However, finding a dying project that’s on a rebound and betting on it before its full resurgence – that’s the stuff of legends.

The crypto market is littered with tokens that appear to have died a final death, whether through exploits, market conditions, poor management, or otherwise.

Yet, on rare occasions, we spot a dying project rising like Phoenix being reborn from the ashes. Today, we make a contrarian bet on one such project.

This DeFi project is making a comeback after being down in the dumps and left for dead by the mob.

This is a play for the degens, but the rewards for pulling it off are BIG.

Ready to go against the grain? Let’s dive in!

TLDR 📃

- A promising DeFi protocol suffered a devastating exploit, causing its token price to crash from its peak.

- The protocol recently secured fresh VC funding, it has launched a new product, and it has renewed interest despite the previous incident. Could this be the start of a turnaround?

- The project is still at a micro-cap level below $2 million, but it offers a moonshot upside potential if there’s sustained positive momentum behind its resurgence.

- Based on favourable protocol growth and valuation scenarios, price targets for the neglected token range from 10x to 43X compared to today's prices.

[player id='288566']

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the R:R trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

What is unshETH? 🏛️

unshETH was born after some people saw the huge market share that Lido Finance has within the Ethereum liquid staking ecosystem, and they started asking the right questions. The main question is, “How decentralised is Ethereum truly if one protocol holds 33% of the overall staked ETH?”

And so, they devised a solution that leverages competition to breed innovation.

unshETH is a protocol designed to promote decentralisation in the Ethereum staking ecosystem by strategically allocating capital across multiple LSTs to counter validator centralisation.

unshETH does this through their derivative token of the same name (unshETH), which is an index of all the top Ethereum LSTs. It's kind of like a Tech Stock ETF - unshETH has a basket of liquid staking tokens like stETH, rETH, frxETH, etc.

The composition of this index is decided by the unshETH DAO, which is governed by USH token holders.

Essentially, unshETH is a marketplace for LSD protocols to compete for stake while democratising staking participation for everyday users.

What is USH? 🪙

USH is the utility, governance and incentive token of the unshETH network.It has the following uses:

- Governance: USH can be staked through various means to acquire vdUSH, an untradeable token used purely to represent the voting power of a particular wallet. This stake is time-locked, for a minimum of one month and a maximum of one year.

- Rewards: vdUSH holders are rewarded for participating in governance, partly through USH emissions.

- Market cap: $1.4 million.

- FDV: $4.2 million.

- Circulating supply: 47.875 million USH.

- Total supply: 143.5 million USH.

