Market Direction

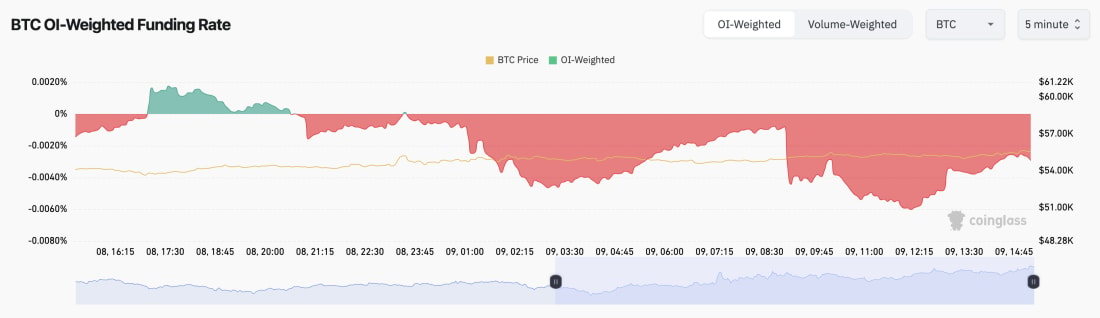

- In BTC terms, Open Interest has increased slightly over the past few days and the Funding Rate has turned more substantially negative.

- Traders are now paying a premium to be Short here. This provides the setup for a slight furthering in the relief rally that we're seeing.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

BTC funding rate:

Technical analysis

- Prices across the board moved down meaningfully last week. For BTC, price found support and bounced from the major horizontal support we have had outlined for many months at $52,800.

- Price is now below the grey support box ($56,500 to $58,000), which will now likely turn into new resistance.

- Beyond the grey box, $60,300 will likely act as a resistance for price in the short term.

- BTC is currently squeezing into a local downtrend line; a breakout could see price rise to and retest $58,000, although we're not confident in the short term that it will return above this level.

- To the downside, we expect the $48k to $52k area to be a large area of support.

- BTC has put in a bullish divergence (lower low in price but higher low on the oscillator). This can help push BTC up to $58k.

Cryptonary's take

Over the coming days, we expect risk assets (Bitcoin included) to have a continuation of the relief rally. However, we expect this to stall around or just shy of the $58k level. Following that, we expect a move back down to the low to mid-$50k area. The next few weeks will likely see substantial volatility, and we think we'll see BTC trade between $52k and $58k during this period.We're not necessarily on board with the view that Bitcoin will materially break down below $48k, as we see some calling for on Twitter. If BTC were to re-visit the late $40k region, we would be strong buyers in that zone.