Home

Research

Analysis

Community

Market Direction

Explore the latest Solana (SOL) crypto analysis and predictions

- SOL/BTC ratio, ETH/BTC ratio, and BTC dominance: what investors need to know (August 14, 2024)

- SOL dominance at 3.3%: Is 2024 the year of SOL (August 14, 2024)

- SOL ETH ratio today: Is the 0.058 resistance about to break? (August 14, 2024)

- SOL BTC ratio today: Will 0.0028 resistance trigger a bullish move? (August 14, 2024)

- SOL price prediction today: Will it break $170 resistance soon? (August 13, 2024)

- Crypto technical analysis: Key insights on BTC, SOL, ETH, DOGE, and more (August 12, 2024)

- Solana (SOL) price prediction today: Will it dip to $120 or bounce? (August 12, 2024)

- Crypto price predictions today: BTC, ETH, WIF, POPCAT, SOL analysis (August 12, 2024)

- Solana SOL price Prediction today: Can Solana push beyond $160 this week? (August 12, 2024)

- Solana (SOL) price prediction today: Will $143 support bring a bounce? (August 9, 2024)

- Solana (SOL) price prediction today: Will $162 block a 20% rise? (August 9, 2024)

- Solana (SOL) price prediction today: Will $155 hold after 40% rise? (August 8, 2024)

- Solana Price Prediction Today: Is a Pullback to $162 Likely for SOL? (July 24, 2024)

- Price Prediction Bitcoin, Ethereum, Solana & Meme Coins (July 24, 2024)

Solana (SOL) price predictions

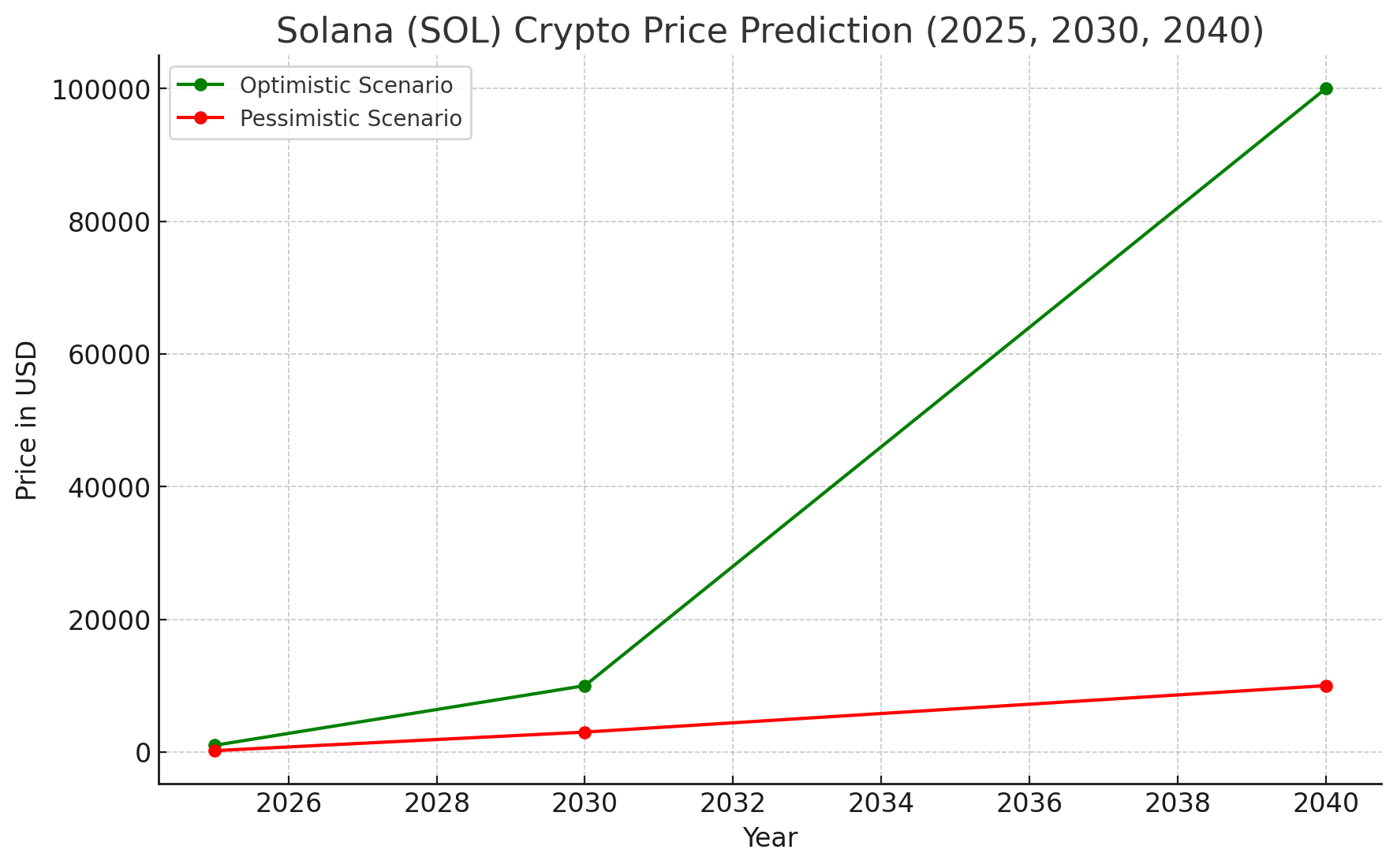

2025 price prediction

Optimistic scenario ($500 - $1,000):

Why? Solana's price could experience substantial growth if the blockchain continues to solidify its position as a top choice for high-performance decentralized applications (dApps) and DeFi platforms. With its incredibly fast transaction speeds and low fees, Solana is well-positioned to capture a significant share of the market, especially if Ethereum faces scalability challenges. Increased institutional adoption, the rise of NFTs on Solana, and the expansion of Web3 could also drive its value higher.Key drivers:

- Solana's ability to scale effectively with increasing demand.

- Growing adoption in DeFi, NFTs, and Web3.

- Institutional interest and partnerships.

- Favorable macroeconomic trends supporting digital assets.

Pessimistic scenario ($50 - $200):

Why? Solana's price could face downward pressure if the blockchain encounters major technical issues, such as network outages or security vulnerabilities, which could erode trust among developers and users. Additionally, if Ethereum successfully implements its upgrades and new competitors emerge, Solana could lose market share. Regulatory challenges and a broader market downturn could also negatively impact its price.Key drivers:

- Technical challenges, such as network reliability issues.

- Increased competition from other blockchains.

- Regulatory pressures affecting Solana's ecosystem.

- Potential shifts in market sentiment away from Solana.

2030 price prediction for Solana (SOL)

Optimistic scenario ($5,000 - $10,000):

Why? By 2030, if Solana has established itself as a critical infrastructure for decentralized applications, gaming, and DeFi, its price could see exponential growth. The blockchain’s ability to handle a high volume of transactions with low latency could make it the go-to platform for developers and enterprises alike. Widespread adoption in new industries, continuous innovation, and strong community support could further propel Solana's value.Key drivers:

- Dominance in high-performance dApps and DeFi sectors.

- Adoption in gaming and metaverse projects.

- Continuous technological advancements and innovations.

- Integration into mainstream financial systems and services.

Pessimistic scenario ($1,000 - $3,000):

Why? Solana's price growth could stagnate if the platform struggles with scaling issues or if new, more advanced blockchains emerge, offering better solutions for developers. Regulatory hurdles, particularly in key markets, and a failure to innovate could also hinder Solana's long-term growth. If market interest shifts towards other technologies, Solana could see a more modest price trajectory.Key drivers:

- Scalability challenges or network limitations.

- Emergence of more advanced blockchain platforms.

- Regulatory uncertainties.

- Decreased interest from developers and users.

2040 price prediction for Solana (SOL)

Optimistic scenario ($50,000 - $100,000):

Why? If Solana continues to evolve and remains a fundamental part of the global digital economy, it could become one of the pillars of the decentralized internet. Its extensive use in various industries, from finance to entertainment, could drive demand for SOL, pushing its price to new heights. By 2040, Solana might be deeply integrated into global finance, decentralized governance, and next-generation internet protocols.Key drivers:

- Global adoption and integration into the digital economy.

- Continuous innovation in decentralized applications and smart contracts.

- Strong market presence and institutional adoption.

- A stable or growing global economy favoring digital assets.

Pessimistic scenario ($5,000 - $10,000):

Why? If Solana is outpaced by newer technologies or fails to adapt to the evolving demands of the market, its price could stabilize at lower levels. The emergence of more efficient and secure blockchain solutions could challenge Solana’s dominance. Additionally, if regulatory environments become more restrictive or if the market moves away from Solana's solutions, its long-term value might be compromised.Key drivers:

- Technological obsolescence or lack of innovation.

- Market shifts towards newer, more efficient blockchains.

- Regulatory challenges impacting adoption.

- Decreased relevance in the evolving digital landscape.

Factors affecting Solana (SOL) price

Historical data analysis

Objective: Understand the past behavior of Solana’s price, including trends, cycles, and patterns.Steps:

- Collect data: Gather historical price data of Solana from its inception to the present, focusing on daily, weekly, and monthly prices.

- Identify trends: Look for long-term trends, including significant price movements correlated with major events like network upgrades or new partnerships.

- Pattern recognition: Identify recurring patterns, such as bull and bear cycles, that may help predict future movements.

Market sentiment analysis

Objective: Gauge how the market feels about Solana, which can influence its price.Steps:

- Social media monitoring: Track discussions on platforms like Twitter, Reddit, and specialized Solana forums.

- News analysis: Monitor news sources for developments related to Solana, including partnerships, technological updates, or regulatory changes.

- Community engagement: Assess the level of community and developer activity, as a vibrant community often correlates with a positive price outlook.

Technical analysis

Objective: Use historical price data to predict future movements based on patterns and technical indicators.Steps:

- Chart analysis: Use various timeframes to analyze Solana’s price movements and identify patterns such as double bottoms or ascending triangles.

- Indicators: Apply technical indicators like Moving Averages (MA), RSI, and MACD to predict potential price movements.

- Support and resistance levels: Identify key levels where Solana has historically found support and resistance, which can guide future predictions.

Fundamental analysis

Objective: Assess Solana’s intrinsic value based on its utility, adoption, and broader market conditions.Steps:

- Use case evaluation: Evaluate Solana's use cases in DeFi, NFTs, gaming, and dApps, which drive demand.

- Adoption rate: Analyze the adoption rate of Solana across various sectors, including institutional interest and developer activity.

- Partnerships and integrations: Investigate strategic partnerships that could enhance Solana's value.

- Regulatory environment: Consider how regulations may affect Solana’s adoption and price.

Economic factors

Objective: Understand how broader economic conditions might influence Solana’s price.Steps:

- Global economic conditions: Consider the impact of global economic trends, such as inflation or recession, on Solana as a digital asset.

- Monetary policy: Analyze how central bank policies might affect the flow of capital into Solana.

- Market correlation: Assess how Solana correlates with other assets like Bitcoin or traditional financial markets.

AI-based forecasting models

Objective: Utilize AI models to predict future prices based on identified patterns and correlations.Steps:

- Data feeding: Input historical price data and relevant economic indicators into the AI model.

- Model training: Train the model to recognize patterns that have historically led to price changes.

- Prediction output: Use the model to predict future prices, providing a range of possibilities with different probabilities.

FAQs

- What is Solana and how does it work?Solana is a high-performance blockchain platform designed for decentralized applications (dApps) and crypto-currencies. It uses a unique consensus mechanism called Proof of History (PoH) combined with Proof of Stake (PoS) to provide incredibly fast transaction speeds and low costs. Solana's architecture is optimized for scalability, making it an attractive platform for developers building DeFi projects, NFTs, and more.

- What factors influence the price of Solana?Several factors can impact the price of Solana:

- Network Upgrades: Significant upgrades can enhance Solana’s performance, driving demand.

- Adoption in DeFi and NFTs: Solana's extensive use in DeFi platforms and NFT marketplaces boosts demand for SOL.

- Market Sentiment: The overall sentiment towards Solana, influenced by news and social media trends, can drive price fluctuations.

- Regulatory Environment: Changes in cryptocurrency regulations, especially those affecting smart contracts and dApps, can impact Solana's market perception and value.

- Where can I buy Solana?Solana (SOL) is available on most major cryptocurrency exchanges. To buy Solana, you typically need to:

- Create an account: Register on a cryptocurrency exchange that supports Solana.

- Verify your identity: Complete the KYC (Know Your Customer) process as required by the exchange.

- Deposit funds: Add funds to your account in fiat currency or other cryptocurrencies.

- Purchase Solana: Use the exchange’s trading platform to buy Solana. After purchasing, consider transferring your SOL to a secure wallet, especially if you plan to hold it long-term.

- Is Solana a good investment?Investing in Solana, like all cryptocurrencies, carries significant risks due to its volatility. Solana has shown strong growth potential, especially with its focus on high-performance applications and scalability. However, it is also subject to market risks, regulatory changes, and competition from other blockchain platforms. Before investing in Solana, it’s essential to conduct thorough research, understand the risks, and consider your financial situation and investment goals. Diversification and a long-term perspective can also help mitigate some of the risks associated with investing in cryptocurrencies.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Get started for free

Create your free account or log in to read the full article.

By signing up, you agree to our Terms & Conditions

Recommended from Cryptonary

PRO

Market Direction

10 min read

Feb 20, 2026

PRO

Market Direction

12 min read

Feb 17, 2026

PRO

Market Direction

10 min read

Feb 13, 2026

PRO

Market Direction

10 min read

Mar 3, 2026

PRO

Market Direction

12 min read

Feb 27, 2026

PRO

Market Direction

11 min read

Feb 24, 2026

PRO

Market Direction

10 min read

Feb 20, 2026

PRO

Market Direction

12 min read

Feb 17, 2026

PRO

Market Direction

10 min read

Feb 13, 2026

PRO

Market Direction

10 min read

Mar 3, 2026

PRO

Market Direction

12 min read

Feb 27, 2026

PRO

Market Direction

11 min read

Feb 24, 2026

PRO

Market Direction

10 min read

Feb 20, 2026

PRO

Market Direction

12 min read

Feb 17, 2026

PRO

Market Direction

10 min read

Feb 13, 2026