Crypto Strategies: Outwitting Bank Collapses & Safeguarding Your Wealth

The recent collapse of regional banks and high-profile banks facing outflows have sparked renewed concerns about the vulnerability of the global financial system. Our dependence on banks to manage money and payments leaves us exposed to a centralizing power that is showing signs of overreach.

What if there were an alternative to this system? Couldn’t crypto play a role in protecting individuals from bank collapses and safeguarding their wealth?

It could.

TLDR:

- Trust in traditional banks can be risky, with the potential for mistakes and bank runs during times of stress.

- Cryptocurrency offers a solution by allowing individuals to hold assets in self-custody and eliminating the need for intermediaries.

- Despite skeptics’ arguing against the need for crypto, the current strain in the banking system demonstrates the practical value of crypto during times of system strain.

We Are on an Empty Plane Again

As you settle into your seat on a long-haul flight, the seatbelt sign switches off and you start to browse the in-flight entertainment. Suddenly an explosion rocks the plane. Flames shoot out of the engine and the plane shakes violently. You press the Call button and the flight attendant rushes over, but her assurances that it's just technical difficulties do little to calm you down. You can't sit still and need to see for yourself what's happening. You push past the flight attendants and open the cockpit door, only to find the pilots’ seats empty.This is what happened in the financial crisis of 2008, which brought the financial system to the brink of collapse, leaving many with the feeling of being on a doomed airliner. Although the financial system was rescued from the collapse at that time, we find ourselves on that same metaphorical plane again today. The collapse of three major banks, significant outflows from hundreds of regional banks, and the establishment of a new backstop facility by the United States Federal Reserve are clear indications that this plane is once again showing signs of wear and tear.

While it may seem that the U.S. banking system is not headed for another 2008 crash despite its fragility, it's important to keep in mind that the world is much bigger than the United States. In Lebanon, individuals have had their assets frozen due to trusting a bank, and in Cyprus in 2013, local authorities sparked outrage by imposing a 10% tax on withdrawals

Every year, the world is reminded of the vulnerabilities and risks inherent in the opaque banking system. Individuals who deposit their hard-earned money have no choice but to trust the bank, despite the high potential for mistakes. Politicians blame irresponsible bankers, but history has shown that the banking system itself is prone to failures and bank runs during times of stress, highlighting a systemic issue rather than a problem caused solely by greedy or corrupt individuals. It's not a matter of whether a banking failure will happen, but a matter of when.