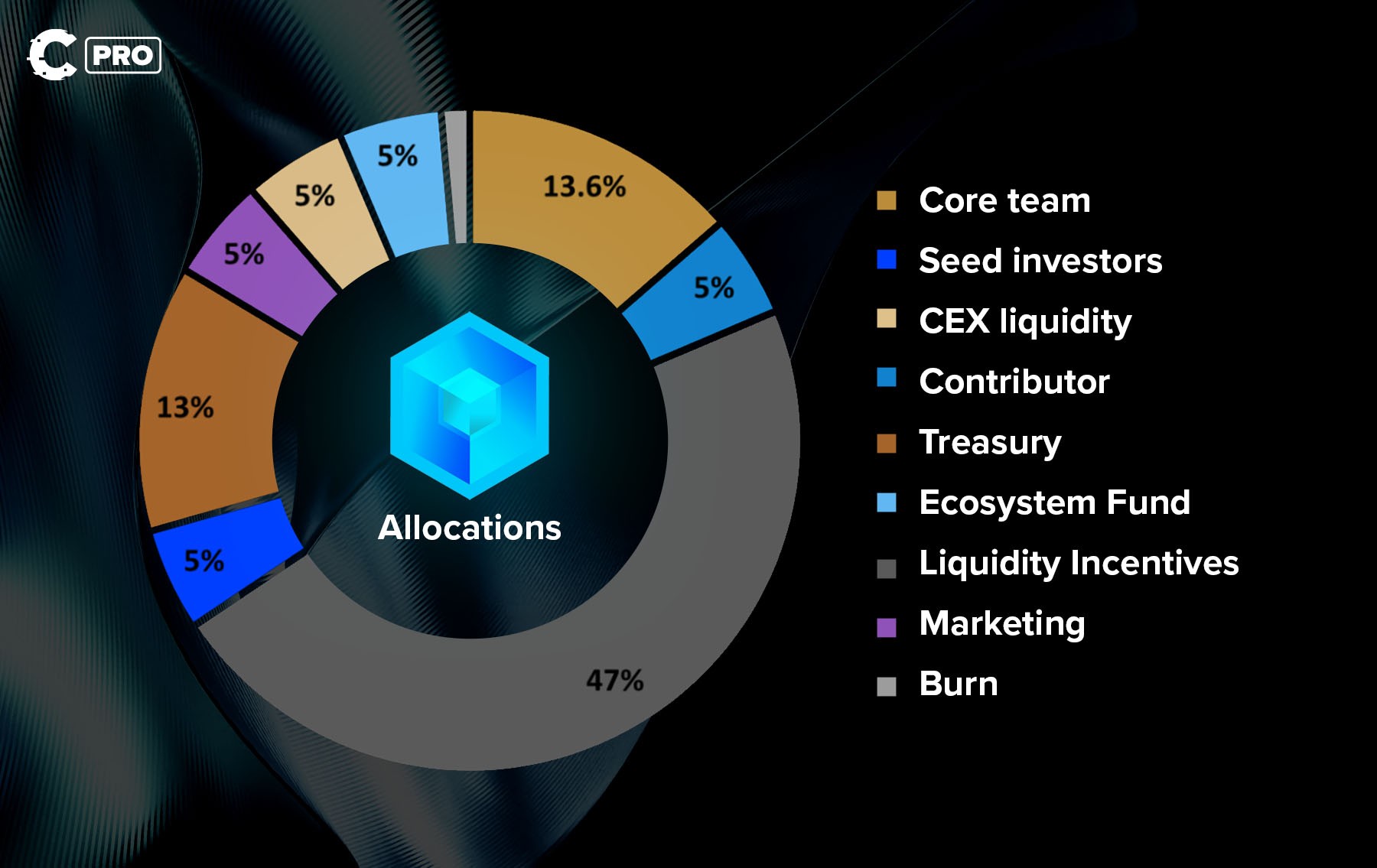

There have been a couple of key changes to the tokenomics (the above chart is accurate):

- Two million USH has been burned from the team allocation, reducing supply by 1.4%.

- 7.2 million USH (5%) has been redirected towards seed investors to bootstrap the development of unshETH.

- Inflation has been cut by 60% to better align rewards with the current TVL and USH market cap.

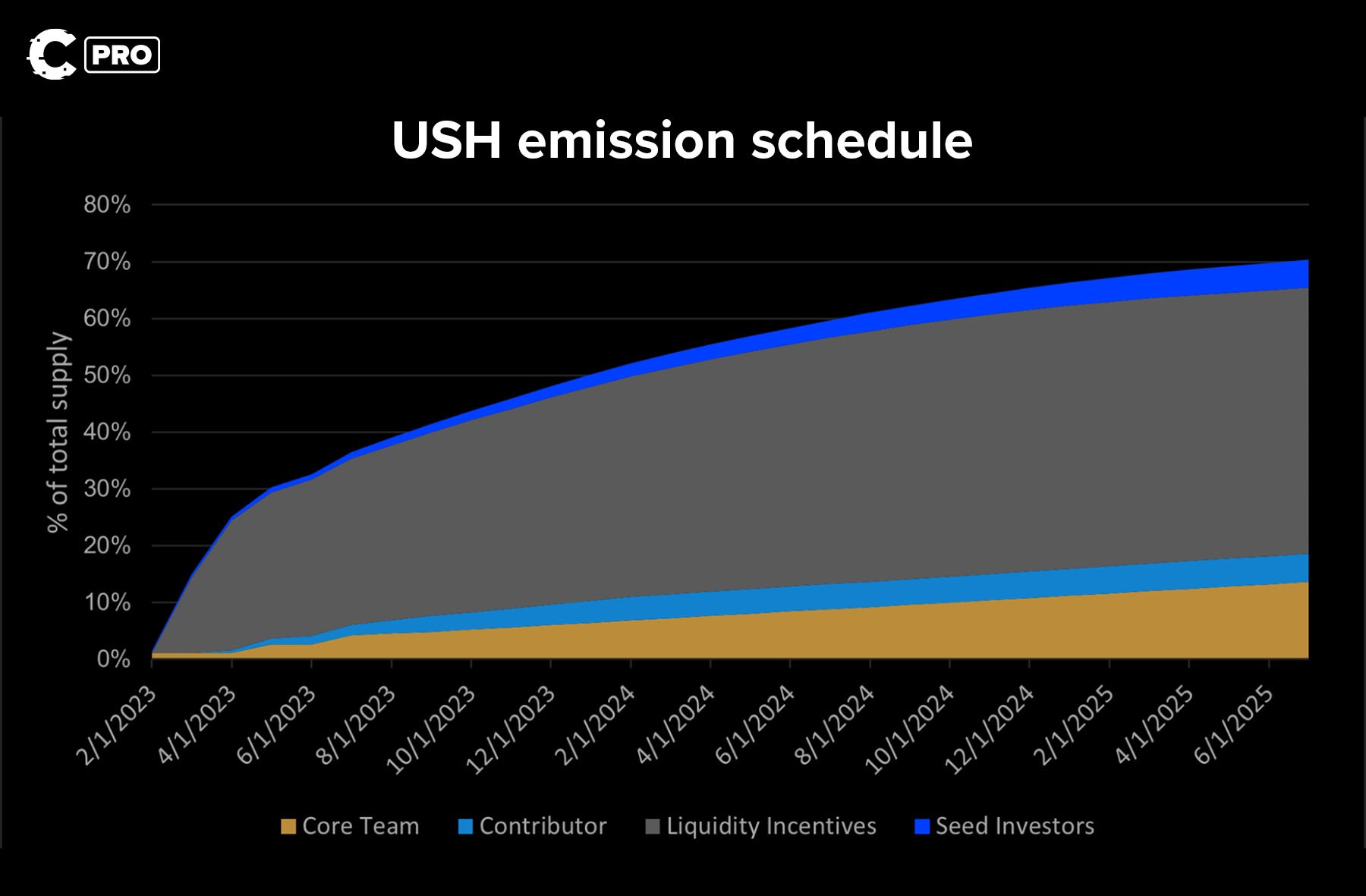

This represents a rough ~20% token supply increase over the next ten months. It’s nothing crazy and will likely be offset by the low market cap.

So, the changes to tokenomics are net-positive for USH - and all of this has happened in the last three months.

The investment thesis on USH 💭

unshETH got a lot of bad press throughout the Summer after a hacker exploited it for $375,000 in June.What happened?

The team accidentally uploaded the private keys for the governance contract to GitHub, giving a hacker unrestricted access to unshETH.

It gets worse!

The unshETH team grossly mishandled the situation; at some point, they seemed to have threatened the hacker and his friends with doxxing. It was a shitshow, if we’re being honest.

Long story short, the media had a field day, the community lost confidence, and unshETH’s TVL tanked from a high of ~$35 million in June to just ~$8.5 million today.

But Cryptonary, doesn’t this scream incompetence at the highest level?

How does the protocol still have any standing?

Well, rather than throw the baby away with the proverbial bathwater, a few crucial developments have largely flown under the radar of most investors.

And those developments are the key to unlocking unshETH’s reemergence.

VC confidence remains unshaken

The first development is that VCs haven’t given up on the project despite all the negativity. VCs don’t give out money for philanthropy, and an early-August raise of $3.3 million says VCs are still betting on unshETH.Of course, this raise came with a redistribution of the team allocation, but it supports the thesis that there is still “meat on the bones” for USH, at least in the eyes of VCs. The raise is hardly the biggest we’ve ever seen, but with these funds, the team has enough ammo to continue operations.

Now, $3.3 million isn’t a lot of money for VCs, and the entire business model of VCs is built around placing lots of bets and hoping for one mega-sized exit. So, what makes the VC investment in unshETH meaningful for retail investors?

Cue in our next point - what has unshETH done with the funds?

Project Sentience

Project Sentience is a phased-launch product, and the first phase was launched last week. The full explainer is expansive, but the TLDR goal is to decentralise the creation of LSDs so that any team can leverage unshETH to create their derivatives.USH will be the governance token for the new product. Obviously, Project Sentience's success will influence USH's price as new participants are incentivised to lock up USH to participate in unshETH’s decision-making.

