FTX acquired Blockfolio which will boost its retail presence. On a less positive note, Bitcoin Cash will likely get forked, again.

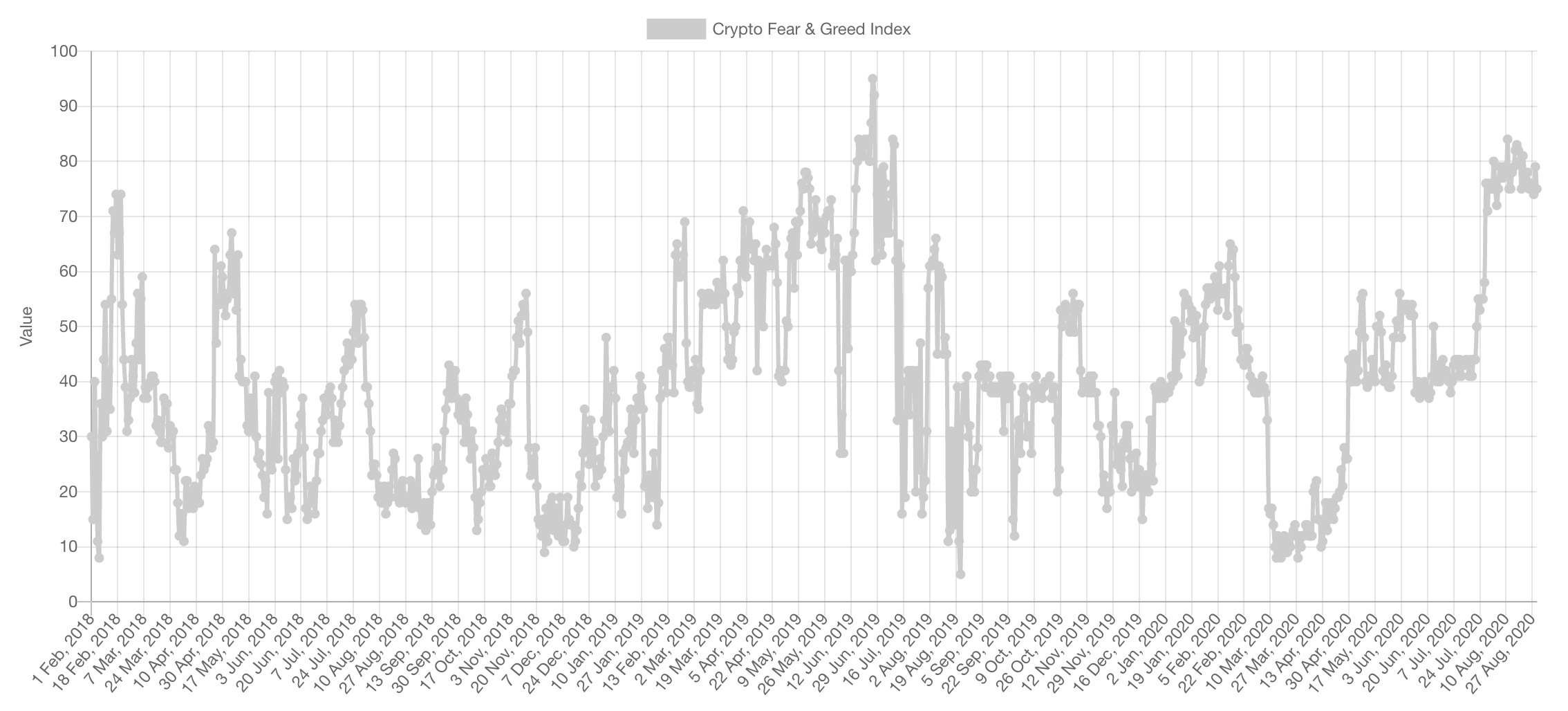

Market Sentiment

Greed is all over the place. However, note that there is no previously recorded data for sentiment during the 2016/17 bull market which is why the data set is limited. A topic we explained in the previous Weekly Technicals.

