From the unending bankruptcy drama at FTX to the deepening troubles at Binance, no two days are the same in crypto. And then, you have Layer 2 solutions multiplying like rabbits while the SEC cracks down on NFTs.

Amidst all these, on-chain metrics reveal an interesting secret – everyone is tired of the bear, but they are choosing to err on the side of safety.

So, grab your virtual binoculars and join us as we navigate the treacherous waters of the crypto world.

TLDR 📃

- The key news is that FTX's bankruptcy and Binance's ongoing are causing more uncertainty in the market.

- Layer 2s: Astar Network cross carpets to Polygon, and Synapse Protocol is set to launch out on its own with the Synapse Chain.

- In DeFi: Prisma Finance has entered the LSD-Fi scene with the Prisma Points system

- On the regulatory front, The SEC has charged Stoner Cats with conducting an unregistered NFT offering.

- Peering into capital flows shows BTC volatility increased in September; historically, volatility remains low.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the R:R trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice. Any capital-related decision you make is your responsibility and yours only.

The biggest news of the week 🔑

FTX and Binance are creating market uncertainty

If you’ve been paying attention to crypto headlines, you would have seen several stories on the looming liquidations from FTX’s bankruptcy proceedings. And then there’s Binance, which can’t seem to stop digging itself into deeper holes.

All these have caused the dark clouds of uncertainty to gather over the market this week.

$3.4B of assets are being liquidated

- Starting with FTX: this week, the main cause of concern in the market was that a bankruptcy judge granted FTX permission to liquidate approximately $3.4 billion in crypto assets. Investors feared that these liquidations could create selling pressure.

- However, of these $4.3 billion assets, only $1.3 billion are liquid crypto assets. FWIW that $1.3 billion is concentrated in SOL and APT, so it’s not like the FTX liquidations will impact the entire crypto market – but we don’t envy people with exposure to SOL and APT right now.

- However, it is important to note that the liquidation plan sets a 'weekly limit' of $50 million in the first week. The court can approve an increase to $100 million per week, but liquidations won’t exceed $200 million per week.

More Binance executives jump ship

- Two more Binance U.S. executives have left the company in addition to the other departures and layoffs of the last few months. Specifically, Binance U.S.’ Head of Legal, Krishna Juvvadi, and its Chief Risk Officer, Sidney Majalya, have both bolted from the company.

- And while execs are jumping off the Binance ship much faster than rats aboard a sinking ship, the company is still fighting to stay afloat. For instance, it has pushed back against the SEC in court, arguing that most of the SEC's requests are 'unreasonable' and ‘overly burdensome.’

- The bigger problem, however, is that the connection between Binance and Binance U.S. may be stronger than expected. Case in point, Binance U.S. now mentions Binance International as its custodian. So, there’s now a possibility that Binance’s troubles in the U.S. aren’t self-contained problems after all.

Cryptonary’s take 🧠

Bringing the current events at FTX and Binance together, the FTX liquidations should be the lesser cause of concern. Since the FTX bankruptcy estate aims to obtain a good price for its tokens, it's unlikely that we will see massive sell pressure all at once. So, we don’t expect the FTX liquidation to have an enormous impact on the prices of BTC or ETH.However, what keeps us up at night is the outcome of the troubles happening at Binance. Whatever happens to Binance will have a larger impact on the market's next direction. Since there is no clear information yet on how bad the situation is, we are closely monitoring this and consider it the main risk in the market – risk is what you don’t see!

WTF is happening with Layer 2s? 💣

Astar, Manta, and Layer N introduce new Layer 2 networks

Layer 2 solutions are in the spotlight this week after some new chains emerged from unexpected corners. For instance, Astar Network abandoned Polkadot to join the Polygon clique. There are some interesting undercurrents in the L2 space, and we’ve surfaced them for your attention.

Polygon goes gangsta

- Astar Network is working with Polygon Labs to launch Astar zkEVM, an Ethereum Layer 2 scaling solution. The collaboration aims to boost blockchain adoption in Japan, especially in the entertainment and gaming sectors.

- However, The move is controversial because it means Astar is abandoning Polkadot for Polygon.

- Meanwhile, Polygon itself is also making a big move in light of new proposals to implement the Polygon 2.0 upgrade.

A slew of other new layer 2 solutions emerge

- Manta Network has launched its zero-knowledge proof layer-2 scaling network.

- Synapse Protocol has unveiled the testnet for Synapse Chain, its layer 2 solution for cross-chain applications and the Synapse bridge.

