Grayscale has chosen to stand tall against the SEC, embarking on a legal journey with vast implications for Bitcoin and its future trajectory of the entire crypto market.

And you know what? The lawsuit's outcome could set a historic precedent, marking a turning point in the cryptocurrency industry.

This story is of high stakes, legal battles, and possibly the key to Bitcoin's golden age.

Buckle up; it's going to be a thrilling ride!

TLDR 📃

- Grayscale seeks to convert its Bitcoin Trust into a Bitcoin Spot ETF to address the trust's trading discount.

- Grayscale has filed a lawsuit against the SEC; there’s a 70% chance of success.

- The outcome of the lawsuit will affect the approval of Bitcoin Spot ETFs.

- A positive outcome in the lawsuit could lead to a potential 50% increase in BTC price this year.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your full responsibility.

Why does Grayscale want a Bitcoin Spot ETF? 🤔

As a powerhouse in crypto asset management with a staggering $30 billion portfolio, Grayscale is no stranger to the crypto landscape. Its crowning glory? The Grayscale Bitcoin Trust (GBTC) is a behemoth holding $19.6 billion worth of Bitcoin.

However, there's a glitch in this matrix. GBTC's design denies investors access to the underlying Bitcoin, which they can't redeem. This is a troublesome constraint with profound financial implications.

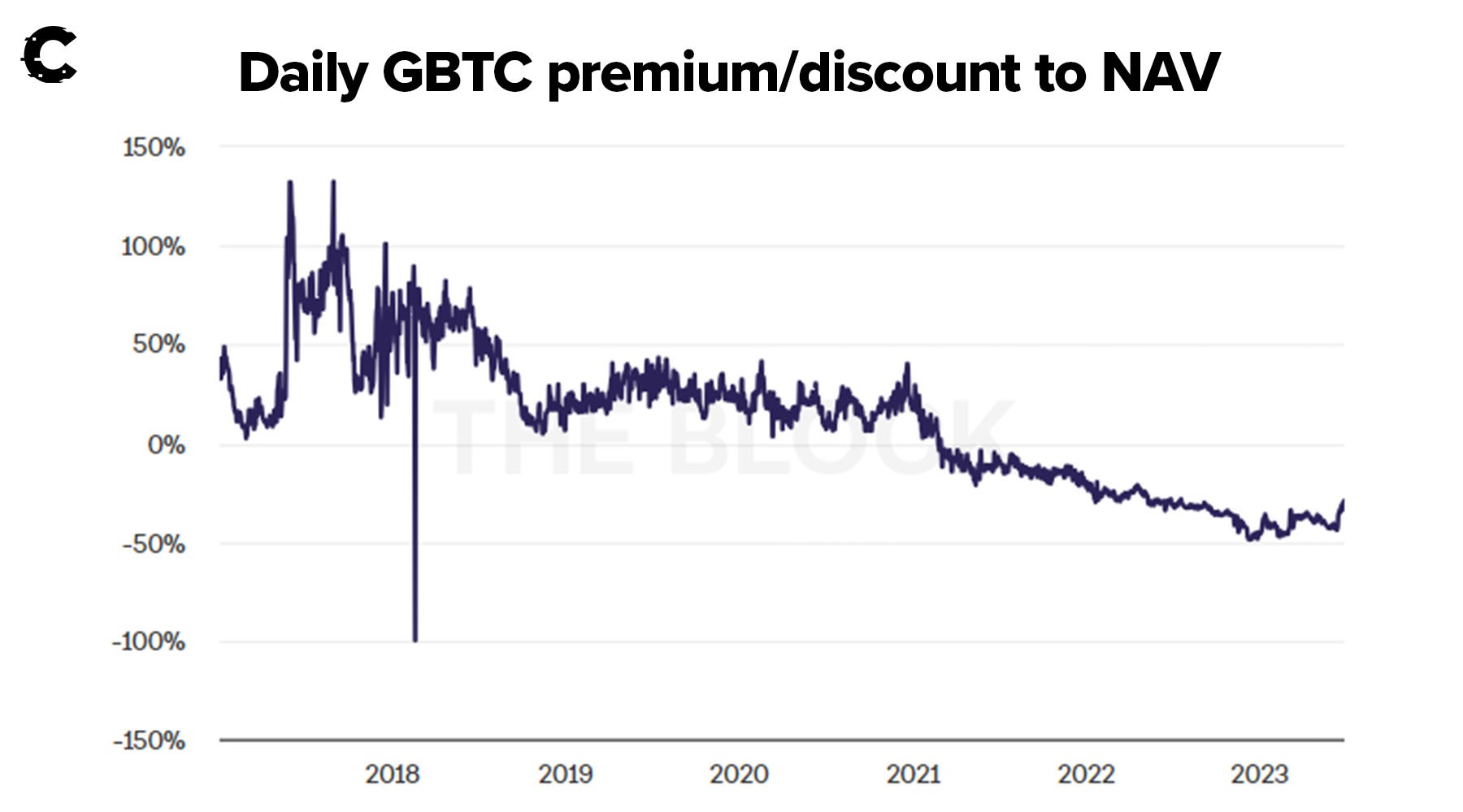

For instance, even though Bitcoin is trading around $31,025.30, the Trust's shares trade at a steep 29% discount, leaving investors with a disappointing $22,028 per share. Investors who want to exit the asset will have to do that at a loss relative to BTC’s price.

Recognising this fiscal pitfall, Grayscale has been steering towards converting the Bitcoin Trust into a Bitcoin Spot ETF. This pivot would enable the ETF to mirror Bitcoin's price and offer investors a chance to regain lost ground.

However, this strategic pivot has met with resistance from the SEC, adding a new layer of complexity to this riveting tale.

Crypto chess: Grayscale takes on the SEC ♟

In Q4 of 2021, Grayscale took a definitive step to solve the problem. This meant filing the first application for a Spot Bitcoin ETF. However, the SEC rebuffed the attempt, citing market manipulation concerns.

Grayscale, irked by the fact that Bitcoin Futures ETFs received the SEC's nod—despite being similar to its proposed product—decided to take the legal route. In February 2022, Greyscale sought judicial intervention to decide the fate of its ETF.

This lawsuit now sits at the crossroads of the Spot Bitcoin ETF's potential approval. If the court rules in Grayscale's favour, the SEC will be compelled to greenlight the ETF.

