Disclaimer: Not financial nor investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Macro

Last Friday’s Jobs data came in as a ‘Goldilocks’ set of numbers (a Goldilocks set of numbers is a set of numbers that are not too hot or too cold, they’re just right). Non-Farm Payrolls came in at 315k which was slightly over the Consensus whilst the Unemployment Rate came in at 3.7% which was higher than the Consensus of 3.5% - this was likely due to the Participation Rate increasing. With these kinds of numbers, it suggests that the FED may still have more to do but that the demand destruction effect that the FED is hoping to get (from the increasing interest rates) to help bring down inflation, starting to seep into the economy.Without debt, the FED still has more to do in terms of raising rates to a level that’ll bring down inflation. It is anticipated that by Christmas, the FED will have rates as high as 3.5%. The big question is now, will the FED raise interest rates on September 21st by 50 or 75 basis points? If next week’s Inflation print (13th September) comes in considerably less than expected, this may encourage the FED to only do a 50-basis points rate rise.

TLDR

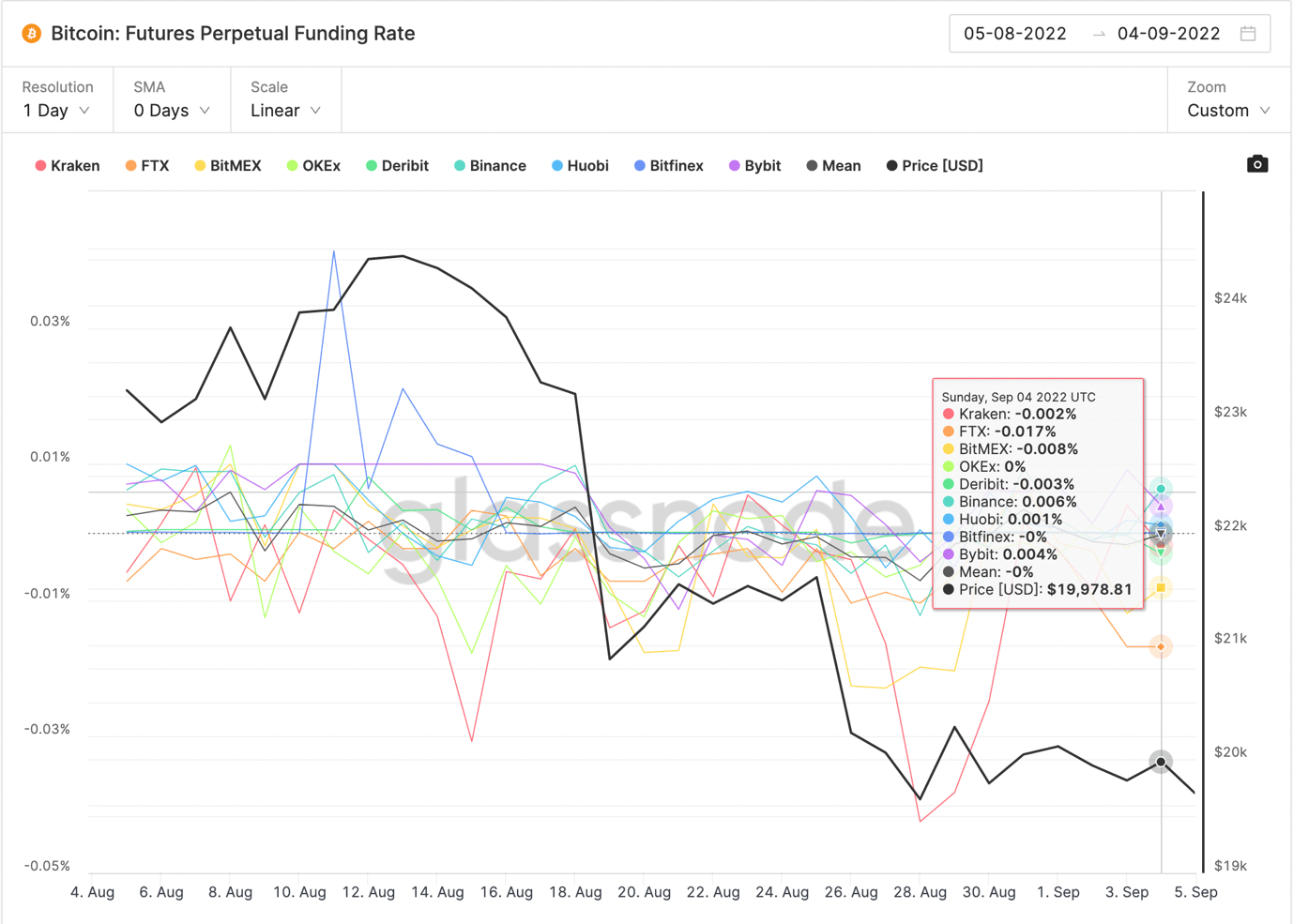

- The Futures Perpetual Funding Rate suggests that the historically more profitable traders are Net Short rather than Net Long.

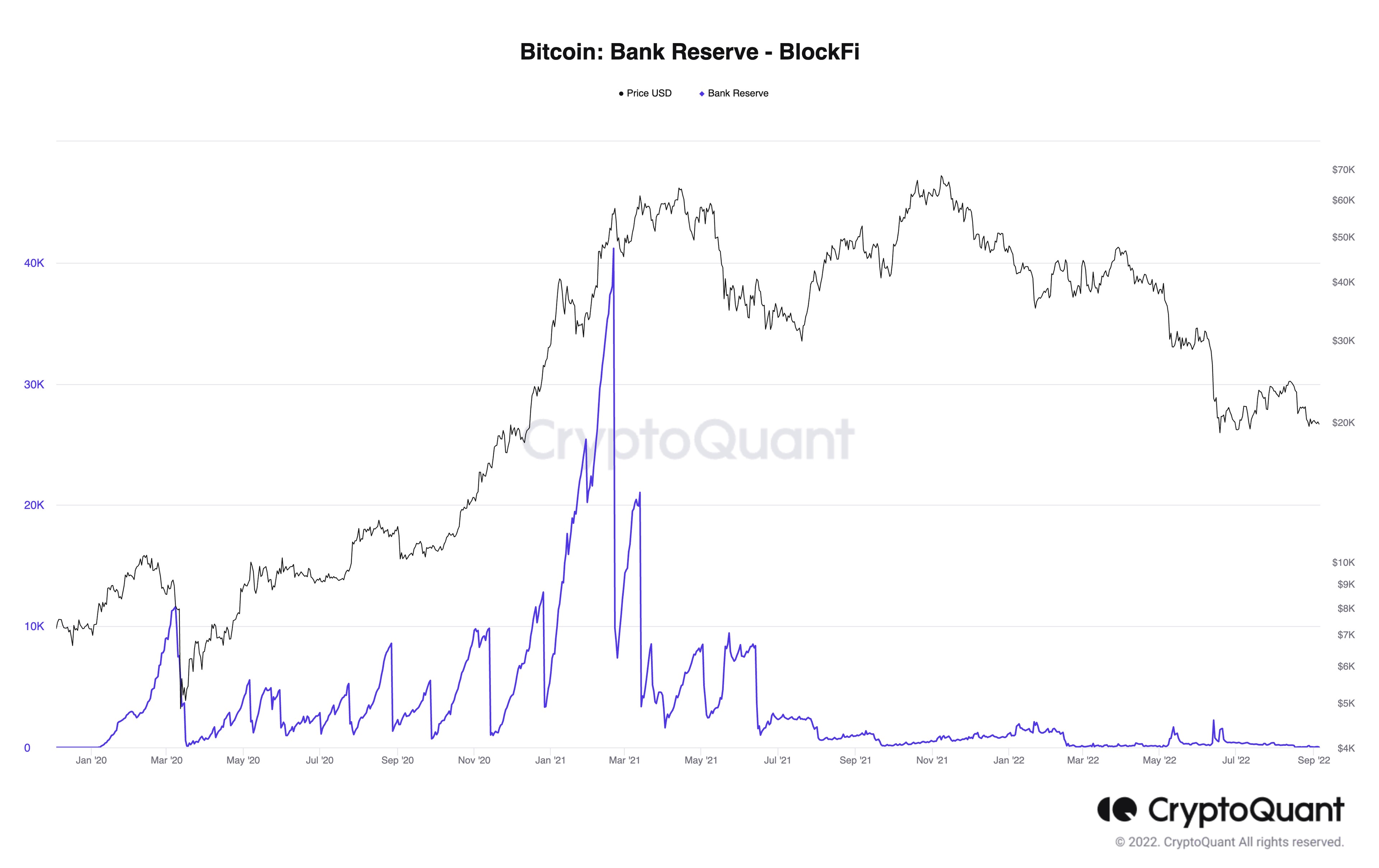

- The Bitcoin Bank Reserve shows that exposure from the digital asset bank is down, and risk sentiment has not yet improved.

