First, in terms of a decision, we expect many of the current ETF applications to be approved in early January when the SEC is due to make a decision.

Below, we will look into several on-chain metrics to assess if we should buy in now if we were currently under-exposed.

We will then look at what TradFi are doing in terms of its positioning today.

On-chain Data

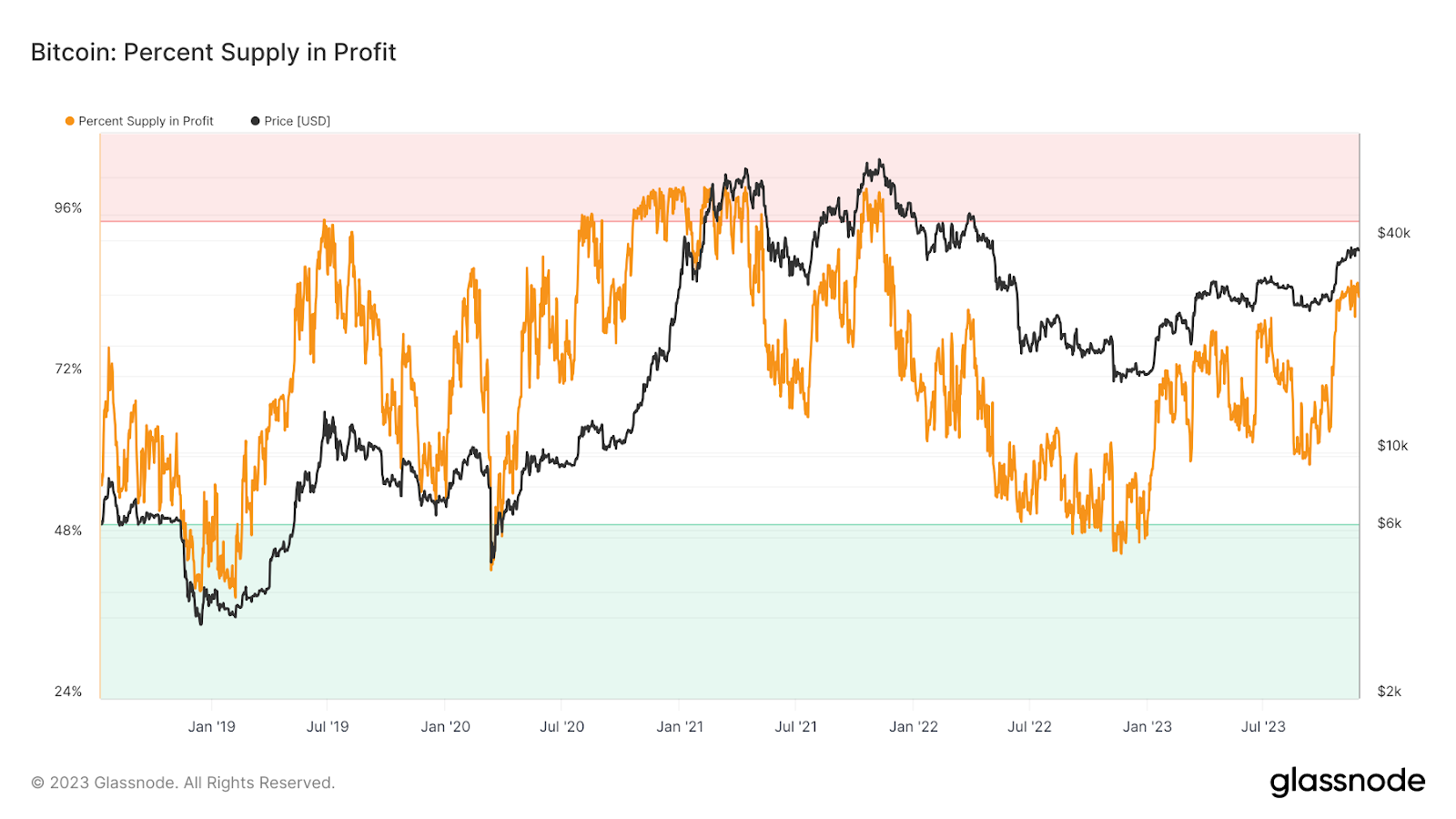

Below, we will cover several key metrics. The first of these is the Percent of Supply in Profit, which is, as it suggests, the percent of the supply of coins that have been in profit since the last time they were moved.We can see that this metric looks similar to how it did in 2019 - relatively high but not exhausted to the upside. Essentially, if this metric dipped, that would likely indicate to us to DCA into that price level.

Percent supply in Profit

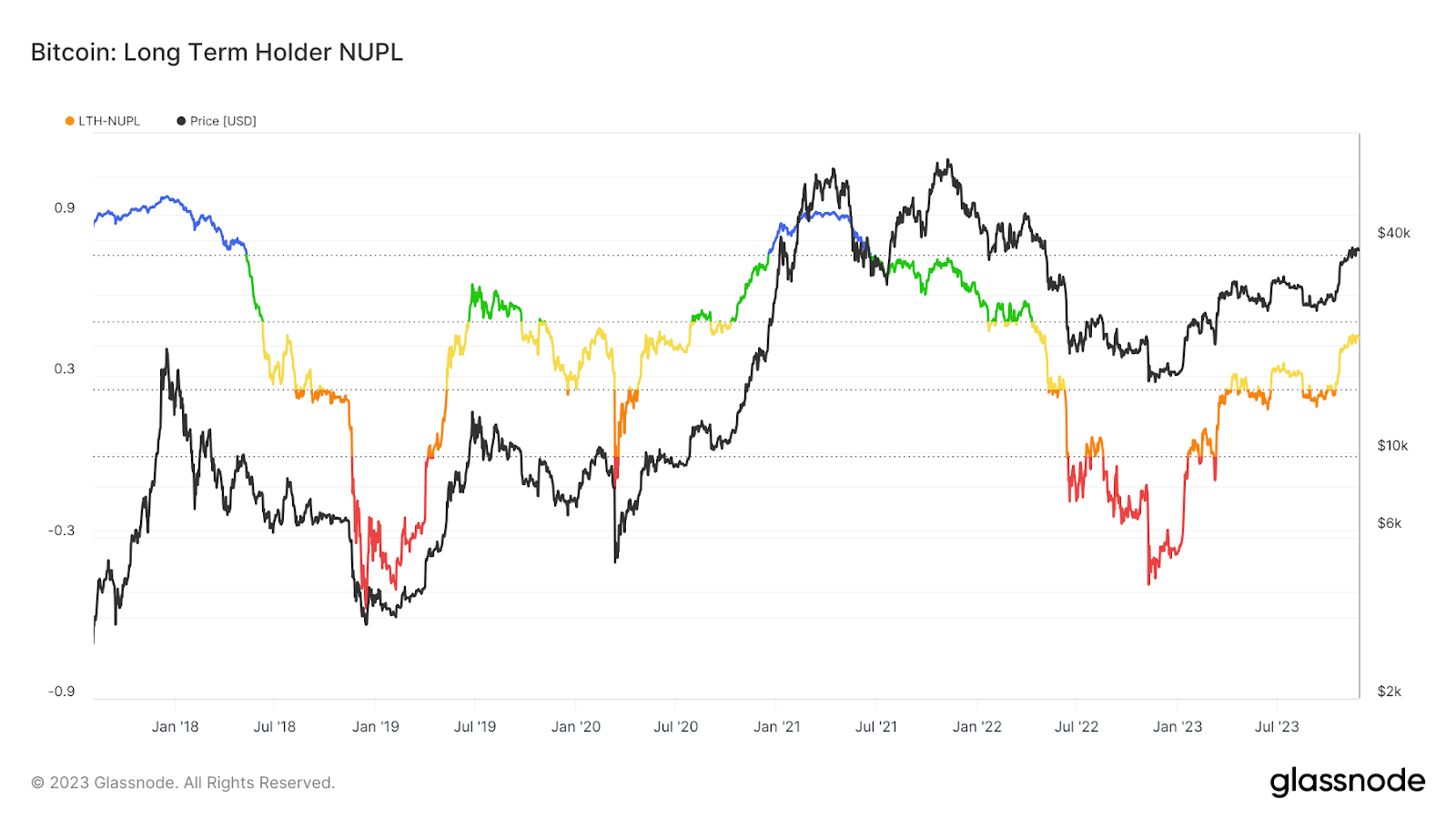

The second metric is the LTH-NUPL; Long-Term Holder - Net Unrealised Profit/Loss. This indicator assesses the long-term holders in terms of their overall profitability.

Long-term is identified as 155 days (nearly six months). We can see from this chart that it is quite extended to the upside, and it looks somewhat exhaustive - as if it’s due for a pullback.

Once again, we would be assessing this metric to see if there is a pullback, and if there is, we will see what price is given at the time of that pullback, and we will most likely be DCA buyers of Bitcoin into that price - of course, we will assess again at the time.

LTH-NUPL

In the above, we’d be eyeing a pullback from close to the top of the yellow zone back to the orange zone.

Alongside the above, several metrics suggest we’re in early bull market territory.

