And that’s our advice to CZ as Binance continues to struggle.

Binance faces many challenges, starting with its banking partners turning their backs on it and a $130M bad debt looming.

However, something new is coming to the BNB Chain that could turn the tides in its favour.

But can this new technology bring Binance out of the trenches, or do the problems outweigh this new opportunity?

There’s only one way to find out. Read more…👇

TLDR 📃

- BNB Chain introduces opBNB, a Layer 2 solution to enhance speed and cost-effectiveness

- Binance faces isolation from traditional financial partners, and there's a $130M risk due to a loan tied to BNB prices.

- BNB's trading outlook is bearish, focusing on opBNB for potential opportunities, while Binance faces growing problems in the traditional finance sector.

This is how you can access opBNB 🪂

After months of development and testing, BNB Chain has announced the mainnet launch of its opBNB chain to infrastructure providers. However, it will soon be fully available to the public. The mainnet will open to the public from the end of August or early September.But what exactly is opBNB?

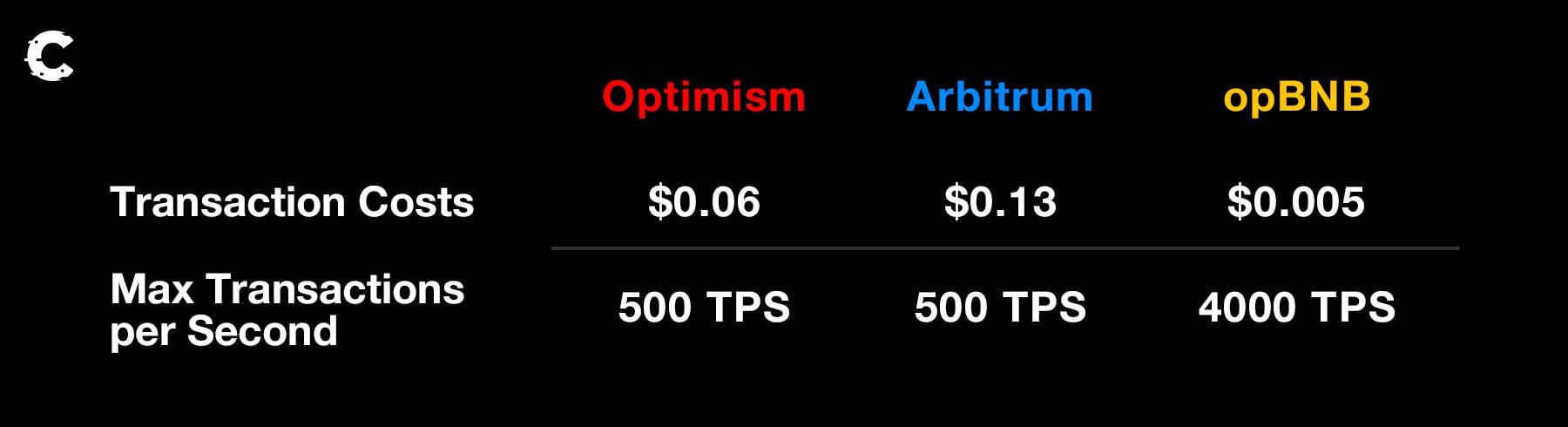

opBNB is a Layer 2 solution designed to make the BNB Chain faster and cheaper, similar to how Arbitrum and Optimism enhance Ethereum. But opBNB will make Binance chain much faster and more cost-effective than Ethereum’s L2s. We previously covered what’s under the hood of opBNB.

opBNB’s mainnet launch presents a fantastic opportunity for users to become early adopters in a new ecosystem. And the best part is an airdrop opportunity for those who try out the network early on.

However, you must complete three network steps to qualify for a share in the $50,000 airdrop – you can find the steps here.

opBNB network highlights

Here are some essential resources to help you make the most out of opBNB and give you an easier airdrop hunting experience.opBNB Network

- Network Name: opBNB Mainnet

- RPC URL: https://opbnb-mainnet-rpc.bnbchain.org

- ChainID: 204

- Symbol: BNB

- Explorer: http://mainnet.opbnbscan.com

- https://opbnb-bridge.bnbchain.org/deposit

- https://www.orbiter.finance/?source=BNB%20Chain&dest=OpBNB

However, while opBNB presents a significant opportunity for Binance, looming problems may outweigh the positives.

Wall Street has stopped playing nice with Binance 👿

The old guard is turning against Binance.Checkout.com, the credit card processing company that handles billions in crypto transactions for Binance clients, has terminated its contract with the crypto exchange.

At the same time, Binance's European banking partner, Paysafe Payment Solutions, will cease its support for the exchange in September.