How Crypto Offers a Solution

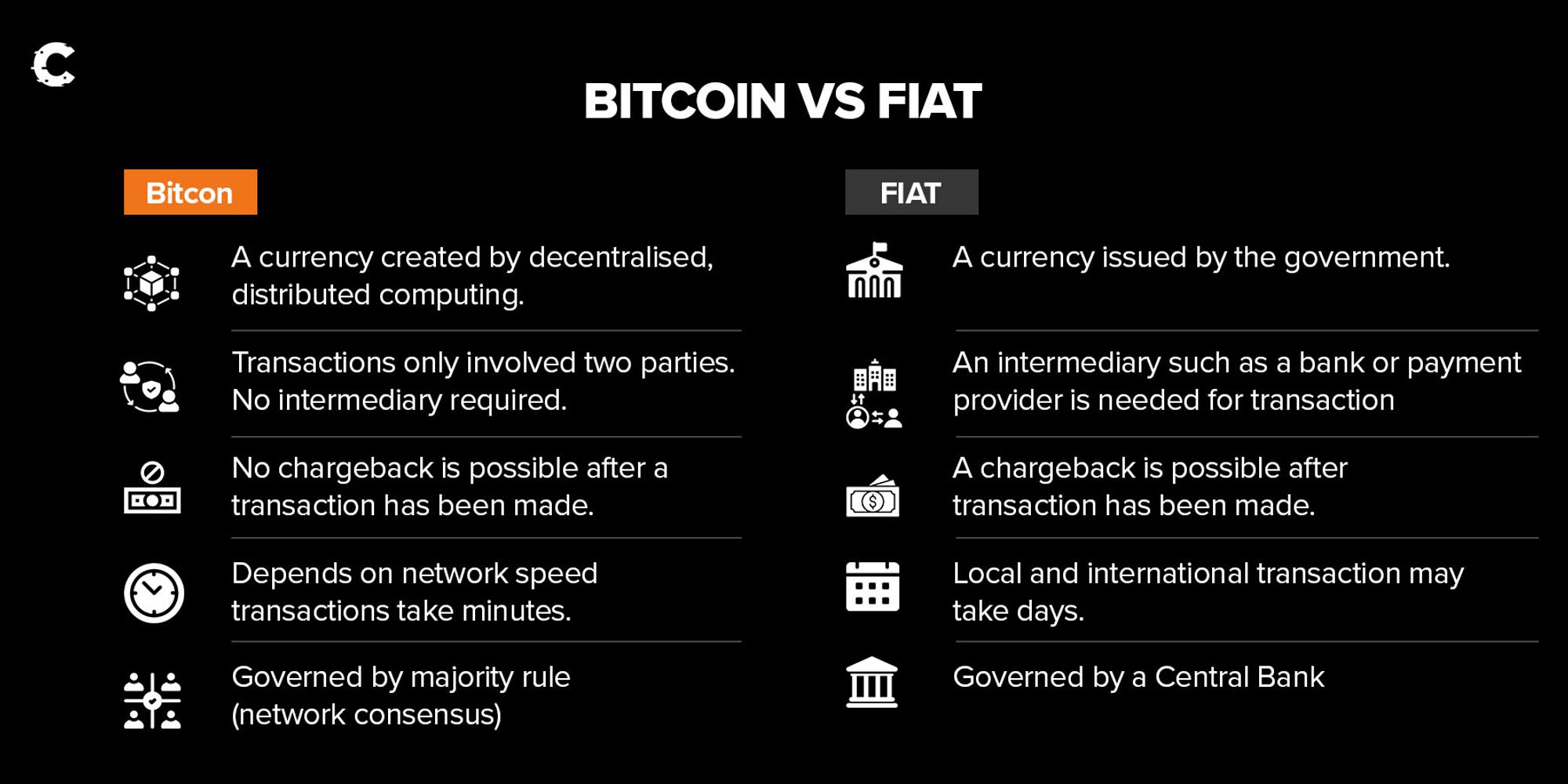

The creation of Bitcoin in 2009 was a response to the financial crisis, with its genesis block marked by a headline from the London Times, "Chancellor on the brink of second bailout for banks." Although Bitcoin was initially seen as a form of activism against the financial system, it also offered solutions to the issues that caused the crisis.One of the main issues with traditional banking is the need for intermediaries like banks to facilitate transactions. This not only adds fees and transaction times but also introduces an element of trust in the system. With cryptocurrency, individuals can take control of their assets and hold them in self-custody, eliminating the need for intermediaries like banks. This allows for faster and more cost-effective transactions, as well as greater transparency over financial activities.

Moreover, cryptocurrency has proved to be a powerful solution during times of banking system stress, especially in countries with low trust in the banking system. In these contexts, crypto offers a viable alternative that gives individuals greater control over their finances. For instance, during the financial crisis in Greece in 2015, citizens turned to Bitcoin to protect their assets as the banking system struggled to keep up with the high demand for withdrawals. This was a clear example of how crypto can serve as a viable alternative to traditional banking during times of stress.