The Hash Ribbon is one of those. It is trending up, and the 30d is above the 60d - a sign that this metric has bottomed and inefficient miners have been flushed out at the lows between $16k and $19k.

Only the most efficient miners remain. Hence, we’ve also seen the Hash Rate reach new highs in the last few days - more computing power is needed to mine the same amount of Bitcoin.

How is TradFi positioning into crypto?

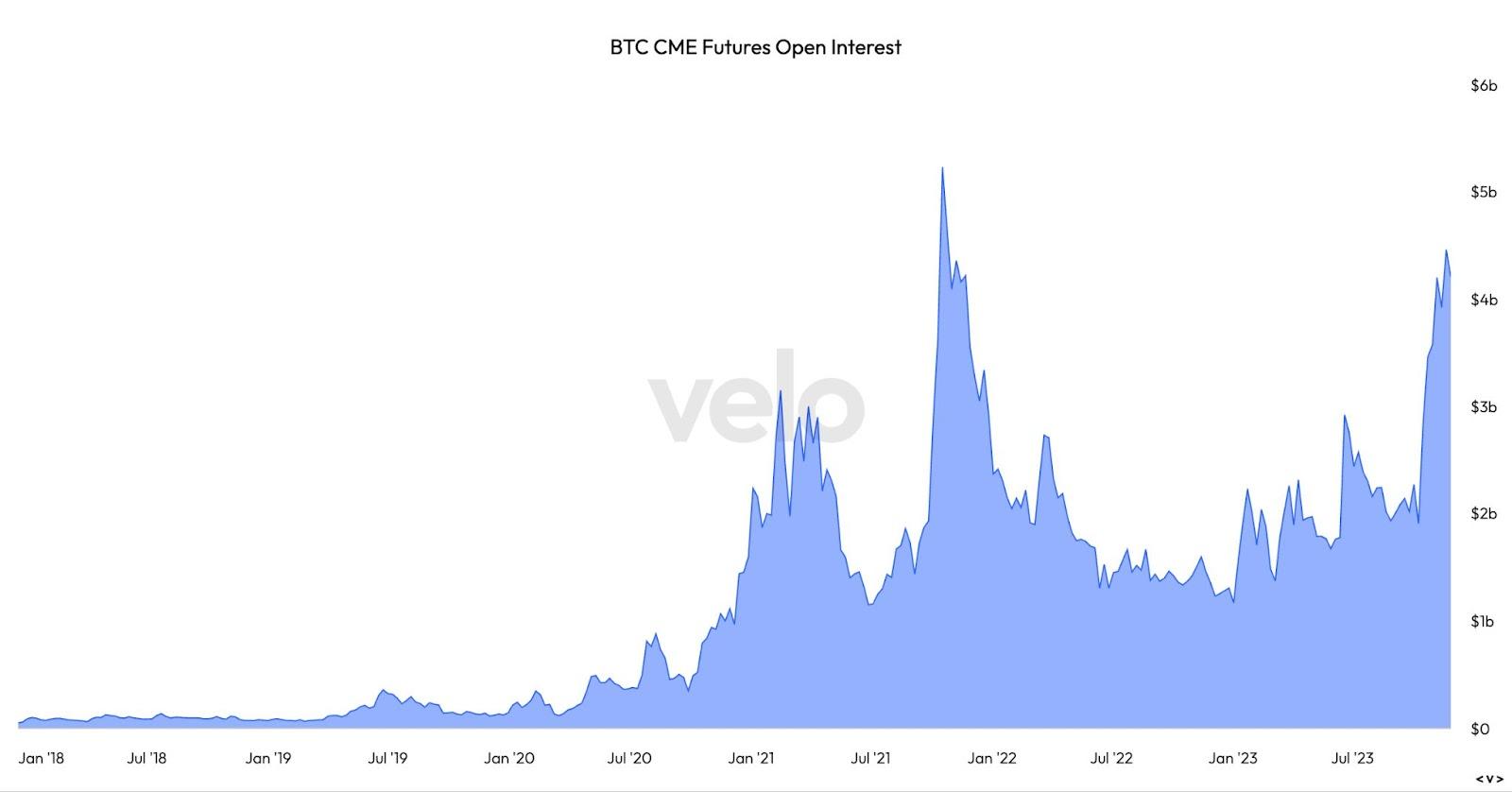

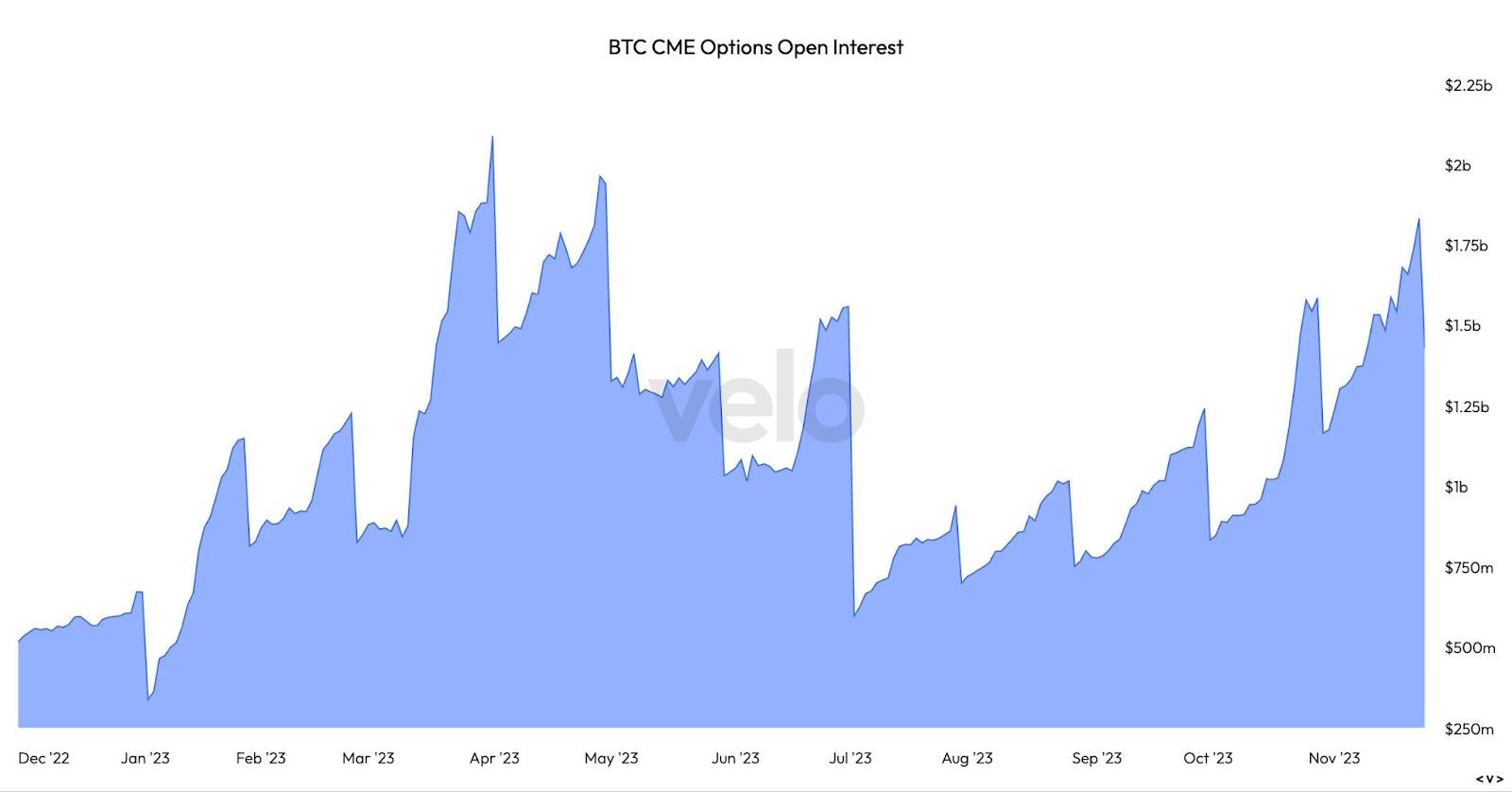

We will now take a look at TradeFi and how they’re positioned.A lot of TradeFi trades using Options or the CME. We can see below that both volumes have spiked to massive levels, both just shy of their all-time highs.

BTC CME Futures Open Interest

BTC CME Options Open Interest

Both charts above show us that TradeFi is now participating in trading Bitcoin with far greater volumes than in most of the years before.

What also supports this is that the GBTC Premium is trading back close to parity, now at just -8% to NAV. A year ago, this traded at -48%.

Cryptonary’s take

The above shows us that from an on-chain perspective, price may be due for a slight cooling in the coming weeks before the ETF decision.If a price pullback resets some of the on-chain metrics, we would be buyers of this pullback for Bitcoin.

It’s clear that TradeFi is participating, and with close to record volumes, they are trying to front-run the ETF.

If ETF applications are approved in early January, we can see a slight pullback for price in the weeks that follow as those that have front-run will likely look to close out for some profits.

However, we expect that the approval of several ETFs will see large amounts of USD inflows in the months that follow.

Therefore, if there is a price pullback in the coming weeks, we will look to get close to fully exposed.