TLDR 📄

- Mt. Gox repayments still uncertain; investors await funds.

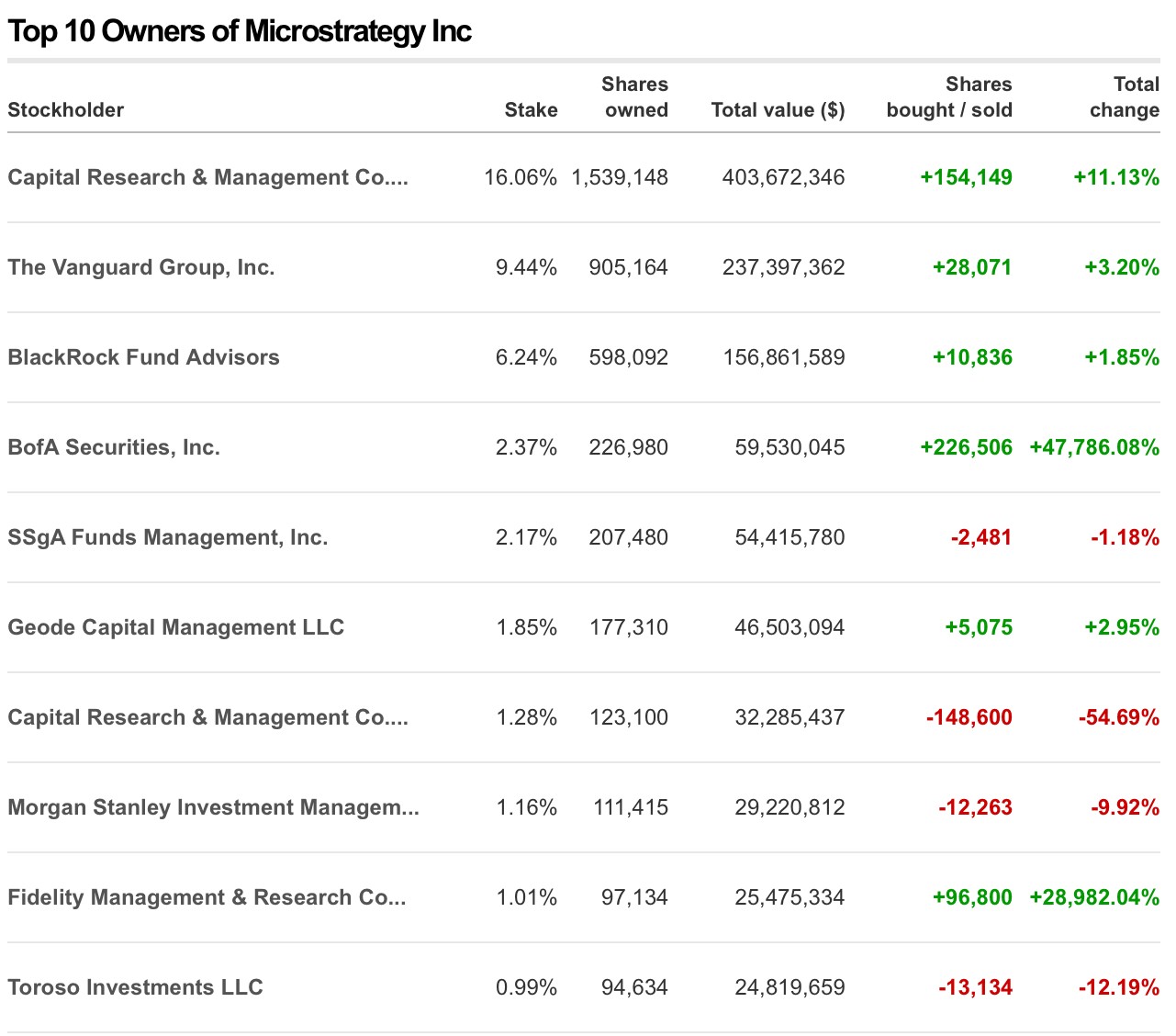

- Institutions use MSTR as a proxy for a Bitcoin ETF.