These are clear signs that Binance is becoming more isolated from the traditional financial system. This isolation makes it harder for Binance to onboard real dollars into crypto – and onboarding fiat into crypto used to be Binance’s competitive advantage.

The shutdown of Binance Connect is another clear sign that Binance is being forced to scale down, in contrast to its usual upward growth trajectory. Binance Connect is a fiat-to-crypto payments provider that links crypto firms with the traditional finance system.

Long story short, there’s a significant shift in sentiment towards Binance. Of course, there’s still the possibility that Asia presents an opportunity to Binance, as we previously wrote. Yet, the broad change in attitude from the financial services industry is something we can’t afford to ignore

However, there's something even more problematic on the horizon for BNB.👇

There’s a $130M hole in CZ’s pocket 😱

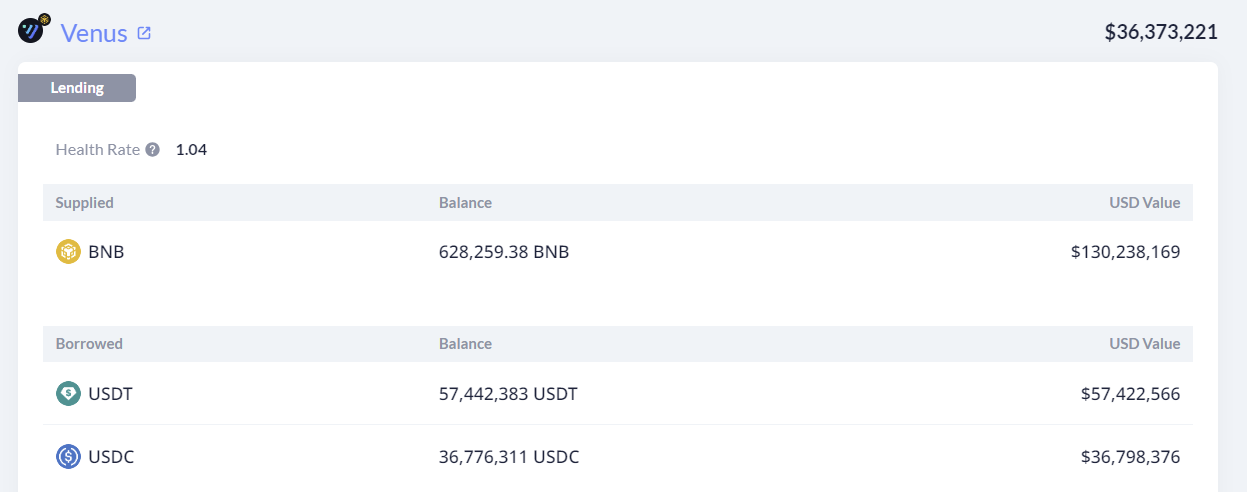

Do you remember a wallet that exploited the BNB Bridge in 2022 to borrow over $150 million worth of stablecoins from the Venus Protocol? Well, that wallet saw a $30M liquidation than $30 million as BNB prices dropped to $209 yesterday.

As BNB prices continue to fall, this massive loan is now at risk of complete liquidation. A liquidation of such proportions will be highly disruptive to the nascent DeFi ecosystem on BNB Chain.

Hence, Venus and BNB Chain opt for a gradual rather than sudden liquidation. It’s like choosing the lesser of two evils – unless BNB prices rise, the position will be eventually liquidated – it is only a matter of how fast.

As BNB gets liquidated, the price is likely to decline. This is worth watching if you’ve got BNB in your portfolio. To monitor the position, you can visit this page to check its health factor and observe whether more BNB is being liquidated.

But when it comes to trading, are we trading BNB now? Well, here's your answer 👇

BNB was no stranger to last week's bloodbath. BNB’s bearish structure continues, and we are now on track for the June '22 low of $185.

Note that BNB has been ranging inside the same region for over a year, between $335 and $185.

Although buying once $185 is reached would be a great decision, the price of BNB will likely need help to reach the top of the range - we're talking months.

We'll be very realistic with you and say there are far better opportunities from a technical standpoint. You can find out more about those opportunities here.

For BNB, we expect a slow ride on the way down, given that BTC's price action has been steady since crashing last week.

Cryptonary’s take 🧠

Our primary recommendation now is to familiarise yourself with the opBNB ecosystem.This is where a significant portion of activity within the BNB ecosystem will be concentrated. Exploring the airdrop opportunities is worthwhile, so use our guides and links to get up to speed.

For Binance and the BNB token itself, the outlook remains bleak. We don't see any opportunities there unless BNB drops lower to $185, which could be an interesting level to buy, as we may see it return to the mean after such a drop.

However, Binance's problems in traditional finance and the pressure BNB faces due to the Venus loan make it one of the least attractive assets.

As always, thanks for reading! 🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms