Weekly Technicals Pro - Volume 78

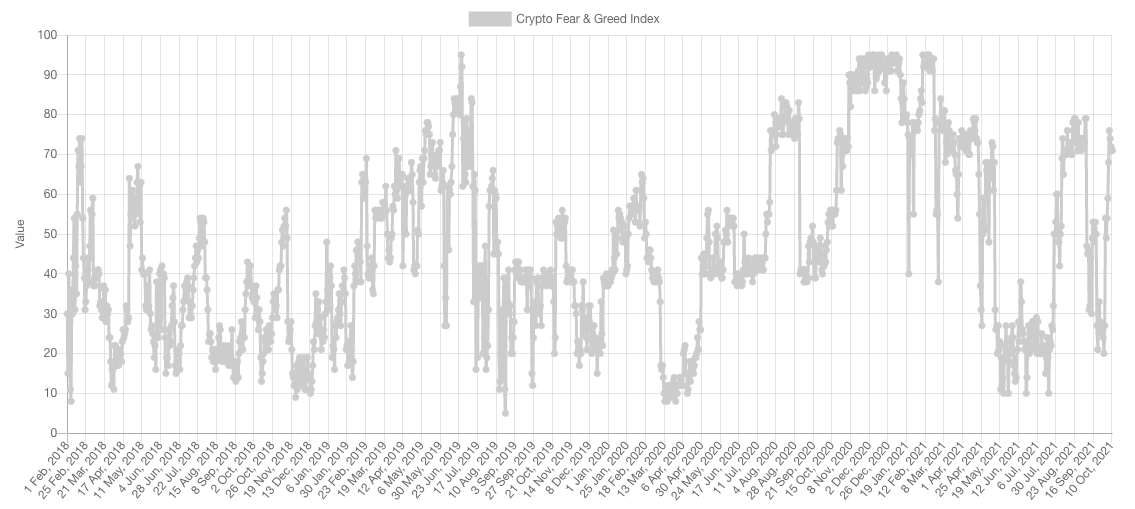

We are covering the Fear & Greed metric because we do so every week, nonetheless at this current moment in time it is not conveying too much information as it is not at one of the extremes. Currently, this metric is sitting at Greed but it is not high enough to be a warning sign. For this reason, we'll be looking at another metric: Funding Rate for perpetual futures across all exchanges.

Institutions front-running an ETF?We think so.

