XRP cools off after fake ETF news, but long bias remains

Yesterday was a whipsaw day for XRP after prices spiked on the false news of a Blackrock-backed ETF before violently reversing those gains. XRP has now settled into a range between support around $0.64 and overhead resistance at $0.70. While the erratic price action helped shake out some excess leverage from the derivatives market, a bias to the long side remains.

TLDR

- XRP surged on fake ETF news, then quickly gave back gains.

- It is currently rangebound between $0.64 support and $0.70 resistance.

- The pullback helped cool excessive leverage, but the long bias persists.

- XRP needs to break out of the range to signal the next significant move up.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Technical analysis

When the fake news of an XRP ETF filing broke yesterday, XRP stormed higher into the $0.70 horizontal resistance. However, the move was quickly retraced, taking XRP back to the $0.65 level.XRP remains in its uptrend while also holding above the horizontal support of $0.62 to $0.64. Until this level is broken, we should remain constructive on XRP. Like several coins, XRP is in a key range between $0.64 and $0.70. A break or retest of one of the borders of the range is where we may get a further volatile move.

The RSI shows a healthier setup in that on the daily timeframe, we’re at 62, well below overbought territory. This should aid XRP to go higher in the short term, assuming the rest of the market can hold up.

XRP 1D

Market mechanics

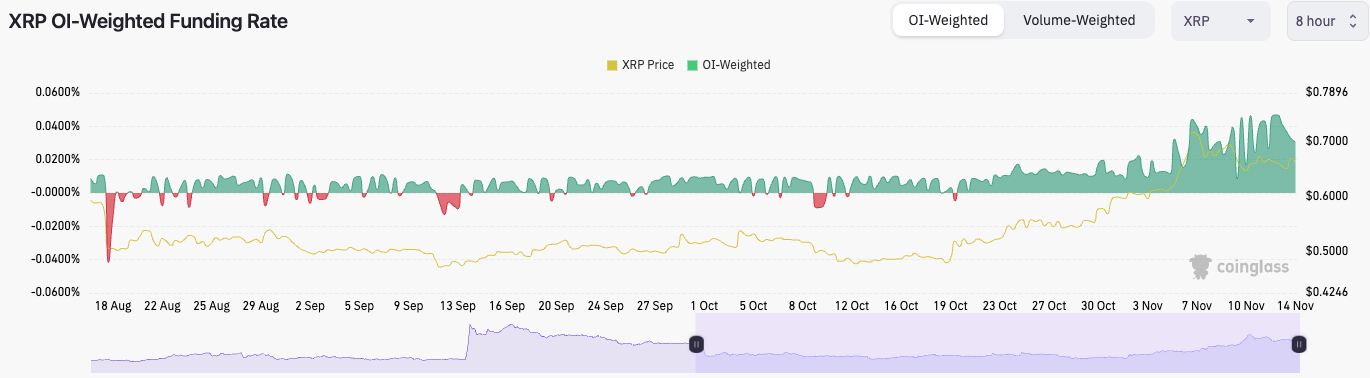

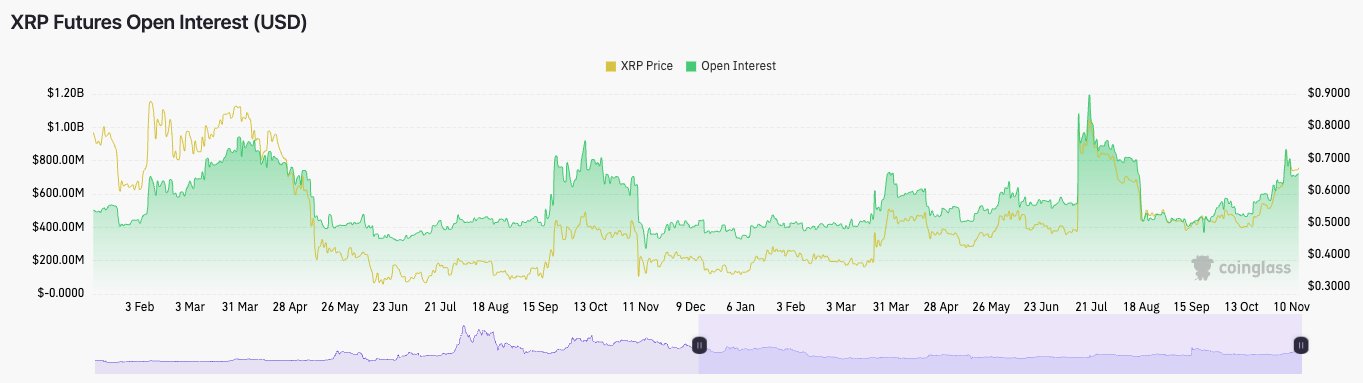

The funding rate for XRP is very positive. However, the amount of open interest has come down meaningfully in the past day - likely due to yesterday’s massive move higher and then immediate retracement. The number of longs and shorts is likely closer to being balanced, but the weighting remains towards longs.

In terms of open interest, this is at a healthier point because it’s not massively high. It’s increased like many other coins have, but it’s not alarming enough to indicate too much froth here. But there is the positional bias amongst traders to be long.

Cryptonary’s take

XRP remains in an important range between $0.62 and $0.70. The move yesterday shook out some of the froth in the derivatives market, although there is still a build-up of open interest with the bias to be long.We’re unsure about the market overall; it looks as if prices need a further pullback to reset some of the open interest and go through a consolidatory phase that can fuel prices to go higher in the medium term.

We’re currently not taking any positions in XRP; if there were a break below $0.62 horizontal support, we would likely buy the landing zone for that, potentially the $0.55 to $0.57 area.