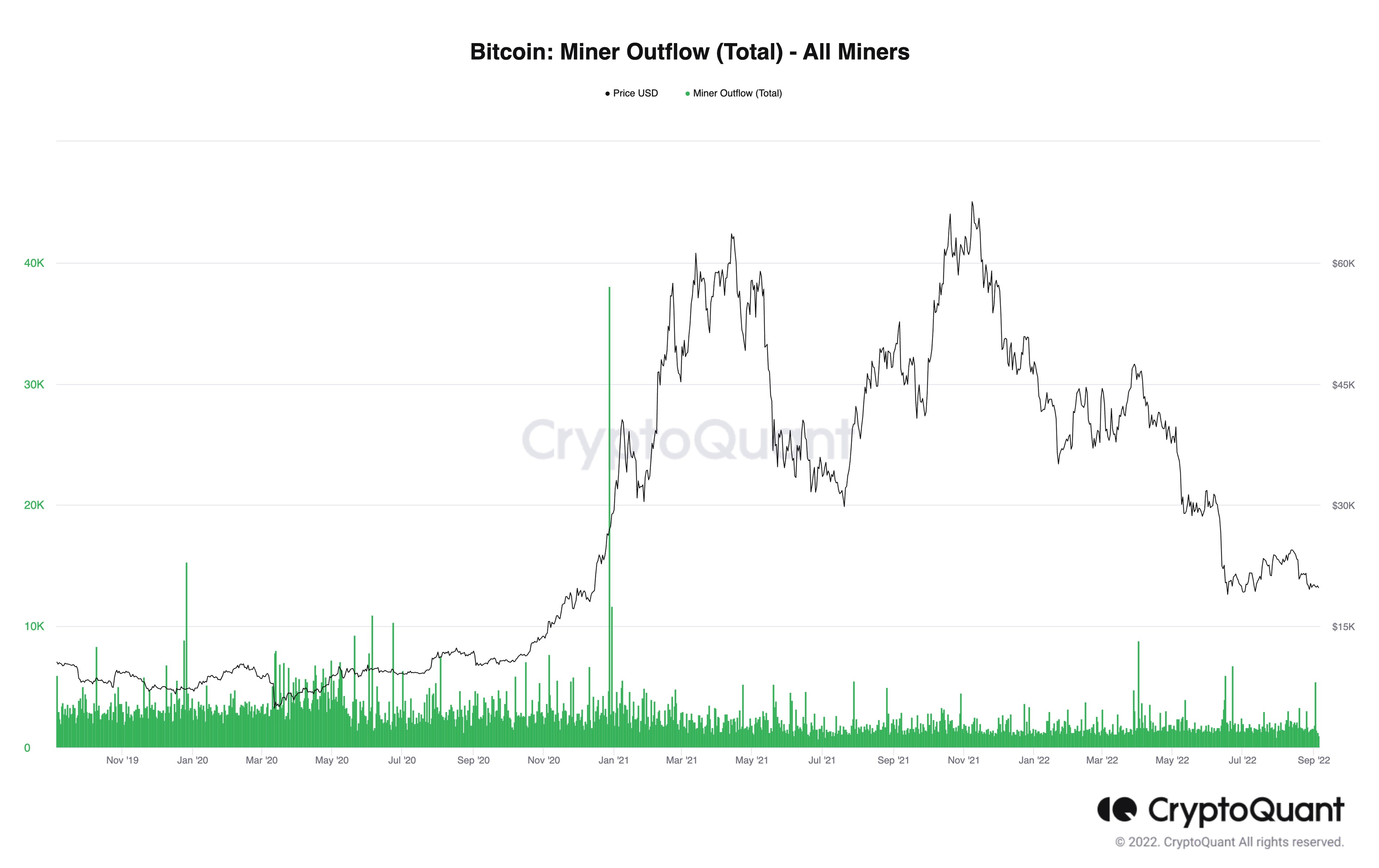

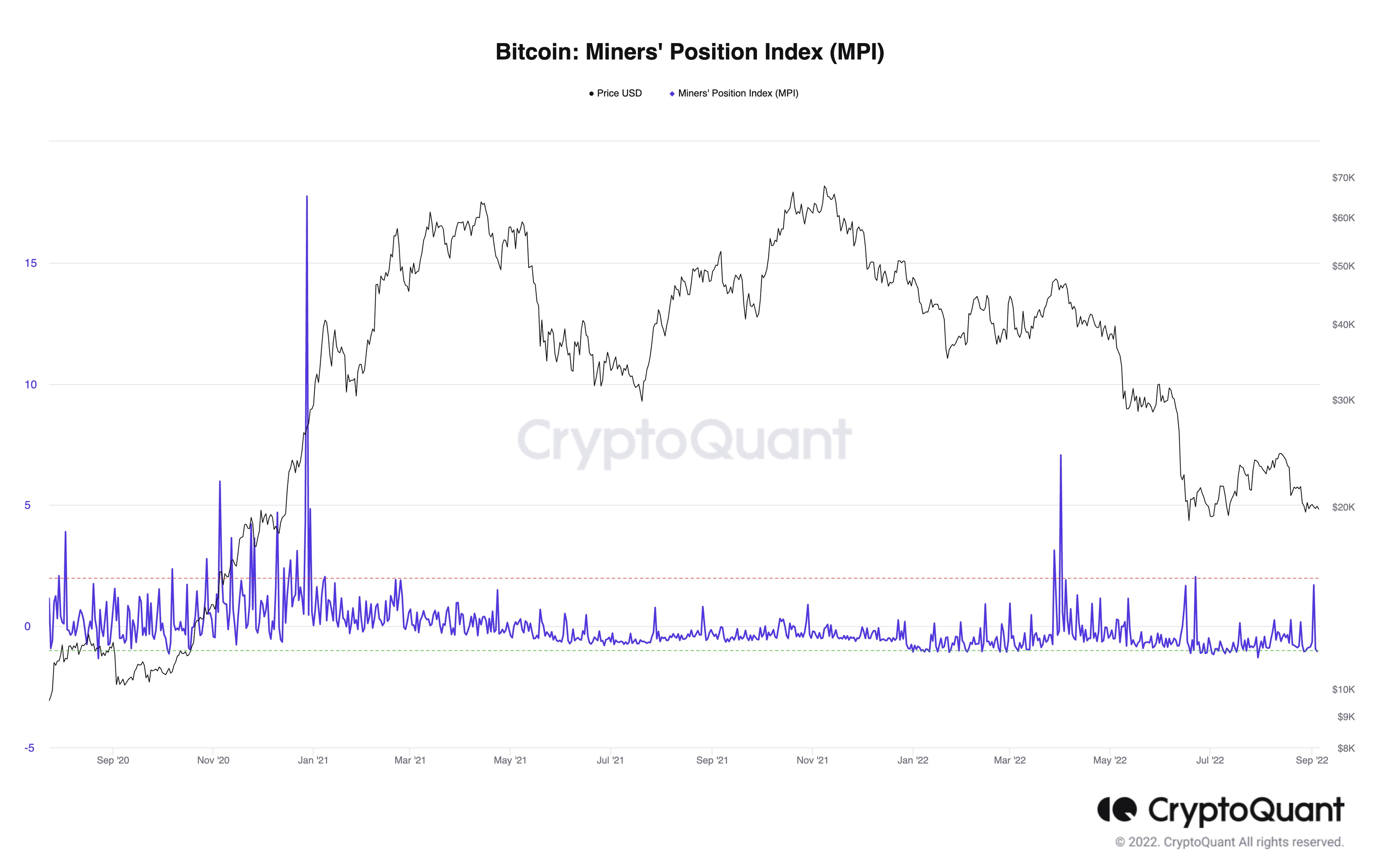

- In the past few weeks, miners have been offloading Bitcoin reserves at a greater amount than in prior weeks.

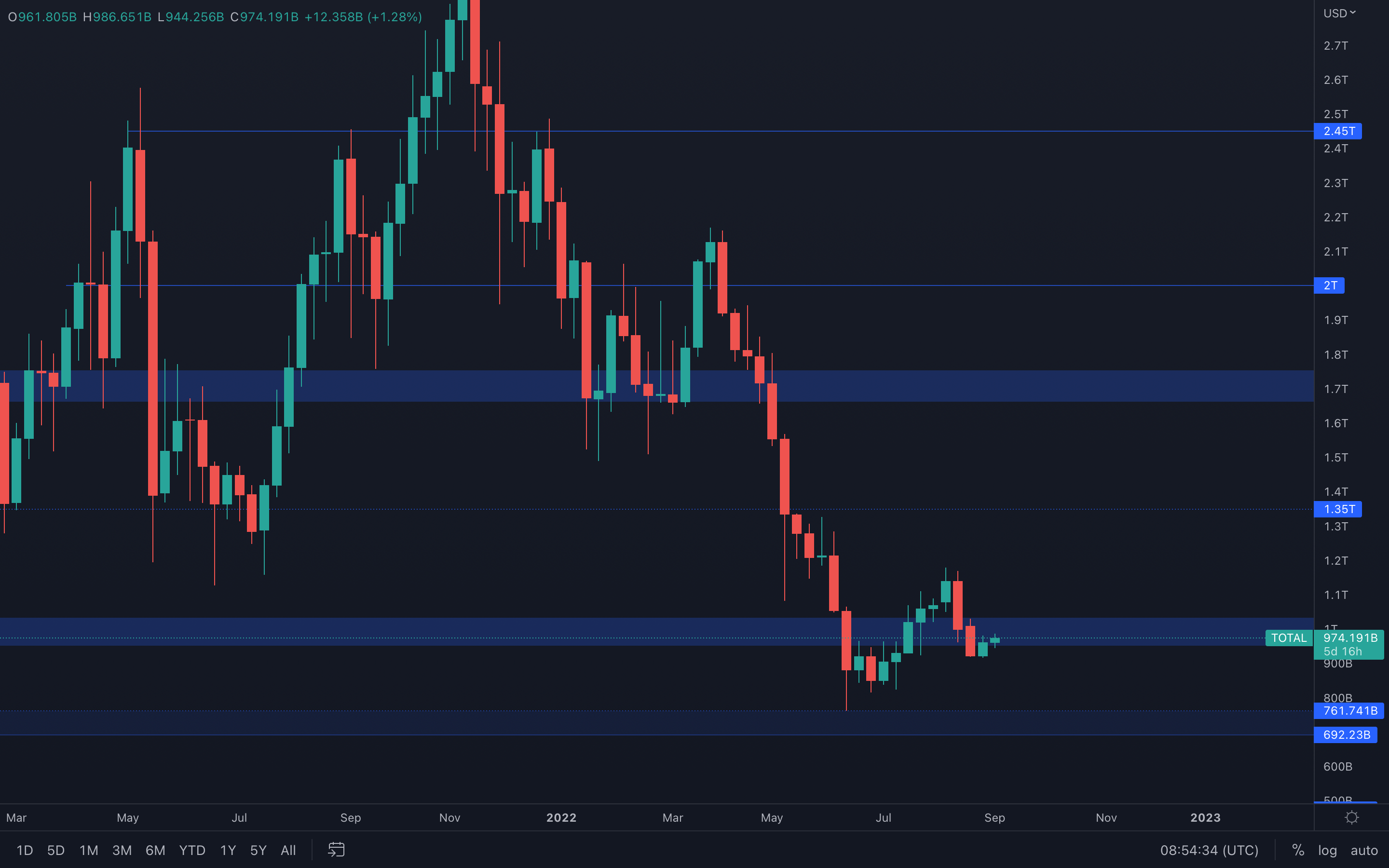

Total Market Cap

With the index still under its psychological and technical level of $1T, the risks remain the same - failure in reclaiming $1T can lead to further downside towards $760B, as the bearish market structure remains intact. For this scenario to be invalidated entirely, a higher high needs to form on the weekly timeframe. This requires a weekly candle closure above $1.20T, a ~23% increase from the index's current evaluation.

With the index still under its psychological and technical level of $1T, the risks remain the same - failure in reclaiming $1T can lead to further downside towards $760B, as the bearish market structure remains intact. For this scenario to be invalidated entirely, a higher high needs to form on the weekly timeframe. This requires a weekly candle closure above $1.20T, a ~23% increase from the index's current evaluation.

The main interest on this chart remains reclaiming $1T, so that is what we will be monitoring from now on.

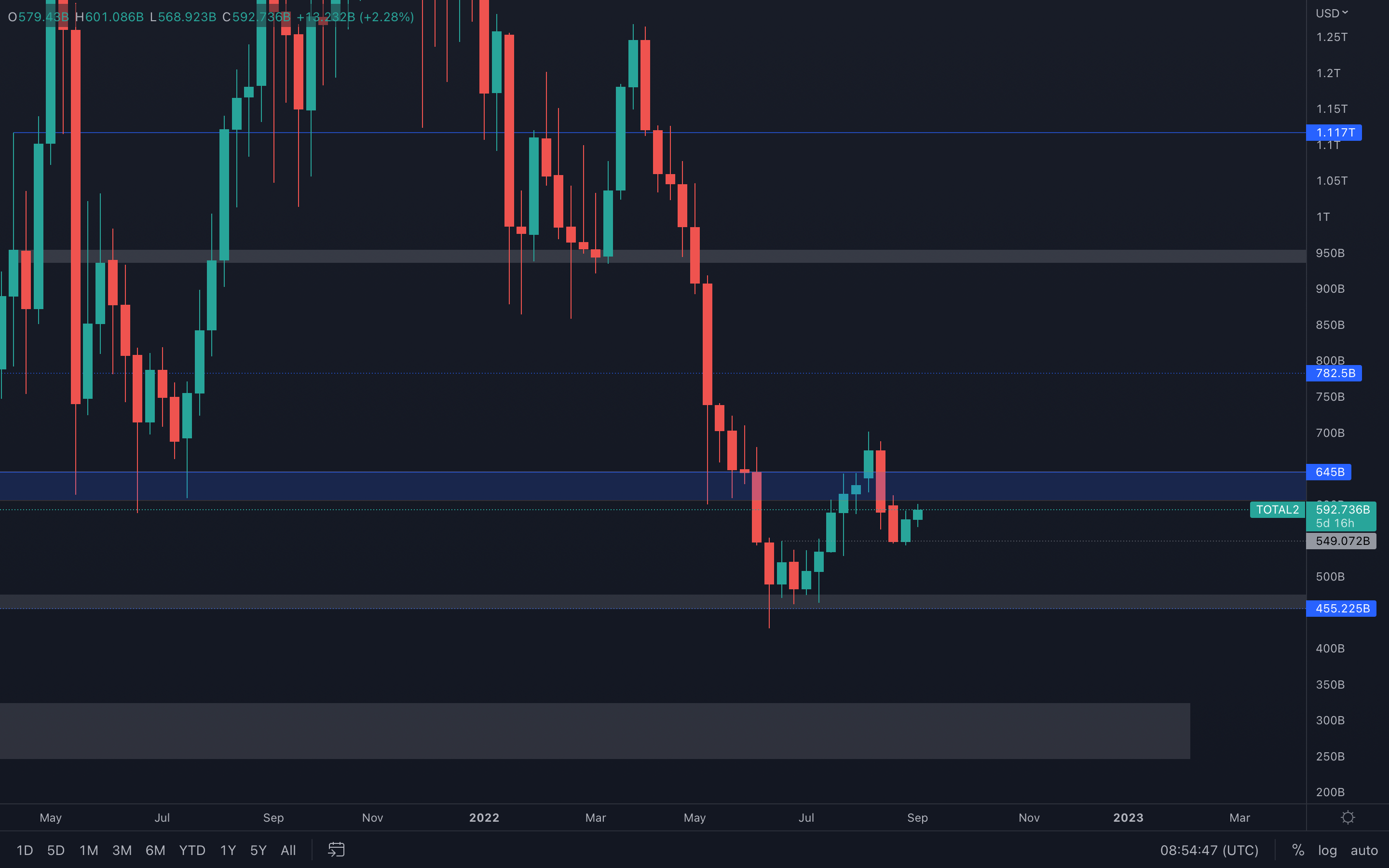

Altcoins Market Cap

After perfectly retesting the intermediate support of $550B, the Altcoins Market Cap Index has risen just under its $600B - $645B resistance area. Although a $645B test is possible, the index can as easily get rejected from its current level as it acts as the bottom of the $600B - $645B resistance area. A failure of reclaming $645B can lead towards lower prices.