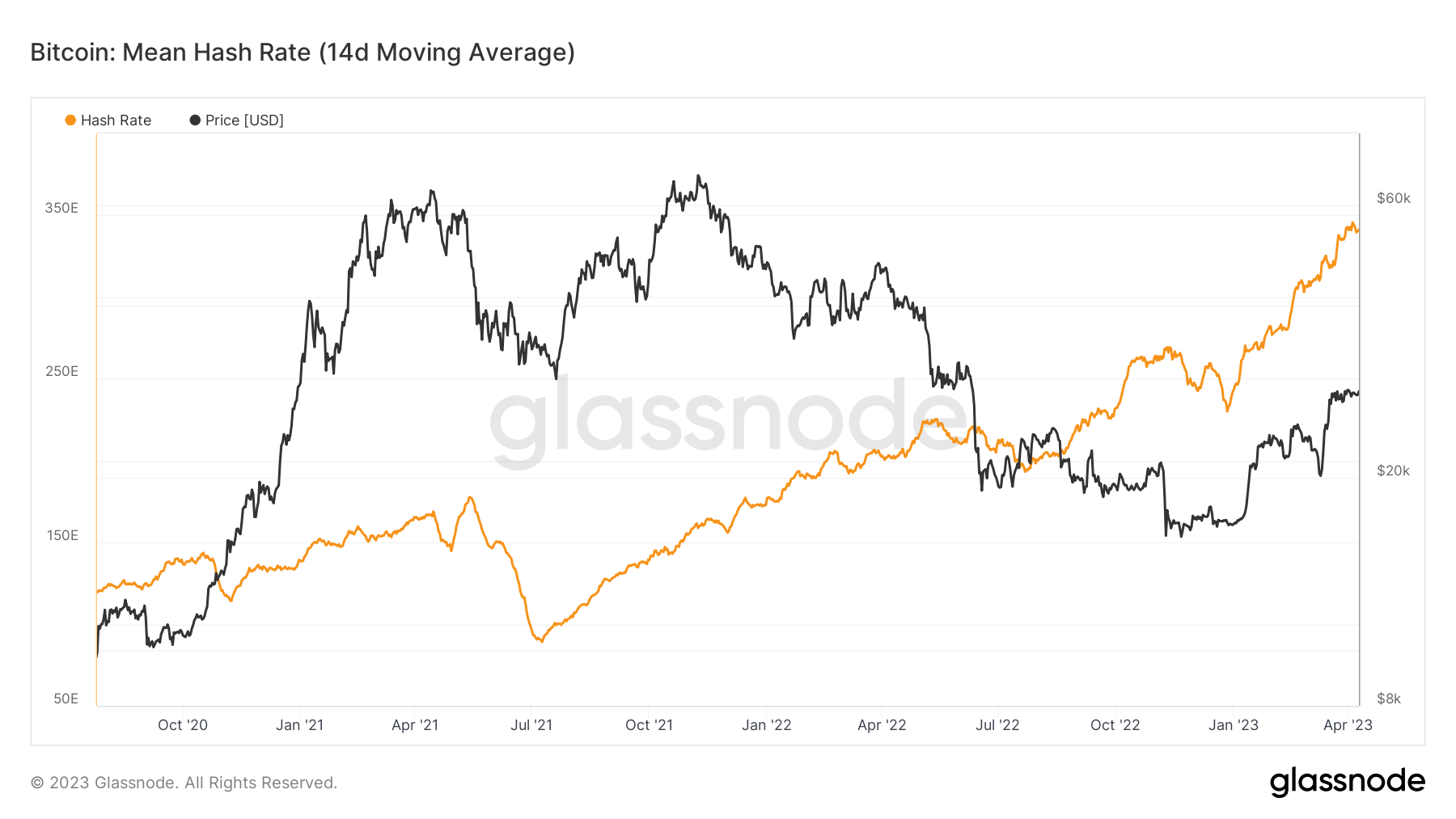

- Rising Bitcoin hash rate reveals bullish sentiments.

- BTC is “bullishly” consolidating under the $30,000 resistance.

- Share this digest with your family and friends!