- Layer N, a new Ethereum layer 2 network, has raised a $5M seed round co-led by Peter Thiel's Founders Fund and investment collective dao5.

Cryptonary’s take 🧠

Layer 2 solutions are not just a passing trend, as we witness the continuous launch of new layer 2 solutions each week. Even Astar Network, a project initially exclusive to Polkadot, has now introduced its own layer 2 solution, secured by Ethereum. Astar Network won't be the last project outside the Ethereum network to launch an Ethereum L2; we expect to see more launches in 2024.However, among all the new L2s, we are most excited about Layer N. The fact that Peter Thiel is backing the project signals some substance; we will probably do a deep dive into the project once it goes live.

Chart of the week 📊

friend.tech is fastest-growing app in crypto

The Web3 space has been abuzz with news of friend.tech over the last weeks, we also covered the project here. Well, after the initial excitement seemed to have mellowed out, friend.tech is back in the limelight as the hottest crypto app of the week.

What makes it hot?

Well, its Total Value Locked (TVL) has been steadily rising. And more importantly, the app achieved a higher trading volume this week than the entire NFT market has generated.

friend.tech has generated over $100 million in fees this year, with much of the activity driven by the expectation of an airdrop for early users. You can read our full report on the friend.tech airdrop here.

Cryptonary’s take 🧠

We previously wrote about friend.tech to explain how to farm the airdrop, and we still believe it's worthwhile to set up an account to become familiar with the platform and potentially receive an airdrop by earning points.However, the market is becoming overheated. With friend.tech gaining significant attention, we may witness another local top in the coming weeks as early users seek to take profits.

Therefore, we wouldn't recommend taking on too much risk if you're entering now, as you have probably missed the early adopter’s boat.

This week in DeFi 🏦

Prisma Finance has entered the LSD-Fi scene with a bang

Exciting developments are happening in the LSD-Fi sector. Prisma Finance and DyDX are rolling out new features, while Unibot and Lido are expanding into new networks.

Here's everything you need to know.

- Prisma Finance has announced the launch of the Prisma Points system, designed to reward users for their contributions during the Prisma Guardian launch period. As a result, its TVL has reached $38.76 million, as users anticipate an airdrop.

- The protocol has also increased its debt cap, allowing users to mint more stablecoins with liquid staking tokens.

- DyDX open-sourced its code for the upcoming DyDX V4 launch. This marks a positive development and signals the launch is imminent.

- Unibot has announced its integration with friend.tech to enable users to trade friend.tech via Telegram. This development signals the expansion of Telegram trading bots into the Friend.tech narrative.

- Lido plans to bring its liquid staking token to Cosmos by selecting Axelar and Neutron to assist with launching wstETH on the network. This highlights Lido's efforts to expand its liquid staking solution.

Cryptonary’s take 🧠

The two primary contenders for the #1 spot in the LSD-backed stablecoin space will be Lybra Finance and Prisma Finance.Considering our bullish stance on LSD-Fi, the launch of Prisma Finance is an exciting event for us. We also see it as an intriguing airdrop opportunity, and we recommend that you try to ride on the narrative if you have sufficient capital – participation in the point system requires at least 2 ETH.

Regulations and mass adoption 📜

The SEC goes after NFTs, and the CFTC tables a proposal for regulations

Both the SEC and CFTC have been active this week, with the SEC taking an aggressive approach and the CFTC appearing more open to discussion.

- The SEC has charged the company behind the NFT project, Stoner Cats, with conducting an unregistered offering of nonfungible tokens that brought in $8 million from investors.

- The move is the latest action brought by the agency against an NFT project – it filed similar charges against Impact Theory last month.

- The SEC has also accused Ripple of trying to delay a resolution “so that they may continue freely selling XRP into public markets without the disclosures that come with registration.”

- Meanwhile, CFTC Commissioner Caroline Pham has proposed a limited pilot program to establish effective crypto regulations.

- Her plan involves setting up a roundtable of stakeholders, after which the agency would propose and adopt registration requirements and risk management rules.

Cryptonary’s take 🧠

The fact that the SEC is pursuing multiple NFT projects signals their interest in gaining more control over this market. We believe this could signify a shift in the NFT market, which had previously faced little regulatory pressure.Simultaneously, while the CFTC is engaging stakeholders in discussions about new regulations, these talks are unlikely to result in significant steps forward.

While many people believe that the CFTC is friendlier towards crypto than the SEC, there’s a chance its rules will become more burdensome. This pessimism is based on its past aggressive actions against DeFi protocols like Ooki DAO.

Follow the money 💰

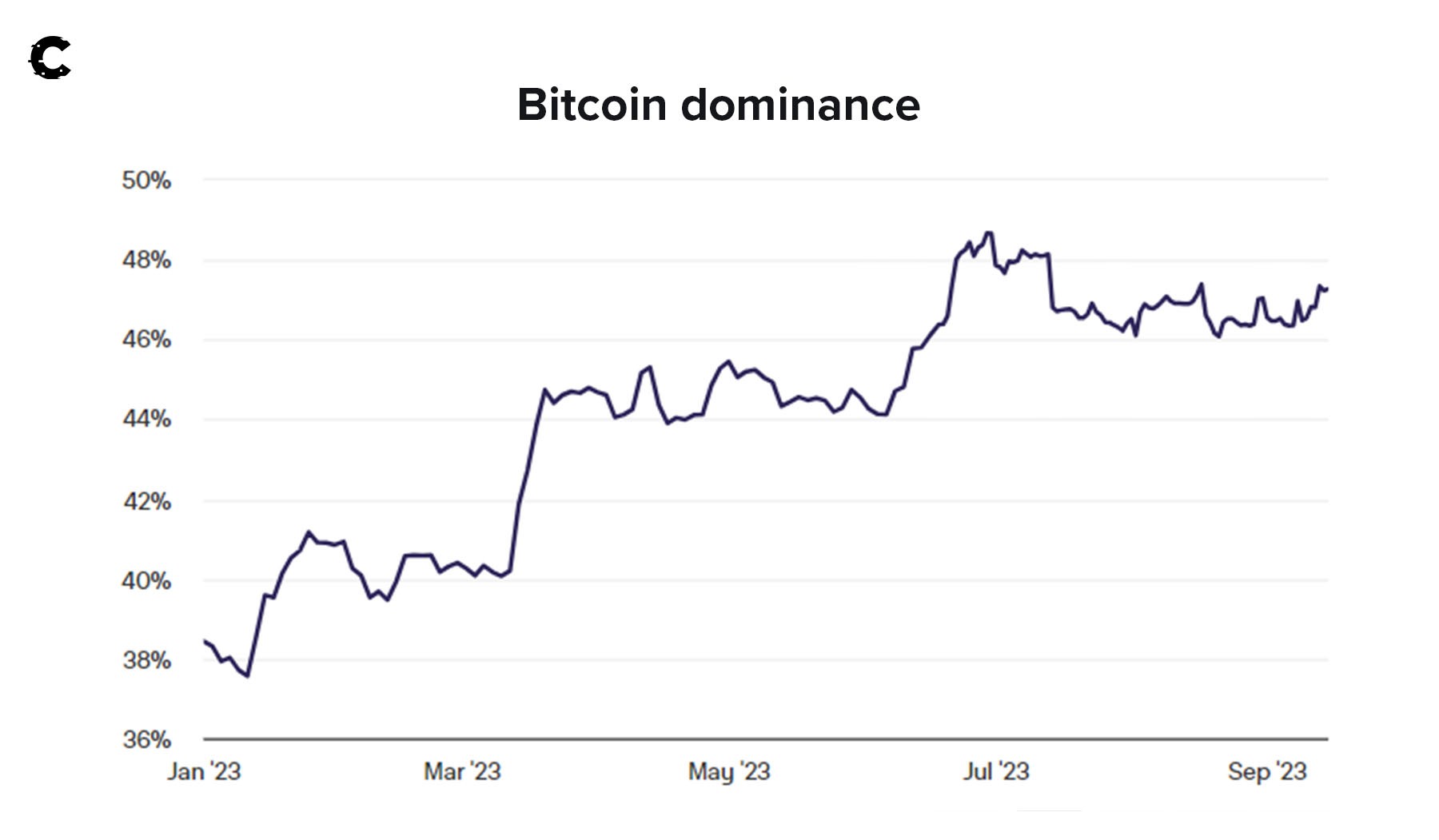

Now, let's examine data that reveals capital flows in crypto to gain insights into what’s in store for the market in the coming weeks.BTC dominance

When we examine Bitcoin's Dominance, we see that it has steadily risen throughout the year and shows no signs of declining. This growing dominance suggests that the majority of capital remains cautious about altcoins.