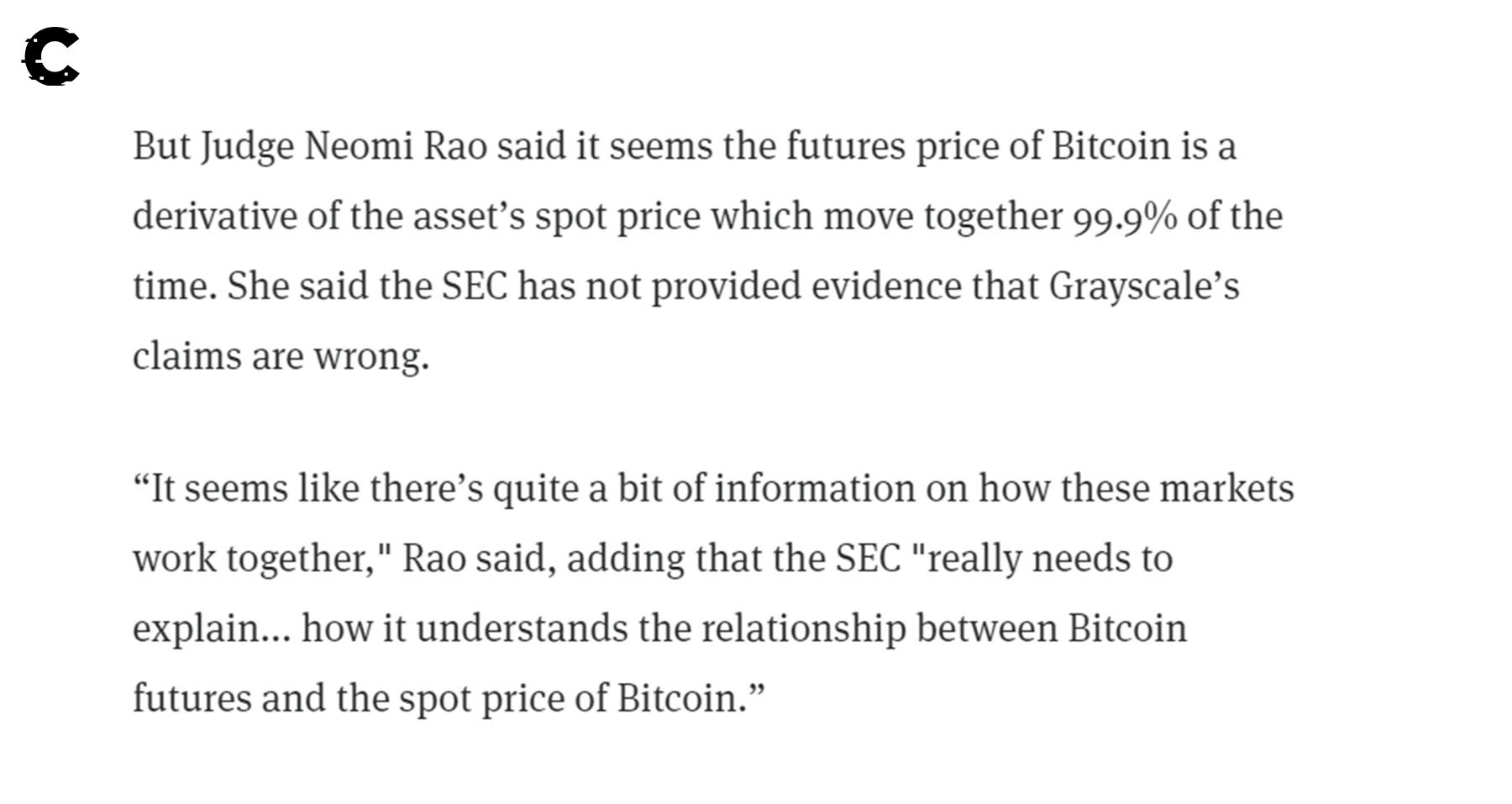

Encouraging signs have emerged from the courtroom. Judge Neomi Rao, in a hearing on March 7, hinted at the SEC's failure to counter Grayscale's assertions, indicating a possible tilt towards Grayscale.

While the final verdict is anticipated between August and November, Elliott Z. Stein, a noted Bloomberg litigation analyst, places Grayscale's victory odds at a hefty 70%. If he's correct, the crypto world could soon welcome the long-awaited Spot Bitcoin ETF.

How Greyscale’s lawsuit impacts the other spot ETF applications 💼

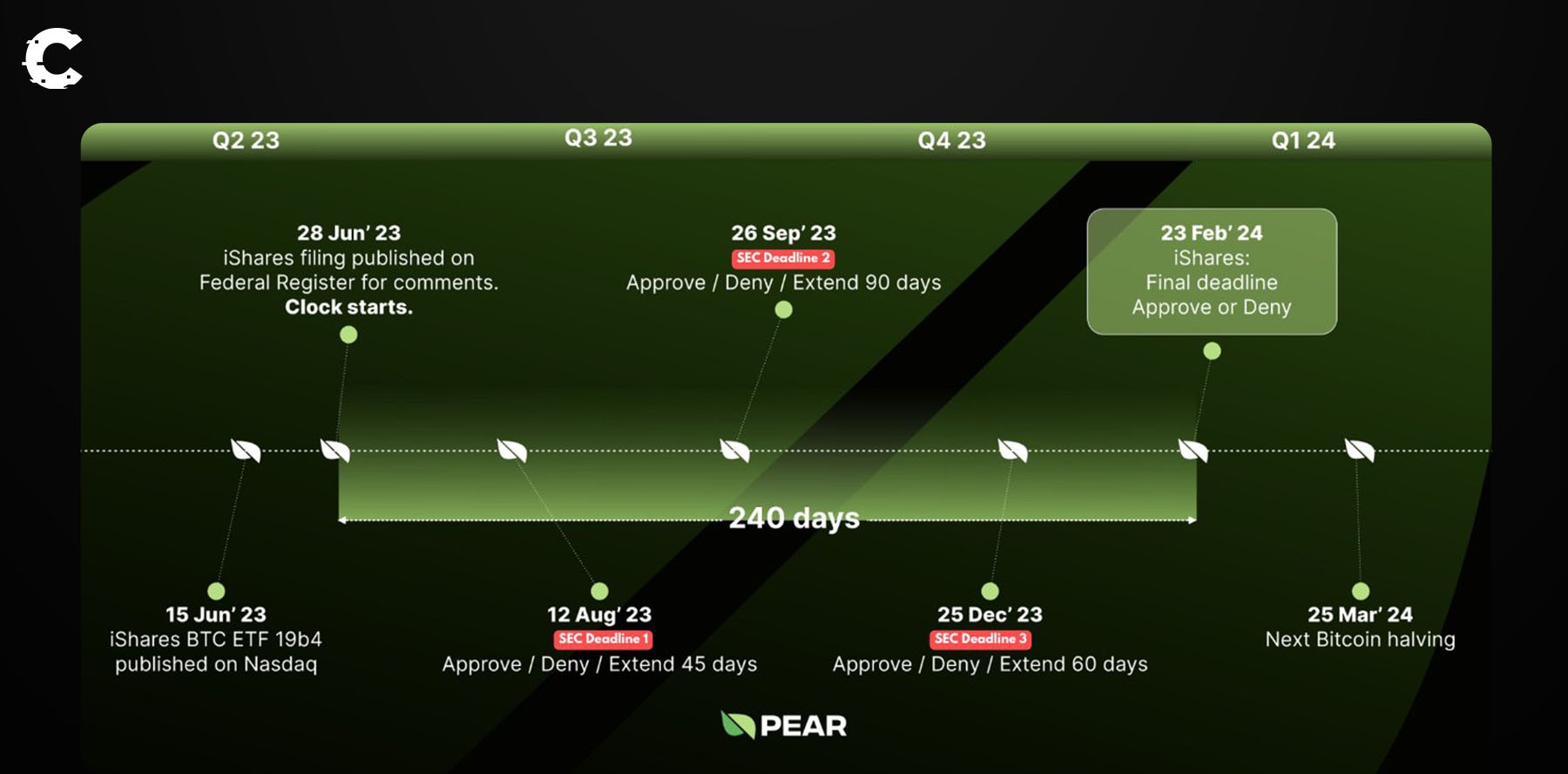

As Grayscale's lawsuit stirs the pot, other ETF giants like BlackRock, Fidelity, and ARK Investments aren't idle. They're racing to file for their own Spot Bitcoin ETFs, eyeing a pivotal edge if Grayscale clinches a courtroom victory. There’s a significant first-mover advantage to being listed first.

Numerous other providers have hastily submitted their bids to counter this potential advantage. As a result, the SEC now faces multiple deadlines in 2023, from August to December, to review and approve these ETFs.

Among these contenders, BlackRock commands attention. Notoriously conservative, it has steered clear of Bitcoin ETFs despite their giant footprint in asset management. With $10 trillion in assets dwarfing Grayscale's $30 billion, BlackRock's entry into this sphere is nothing short of groundbreaking.

Rumours suggest the SEC might use BlackRock as a safe harbour, avoiding a potential legal defeat and circumventing the approval of Grayscale's ETF. After all, Grayscale is a crypto company, while Blackrock is a well-known TradFi behemoth. BlackRock's political influence and traditional market expertise make it a favourite pick for the SEC to save face pre-verdict.

With the unfolding drama, 2023 could see the debut of a Bitcoin ETF. But with multiple scenarios at play, it's time to dissect each and gauge their potential impact on Bitcoin's price.

Predicting the future: Three potential scenarios unveiled 🧮

Here’s what we want!

This is the most favourable outcome, with a 30% likelihood. Grayscale will emerge victorious, or the SEC greenlights BlackRock's ETF by fall. It could set the stage for a Bitcoin Spot ETF debut, rocketing Bitcoin's price to a potential $40K-$45K by year-end.

Here’s what may happen

This is the most likely outcome, with a 50% chance. We could witness a lawsuit delay or ETF approval spill into early 2024. While it's a positive sign with no outright ETF denial, Bitcoin's price may hover around $35K-$37.5K due to the prolonged decision.

Here’s what nobody wants

In a grim 20% probability scenario, Grayscale loses, and the SEC disapproves of the ETF. This might bruise the market, potentially driving Bitcoin prices down to a $25K-$27.5K range.

Cryptonary’s take 🧠

The fate of the long-awaited Bitcoin ETF hangs in the balance as we sit on the precipice of a potentially game-changing legal dispute between Grayscale and the SEC.

While the financial world is buzzing with BlackRock and other ETF aspirants, the real game-changer is the outcome of Grayscale's lawsuit.

With an expected decision by late summer or early fall, we have ample time to brace for this potential crypto earthquake. It could ignite the market, rocketing Bitcoin upwards should Grayscale pave the way for a Bitcoin ETF.

The odds seem enticing. Our analysis suggests minimal downside risk. A green light for the ETFs could usher in a Bitcoin surge of up to 50% this year, even before the anticipated 2024 Bitcoin halving.

Conversely, the worst-case scenario is a modest 19% drop from our current standing. The stage is set for a thrilling year in the crypto world!

As always, thanks for reading! 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms