- the past week of price action

- where we think we're at in the cycle

- how we are building positions (mostly in altcoins) going into the rest of 2024

Last week's worth of price action

In the last week or so, BTC has broken down from its bear flag to fill Target 1 and touch Target 2.This was a really clean technical pattern that we called while price was still in the flag - pre-breakdown.

So far, we called for the local top on the day the ETF launched at $48k ($49k) and for price to pull back 20%-30% from this high in the coming month or two.

This price pullback has happened much quicker than we expected, which now opens the door to more possibilities in the coming months. But we'll pick this topic back up further down in the update.

Let's now address Grayscale first.

Essentially, GBTC is seeing large outflows, which are being market-sold most days.

Fortunately, the other ETFs are picking up the majority of this supply. But, demand generally has fallen.

Price moved into a 21-month high, so a 20%-30% pullback is still considered healthy in a general uptrend.

So, we are not worried here, to be honest.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Where are we in the current cycle?

We are 3-4 months before the next halving.But, looking at the last halving, for six months past the halving, price stayed range bound between $8,600 and $12,200.

Yes, this is a 50% increase, but price predominantly stayed around the $10,300 mark.

And the high was $13,800, 10 months before the 2020 halving. If the current halving is in April, then we could expect prices to stay somewhat "subdued" until potentially September time, having seen local highs come pre-halving.

This is just something to consider.

Now, also looking at the last halving, we had a strong performance from the market approximately ten months before the halving.

In this new cycle, we've had a strong performance from the market 4-7 months before the halving in April.

In our opinion, both situations seem remarkably similar so far.

We have attached a Weekly BTC chart to best show this. We have also attached some key on-chain 'Market Indicator' metrics.

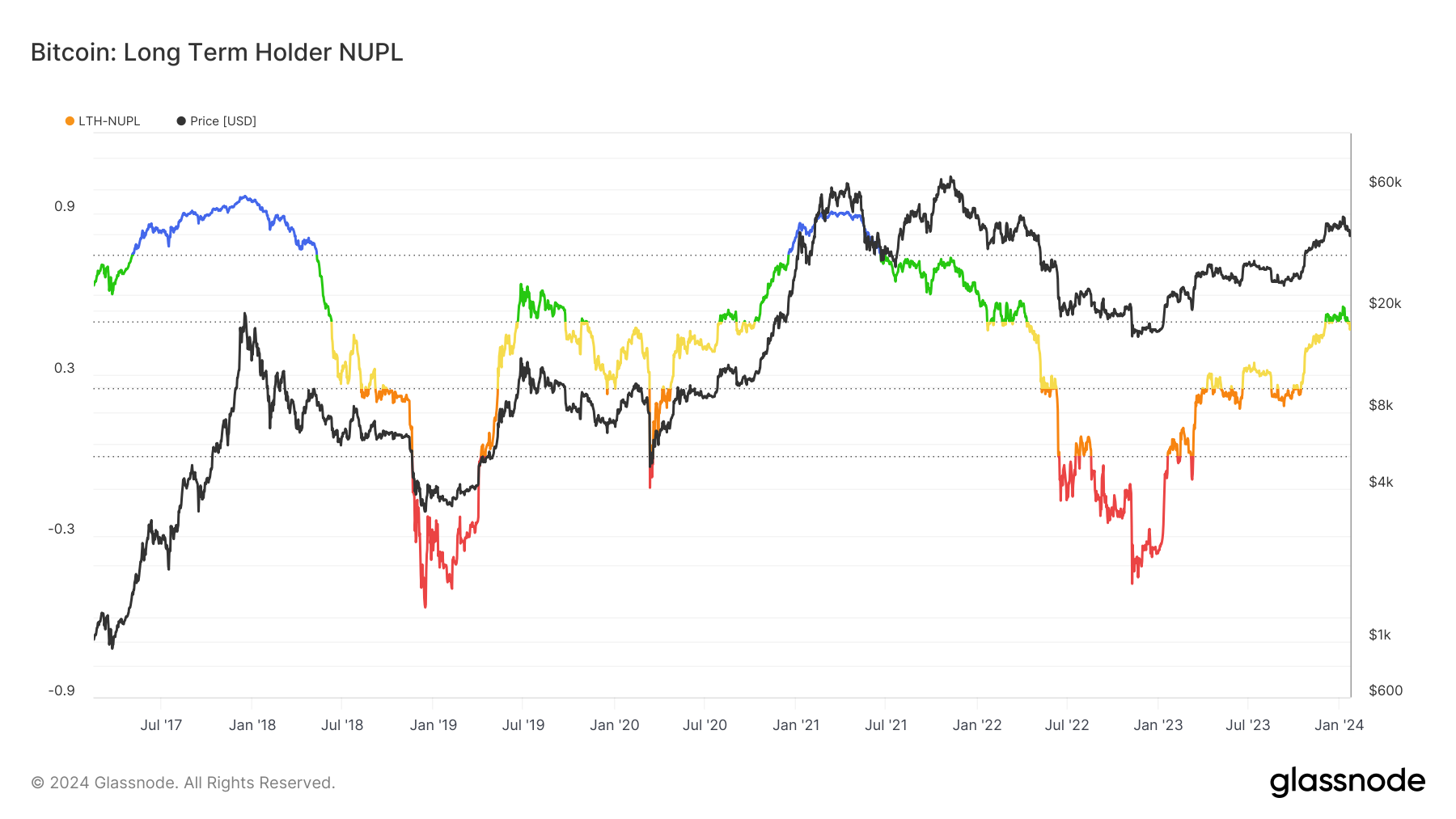

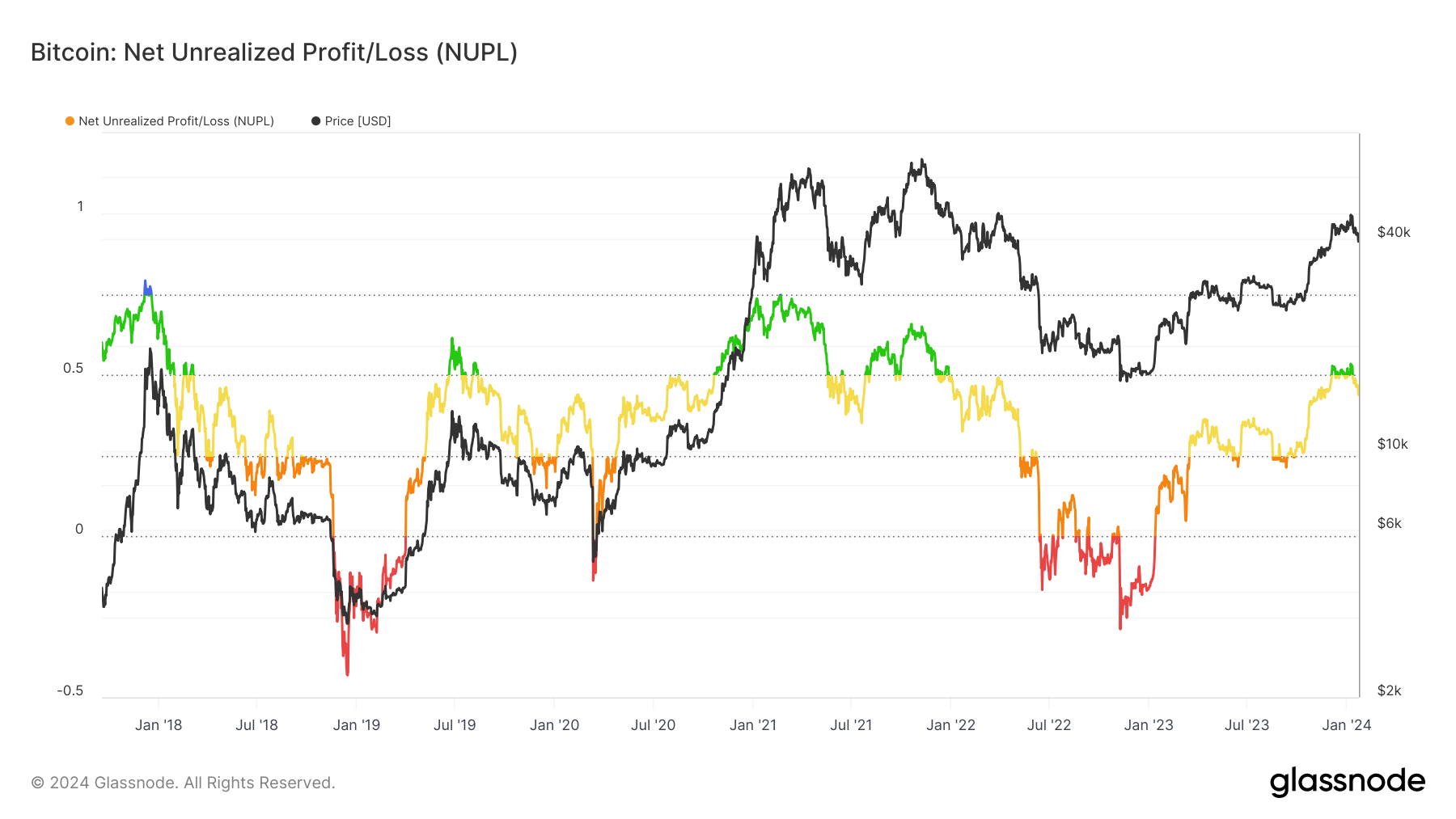

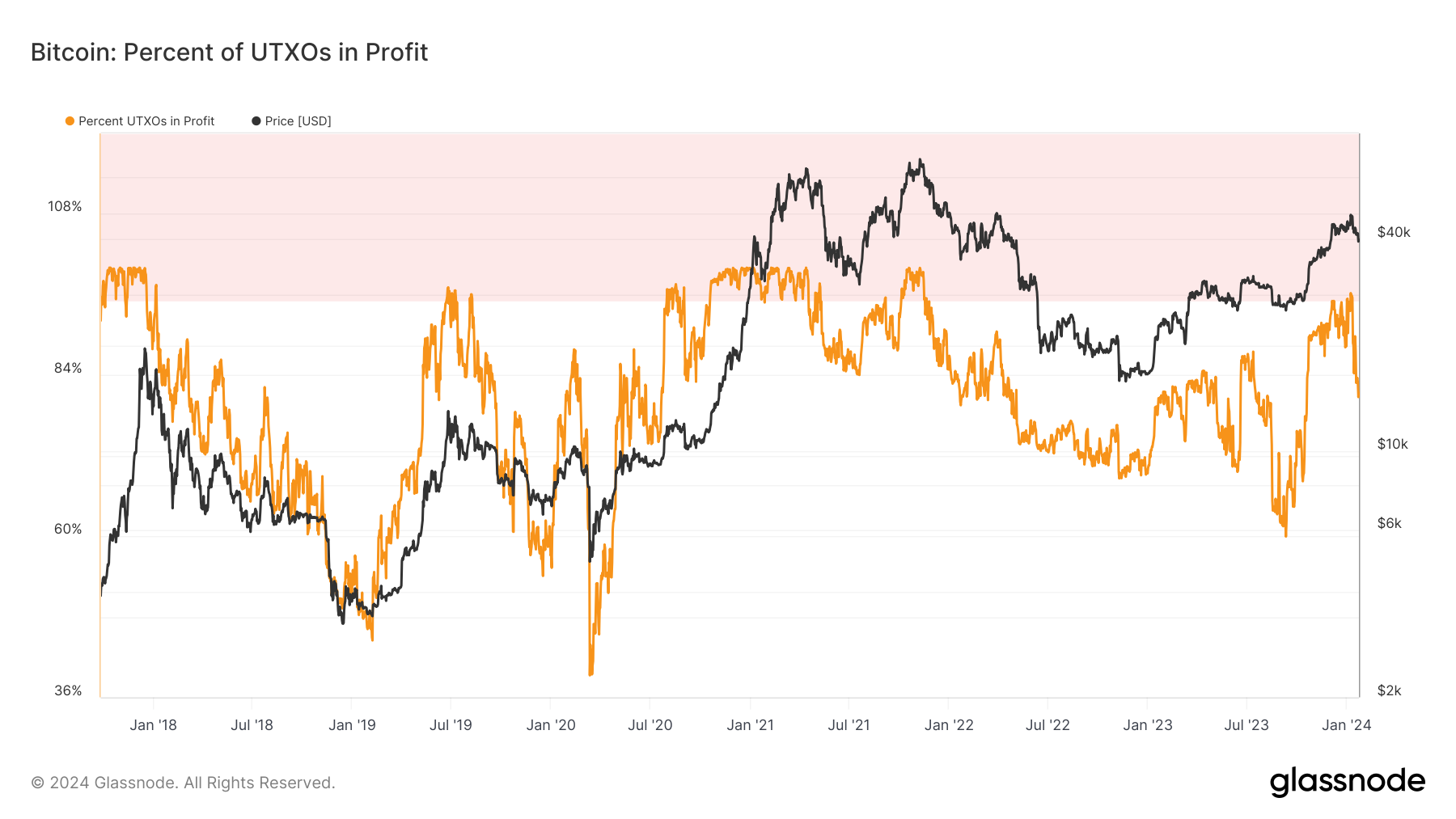

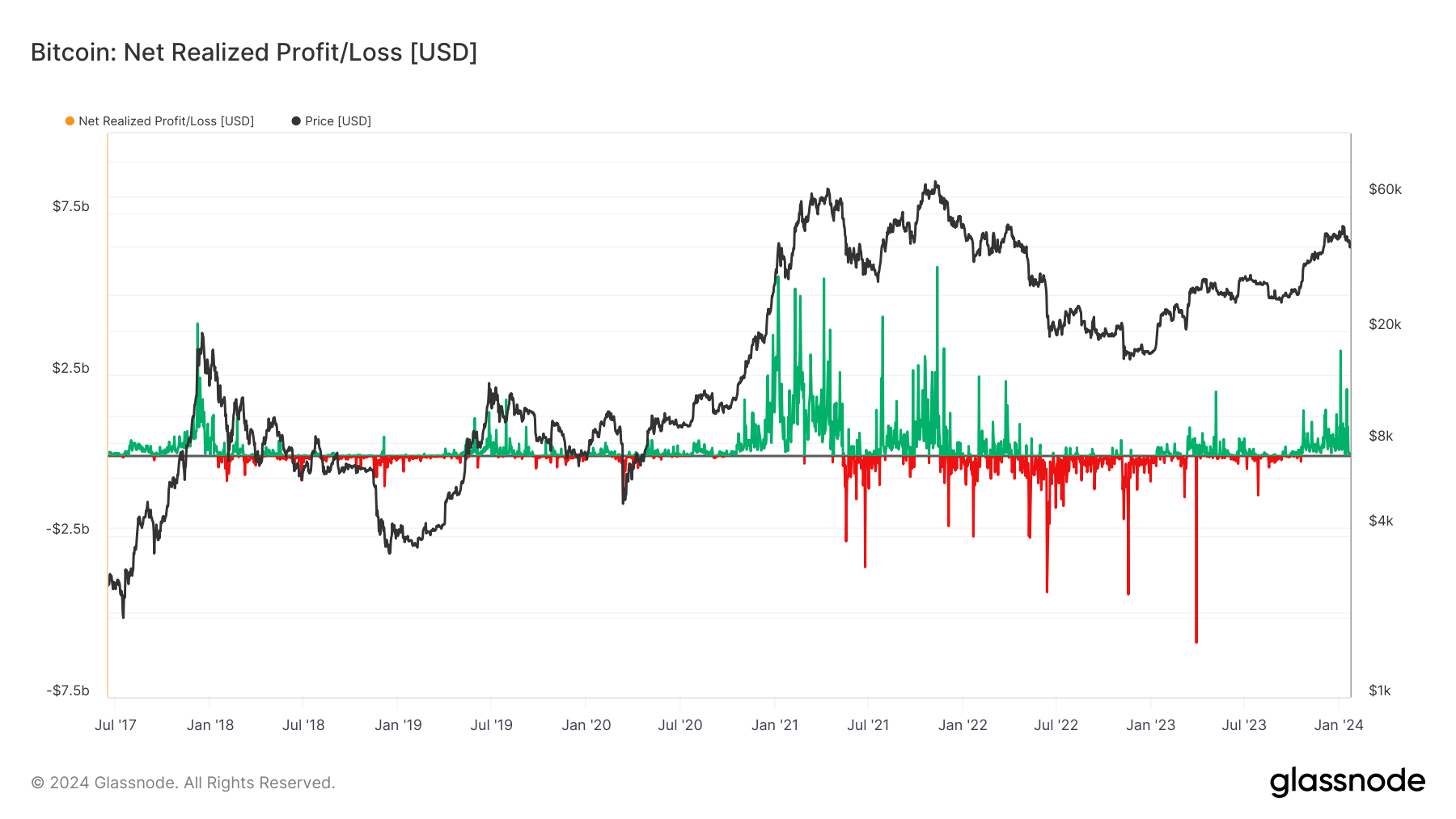

On the on-chain metrics, you should focus on the summer of 2019 and now.

The metrics look very similar, and if 2019 is worth going off, then it could be the case we have several months of downward or, at best, stagnant price action going into and maybe in a couple of months following the halving.

$BTC weekly chart

Now, closely assess the similarities between summer 2019 and today on the on-chain metrics.

Long-term holder NUPL

Net unrealised profit/loss

Percent of UTXOs in profit

Net realised profit/loss

Now, attach to this the fact that the RRP facility is now at $600b, having been at $2.2 trillion. This has so far offset quantitative tightening (QT) in terms of liquidity, yet the RRP is likely to be at 0 by the end of March; then, there may be a liquidity issue on the horizon.

Alongside this, the BTFP (Bank Term Funding Program) set up to allow banks to deposit Treasuries and have them marked to the price paid for the Treasury is supposed to close in March.

To avoid more Bank failures, Yellen will likely have to extend the BTFP's duration.

But let's see. Either way, you're pairing the BTC price action, the on-chain metrics and what they're showing with a potential macro market liquidity crisis in March/April.

For context, the last time Repo drove a liquidity crisis was in November 2018. If you're asking yourself if crypto will be immune from a liquidity crisis, here is a BTC Weekly chart of 2018/early 2019.

BTC weekly chart - 2018/2019

Now, a liquidity issue isn't guaranteed to happen in March/April time, but the FED and the Treasury are beginning to run the risk that one does happen once the RRP depletes to $0, which it looks like it will do sometime in mid/late March (in 2 months).

Cryptonary's take

How are we looking to play this?In terms of building altcoin positions and attractive entry prices, we have tried to explain this better in the video below.

Essentially, our Head of Analysis has taken profits on some positions in the past few weeks, but mostly BTC.

The aim is to re-buy sub $37k; he is also not buying a full size and allocating more capital into altcoins.

Alongside this, he will keep adding more USDT to his pot every month, which will be used to keep buying.

Now, the timeline on this is what's key in our opinion. Looking at the above, we may have a liquidity issue in March/April, which would be a good buying opportunity.

Also, price was quite stagnant for several months following the halving, so we have at least a few months to keep building positions.

On top of this, if the on-chain metrics are showing 2019 to be similar to now, then it's possible they can pull back further also. When they start getting to those pullback zones, that would signal us to risk-on more.

Overall, may have another 4-5 months to build altcoin positions. So, if we like certain altcoins, we will buy them when we consider the price attractive.

If the price of a certain altcoin never comes down to the level we consider attractive, we won't chase and buy it; we’ll go into the next bull run without that coin.

Cryptonary, OUT!