We’ve never been fans of Cardano, but we appreciate progress wherever we see it – and Voltaire offered hope.

However, the SEC case has thrown a spanner in the works.

Does Cardano have the fundamentals to bounce back from this?

Not as it stands - here’s why.

TLDR 📃

- ADA's strong start to 2023 was overshadowed by the SEC case, halting its progress.

- Cardano's centralisation and lack of frequent updates are red flags.

- The peer review process and slow development continue to hold Cardano back.

- ADA's underperformance and bearish market structure suggest limited upside potential.

- Cardano is self-sabotaging; we aren’t touching ADA anytime soon.

Disclaimer: Not financial or investment advice. Any capital-related decisions you make are your responsibility and yours only.

Is ADA security or not? 💱

The SEC’s attack on crypto is old news. After all, the market has rallied since news of a BlackRock Bitcoin ETF broke.

So what has SEC news got to do with anything again? If you’re an altcoin enthusiast, you’ll notice altcoins have been lagging behind BTC.

Now, do we think that altcoins are destined to lag BTC forever from this day onwards?

No, of course not. But the alt market is under heavy fire from the SEC.

We’ve covered some other assets the SEC’s case affected, like SOL and BNB.

ADA was also singled out. And like SOL, ADA was delisted from Robinhood. While Robinhood is a centralised exchange not primarily focused on crypto, it has a TradFi business to protect.

So, delisting ADA and the other tokens mentioned by the SEC is rational – no one wants the SEC’s attention at the moment (or, like, ever).

The thing is, delistings anywhere are never good news. And out of all of the tokens targeted by the SEC, ADA has us the most worried. Look at the chart below.

You’ll notice that while SOL and BNB have underperformed the broader market, ADA is down tremendously.

But why does this scene look significantly worse for ADA? It all goes back to the fundamentals – or lack of it.

Is Cardano sufficiently decentralised? 🌐

Decentralisation is a core ethos of crypto, and we do not believe ADA is decentralised to the same extent as SOL and BNB. And yes, we’re implying that “Binance Smart Chain” is more decentralised than Cardano.

The Cardano Voltaire upgrade set for later this year should improve decentralisation.

Is it too little too late?

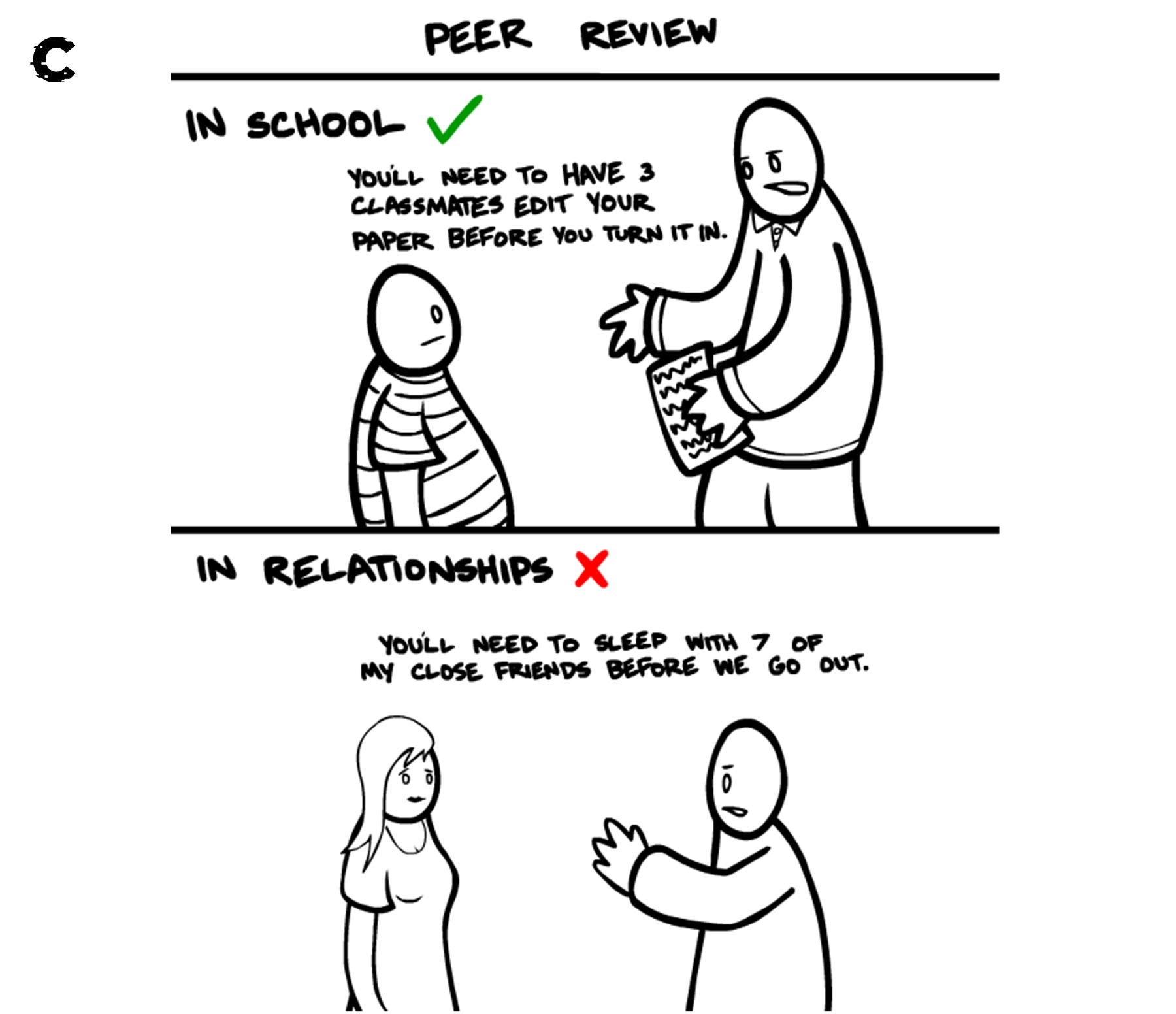

At its very core, Cardano is extremely centralised. It is being built by a “private” engineering company, and nothing goes to the mainnet without first going through a fundamental peer review mechanism. Let’s not even get started on the trinity of entities responsible for managing Cardano.

This structural design inherently, and unfortunately, makes Cardano one of the most centralised projects on the market.

The worst part is that this same tight-knit development process has also held back Cardano for years. It’s a running gag amongst those who have been around for a while.

For Cardano, perfection is the enemy of progress 👹

Peer reviews are good when building things like spaceships, electron microscopes, and other advanced (and expensive) equipment. In the above examples, precision is essential.

And while Charles Hoskinson likes to say he wants Cardano to power mission-critical infrastructure, it sounds like all talk and no action.

You see, striving for perfection is not so good when competing in a constantly evolving, fast-paced environment like the crypto market.

Chains like Solana have been striving to push updates as quickly as possible and dealing with any problems by patching the chain down the line. It’s a crude and brute-force way of doing things. And you end up with short-term discontent users when things go wrong. Look at the bad wrap SOL has had from outages, etc.

But shipping fast works, and it keeps people interested.

At least you actually end up with users.

But, more importantly, shipping things fast means that your development process is constantly taking in user feedback and you can make the chain more usable for them in real-time.

On the other hand, scrutinising every detail, endlessly reviewing potential updates…

Not only is it a highly centralised process, but nothing gets done in the end.

Cardano launched in 2017 - 6 years ago.

And what do they have to show for it?

Basically, a centralised chain laden with a lot of ammunition the SEC can use against them.

Price analysis 📊

Straight to the point. ADA's weekly market structure is bearish, and we're not expecting much upside until that changes. Still, three scenarios can occur here, and we've set our own conviction levels for each.

Worst case (15% conviction level)

- ADA loses $0.24 as support and heads into new lows. This will result in months of consolidation, potentially for the entire year.

- Potential catalysts for this case include:

- A downturn from BTC, taking the market with it.

- Further SEC singling out of ADA.

- More delistings from exchanges.

Base case (84% conviction level)

- ADA heads to $0.30 and flips this level into support. From there, more upside can slowly follow in the coming months if the market structure changes.

- This is a “status quo” case. Nothing changes with the SEC case, and BTC continues with upwards momentum.

Best case (1% conviction level)

- ADA breaks past the $0.40 - $0.45 resistance region. This will start a powerful rally toward the psychological and technical level of $1.

- Potential catalysts for this case include:

- Voltaire upgrade goes live, decentralising Cardano and removing many of the SEC’s issues.

- Binance/Coinbase, or any of the assets singled out by the SEC, cause a setback for the regulator in their case.

You can obviously see which one we believe is the most likely out of the three.

So what’s our opinion on the future of Cardano?

Cryptonary’s take 🧠

Cardano concerns us, both from the standpoint of navigating the SEC lawsuit and from its core as well.

There’s always a reason for underperformance in the crypto market, and there’s room for fundamentals to change the tide.

But ultimately, the asset's price action tells us the market’s attitude towards that asset. ADA’s lacklustre performance is unlikely to improve anytime soon.

It would be different if there were upcoming catalysts for Cardano. But as has been the case for years, updates are few and far between.

From an investment perspective, ADA has never interested us. We can understand the vision, but for Cryptonary, Cardano has had its chance to be competitive and remain relevant.

Unfortunately, it has failed to meet those expectations, and now we’re here.

As always, thanks for reading.🙏

Cryptonary, out!

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms