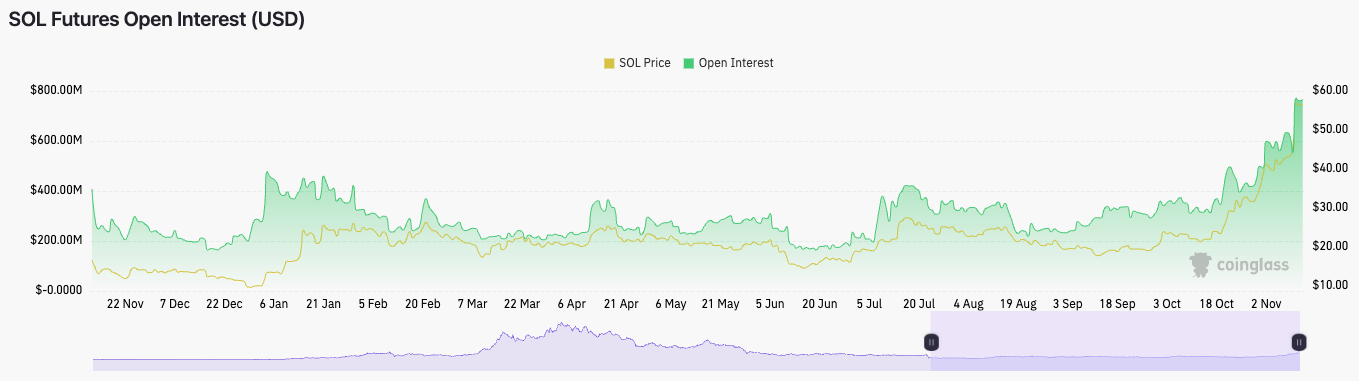

The open interest remains high. So, with funding rates being massively positive and then coming down significantly, and the long/short ratio at 0.9433 over the past 24 hours, this all suggests that shorts have piled in over the last day, while some longs have taken some profits. As price came down yesterday, longs took some profits while shorts piled in. These late shorts may get squeezed here - something to watch out for here.

Cryptonary’s take

If the market (BTC) holds up today, in the short term, we could see a slight squeeze to the upside for SOL to shake out some of yesterday’s late shorts that piled in.However, we feel SOL is still overheated. Unless a Spot BTC ETF is approved this week (what we think is needed to give the market another major leg higher), then SOL is likely due for some more downside or a more consolidatory period. This consolidatory range may come in between $42 and $49.

If we get this price point ($42 to $49), we would be DCA buyers of SOL at those prices with a long-term view.

In the short term, volatility can remain, so be careful on trades, as the volatility can shake you out.