Market Sentiment

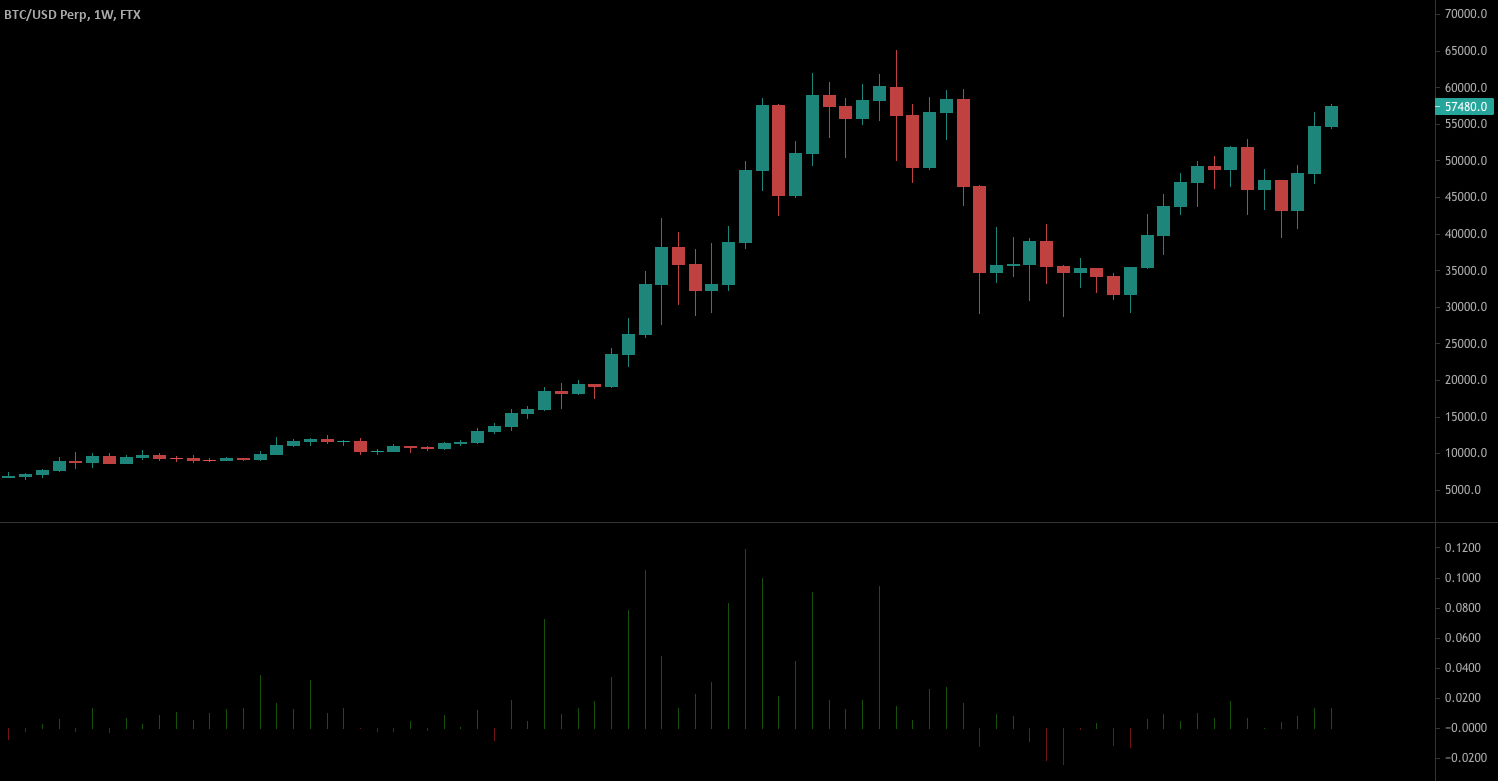

Relatively speaking, we can see that funding is not at extreme levels like it was pre-May dump which simply tells us there is more room for speculation to grow and prices to increase.

Market Indexes

Total Market Cap

The Total MCap is making a comeback towards the $2.5T resistance where price was crushed earlier this year. Generally speaking, the more a level is tested, the weaker it becomes. Think of it as a well that keeps getting hit, at some point it ought to break - especially if enough people are hitting it. This is currently the case in crypto and to summarise our bias of what we think happens we've drawn the red squiggly line.

Altcoins Market Cap

The Alts MCap held $1.115T as support and is heading towards $1.5T. If the latter occurs then we'll see further price discovery on Alts but it seems highly likely that we see it on BTC first.

Bitcoin

BTC had a very bullish weekly closure and is now aiming to overtake the $57,000 resistance area. We've mentioned this target since Bitcoin was trading at the latest $40,000 retest and here we are. Given the likelihood of an ETF approval, BTC seems geared to reclaim this resistance and head into price discovery. If the latter occurs, we'd expect price to reach $100,000 this quarter.

Ether

ETH perfectly bottomed at the previous weekly high in late September and is setting up for a rally towards $4,200 and all-time highs. On the daily timeframe, the chart is as simple as "above $3,200 = $4,200 next".

DOT

DOT perfectly holding $27 support and we are still targeting $40.

SNX

SNX is in bear territory still and it will only provide an opportunity above $14.10 n the weekly or with a dump to $7.50.

RUNE

Nothing has changed, RUNE is interesting above $11.50 on the weekly or at a $5.75 test.

SOL

SOL has failed to maintain $150 which brings the point of concern, has price just set a lower high? Unless a $150 reclaim occurs we'll have to assume that is the case with further downside to [$124-$130] incoming.

SRM

Similar energy to SOL with a bearish engulfing candle indicating further downside to $6.40.

MINA

The falling wedge breakout has been invalidated given the lengthy consolidation and lack of follow-through. We're back at observing key levels with $4.88 being of interest now.

FTT

FTT must reclaim $60 for further price discovery. Right now, price hasn't done so but with the rise of FTX we're still positive on $100 per FTT for our bag.

DYDX

Breakout, retest and jump back up. DYDX is back in bull-mode with $28 as the first target and $36.50 as the second.