After perfectly retesting the intermediate support of $550B, the Altcoins Market Cap Index has risen just under its $600B - $645B resistance area. Although a $645B test is possible, the index can as easily get rejected from its current level as it acts as the bottom of the $600B - $645B resistance area. A failure of reclaming $645B can lead towards lower prices.

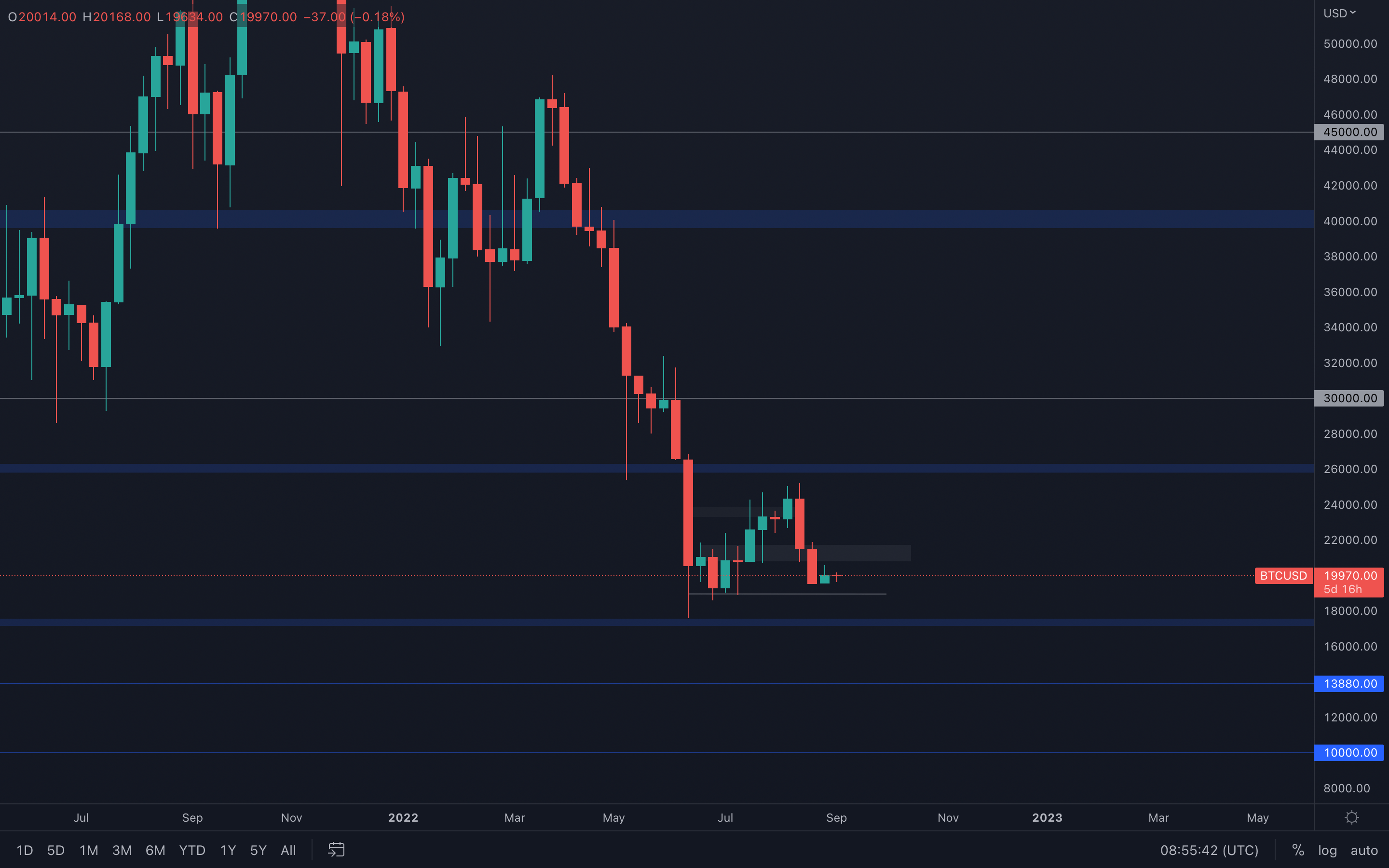

Bitcoin - Technical & On-Chain Analysis

With $19,000 still not retested, Bitcoin has found itself in an indecisive situation that requires additional data for confirmation. The price of the asset is neither at support nor resistance, but based on last week's candle closure, in which buyers managed to close green, it's safe to assume that the bottom ($20,700) of the local resistance area we highlighted on the chart can be tested this week.

With $19,000 still not retested, Bitcoin has found itself in an indecisive situation that requires additional data for confirmation. The price of the asset is neither at support nor resistance, but based on last week's candle closure, in which buyers managed to close green, it's safe to assume that the bottom ($20,700) of the local resistance area we highlighted on the chart can be tested this week.

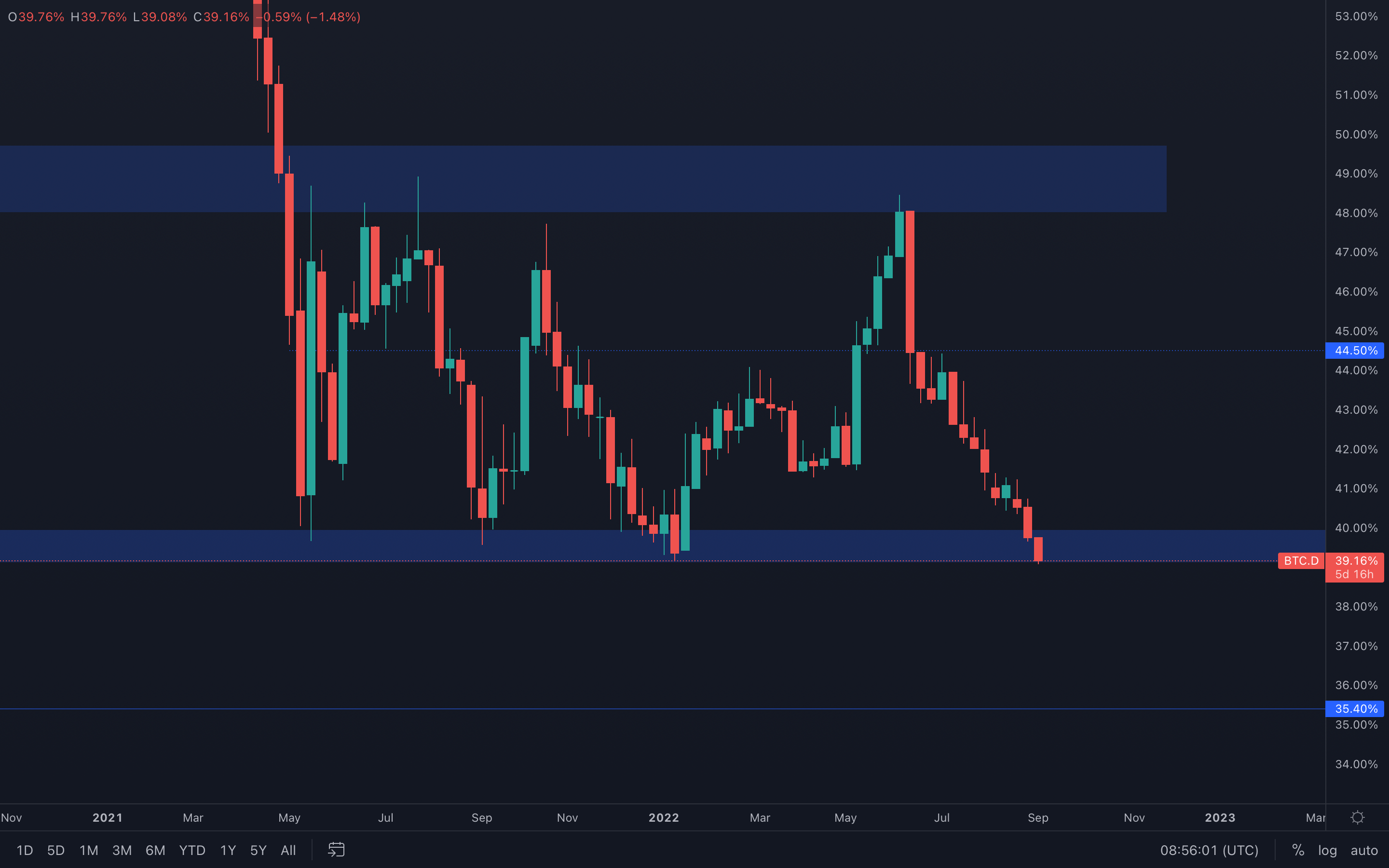

On another note, Bitcoin's dominance has descended into new lows, but is still above a huge support area. A weekly loss of this area can lead to an overall bad performance for the crypto market, with 35.40% to be tested in the near future, which is the lowest percentage we've ever tested.

BTC Dominance

Metric 1 – Futures Perpetual Funding Rate

The first metric we will cover is the Futures Perpetual Funding Rate. This shows the average funding rate set by Exchanges for Perpetual Futures Contracts. When the rate is positive, this is Longs paying Shorts and when the rate is negative, this is Shorts paying Longs. Currently, in the below graph, we can see that both the FTX and the Deribit Exchange have a negative funding rate (Shorts paying Longs), whereas Binance and Bybit, both have a positive funding rate (Longs paying Shorts). Historically, the better traders are on FTX and Deribit where the premium is to be Short, yet Binance and Bybit are net Long (premium is to be Long). This may indicate that the markets next move down is to the downside.

Bitcoin – Futures Perpetual Funding Rate

Metric 2 – Bitcoin Bank Reserve

The Bitcoin Bank Reserve is the amount of coins held by the digital asset bank, BlockFi. Currently, this metric shows that there was a small amount of buying at the June lows, but that buying has not been significant at all, particularly if you compare this back to 2020. This suggests that BlockFi do not feel comfortable enough yet buying more Bitcoins and adding risk. When we see this metric begin to increase, that may be the time to begin adding exposure.

Bitcoin – Bitcoin Bank Reserve

Metric 3 – Miner Outflow (Mean) & Miner’s Position Index

Metric 3 – Miner Outflow (Mean) & Miner’s Position Index

The Miner Outflow shows the mean amount of coins per transaction sent from the miner wallets. A spike in miners sending coins is likely them sending coins to an Exchange to be sold. We can see in the below chart that there have been some meaningful spikes over the past month of miners sending coins to Exchanges (indicating a likely sell). This may be the case that we’re seeing the miner capitulation but that it however may not be over due to there being a selling spike in the last few days.

Bitcoin - Miner Outflow (Mean)

The other Mining metric we will be looking into is the Miner’s Position Index. Spikes in this metric show that miners are sending a greater number of coins to Exchanges (likely to be sold). We can see in the below that we have seen a number of reasonable spikes recently – the spike on 02/09/2022 is notable.