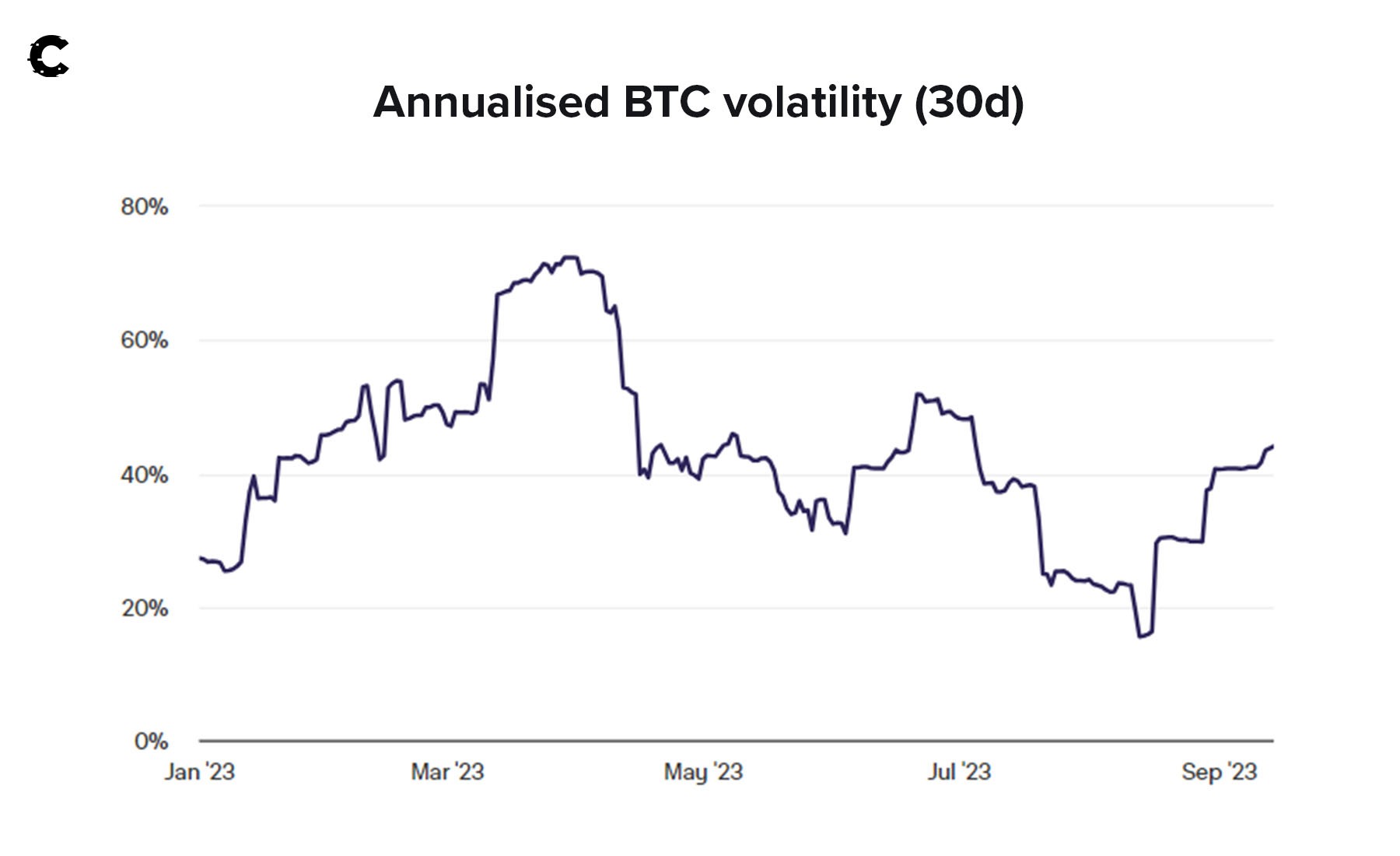

BTC Volatility

What is more positive, however, is that we can spot the early signs of volatility in the market, as BTC’s volatility starts rising in September. If this trend persists, it could set the stage for more interesting and volatile weeks in October. With rising volatility, traders will find more opportunities, both to the downside and upside. This creates a positive feedback loop that attracts more liquidity to the crypto market.

With rising volatility, traders will find more opportunities, both to the downside and upside. This creates a positive feedback loop that attracts more liquidity to the crypto market.

Nonetheless, the uptrend in volatility is still relatively low compared to historical volatility in crypto.

