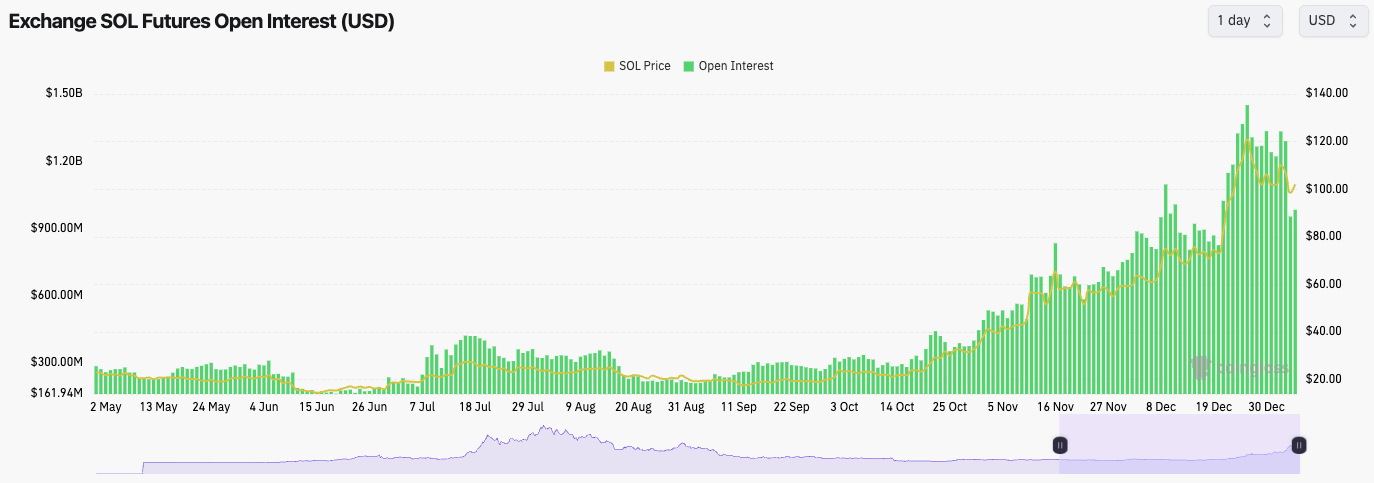

SOL's mechanics have reset in a more material way here. It's not just the Funding Rate that has come down substantially (now back to healthy levels of 0.01%), but the Open Interest has come down from $1.33b to $983m - a 30% clear out.

This is much more positive and really needed. This flushing out may give SOL the room to move higher in a healthy manner.

Technical analysis

- The purple box is to outline a key liquidity range between $97 and $102. $97 is local support, and $102 is local resistance.

- There is another local support at $93, but beneath that, the next support is the major level of $77 to $81.

- To the upside, $107 is a local resistance, with $117 being the current main resistance.

- The RSI on the 12hr and the 1D are clean. However, the 3D is still overbought but close to 70. But, the Weekly is still very overbought. We still think SOL will pull back more significantly in the coming months.

Cryptonary's take

Straight away, our initial feelings are that SOL can move up in the pre-ETF decision and immediately after the decision (assuming the BTC ETF is approved).But, beyond that, we think you'll see a strong consolidation period and even a more meaningful pullback potentially into the mid $80's again. To be more accurate on this, we'd want to see how price does on the ETF decision.

If the price gets to $117, and then that seems it, we would be inclined to sell some of our SOL to re-buy much lower. But that sale would likely be on the euphoria of the ETF pump (again, assuming it gets approved).

Let's re-assess SOL around the ETF decision.

In short, even though we think SOL could go higher (to say $117), we remain cautious for now. We are still positioned but not looking to add to our position currently.