Bitcoin – Miner’s Position Index

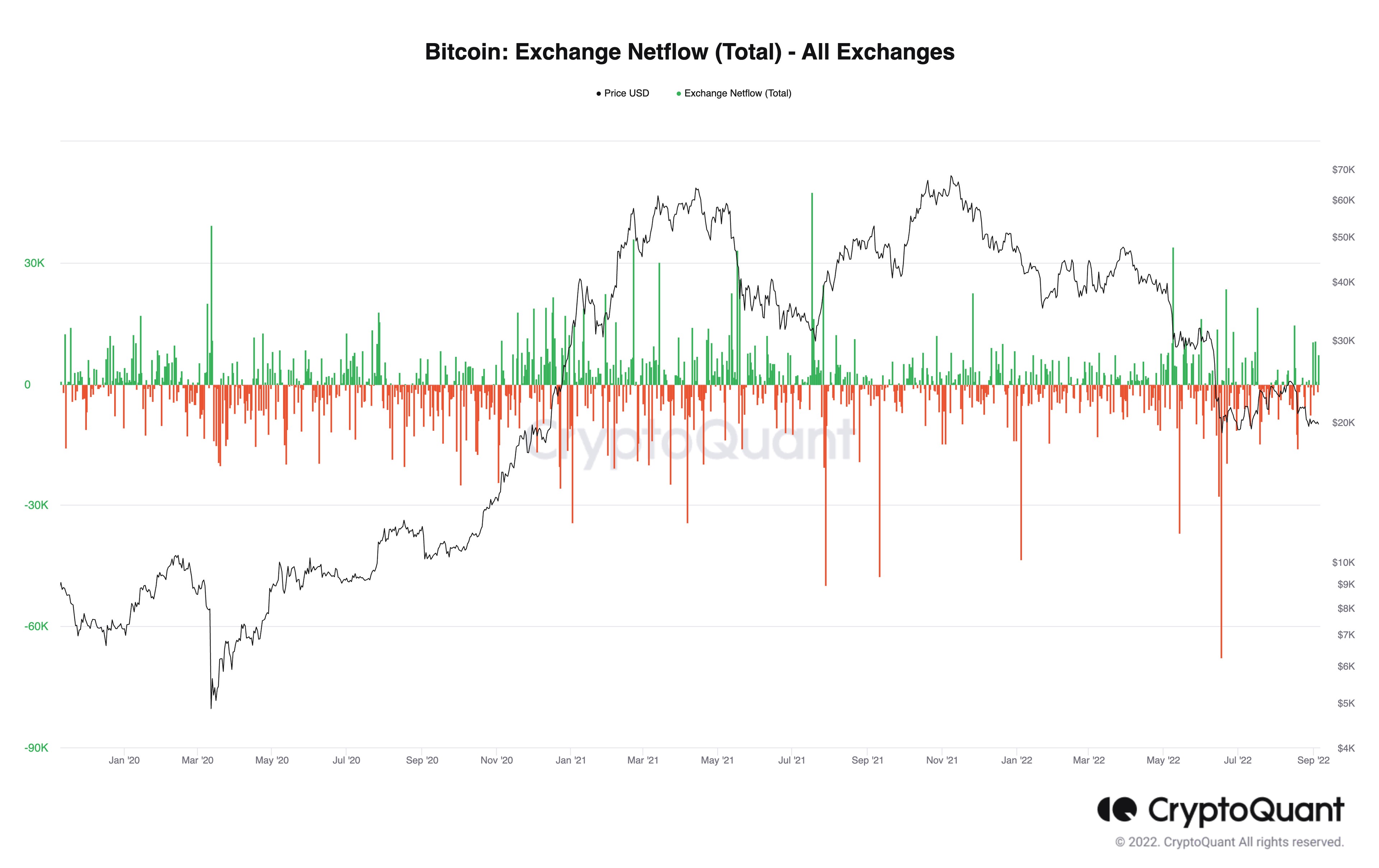

Metric 4 – Exchange Netflow Volume

The penultimate metric we will cover today is the Exchange Netflow Volume. This metric shows us the difference between the coins flowing into and out of the exchange. If there is green spikes, this indicates that there is increasing selling pressure into Exchanges. We can see that there have been increasing green spikes over the past few days. This indicates that sell pressure has begun increasing on Exchanges, which may result in more selling if prices fall more.

Bitcoin – Exchange Netflow Volume

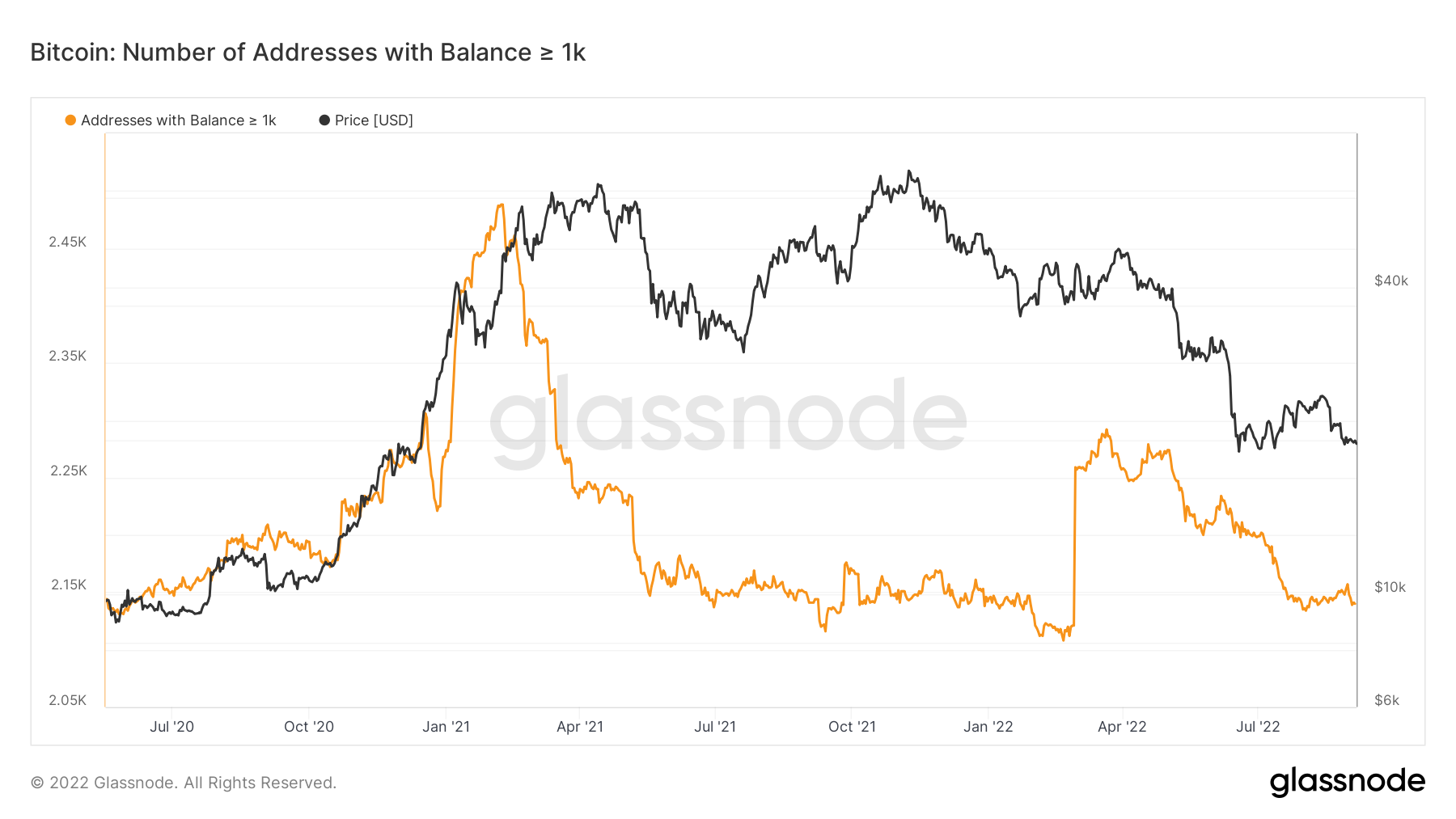

Metric 5 – Addresses

The last metric we will cover is the Addresses metric. We saw last week that the wallet addresses containing more than 1,000 Bitcoin (the cohort we look to emulate) were up trending, however, it has now retraced that entire up move. This shows that the historically most profitable wallets are not yet risking back on, and we should perhaps do the same ourselves.

Bitcoin – Addresses with Balance > 1,000 Bitcoin

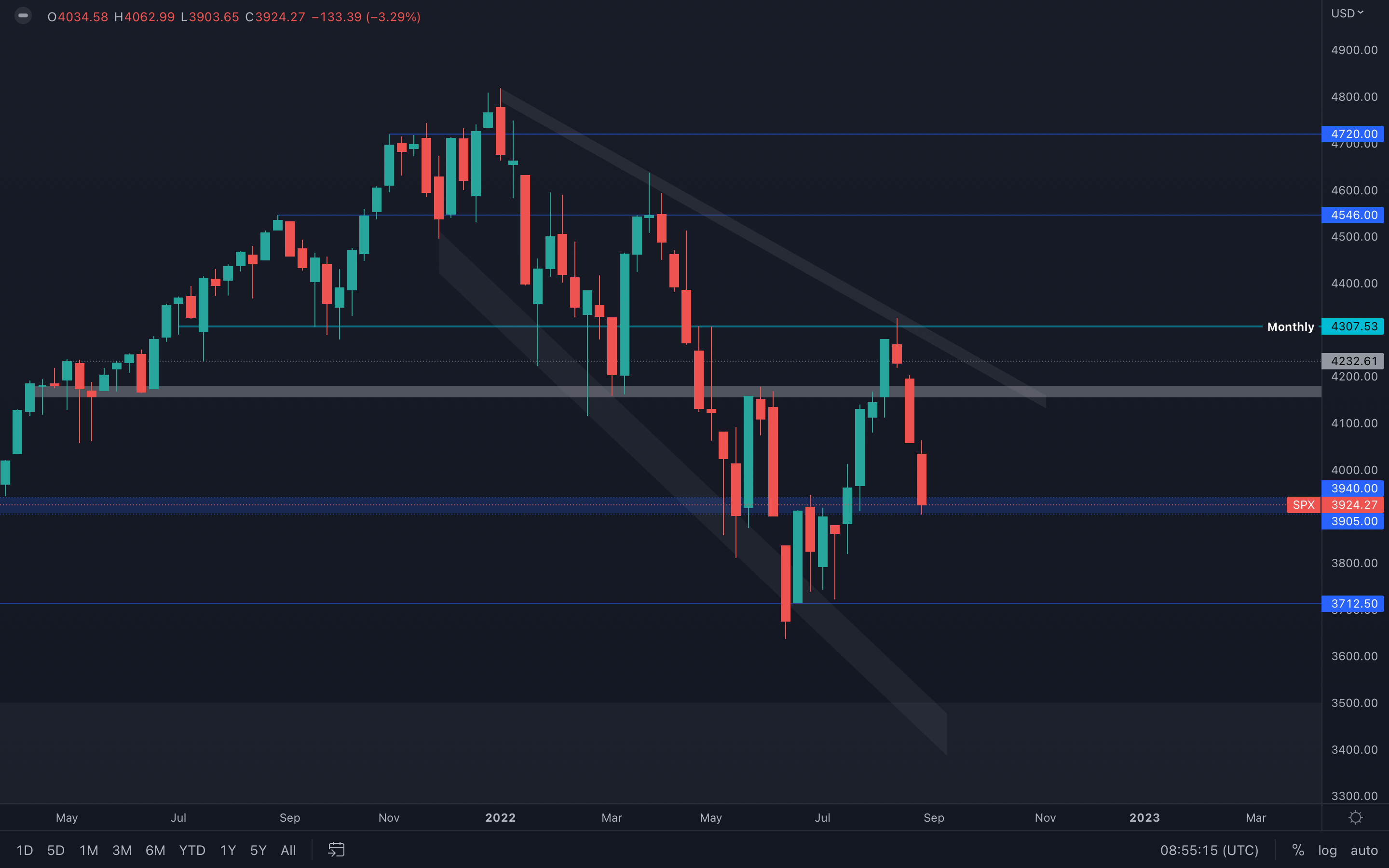

S&P 500 Index

We've been expecting this level to be tested, something we mentioned in editions 14 and 15 of the Weekly Analysis Digest. A loss of this level will bring the S&P 500 Index to $3700, which will most likely have a negative impact upon the crypto market, pushing the majors into new lows.

