On the one hand, we got some very positive news for Bitcoin this week.

On the other hand, we can see dark clouds forming around Binance.

How do we navigate this sense of uncertainty?

We adopt the guiding principle, ‘ embrace the uncertain, envision the possible, and assign probabilities.'

Today’s crypto news roundup provides valuable context to some of the biggest stories in crypto as we head into September.

Let’s dive in.👇

Grayscale wins the battle. Still, the war continues ⚔️

This week was a game-changer for anyone watching the Spot Bitcoin ETF news.

Grayscale scored a legal win against the SEC as the judge ruled in their favour, forcing the SEC to revisit their Bitcoin Spot ETF application.

Now, let's delve into the news and explore its implications 👇

In the news 📰

- The outcome of the Grayscale vs. SEC case implies that the SEC cannot reject a Bitcoin spot ETF over market manipulation concerns while allowing futures-based ETFs.

- The SEC now has 45 or 60 days to appeal the decision, seek alternative grounds for denying the Spot Bitcoin ETF, or ultimately approve the first.

- The SEC’s first move was to postpone all forthcoming Bitcoin Spot ETF decisions until October.

- Bloomberg ETF analysts have assigned a 75% probability of approving a Bitcoin Spot ETF in 2023 and 95% for 2024, so the odds remain in our favour.

Predictions 🔮

The situation is nuanced, with multiple possible outcomes. Our goal isn't to predict every detail but to stay ready and tilt the odds in our favour.We give a 70% chance that the SEC will approve a Bitcoin Spot ETF by the end of 2023, with the highest likelihood that it will happen between October and November.

Discover how this could impact BTC prices in our report. Click here to read more.

Cryptonary’s take 🧠

A Bitcoin Spot ETF will likely be approved by October or November. We suggest you closely monitor the news because we expect the BTC price surge to surpass even the Grayscale announcement once approved.Chart of the Week 📈

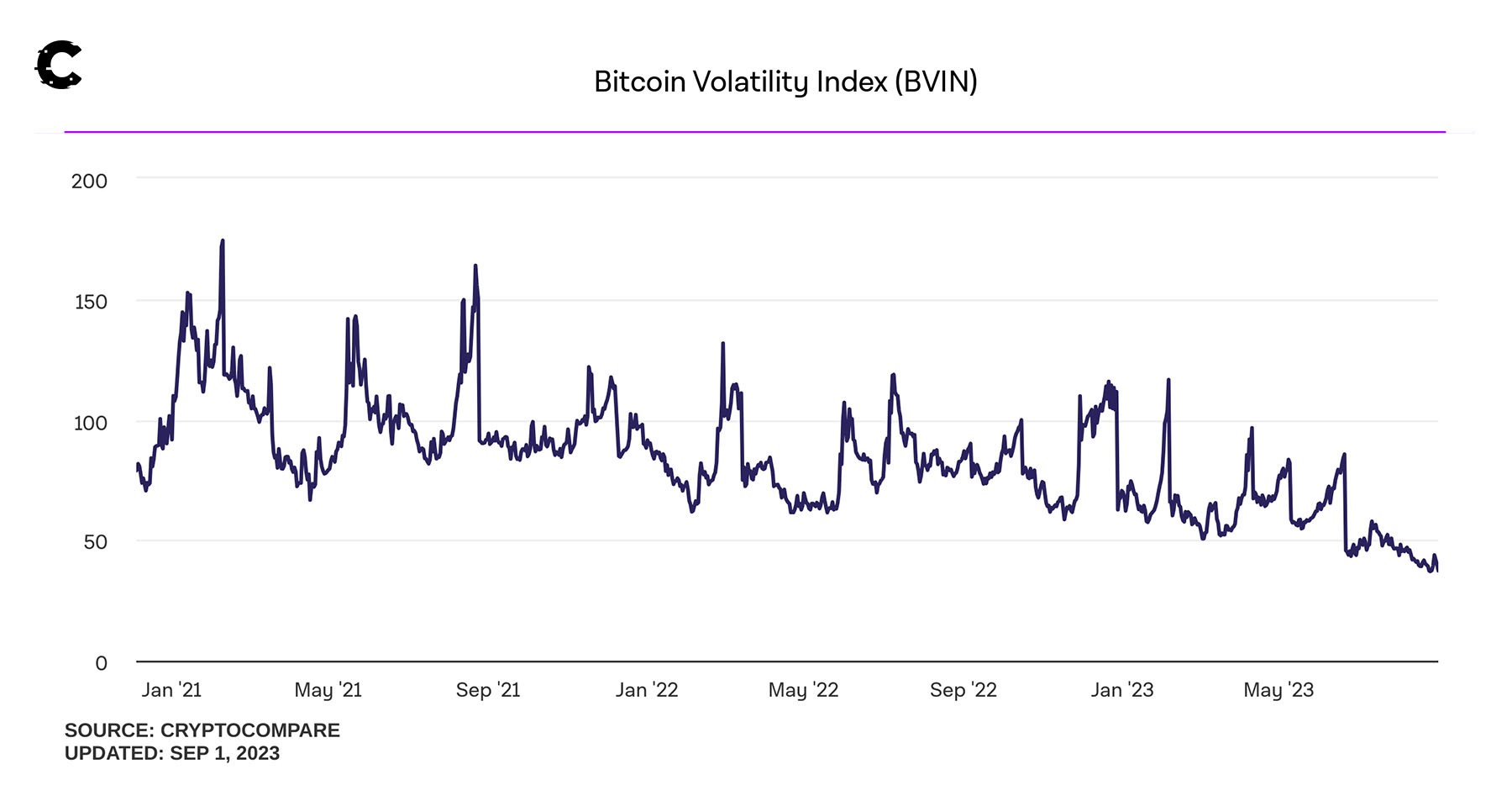

This week's chart shifts the focus away from prices to the Bitcoin Volatility Index, which gauges price fluctuations in Bitcoin, providing valuable insights into market stability.Despite the recent news concerning Grayscale, which led to increased price fluctuations in BTC over the week, volatility has remained exceptionally low.

This was evident in BTC's price action, which saw a pump of less than 10% following the Grayscale news, only to retrace most of the move.

We need a significant positive or negative event capable of shifting market sentiment to get the market moving again. This event could also be a large-scale economic change that affects the macroeconomic landscape.

If you intend to profit from volatility in this market, the events we mentioned above are the cues to watch.

Binance faces more setbacks as market share swindles 🐻

While things look promising for Grayscale and other ETF providers, Binance cannot join the celebration.

Last year, all indicators suggested that Binance would thrive due to FTX's decline, but now the exchange is encountering a series of setbacks.

In the news 📰

- Binance has lost two significant partnerships – both Mastercard and Visa have withdrawn from their card partnerships with the exchange.

- It gets worse. Binance has announced its intention to 'gradually' phase out its BUSD stablecoin. It has already removed BUSD from spot and margin trading pairs.

- A new secret court filing has triggered speculation that more adverse news is imminent for the industry giant.

- Why is the filing secret? Either the SEC is trying to avoid interfering with a criminal investigation at the U.S. Department of Justice or is concerned about putting a witness or company at risk.

- In either scenario, the outlook for Binance is unfavourable, as the legal pressure on the exchange isn’t easing anytime soon.

Predictions 🔮

It's challenging to predict the contents of that sealed court document. And while some anticipate the worst, it's important to remember that the situation remains speculative.The most likely outcome is that Binance will be forced to withdraw from the U.S. market, potentially facing fines and criminal charges for some employees. So, as long as the company has not been operating similarly to FTX, it should be able to continue its operations in other markets like Asia or the EU.

Cryptonary’s take 🧠

For us, Binance's legal situation warrants close attention, as it presents a potential downside risk to the positive developments in BTC. However, the likelihood of significant damaging revelations emerging is low because the process has been slow.If Binance customers were genuinely at risk, one would assume that immediate action would be taken to protect them.

Despite the low probability of a worst-case scenario, we maintain a bearish outlook on BNB.

Binance’s outlook appears significantly worse than at the beginning of the year, and we anticipate that BNB will underperform compared to other crypto assets in the coming months.

Base remains the fastest-growing network 🪂

The TVL (Total Value Locked) of Base, Coinbase's Layer 2 solution, has continued to grow; it increased by 49% in the last seven days to reach $361 million.

This growth positions Base as the fourth-largest Layer 2 solution and the fastest-growing one, as users are flocking to new applications in search of airdrop opportunities.

In the news 📰

- Much of the early increase in TVL on Base can be attributed to Friend.tech, the new experimental, decentralised social media platform launched on the network.

- However, the application's metrics across transaction count, trading volume, and revenue have declined in the last week.

- While the hype around Friend.tech has faded somewhat, Base seized another opportunity as it experienced a significant influx of $100 million through its native bridge.

Predictions 🔮

We predict that while Friend.tech might be losing momentum at the moment, but it could still be worthwhile to farm their airdrop. The token could launch at a decent valuation.Furthermore, we anticipate that Base will continue to gain momentum, serving as the gateway to crypto for retail users who will eventually be onboarded via Coinbase.

If you want to learn more about how to participate in Friend.tech's airdrop, click here.

Cryptonary’s take 🧠

Base deserves close attention as it stands out as one of the most vibrant ecosystems in crypto today. Although much of its activity is fueled by airdrop farming and speculation, it's essential to remember that this is not just any random network. Coinbase has launched it. Understanding where attention is concentrated is crucial, and the data suggests that it's currently focused on Base.And until we bring you another crypto news round-up next Friday, stay winning!

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms