As we stand on the cusp of a potential breakout, the stars seem to be aligning for a significant upward move.

Will the 'barbell strategy' continue to outperform? Is the crypto market poised for a significant surge?

The stage is set for a thrilling ride as we navigate through a week of crucial economic data releases, including GDP growth and the Fed's preferred inflation metric.

The game is afoot, and you won't want to miss a single play!

Key questions

- What's the real story behind this week's economic data releases, and how might they impact the Fed's next move?

- Is the launch of the ETH ETF being underestimated by the market? Discover our surprising prediction.

- How are political shakeups influencing crypto prices, and what does it mean for the future?

- What unexpected trend are we seeing in the "barbell strategy," and why might it change your investment approach?

- Which key indicators are flashing bullish signals for Bitcoin, and what do they reveal about the market's next big move?

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. "One Glance" by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. These are not signals, and they are not financial advice.

This week's data

This week is another quieter week before we have the mega week for data next week.Next week, we have JOLT's Job Openings on Tuesday, the Fed Meeting (Powell to speak at the Press Conference) on Wednesday, and then the big Jobs data (Non-Farm Payrolls and the Unemployment Rate) on Friday.

But, back to this week. This Thursday, we have the GDP Growth Rate, which is expected to be slightly higher than last quarter's 1.4%. The consensus for this quarter is 1.9%. The highlight of this upcoming week (data-wise) is on Friday when we have PCE data—this is the Fed's preferred inflation data point.

The expectation is that the Core PCE and PCE data points will show a continuation of the disinflationary trend we've seen for the last few months. Markets will want to see that the GDP Growth Rate remains positive and that the disinflationary trend continues, as this will aid the narrative for the Fed being able to cut Interest Rates in September.

So we're essentially looking for prints to come in line with consensus.

Politics and the ETH ETF launching this week

We'll keep this section in more brief detail.On the political front, we've just seen Biden drop out of the race (which isn't much of a surprise to anyone), opening the door for Harris to step in. On the news of Biden dropping out, we saw that crypto sold off. This is likely because the market was pricing for a Trump win against Biden (which would be positive for crypto).

However, when Biden dropped out, it was less known who would become the new Democratic nominee. Is Trump's odds of winning still as good? Possibly not.

However, with Harris now looking like the most likely to replace Biden, it doesn't seem she is competent enough to give Trump a real run for his money. Therefore, the market priced back in a Trump win, and crypto re-rallied again.

This is interesting, and we will need to pay close attention to the politics as crypto is clearly volatile to a Trump win or less (or on the changing odds of a Trump win).

Going forward, it's important to be wary of these dynamics and why the market is pricing like it is. The ETH ETF is launching tomorrow (Tuesday 23rd July). Currently, the narrative around this isn't very strong. However, this is just a feeling rather than being data-backed because there isn't much data to go off currently, but the market is probably under-pricing ETH here.

We believe that the ETH ETF may see stronger inflows than the market currently anticipates. Outsized positive inflows could really ignite a memes/alts rally.

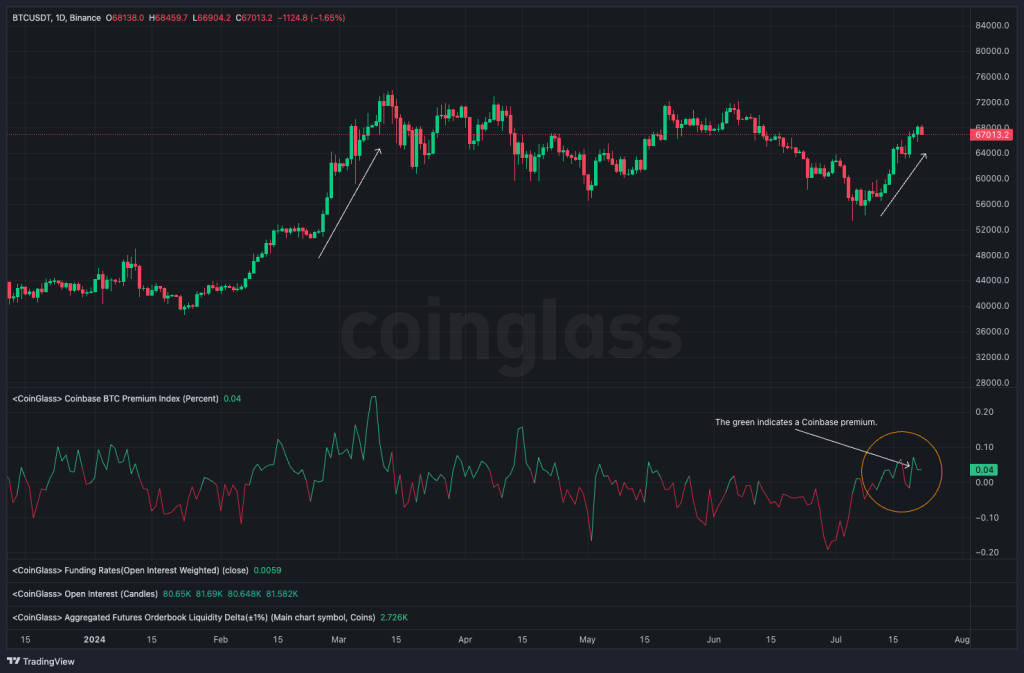

Market conditions on this Bitcoin rally

Towards the end of last week, we began to see the Coinbase premium return. This is where the quoted price of Bitcoin is higher on Coinbase than on other spot exchanges (Binance, etc.). i.e., US traders are strongly bidding on Bitcoin.This is historically positive for price. In the chart below, we can see this effect. When the Coinbase premium is positive, Bitcoin's price tends to move up, and it moves up more organically.

Coinbase premium on BTC chart:

Alongside the above, over the last week, we have seen very positive moves from Industry players such as Microstrategy, Coinbase and Marathon Digitial.

These are all stocks that TradFi participants (who perhaps don't have access to Bitcoin or the Bitcoin ETF) can buy to get exposure to crypto. These charts show breakouts to the upside, and what we can take from this is that TradFi participants have begun risking on.

Microstrategy chart

Coinbase 3D chart

It's looking super clean for a bullish breakout here.

Marathon digital:

This is the least convincing chart of the three, but the price has still broken out from a key level.

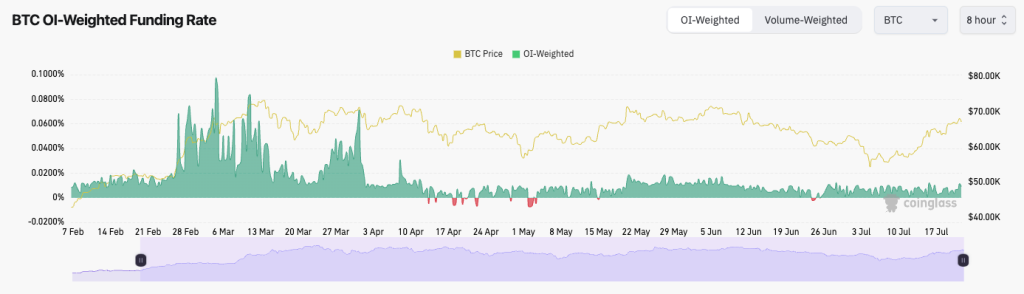

Lastly, looking at the price rally of the last week, we can see that Open Interest (leverage) did increase, but Funding Rates stayed relatively low and even briefly went negative over the weekend.

This indicates that there were a lot of participants opening Shorts on the Majors (BTC, ETH and SOL) and, with a good level of Spot buying (particularly with it coming from Coinbase), helped to drive price up, liquidate Shorts, essentially helping the grind up continue.

BTC OI-weighted funding rate:

There was significant hype around the March price highs, which we can see from the very elevated Funding Rates. However, funding is now very muted, showing that this current rally is much healthier and, therefore, likely more sustainable.

Big caps index 1W chart:

This is a super clean breakout of the downtrend line on a major timeframe chart. Overall, this is a bullish formation, and even if we see a slight retest/pullback lower in the short term, this is a bullish structure, so we expect significantly higher prices in the medium term. A break out above $100 is now the main targeted level to break out above.

Whilst we're now also looking for more opportunities to diversify slightly, as we'd expect in a risk-on environment, other riskier plays to perform well, we note the continued strong/outperformance of the barbell strategy.

This is mostly backed by the memes WIF and POPCAT. If anything, now, I (Tom) am potentially thinking that a better strategy than pure diversification may be to trade some SOL for the hot meme of the week to profit more SOL and then rotate these SOL profits into WIF or POPCAT on down days or just keep the SOL.

But a movement out into altcoins might not be optimal, which is very surprising. It seems to us that the risking-on is in memes rather than altcoins. This would mean we remain quite tight rather than diversified. It may be the case that, for this cycle, the barbell strategy works better. We'll keep paying close attention to this and delay a decision on this for now.

Cryptonary's take

Even though prices were heading into resistance last week, we were right to call in our market direction that this could be when prices break out above the horizontal levels and out of the downtrend lines. We can see this on the Big Caps Index, which we were watching last week intently, and we can now see that it's had a clean breakout to the upside.Now, it's possible that in the short term, we could see a very slight pullback here. But with what could be very positive events this week with the ETH ETF and then the Bitcoin Conference (Trump is expected to be speaking, and possibly even an Elon appearance), and then likely a dovish Fed Meeting next week, you want to be allocated here.