We've been expecting this level to be tested, something we mentioned in editions 14 and 15 of the Weekly Analysis Digest. A loss of this level will bring the S&P 500 Index to $3700, which will most likely have a negative impact upon the crypto market, pushing the majors into new lows.

From a technical standpoint alone, if this level is held successfully, then the SPX should have no issues heading towards $4150 or higher. We're going to monitor this index as usual and react accordingly to any expected or unexpected changes.

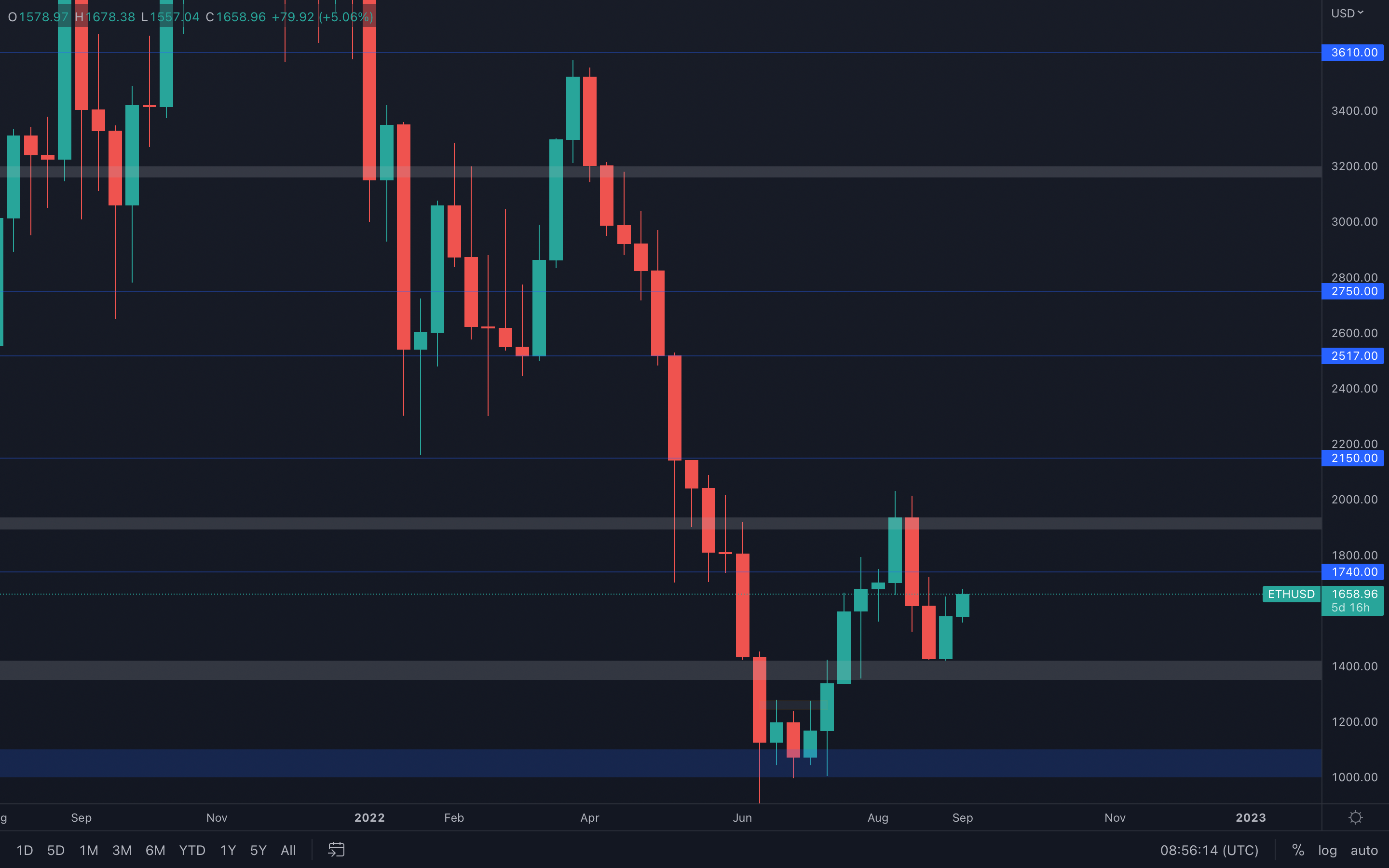

Ether - Technical Analysis

Ether has experienced a far more notable reaction compared to Bitcoin after testing their respective support levels. This quickly brought its price under the $1740 resistance level, which might as well be tested in the next few days. However, a reclaim of $1740 is required in order to confirm a move towards $1900, otherwise this level remains completely speculative, even with the wedge we identified on lower timeframes which we highlighted a few times in our daily analysis.

Ether has experienced a far more notable reaction compared to Bitcoin after testing their respective support levels. This quickly brought its price under the $1740 resistance level, which might as well be tested in the next few days. However, a reclaim of $1740 is required in order to confirm a move towards $1900, otherwise this level remains completely speculative, even with the wedge we identified on lower timeframes which we highlighted a few times in our daily analysis.

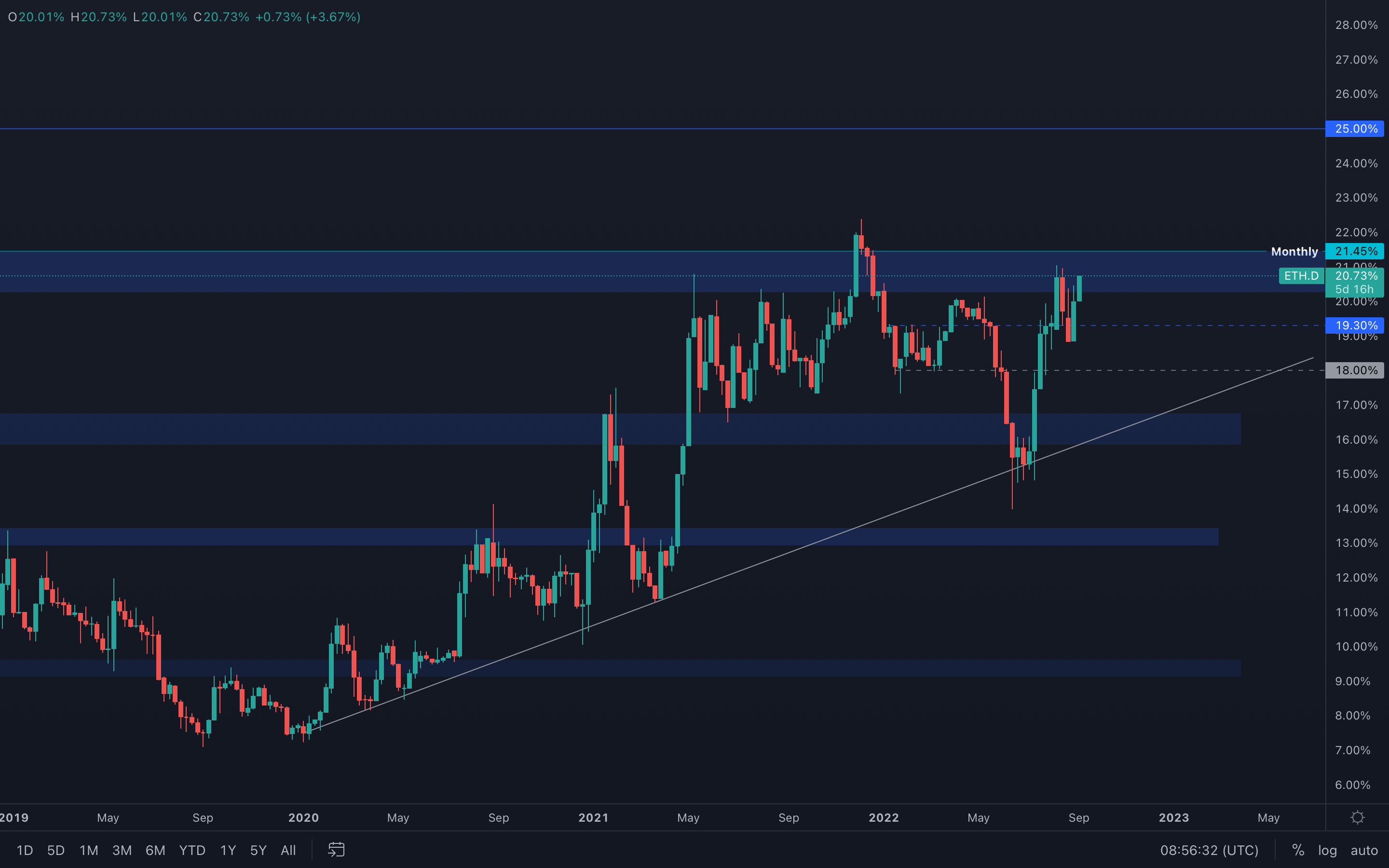

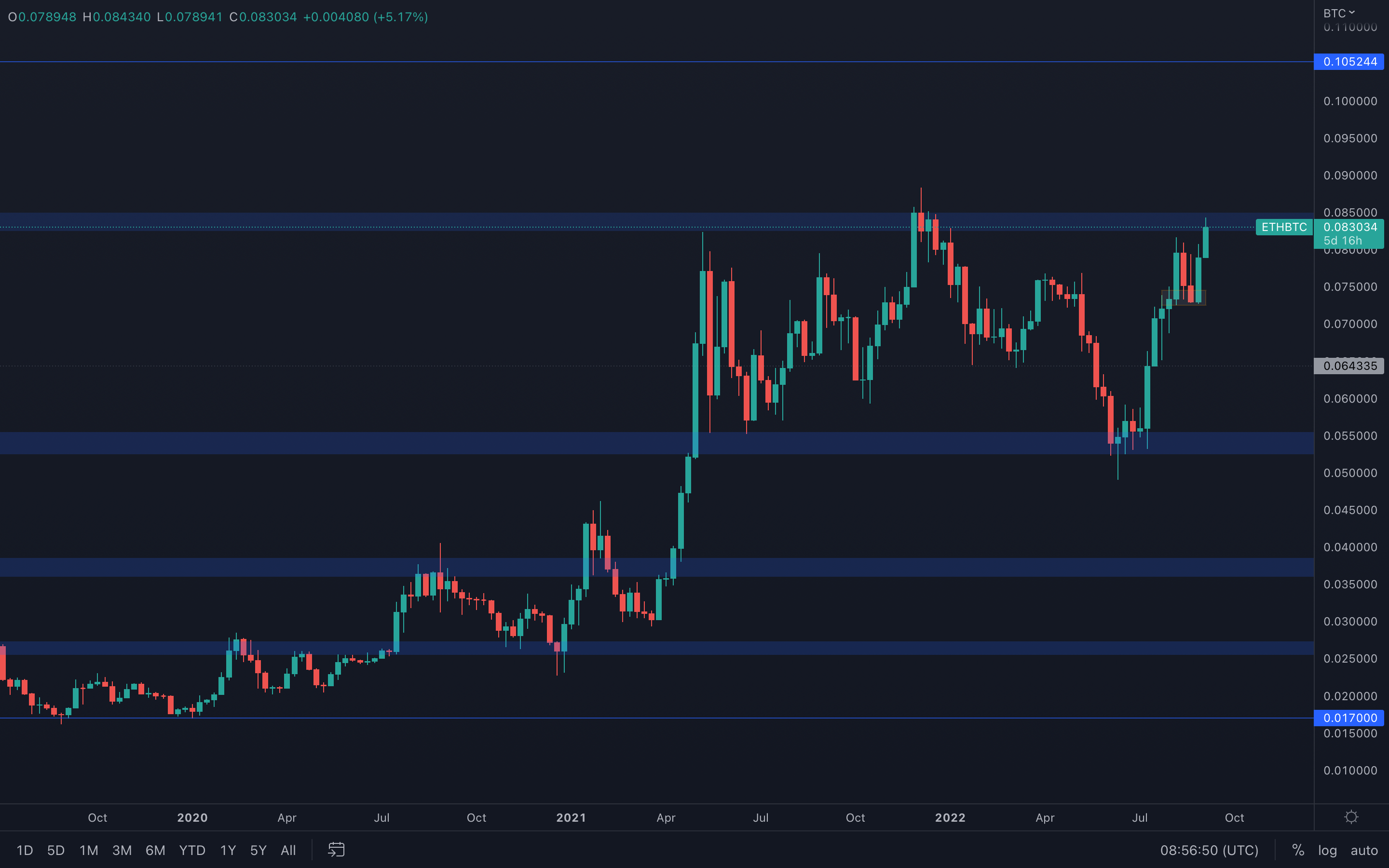

There's also a risk worth mentioning, which is that both Ether's dominance and its BTC pairing are currently at resistance levels. A rejection from these levels will obviously lead towards a bad performance for ETH.

Ether Dominance

ETH/BTC

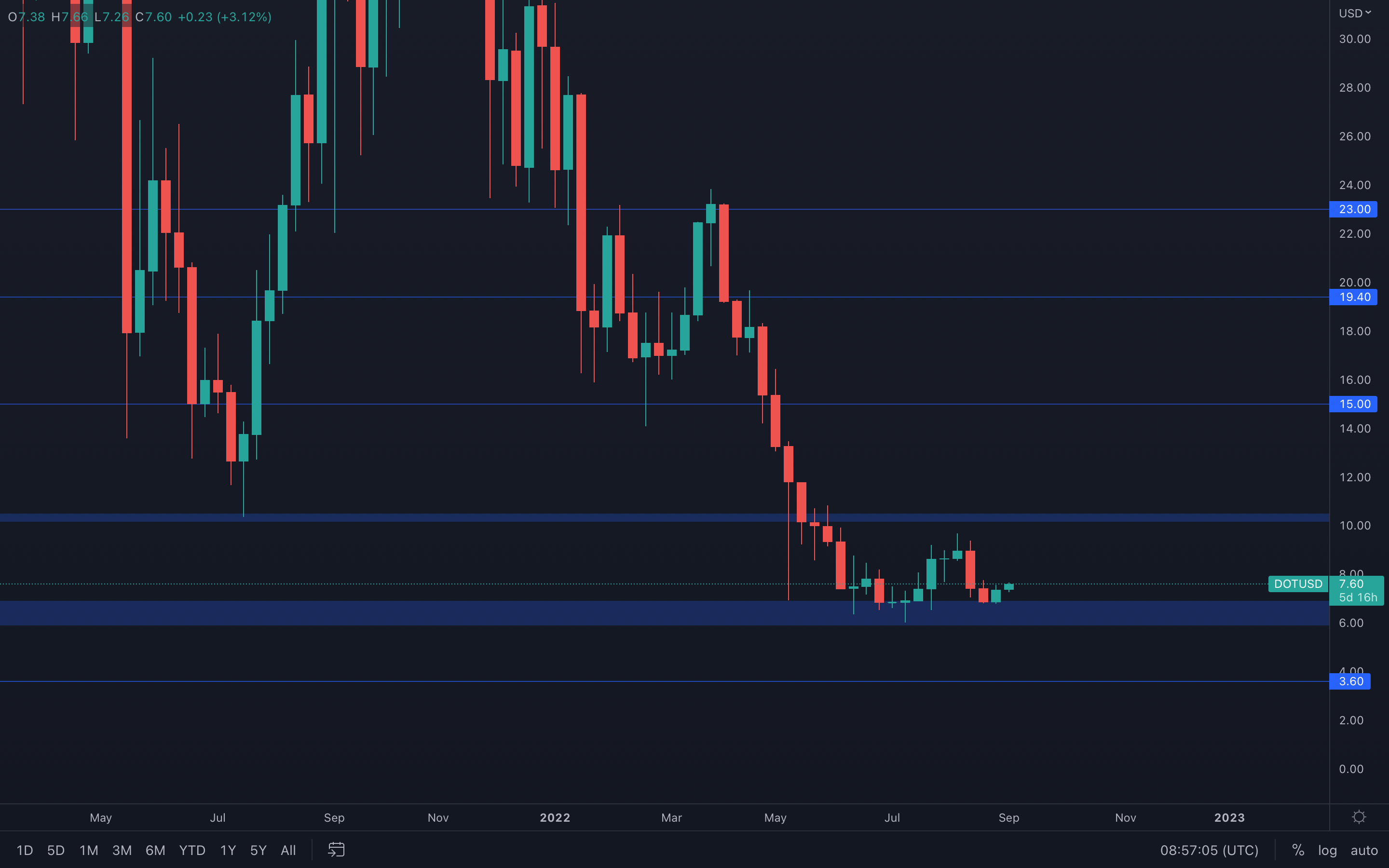

DOT

DOT perfectly retested the top part of the $6 - $7 support area last week, and bounced ~7%. This suggests buyers are present, but not to the extent that we could see DOT outperform and head towards $10 just yet. The majors are still highly influencing DOT's price action, so that's where our focus should be placed.

DOT perfectly retested the top part of the $6 - $7 support area last week, and bounced ~7%. This suggests buyers are present, but not to the extent that we could see DOT outperform and head towards $10 just yet. The majors are still highly influencing DOT's price action, so that's where our focus should be placed.

For now, DOT is likely to either consolidate above $7 or head higher. The possibility of testing $6 is taken into consideration only after losing the $7 via a daily closure under.

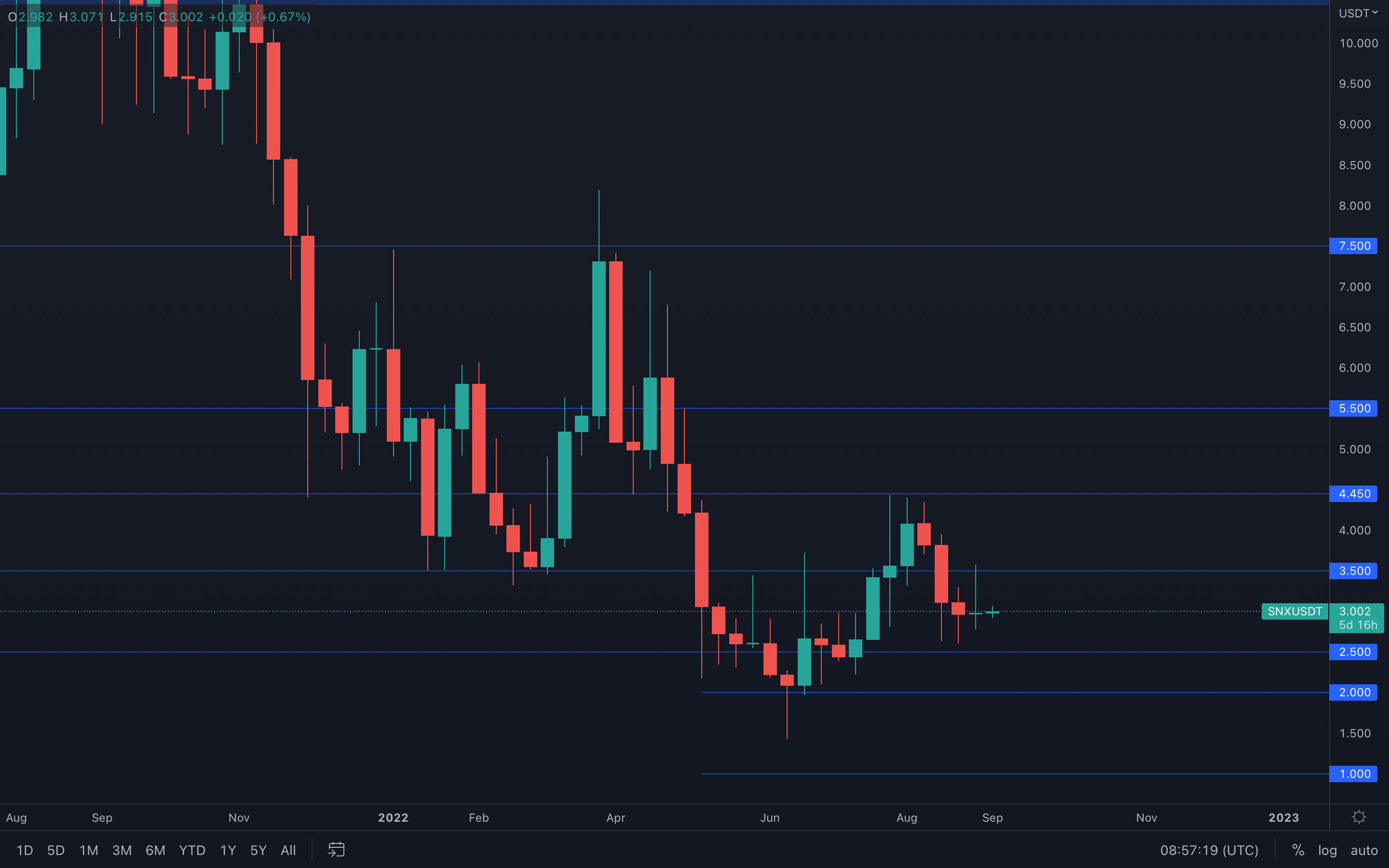

SNX

SNX has seen increased demand last week, but was ultimately invalidated by sudden selling pressure. This led to an indecisive weekly candle closure. The only thing we can deduce for now is that either $3.50 or $2.50 need to be broken to confirm where SNX is headed next.

SNX has seen increased demand last week, but was ultimately invalidated by sudden selling pressure. This led to an indecisive weekly candle closure. The only thing we can deduce for now is that either $3.50 or $2.50 need to be broken to confirm where SNX is headed next.

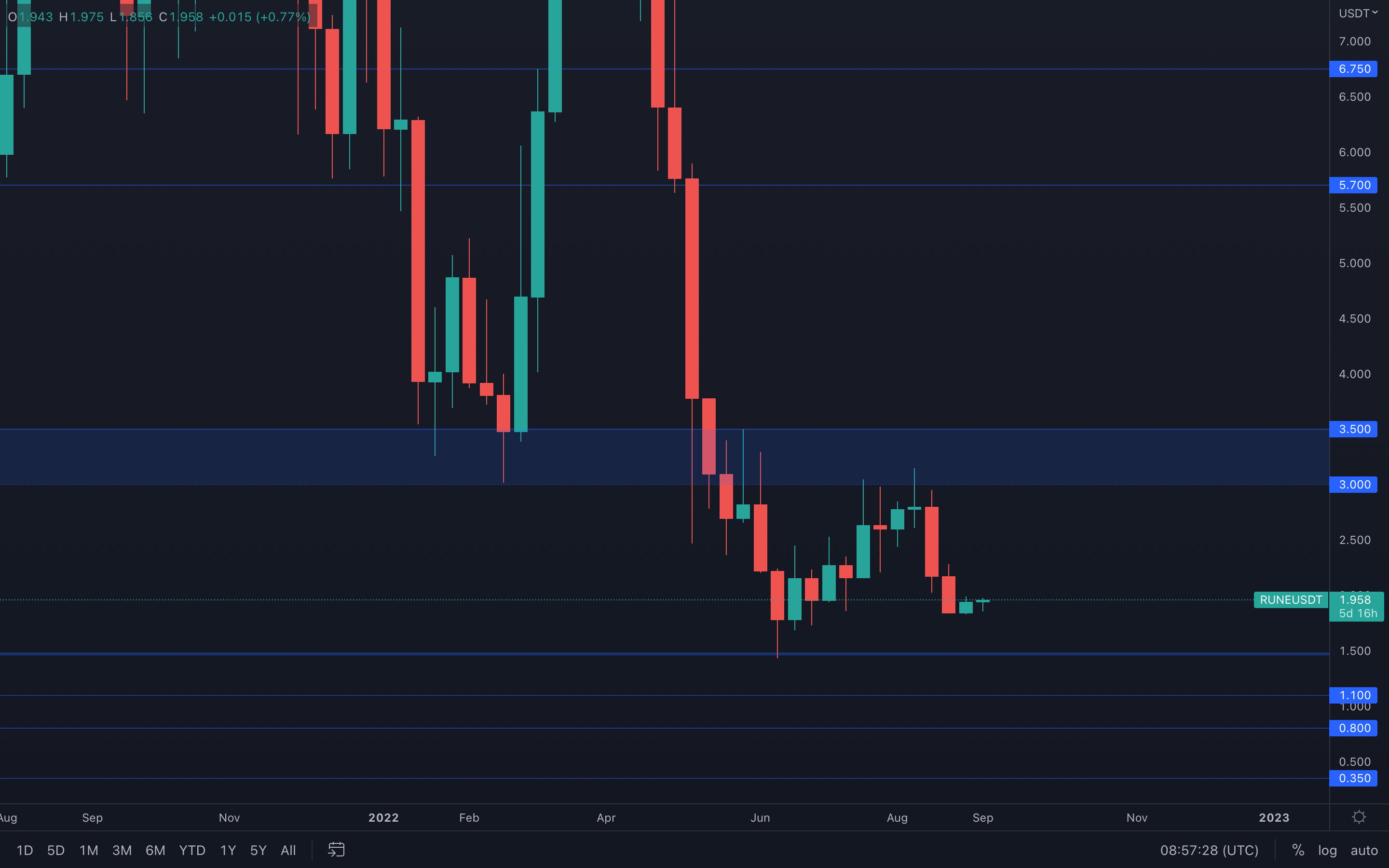

RUNE

Left in the hands of the majors, RUNE's price action lacks the necessary volume to either outperform or at least perform well on its own. Where the majors will go RUNE will follow precisely, as its weekly candle closures have been quite similar to those of Bitcoin for the past few weeks.

Left in the hands of the majors, RUNE's price action lacks the necessary volume to either outperform or at least perform well on its own. Where the majors will go RUNE will follow precisely, as its weekly candle closures have been quite similar to those of Bitcoin for the past few weeks.

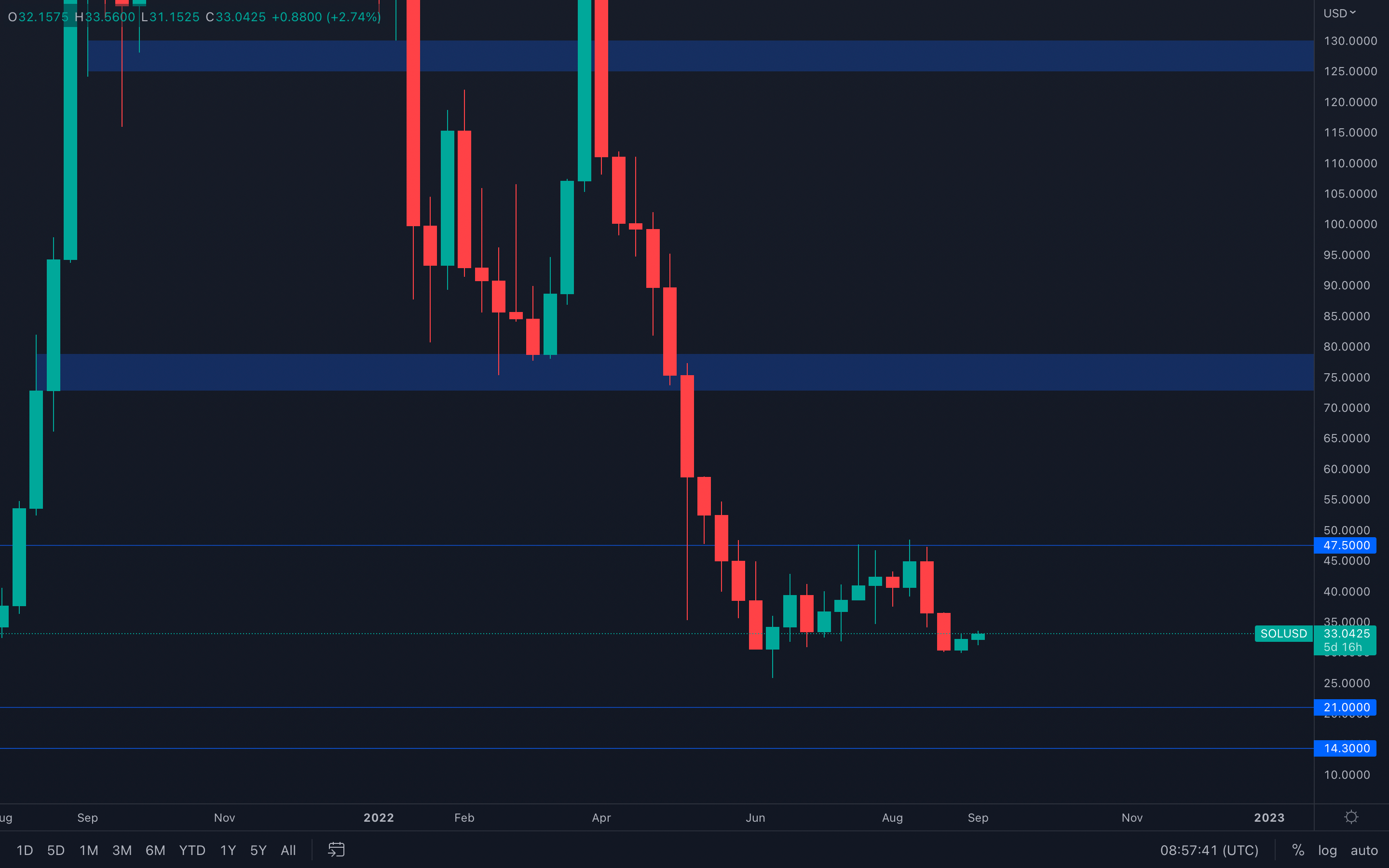

SOL

Same thing can be said for SOL as it has been said for RUNE - the similarity between candlestick formations is notable, which implies Bitcoin is driving most of the altcoin price action because they lack volume. However, SOL bounced right from the previous low last week, registered back in June ($30.5) which can suggest buyers are going to take over control and push prices higher.

Same thing can be said for SOL as it has been said for RUNE - the similarity between candlestick formations is notable, which implies Bitcoin is driving most of the altcoin price action because they lack volume. However, SOL bounced right from the previous low last week, registered back in June ($30.5) which can suggest buyers are going to take over control and push prices higher.

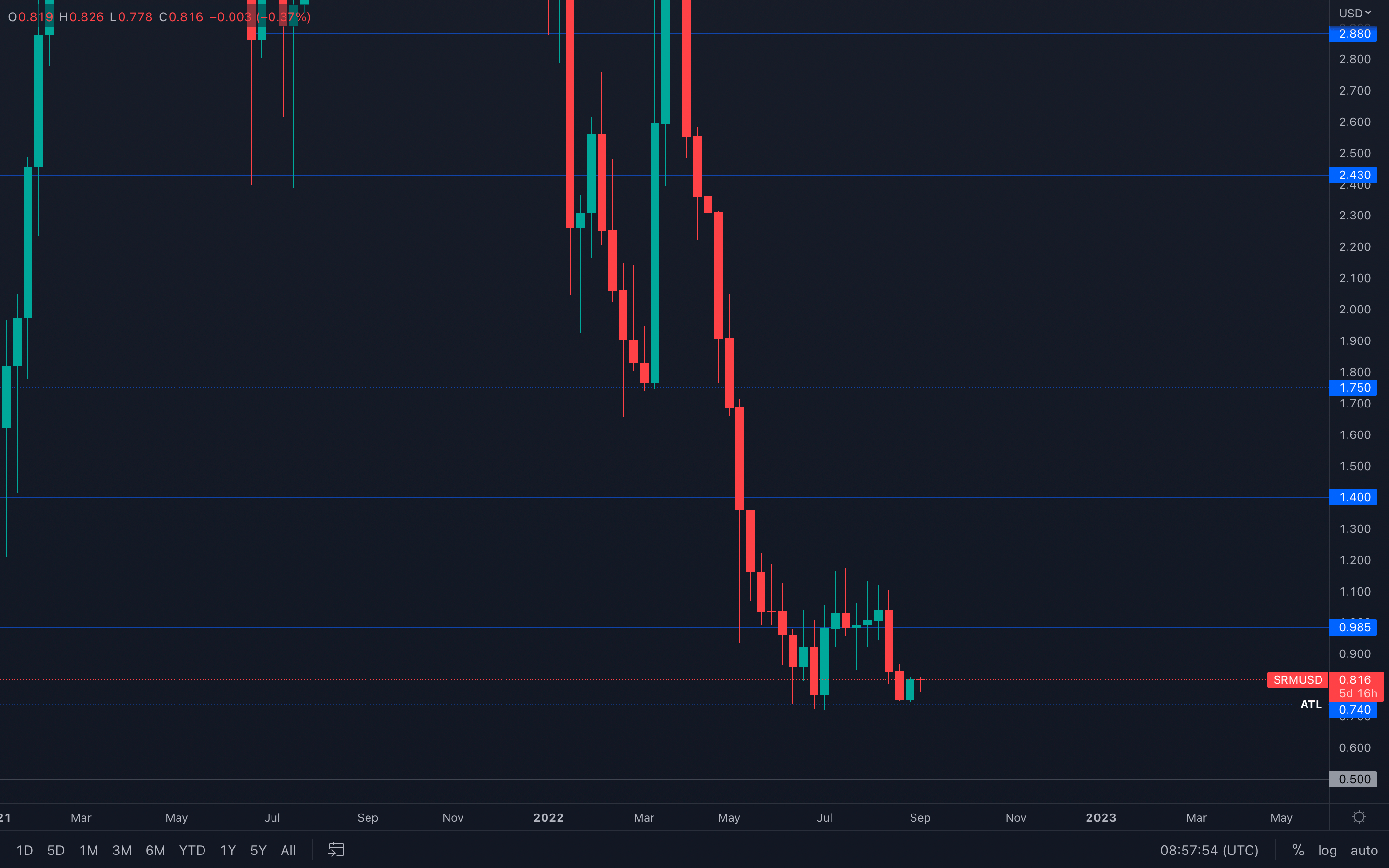

SRM

SRM experienced a full-bodied closure last week, when most assets have either closed near their open or just a bit above. This suggests that buyers have taken over control for now and that SRM can have a swing at $1 once more.

SRM experienced a full-bodied closure last week, when most assets have either closed near their open or just a bit above. This suggests that buyers have taken over control for now and that SRM can have a swing at $1 once more.

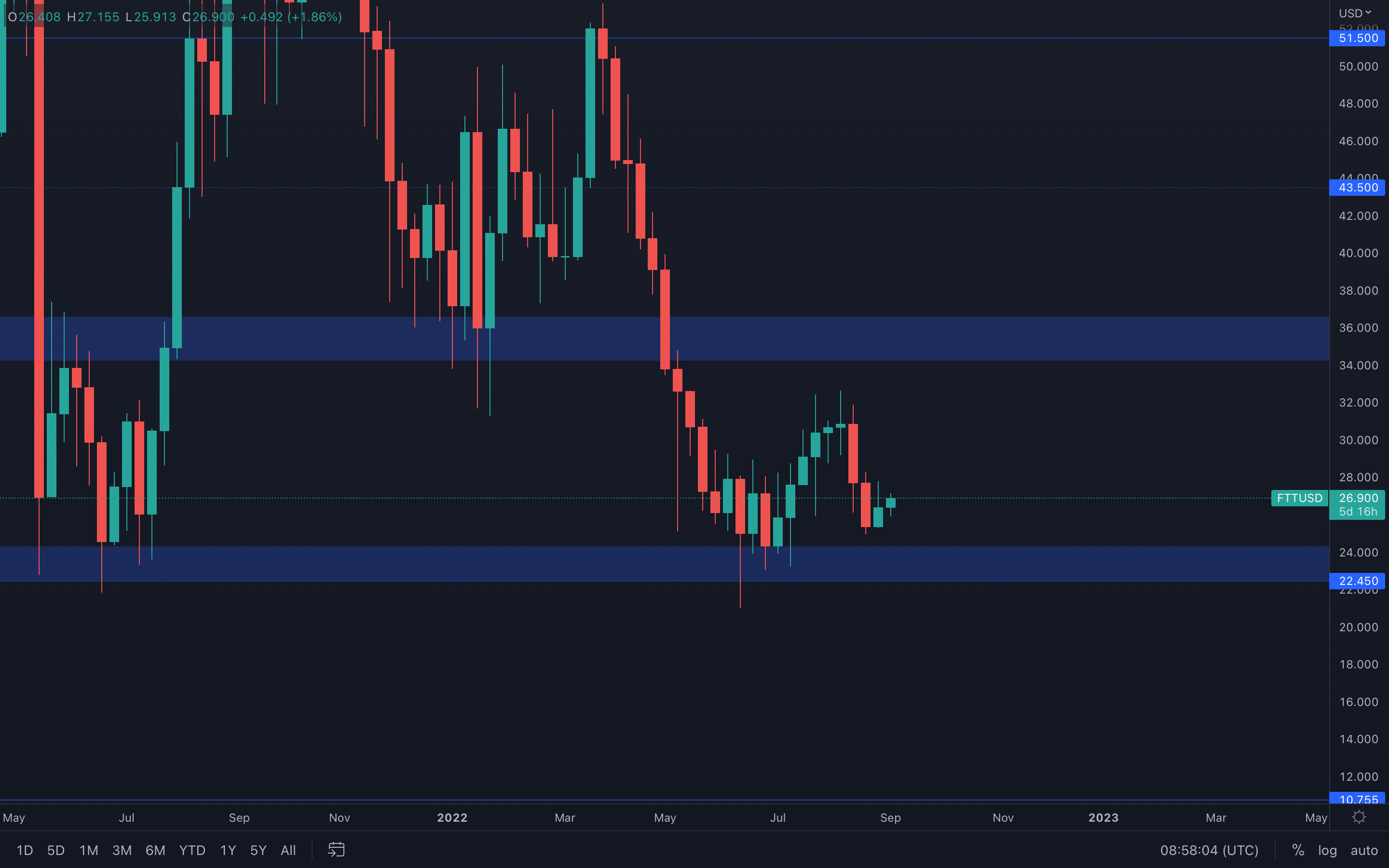

FTT

Because FTT's pairing with BTC has shown signs of bullishness, which we mentioned in last week's report, it's safe to assume that this will have a significant impact on FTT's price action over the course of the next few weeks. If the majors perform well, or at most consolidate, then FTT will likely outperform most assets in this report.

Because FTT's pairing with BTC has shown signs of bullishness, which we mentioned in last week's report, it's safe to assume that this will have a significant impact on FTT's price action over the course of the next few weeks. If the majors perform well, or at most consolidate, then FTT will likely outperform most assets in this report.

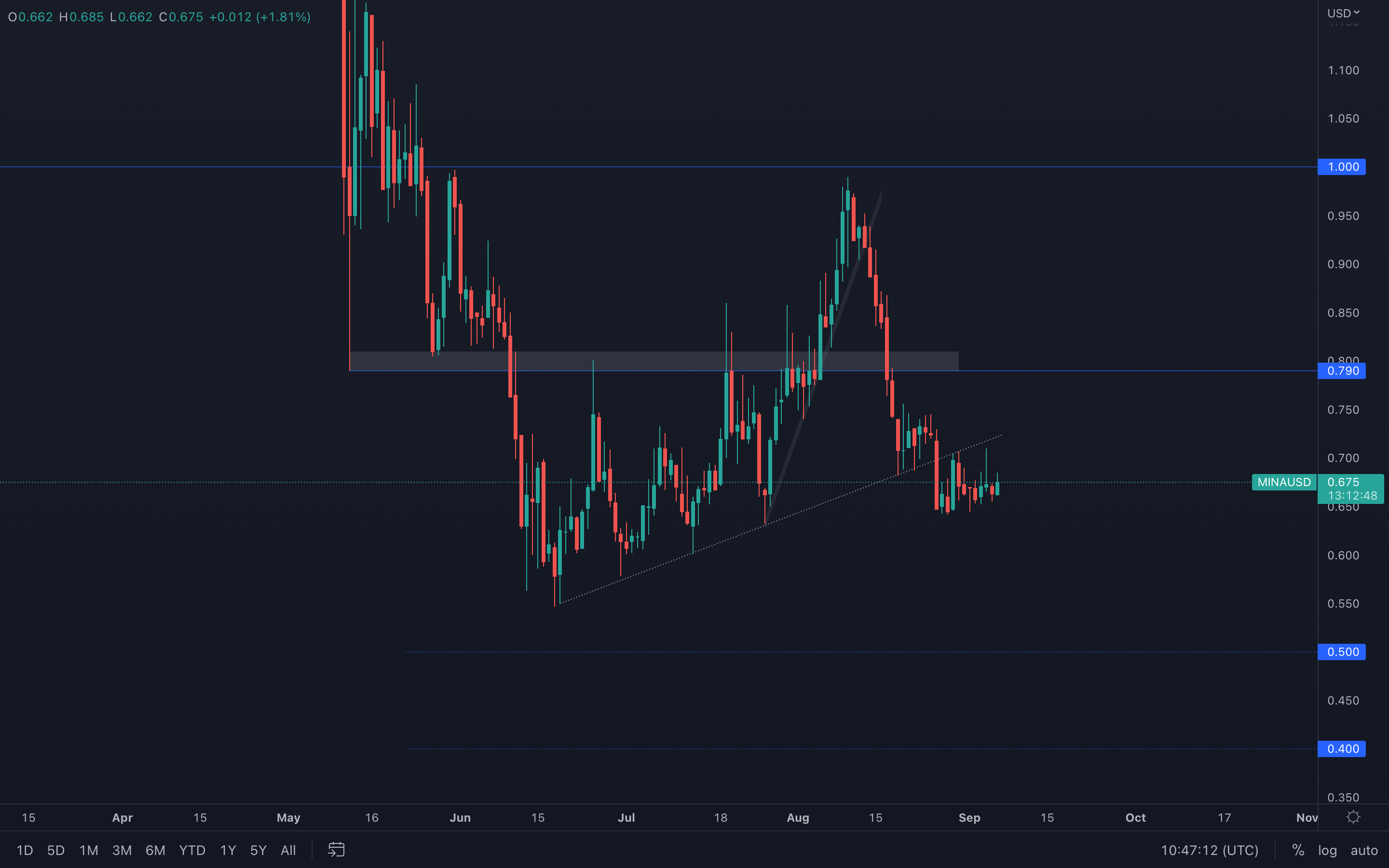

MINA

(Daily chart was used)

There seems to be a bit of indecisiveness after losing the trend line. There have been lower timeframe higher lows formed since the loss of the trend line, which implies that buyers are still in control - this can lead to yet another retest of the trend line.

(Daily chart was used)

There seems to be a bit of indecisiveness after losing the trend line. There have been lower timeframe higher lows formed since the loss of the trend line, which implies that buyers are still in control - this can lead to yet another retest of the trend line.

Unless a reclaim occurs (daily closure above the trend line), then further downside is still on the cards.

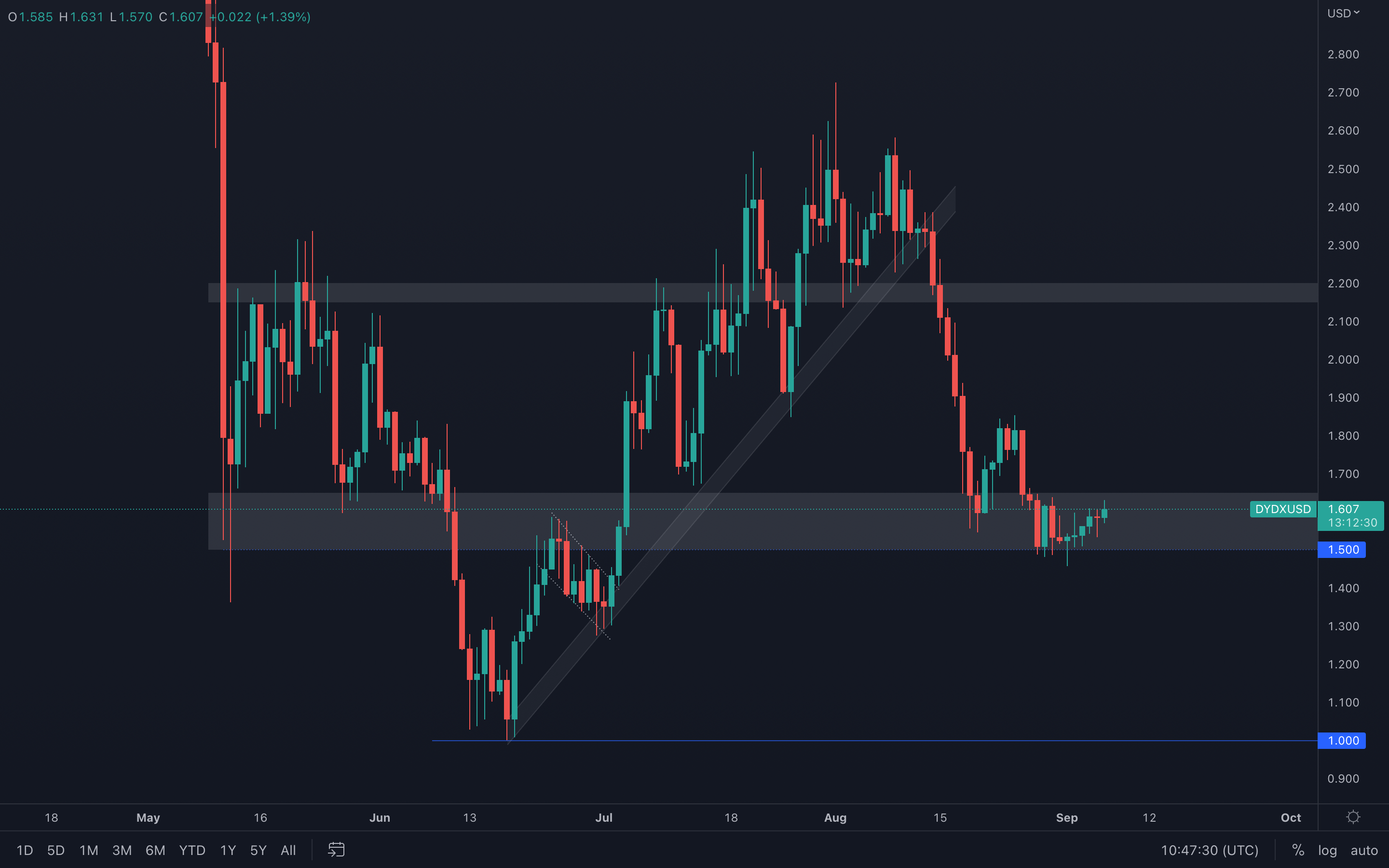

dYdX

(Daily chart was used)

After perfectly testing the $1.50 support level, dYdX quickly came to the top part of its current support area, and that is $1.60. As long as its price is maintained above $1.50, there's no reason for us to expect downside. On the contrary, a $1.85 test (previous higher high) can occur, as long as dYdX current support area isn't lost.

(Daily chart was used)

After perfectly testing the $1.50 support level, dYdX quickly came to the top part of its current support area, and that is $1.60. As long as its price is maintained above $1.50, there's no reason for us to expect downside. On the contrary, a $1.85 test (previous higher high) can occur, as long as dYdX current support area isn't lost.

Summary

With a number of macro headwinds still ahead of us, there is still the general sentiment of risk-off. The Funding Rates suggest that the more professional traders are looking to be Net Short whilst also not adding exposure to their Spot bags. In recent weeks, we have also seen sell pressure increase which may drive prices down further and this may then result in further downside for price.