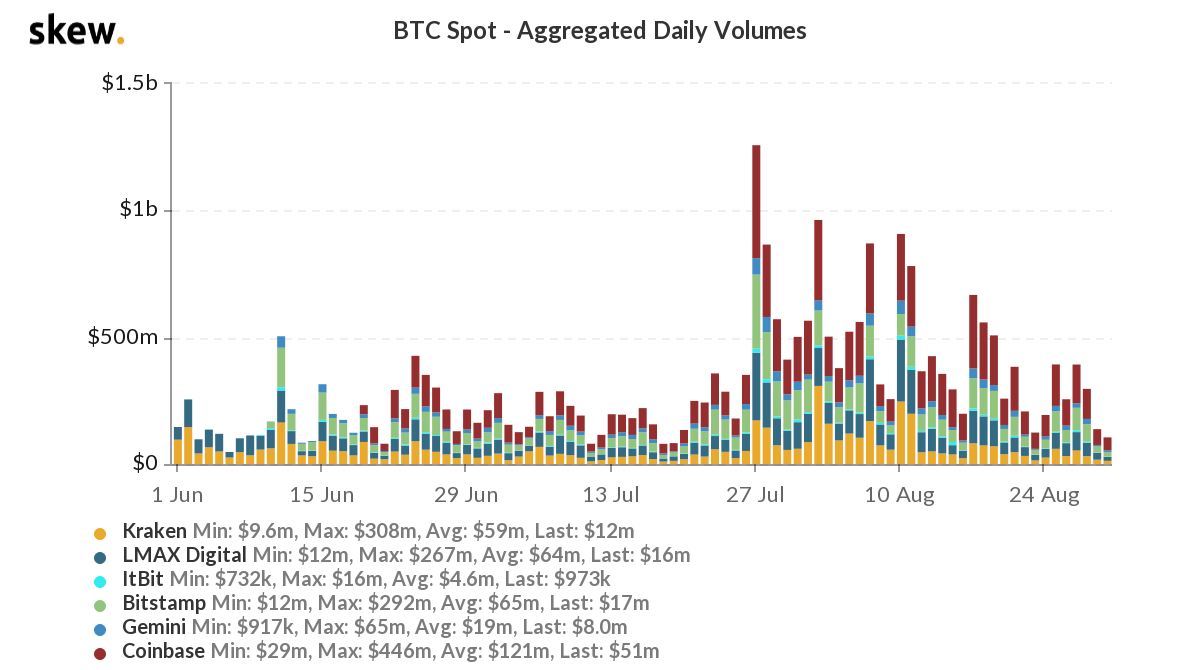

Trading Volumes

Bitcoin

Spot volumes are declining which indicates two things:

- a limited period of low volatility

- a big move on the horizon

If we are to make a judgment purely based on market sentiment and volume it would be: downside. But keep on reading to see what the charts are telling us.

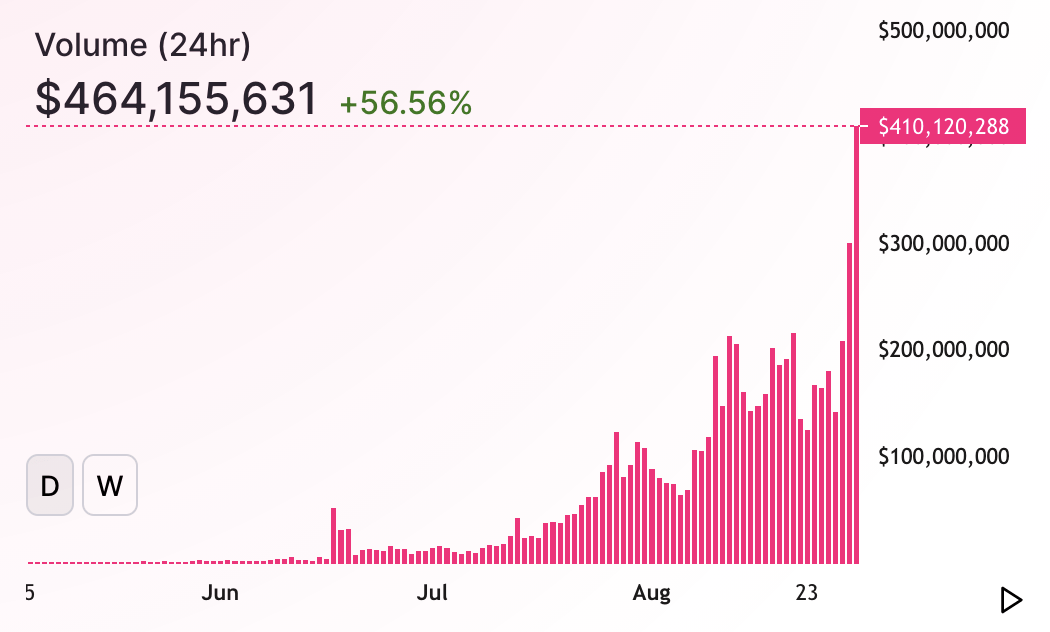

Uniswap

The most used DEX (Uniswap for now) has flipped Coinbase in terms of daily volume. DeFi is coming and it is coming strong! These assets in particular have been very resilient even on Bitcoin down days.

Market Indices

Total Market Cap

The pullback theory has so far only been half-realised when looking at our initial target of ~$290B. The most important and bullish aspect of this is that the 2019 high has been crossed with conviction. To remain within the lines of clarity we can state that as long as $326B holds, $445B is our target. But, IF, $326B is broken then we’d be looking to buy the dip at ~$290B.

Altcoins Market Cap

The Altcoins Market Cap is more bearish because it failed to hold above resistance and cannot be bullish until that is taken over; will lead to the targeted level of $190B. To summarize and remove any sort of confusion, we are highly bullish but being careful with our capital in case a sharp pullback happens. If it does, we consider it a good buying opportunity for us. This would only represent a small detour on the way of this new bullish market. Now of course not all assets will perform equally, which is where the main skill is required.

BTC

In the past few days, Bitcoin has been setting lower high and lower lows which is a subtle change in structure. This paired with the greedy sentiment and the CME gap at $9,600 leads us to believe that the pullback theory is still possible. This gets invalidated by a 3D closure above the blue area.

ETH

With DeFi rocking the entire space, the most important liquidity zone being crossed, it is no surprise that we are highly bullish on Ether. Despite a potential small detour, we are targeting $550s and $800 and believe these could be reached by the end of this year.

ALGO

Often, analysts overcomplicate charts. They also view technical analysis as something indisputable which is very far from the truth. TA only helps us put the odds inn our favour, not give certainty. Here is a very simple, straightforward and clean chart for ALGO/USD. Sitting at support with a target at $0.90 with clear invalidation if the market closes under the grey area.

Disclaimer: None of the above constitutes financial advice or any sort of recommendation. These are purely opinions.