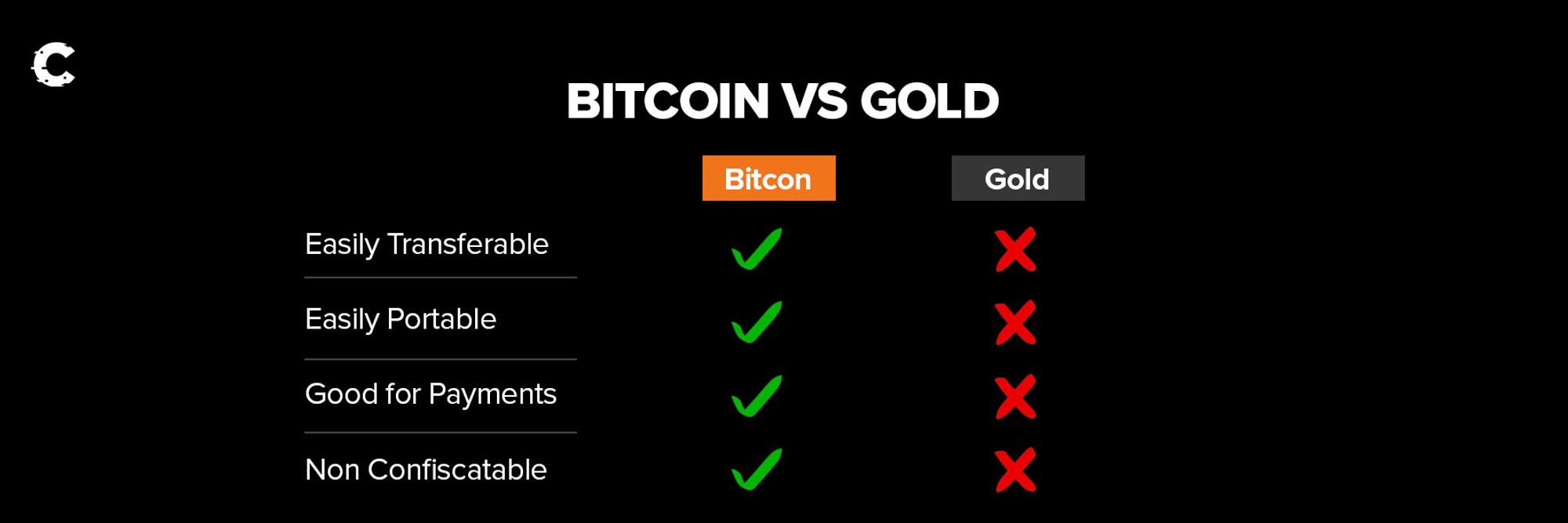

But what about the traditional haven asset during financial crises - gold? Let's face it, it's heavy. Storing it can be a hassle. And if you need to flee your home, carrying gold is not practical. That's where cryptocurrency comes in - it's digital so you can store assets like Bitcoin, Ethereum, or stablecoins without the inconvenience of physical storage. And the best part? You could store up to even a billion dollars in your crypto wallet without worrying about storage costs. Just make sure you remember your seed phrase to access your funds again.

In many ways, Bitcoin can be seen as an improved version of gold, optimized for the digital age. As we navigate the uncertainties of our financial system, like passengers aboard a plane with no pilot, it's reassuring to know that we have Bitcoin as a potential financial parachute in case of a crisis.

Cryptonary’s take

We firmly believe that crypto is the future of finance. It has the potential to lead us toward a more stable financial system. This is because it eliminates the need for trust in intermediaries and offers a truly neutral system that can exist outside the traditional financial system, much as gold has done for many years.Skeptics argue that the volatility of crypto asset prices and the hype surrounding particular coins make crypto unsuitable to serve as a key component of the global financial system. However, the current strain in the tradfi banking system demonstrates that this is a fallacy. Across the globe, people have already benefited from the ability to store assets themselves, without relying on banks or governments.

Although crypto is not yet at a stage where it can completely replace our financial system, it is already a practical asset we can use and trust during times of system strain. With governments introducing Central Bank Digital Currencies that may offer less privacy and impede individual freedom, owning an asset that we genuinely possess and can use without intermediaries has become even more essential.

As part of our investment strategy to protect against potential financial system failures, we hold a diverse portfolio of crypto assets, including Bitcoin and Ethereum. The details of our portfolio are outlined in our monthly Skin In The Game report, which is exclusively available to Cryptonary Pro members. We have also allocated a portion of our portfolio to gold, which is not optimal protection but is at least a resilient alternative to the dollar. To ensure maximum security, we self-custody all of our assets.

Action Points:

- To prepare for potential banking system failures, it may be wise to diversify your assets and include commodities like Bitcoin in your portfolio. To ensure complete control over your holdings, consider storing your Bitcoin in a hardware wallet. By taking this step, you'll be able to safeguard your wealth and maintain access to it in times of financial stress.

- Read our monthly reports for Pro members for a detailed understanding of how we manage our assets and portfolio to protect our wealth, along with valuable insights into the current crypto market.

- Gain valuable insights into the potential impact of Central Bank Digital Currencies on your future by reading our comprehensive CBDC article.

Continue reading by joining Cryptonary Pro

$1,548 $997/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms