Explore the latest THORChain (RUNE) crypto analysis and predictions

- Thorchain (RUNE) price prediction today: Is $3.20 the buy zone? (August 12, 2024)

- Thorchain (RUNE) price prediction today: Is a rebound coming? (August 12, 2024)

- THORChain (Rune) Coin Price Today - Chart, Prediction & Analysis (July 25, 2024)

- Price prediction: TREMP, USA, RUNE and JUP (July 25, 2024)

THORChain (RUNE) price predictions

2025 price prediction

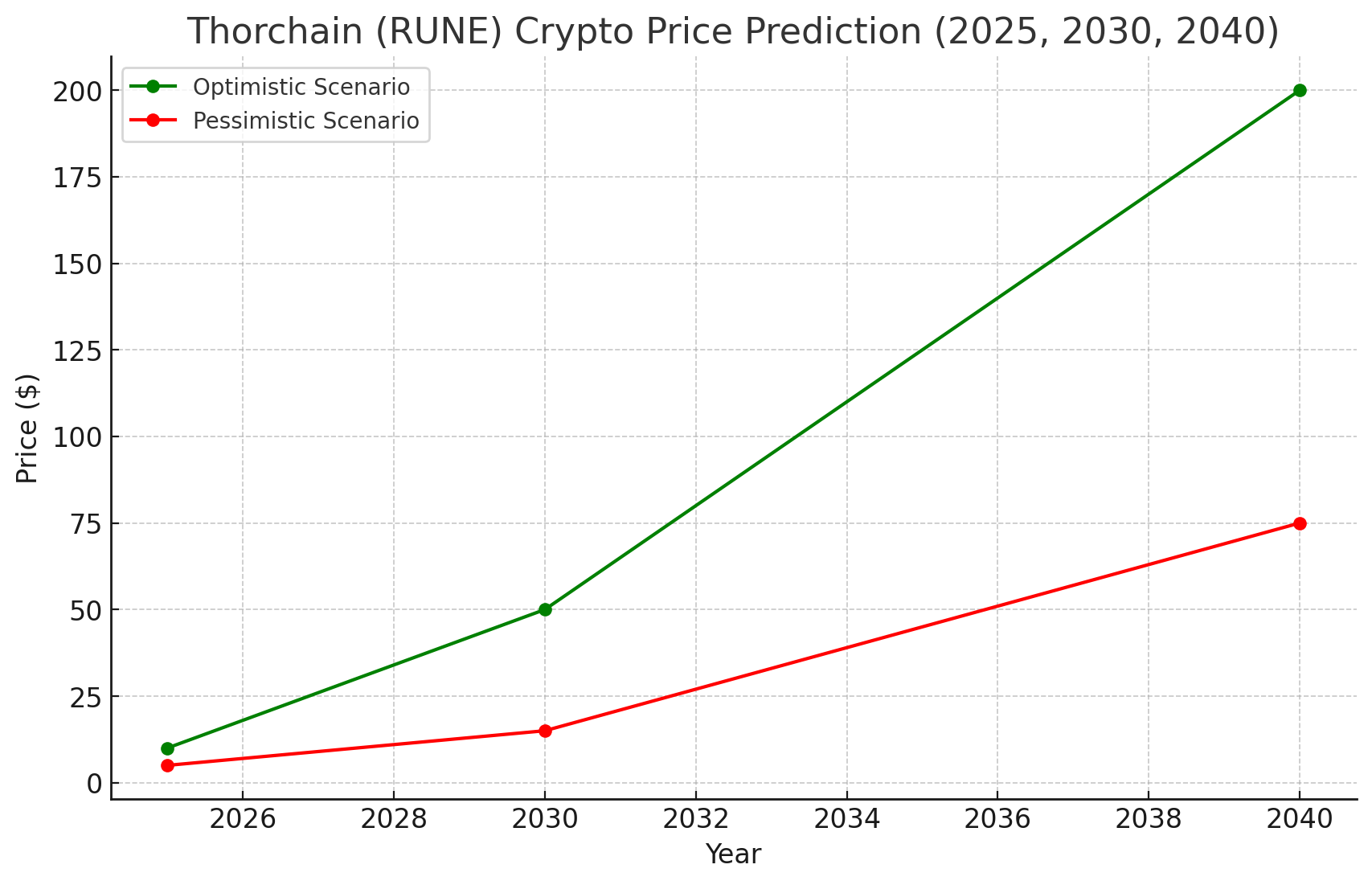

Optimistic scenario ($10 - $20):In an optimistic scenario, Thorchain (RUNE) could reach a price range between $10 and $20 by 2025. This growth would be fueled by RUNE's strong positioning within the decentralized finance (DeFi) sector and its ability to facilitate seamless cross-chain liquidity. If Thorchain continues to innovate, enhance its technology, and form strategic partnerships, it could see significant adoption, driving up its value from the current price of $3.84 per RUNE.

Key drivers:

- Successful technology upgrades

- Increased adoption in DeFi

- Strategic partnerships

- A growing user base

In a less favorable scenario, Thorchain (RUNE) might only see modest growth, reaching between $5 and $7 by 2025. Factors such as increased competition, technological challenges, or regulatory issues could hinder its growth, resulting in limited price appreciation.

Key drivers:

- Development delays

- Increased competition

- Regulatory challenges

- Limited market adoption

2030 price prediction

Optimistic scenario ($25 - $50):By 2030, if Thorchain (RUNE) continues to solidify its role as a leading cross-chain DeFi platform, its price could reach between $25 and $50. This would be driven by widespread adoption, continuous innovation, and integration into broader financial systems. Thorchain's ability to maintain a strong market presence and adapt to emerging trends could result in substantial growth over the decade.

Key drivers:

- Widespread adoption

- Continuous innovation

- Strong market presence

- Integration into mainstream finance

In a pessimistic outlook, Thorchain (RUNE) may see its price stabilize between $10 and $15 by 2030 if it faces challenges in scaling or is outpaced by newer blockchain solutions. Regulatory pressures, market saturation, or difficulties in maintaining relevance could slow its growth.

Key drivers:

- Scalability challenges

- Increased competition

- Regulatory pressures

- Market saturation

2040 price prediction

Optimistic Scenario ($100 - $200):Looking towards 2040, Thorchain (RUNE) could potentially reach a valuation of $100 to $200 if it continues to evolve and remains a significant player in the global digital economy. The integration of RUNE into various industries, coupled with ongoing technological advancements, could lead to widespread adoption and substantial price appreciation.

Key drivers:

- Global financial integration

- Continuous technological advancements

- Strong market presence

- A stable global economy

Alternatively, if Thorchain (RUNE) faces technological obsolescence or fails to keep up with more advanced blockchain solutions, its price might settle between $50 and $75 by 2040. Challenges in maintaining relevance and dealing with competition could limit its long-term growth.

Key drivers:

- Technological obsolescence

- Market irrelevance

- Regulatory challenges

- Competition from advanced platforms

Factors affecting Thorchain (RUNE) price

Historical data analysis: Analyzing RUNE's historical price data is essential for identifying trends, cycles, and patterns that can provide insight into its future behavior.Market sentiment analysis: Understanding market sentiment towards RUNE can be crucial in predicting its price. Monitoring social media discussions, news, and community engagement will help gauge the general mood and expectations surrounding Thorchain.

Technical analysis: By examining historical price charts and using technical indicators like Moving Averages (MA) and Relative Strength Index (RSI), predictions about RUNE's future price movements can be made, identifying key support and resistance levels.

Fundamental analysis: Assessing the intrinsic value of Thorchain involves looking at its use cases, adoption rate, partnerships, and the overall market conditions. Evaluating these factors will help determine RUNE’s long-term potential.

Economic factors: Broader economic conditions, such as global monetary policy and market trends, could also influence RUNE's price. Understanding these factors will provide a more comprehensive view of what may drive RUNE's value in the future.

AI-Based forecasting models: Leveraging AI models to analyze historical data and predict future prices can offer a range of possibilities, with different probabilities based on identified patterns and correlations.

FAQs

1. What is Thorchain (RUNE) and how does it work?Thorchain (RUNE) is a decentralized liquidity network that enables cross-chain asset swaps without the need for centralized exchanges. It operates on its own blockchain and is used for transactions, staking, and governance within the Thorchain ecosystem. RUNE plays a crucial role in securing the network and providing liquidity across different blockchains.

2. What factors influence the price of Thorchain (RUNE)?

Several factors can impact the price of RUNE:

- Technology Upgrades: Successful implementation of new technology or platform upgrades can positively influence its price.

- Adoption Rate: Increased adoption in areas like DeFi can drive demand for RUNE, boosting its value.

- Market Sentiment: General perceptions and discussions within the crypto community can lead to price fluctuations.

- Competition: Strong competition from other blockchain platforms can limit RUNE's growth potential.

- 2025: In an optimistic scenario, RUNE could reach between $10 and $20, while in a pessimistic scenario, it might only rise to between $5 and $7.

- 2030: RUNE could potentially be valued between $25 and $50 in an optimistic case, or between $10 and $15 if it faces challenges.

- 2040: If RUNE continues to innovate and remain relevant, it could reach $100 to $200. If it faces significant competition or technological challenges, it might stabilize between $50 and $75.

Investing in Thorchain (RUNE) carries risks due to the inherent volatility of cryptocurrencies. However, if Thorchain can achieve widespread adoption, successfully implement its technology, and maintain a competitive edge, it could offer significant growth potential. It's essential to conduct thorough research, consider your financial goals, and understand the risks before investing in RUNE or any cryptocurrency.