Mt. Gox repayments aren’t as close as they say they are 💴

Once upon a time, Mt Gox was the world's largest Bitcoin exchange, handling over 70% of all BTC transactions. But in 2014, disaster struck when 850,000 bitcoins (worth $450 million at the time) mysteriously vanished, leaving thousands of investors devastated.The exchange declared bankruptcy. The founder, Mark Karpeles, was arrested for his alleged role in the debacle. Despite years of legal proceedings and asset liquidations, Mt. Gox users still haven't been fully repaid. Victims continue to await their funds anxiously, feeling the weight of their losses and the bitter sting of a dream-turned nightmare.

Creditors finally received an update on April 6 as the deadline for submitting repayment information passed. This doesn’t mean the BTC will be released to creditors immediately, leading to severe selling pressure. Mt Gox owns 140,000 BTC ($4B), 140,000 BCH ($17M), and 69 Billion Yen ($550M).

The first payments will be made from Yen reserves, and the BTC repayments are expected to happen by October 31, though the deadline is subject to extension.

So creditors will need to wait just a bit longer.

MSTR is the Bitcoin ETF 🏦

The world has been waiting for a Bitcoin ETF. Especially crypto holders, as it could open up massive floodgates of capital.Owning Bitcoin isn’t easy, and crypto comes with many regulatory risks. That’s especially true for institutions due to a lack of regulatory clarity. This has discouraged TradFi investors from pumping capital into BTC and the crypto ecosystem.

An ETF might solve this problem. But today, institutions seem to be adopting Microstrategy (MSTR) stock as a proxy-ETF.

No one buys MSTR for their tech. The attractive element of MSTR’s stock is the fact that they own a ton of BTC.

New ATHs for the Bitcoin hash rate

The Bitcoin hash rate is a measure of the total computing power used by miners to validate transactions and add new blocks to the blockchain. It is measured in hashes per second. A higher hash rate indicates increased network security, as it becomes more difficult for any single entity to launch a 51% attack and compromise the network.

When the Bitcoin hash rate reaches an all-time high, it means that miners are investing more resources into mining because they expect future price appreciation. When miners are bullish on the price, they invest more in mining hardware, which leads to an increase in the hash rate. As the hash rate increases, the competition among miners increases, resulting in a more secure and robust network.

A rising hash rate often coincides with a growing network effect as more miners and investors are drawn toward Bitcoin. This increased interest contributes to higher demand, leading to a higher Bitcoin price.

TLDR: A succession of hash-rate ATHs means miners are more bullish than ever on BTC. That is why they are spending more on BTC production.

Price chart 📈

Bitcoin’s price has reached our first target and is currently consolidating under the $29,000-$30,000 resistance area.

A chart represents the actions of all buyers and sellers. Technical analysis is therefore not a random art, but a science. When the price consolidates under resistance and keeps testing it, it means buyers continue to push and are depleting the sell orders present at that resistance. The weaker the selling pressure becomes, the greater the chance buyers have of piercing through the resistance and pushing prices higher. That seems to be the case today. There is a 70% chance it leads to a $35,000 price per BTC.

Nonetheless, we think it is wise to wait for a breakout before jumping to positions.

Bitcoin ecosystem 🌐

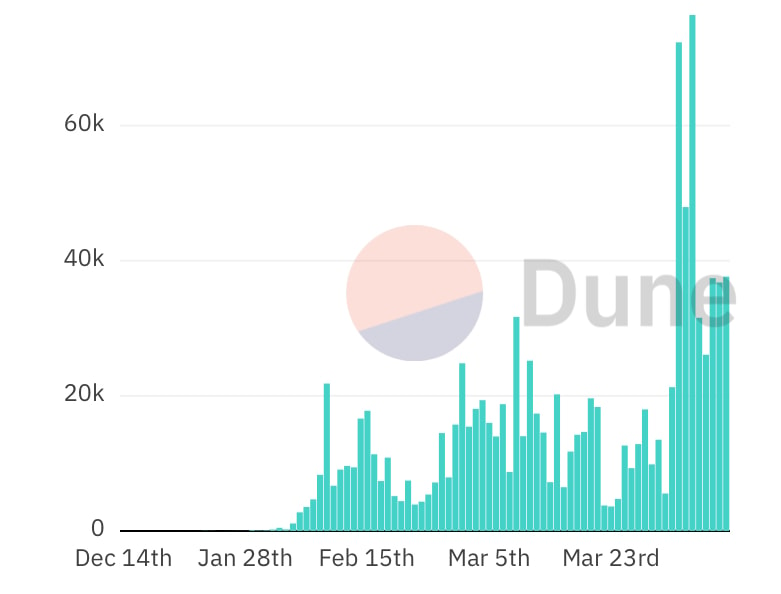

Ordinals (NFTs)

The number of inscriptions/mints continues to grow, with especially high numbers on April 2 and 4.[caption id="attachment_270335" align="aligncenter" width="781"] Number of inscriptions.[/caption]

Number of inscriptions.[/caption]

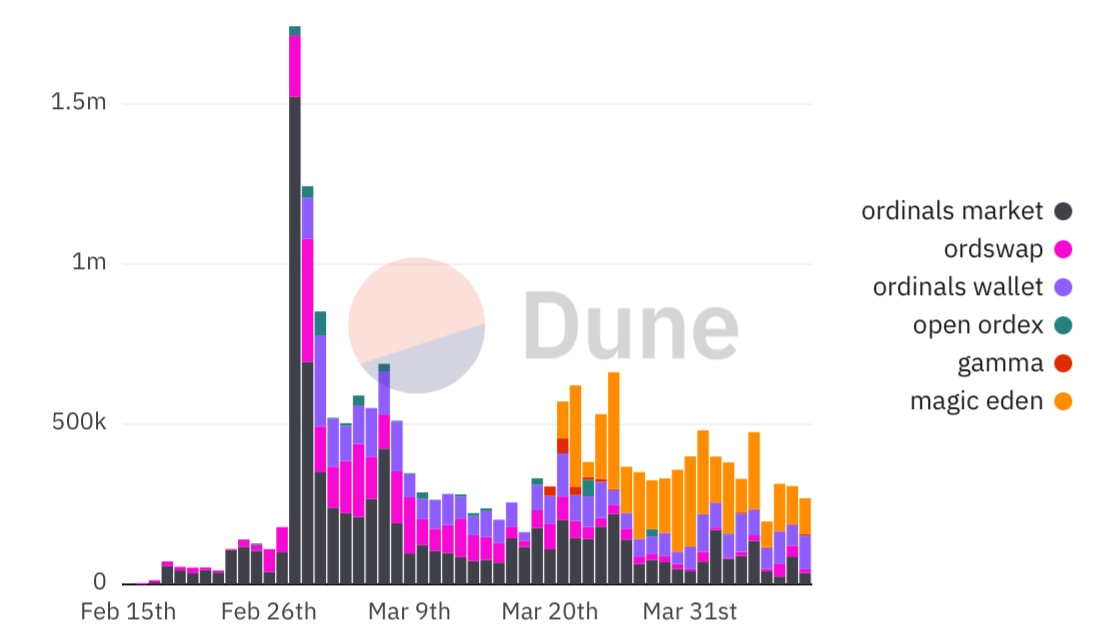

This increased supply doesn’t seem to be met by increased demand, however, as marketplace volumes are low - see below 👇🏼

[caption id="attachment_270334" align="aligncenter" width="1095"] Volume by marketplace.[/caption]

Volume by marketplace.[/caption]

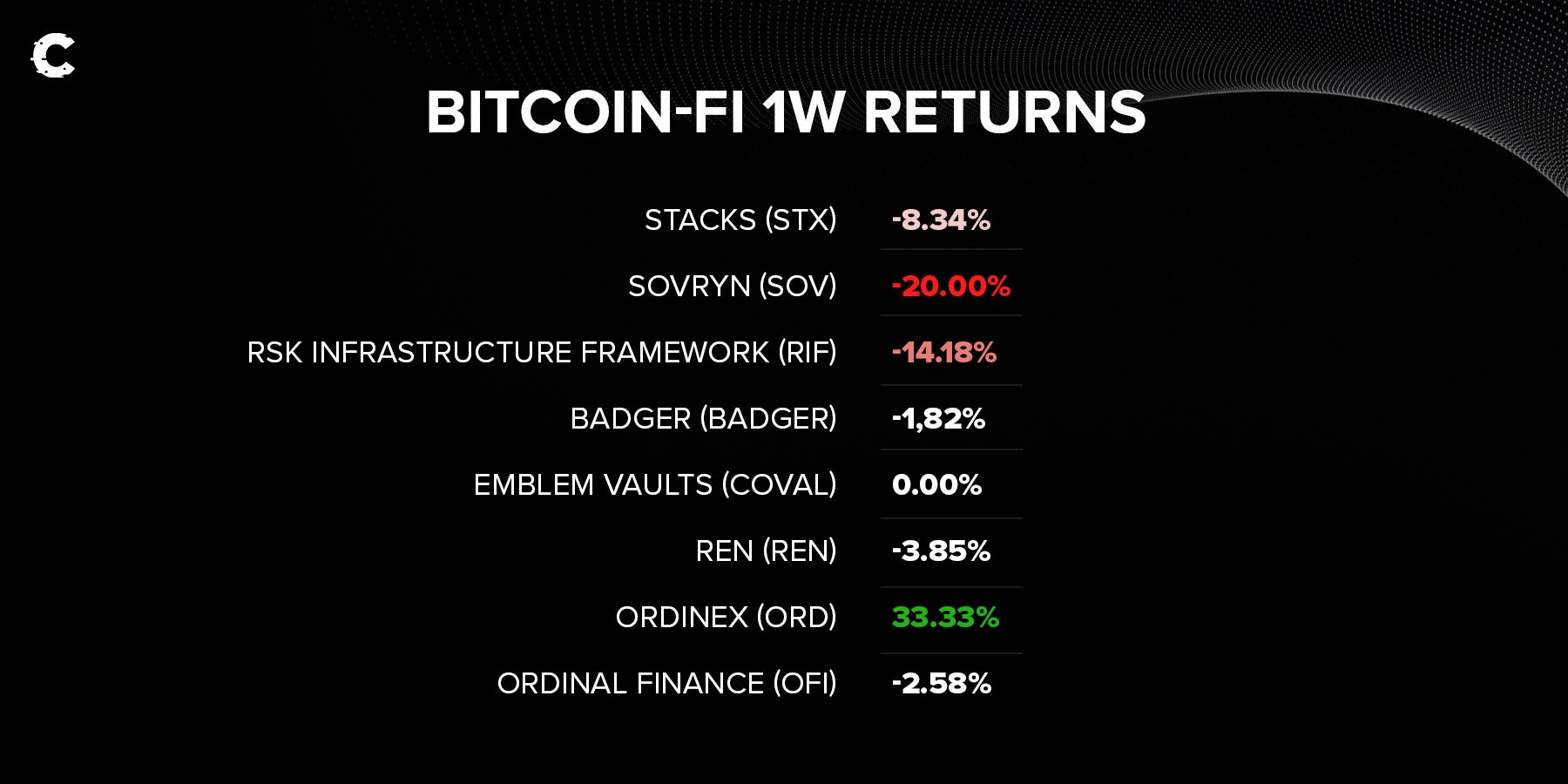

Bitcoin-Fi

The Bitcoin-Fi ecosystem continues to be quiet with few changes. The price increases of previous weeks were part of a mere hype cycle.

Cryptonary’s take 🎯

Mt. Gox claims are getting close after nine years of waiting, but the wait isn’t over, despite what you read elsewhere. The selling pressure from this “unlock” event likely happens closer to Q4 2023.Institutions and miners are both signalling that they have become more bullish on Bitcoin’s future, likely as a form of gold 2.0.

In the near term, the BTC price has decent odds of flying to $35,000, but it is not advisable to long resistances.

As always, thank you for reading 🙏🏼

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms Explaining Bitcoin to bankers 12 years ago. BTC is up 9,640,000% since then.[/caption]

Explaining Bitcoin to bankers 12 years ago. BTC is up 9,640,000% since then.[/caption]