Other selling points that point to unshETH’s reemergence include:

- LSD-Fi narrative: Let’s face it, the LSD-Fi narrative is far from done. We expect this market to continue growing.

- Low market cap: With an MCap of ~$1.4 million, USH is attractive for obvious upside potential reasons.

- Partnership interest: Despite the bad rep, some protocols still want to do business with unshETH. The partner protocols will be interested in unshETH’s governance, and USH is the route for participating in governance.

But how are we valuing USH?

USH valuation 🏷️

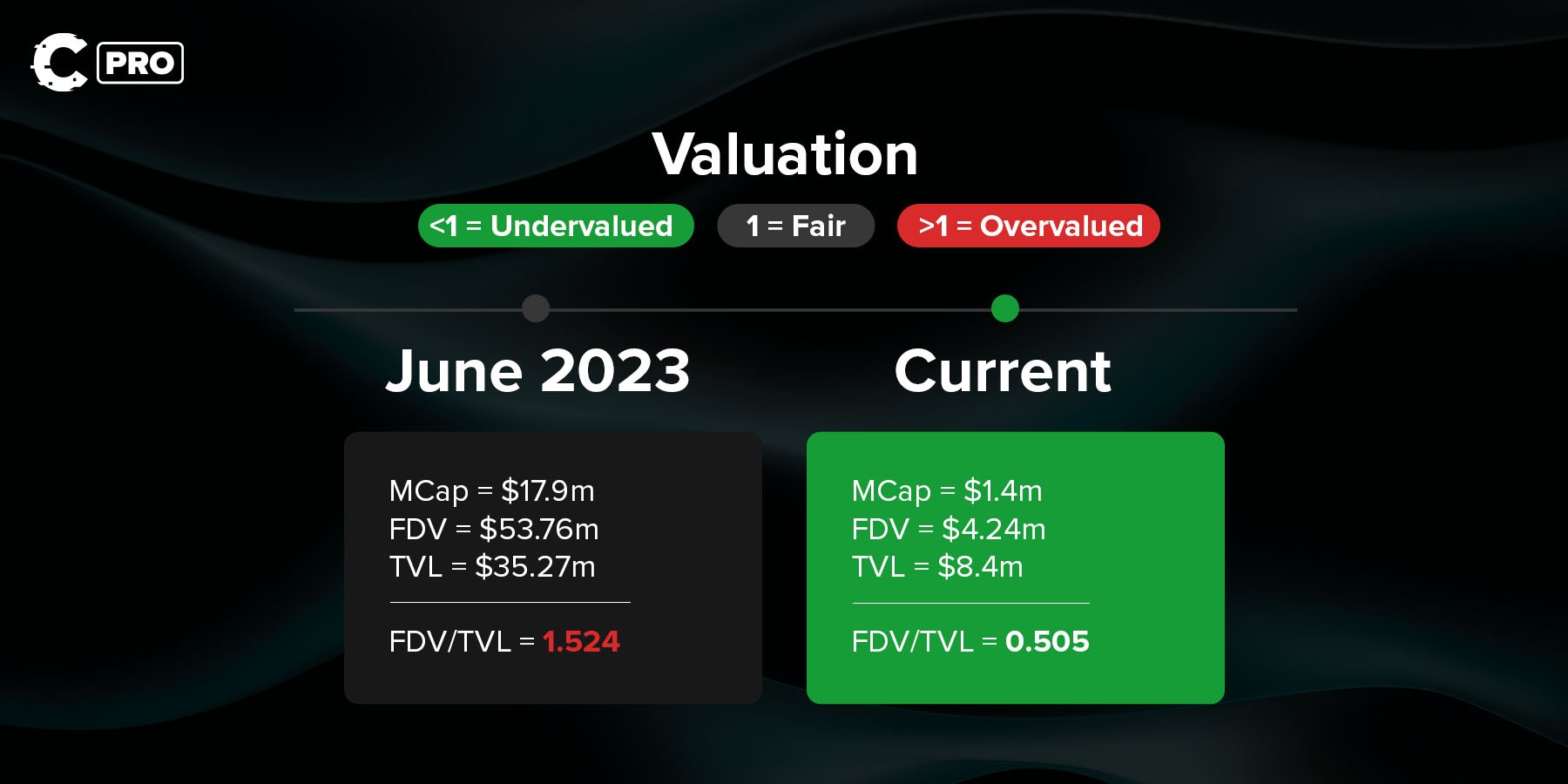

Around the time of the exploit (1st of June), USH had a market cap of $17.9 million and an FDV of $53.76 million. unshETH TVL was $35.27 million at that time.Those numbers gave us an FDV/TVL ratio of 1.524. This means that at that point, USH was overvalued – an FVD/TVL ratio higher than 1 means the project is overvalued.