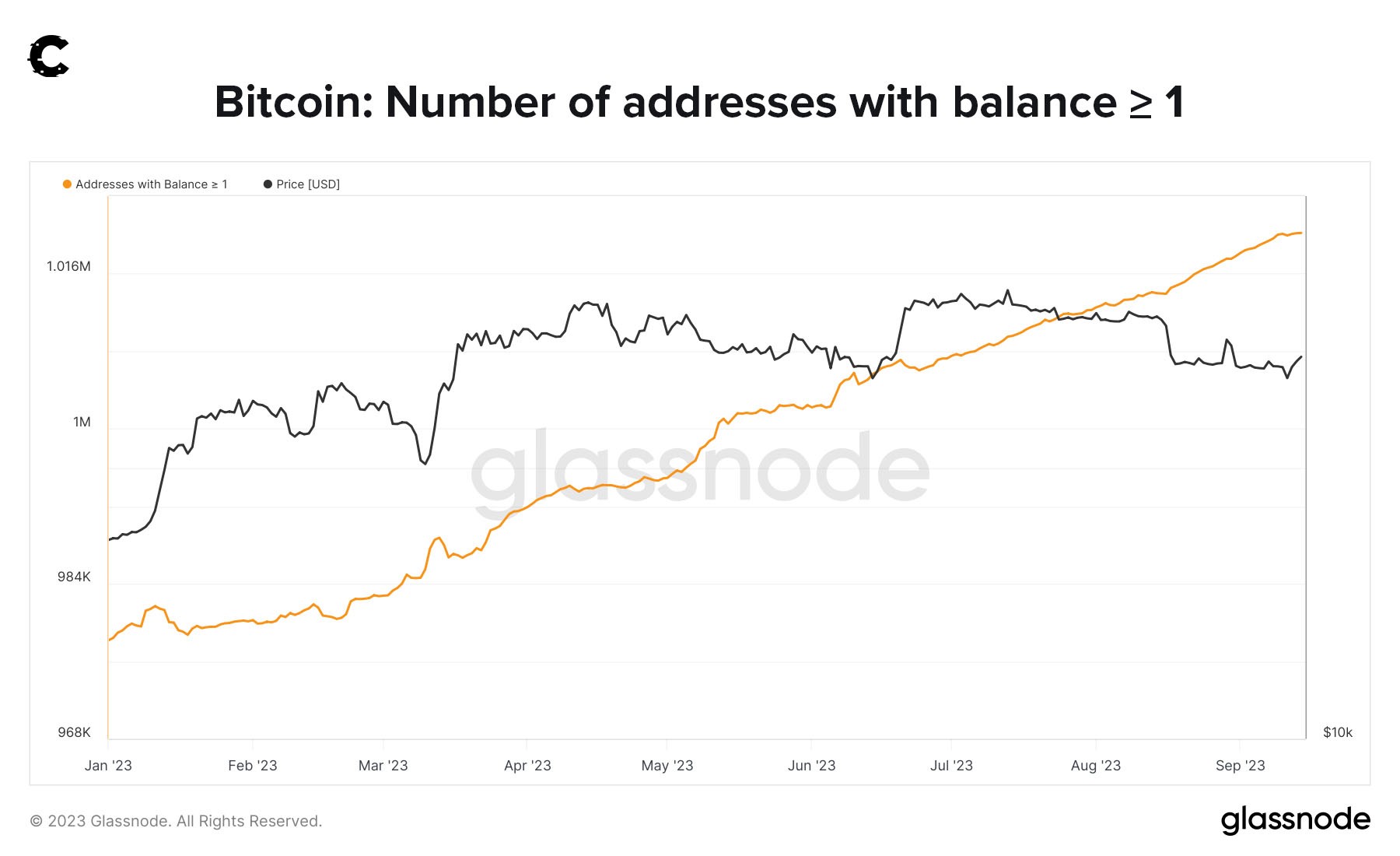

Bitcoin: Number of Addresses with Balance ≥ 1

While the bear market reveals weaknesses in price action, the number of BTC holders with more than 1 BTC has grown. This growth suggests that even during the bear market, a significant cohort of retail investors have shifted some of their altcoins into BTC or are dollar-cost averaging into BTC.

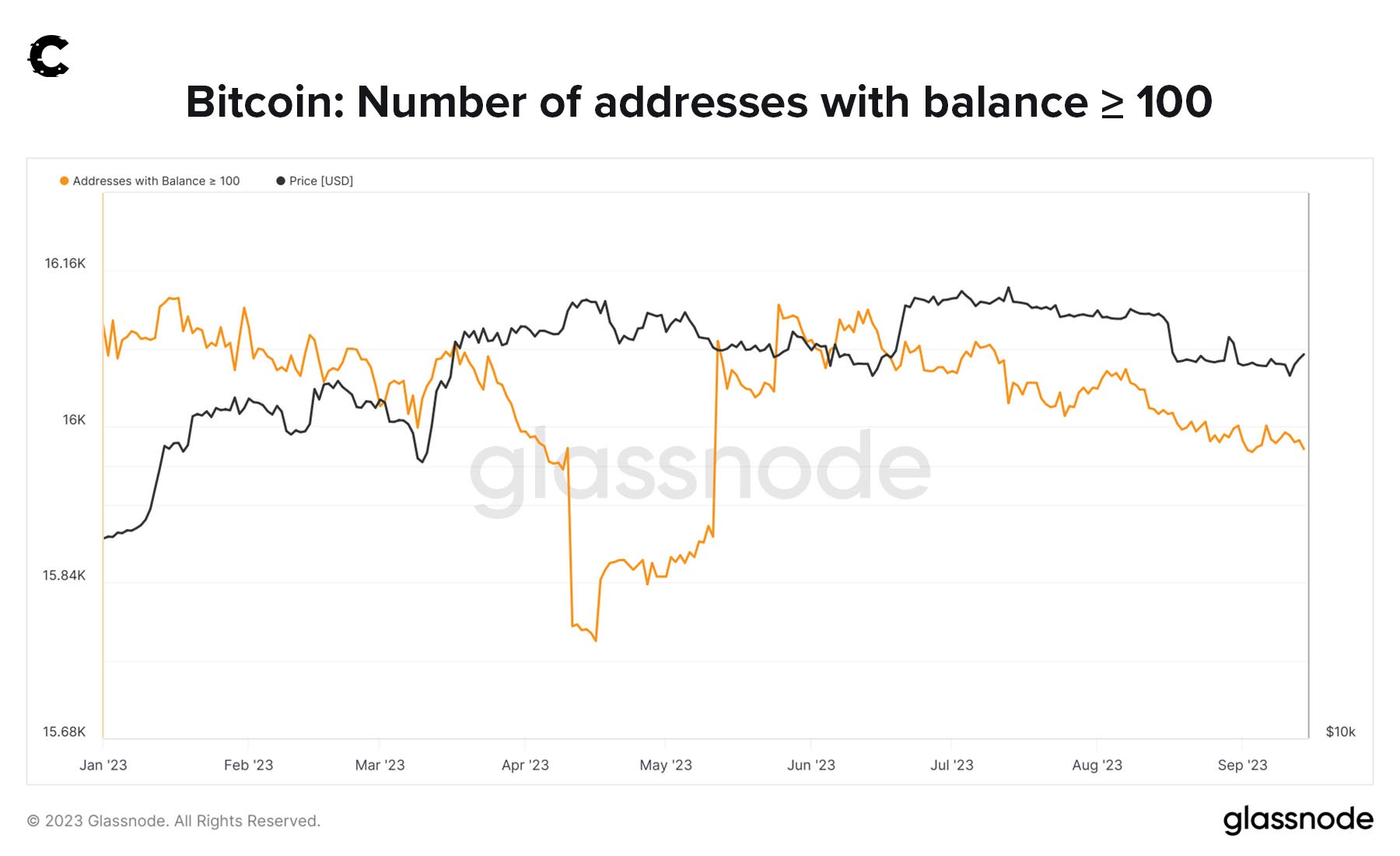

Bitcoin: Number of Addresses with a Balance ≥ 100

However, large holders owning more than 100 BTC have been moving more in tandem with BTC’s price action, and the number has decreased since June this year. This decline suggests that these entities continue to exercise caution and have likely sold off some of their BTC.

We hope to see an increase in the number of large BTC holders this month, as it could signal a favourable setup for October, especially if the BTC price lags behind this metric.

Cryptonary’s take 🧠

We are still clearly in a bear market, with BTC dominance remaining high and Bitcoin volatility staying low. September will most likely end as a relatively uneventful month for BTC.We are bullish on Q4, expecting increased volatility and higher prices during that period. However, we need a catalyst to the downside or upside to shake up the market in Q4. This catalyst could be something that crashes the market, such as potentially negative developments related to Binance. Or it could be something that allows us to gain momentum, like the approval of a Spot Bitcoin ETF.

Without such a catalyst, we are likely to remain in flux as traders stay indecisive.

And until we bring you another crypto news round-up next Friday, stay winning!

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms