Market Direction

RUNE update

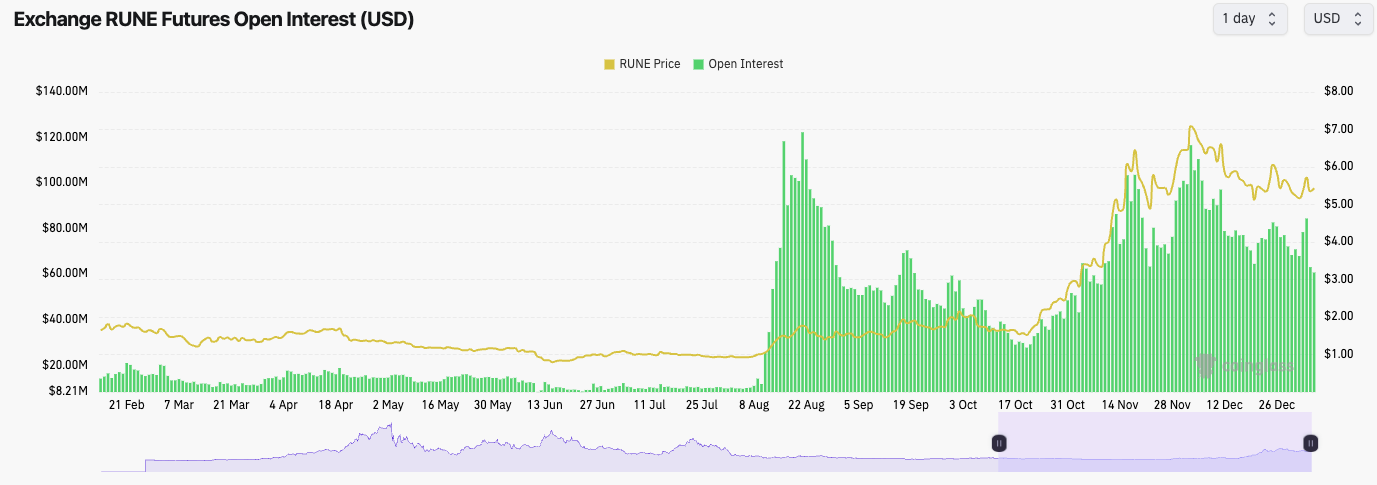

Back to the 12-hour timeframe chart.- Open Interest has decreased substantially while Funding has reset, meaning excess leverage has been flushed out/liquidated. This is positive.

- The green box on the chart was finally filled, which is nice if you had buy orders layered in the box.

- RUNE has also now reclaimed the local horizontal support of $5.30, having rejected from the horizontal resistance of $5.80.

- The aim for price now is to get above $5.80 and head to the main resistance of $6.53. Beyond that, RUNE will likely see more substantial upside.

Cryptonary's take

It's possible a positive ETF decision could take RUNE back into $6.53. However, it would be asking too much to expect price to break out of $6.53 in the near term.You may not like this, but we are still targeting $3.70 to $4.06.

MINA update

- MINA has filled the Yellow buy box we called for buy orders in our last update. This is the perfect entry.

- Price has now bounced and, importantly, reclaimed the horizontal level of $1.28. Its pivotal price stays above this level.

- Ideally, we'd like to see price reclaim the uptrend line also.

- The RSI has reset on the 12hr and the 1D, but the 3D and the Weekly remain overbought.

Cryptonary's take

If you filled orders in the Yellow box, well done. If not, we will wait to see if MINA pulls back and retests the Yellow box in the coming weeks to get new entries.If you're in a position, we would continue to ride this and essentially hope to reclaim the uptrend and then move higher to $1.73.

Let's see what we get.

MINA is in a middle ground here, so we wouldn't chase this now. We recommend waiting for the opportunity to become attractive again if you're not in already.

SNX update

- After losing the local uptrend line, the battle was on to hold the horizontal support of $3.67 and the next uptrend line.

- Price broke beneath this key convergence level and filled the Yellow box in yesterday's carnage. Perfect buy zone.

- Price has now bounced and is retesting the local uptrend line and the underside of the horizontal support of $3.67 as new resistance.

- For bullish price action to return, we need to see price reclaim $3.67.

Cryptonary's take

Until $3.67 can be reclaimed and flipped back into support again (rather than resistance), SNX may remain bearish. If we weren’t already positioned, we would again look for entries in the Yellow box.SHDW update

- We mentioned last time that if SHDW can hold $1.05, then a breakout of the downtrend is likely with a target of $1.60. We got this, and price went to $1.72 - perfect.

- SHDW is difficult to chart. We'd look for a re-accumulation of entries between $1.05 and $1.29 and just continually DCA into this price point.

Cryptonary's take

SHDW moved as we predicted, so overall, it was a really nice move.This is a long-term project that we like. We'd look to continually accumulate DCA into the $1.05 to $1.29 level.