Currently, USH has an MCap of $1.4 million and an FDV of $4.24 million. unshETH currently has a TVL of $8.4 million. These numbers give us an FDV/TVL ratio of 0.505. This means that USH is now significantly undervalued. In fact, the ratio tells us that for every dollar deposited into unshETH, the market is valuing it at $0.50.

Since we’re basing the projection on TVL, we must find a reasonable target.

The recent interest by Stader Labs to include their LST, ETHx, into unshETH suggests that others will be considering the project.

Stader Labs manages around $120 million in TVL across seven chains. Most of these chains are served by unshETH as well. Subsequently, it does seem reasonable to expect that unshETH will be able to accrue at least $120 million in TVL across all chains from various LSD protocols.

This expectation of a $120M TVL gives us our baseline unshETH protocol performance target - now onto USH targets.

USH price target 🤑

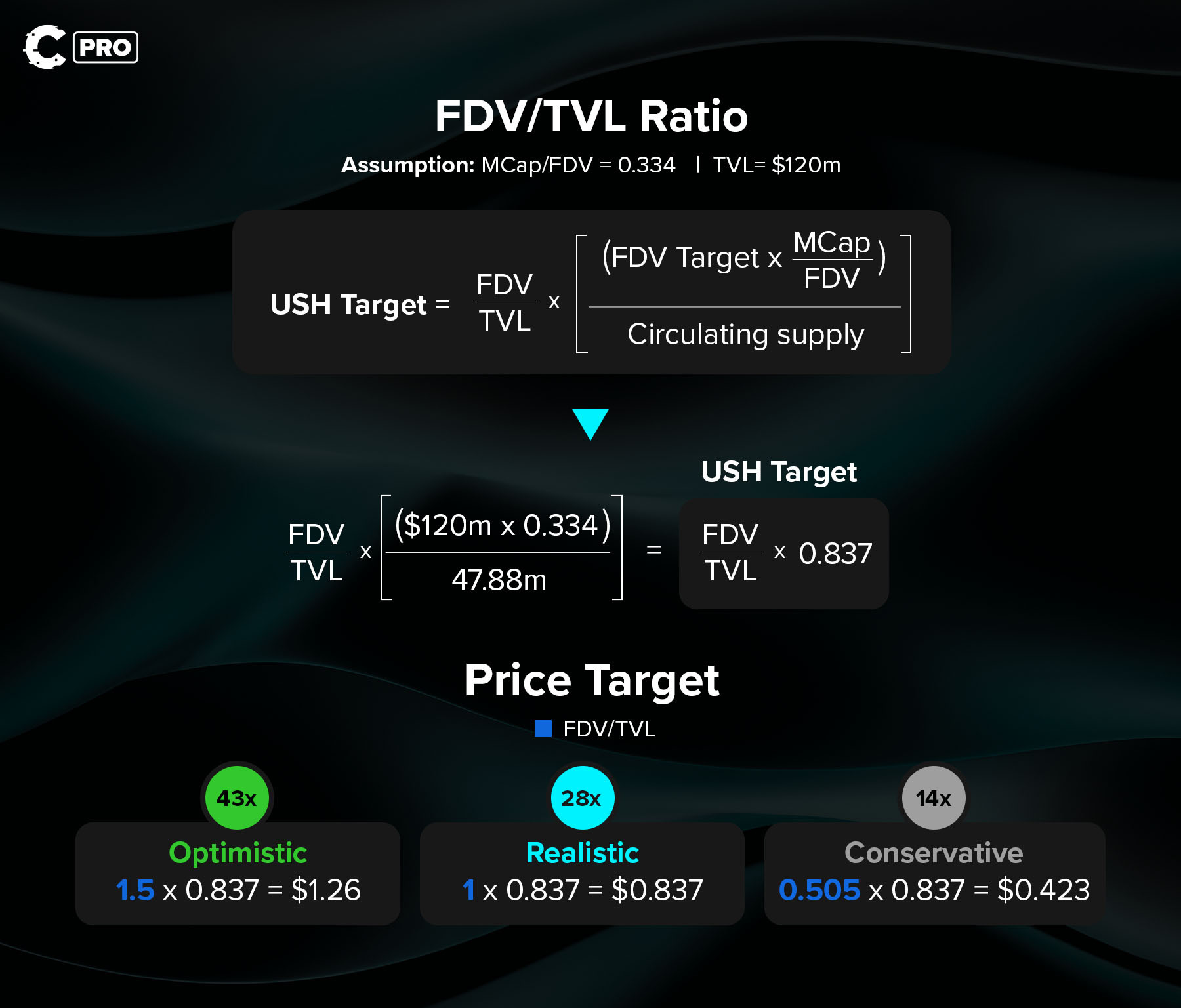

With a baseline TVL of $120 million, we can make USH price projections across the optimistic, realistic, and conservative expectations.The first assumption we’ll make is that the MCap/FDV ratio remains the same (0.334).

The equation we’ll use to get these price targets is as follows:

USH Target = (FDV/TVL ratio * (FDV target * MCap/FDV ratio)) / circulating supply

= (FDV/TVL ratio * ($120 million * 0.334)) / 47.88 million

USH Target = FDV/TVL ratio * 0.837

Targets TLDR

- Current price: $0.0296

- Best case: $1.26, $60.3 million MCap, a 43x.

- Base case: $0.837, $40.07 million MCap, a 28x.

- Worst case: $0.423, $20.25 million MCap, a 14x.

Optimistic case

Our optimistic USH price target assumes that the speculative factor on USH remains high, which means the FDV/TVL ratio is “overpriced” - let’s use the previous figure achieved, 1.5.This gives us a USH price of 1.5 * 0.837 = $1.26.

Realistic case

Our realistic projection assumes that USH is fairly priced, with an FDV/TVL ratio of 1.USH = 1 * 0.837 = $0.837.

Conservative case

Our conservative projection assumes that USH is underpriced as it is now, with an FDV/TVL ratio of 0.505.USH = 0.505 * 0.837 = $0.423.

Invalidation criteria ❌

There are a few key factors that could invalidate this thesis:- TVL decline: If Project Sentience does not positively impact TVL after three months, the underperformance will invalidate the thesis.

- USH loses $0.023 on the weekly timeframe: this would represent downside price discovery, not something we are interested in holding through.

- Further incompetence: We need to be mindful that a team error caused the exploit in June. Therefore, we must reevaluate the thesis if we see signs of further incompetence.

Price analysis 📈

USH (Daily timeframe)

Although the general bearish trend might look scary initially, USH is, surprisingly, showing bullish signs lately.

What you see at the bottom is the RSI, also known as the Relative Strength Index. We use this indicator to understand whether an asset is overbought or oversold, but also to find divergences between the indicator and price.

As you can see, the RSI has been making higher lows (highlighted using the white line), while the price has been making lower lows. In technical analysis, we know this as a bullish divergence - a bullish signal that tells us the price is about to start an uptrend.

You should remember that USH has a low market cap of only $1.4M; whales and institutions can easily manipulate the price, thereby invalidating our thesis.

Still, we're going on a limb here by saying USH will start an uptrend based on the bullish divergence on the RSI and the fact that it has formed support under the current price at $0.023.

Our first target from a technical standpoint sits between $0.093 - 0.123, and USH's path toward that region may extend over the remaining months of 2023.

Cryptonary’s take 🧠

USH represents an extremely high-risk, high-reward play. We want to reiterate that this isn’t for the faint-hearted, and you should not execute it with size.unshETH’s selling point is that even after being exploited and losing investor confidence, the team didn’t give up. They have now raised funds and launched a new product.

Time will tell if confidence can be restored in unshETH, but we feel the positives of this thesis outweigh the negatives.

Action points 📝

- Accumulate a small allocation of USH between $0.023-$0.06.

- Sell 25% of the position at $0.123.

- Sell 25% of the position at $0.423.

- Sell 25% of the position at $0.837.

- Sell 25% of the position at $1.26.

Cryptonary out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms