Ethereum Digest: DeFi a "national security threat"

This conclusion is contained in a 42-page risk assessment published on April 6. The document says DeFi platforms are being used by ransomware hackers, rogue states, and other bad actors for undetected money transfers.

TLDR 📄

- US Treasury labels DeFi a national security threat, calls for tighter regulations.

- Ethereum Shanghai Upgrade expected to create short-term selling pressure, but will be crucial for long-term value.

- DeFi remains stable, with zkSync showing a significant increase in TVL.

- NFT market evolves with new projects and marketplaces; mint and sell strategy remains safest for short-term gains.

- Market structure remains bullish and calls for $2,200.

- Share this digest with your family and friends!

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

US Treasury: “DeFi is a national security threat” 🚔

The United States Treasury has stated that DeFi poses a threat to national security due to its lack of oversight and potential for money laundering.The Treasury Department advises three solutions so far: Heightened oversight from the US government. Strict AML procedures for DeFi users. And collaboration with other governments to establish international standards. This is yet another push for regulations at a very suspicious time (US financial system under severe stress).

18M ETH bullish unlock? 🔓

In our previous digest, we talked about the upcoming 18M ETH that will be unlocked with the April 12 Shanghai Upgrade. Many expect the upgrade to cause drastic selling pressure, but we think otherwise. While there’s a good 1M ETH that are likely to be sold, it won’t be the entire 18M. This is due to multiple factors that we've previously mentioned, which you can read about here.There is one element we have not yet discussed, and that is the state of Ethereum staking post-upgrade. Let’s dive in!

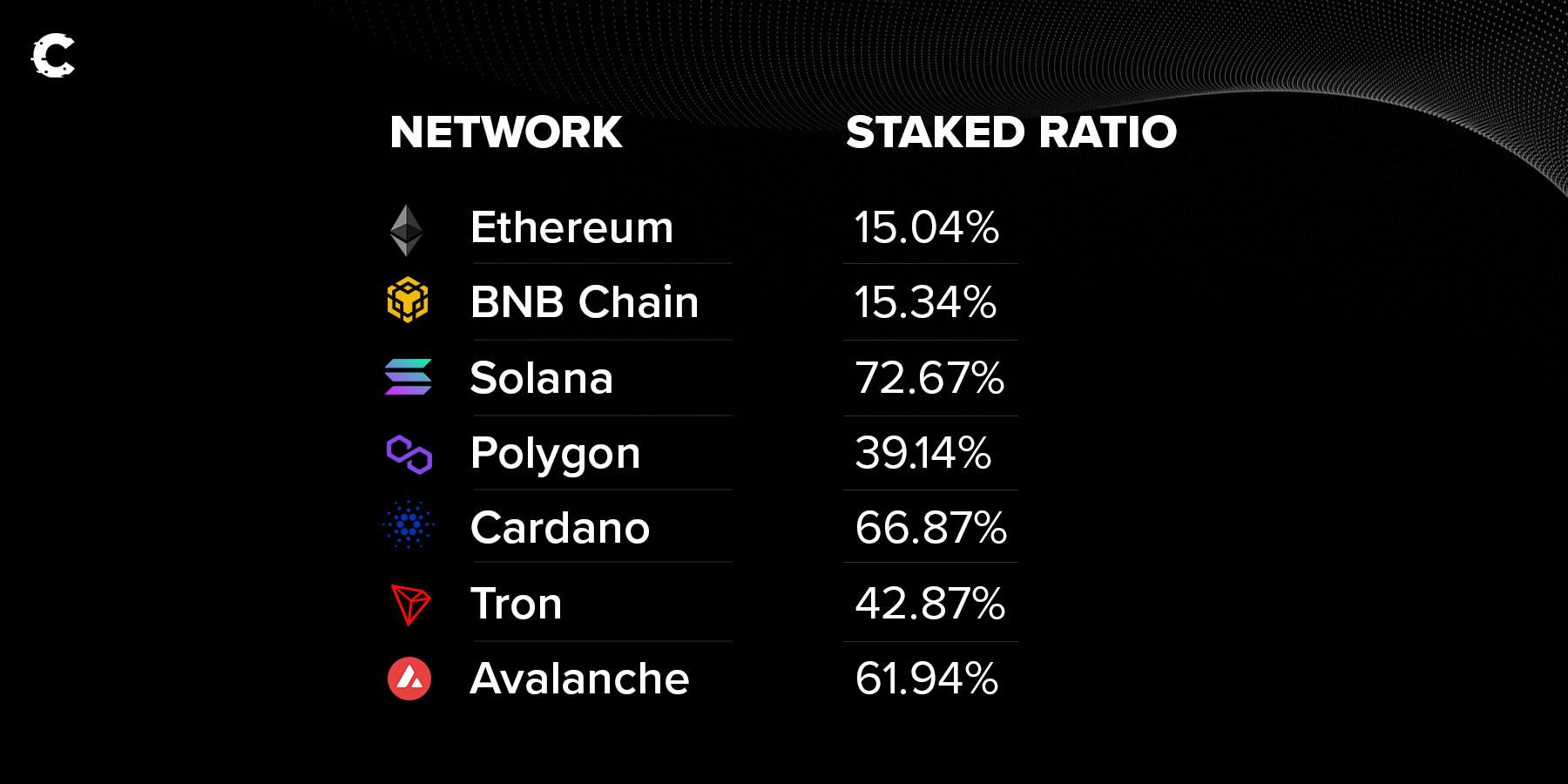

15% of the ETH supply has been staked to secure the network and earn rewards, despite the fact that withdrawals are not possible. In theory, that would beg the question: would the staked percentage be higher if withdrawals were an option?

To find the answer, we have to look at other proof-of-stake networks and find out what their staked ratios are.

As you can see, Ethereum has the lowest staking ratio out of the largest networks.

The average staking ratio is 50%. A high number is beneficial for PoS networks as it is positively correlated to network security and stability. Of course, that does not mean a 100% staked ratio is optimal as it would lead to higher centralisation risks and low liquidity for the main token.

We speculate that once the upgrade is complete and people test the effectiveness of the withdrawal mechanism, the ETH staked ratio will go up to 20-30%. This would lead to a higher ETH price and will open up opportunities for liquid staking providers such as Lido and RocketPool to attract more value (and higher token prices).

In the short term, we’re likely to witness some selling pressure and FUD on withdrawals being processed. However, this upgrade is crucial for long-term ETH value accrual.

On another note, we have seen 84,000 ETH ($155M) staked in the last week despite the fact that withdrawals will soon open up. This suggests that demand is still strong.

Price chart 📈

ETH’s price continues its march toward our $2,200 target.

The market remains bullish, with higher highs and higher lows - especially with the most recent flip of $1,845 from a resistance point into support.

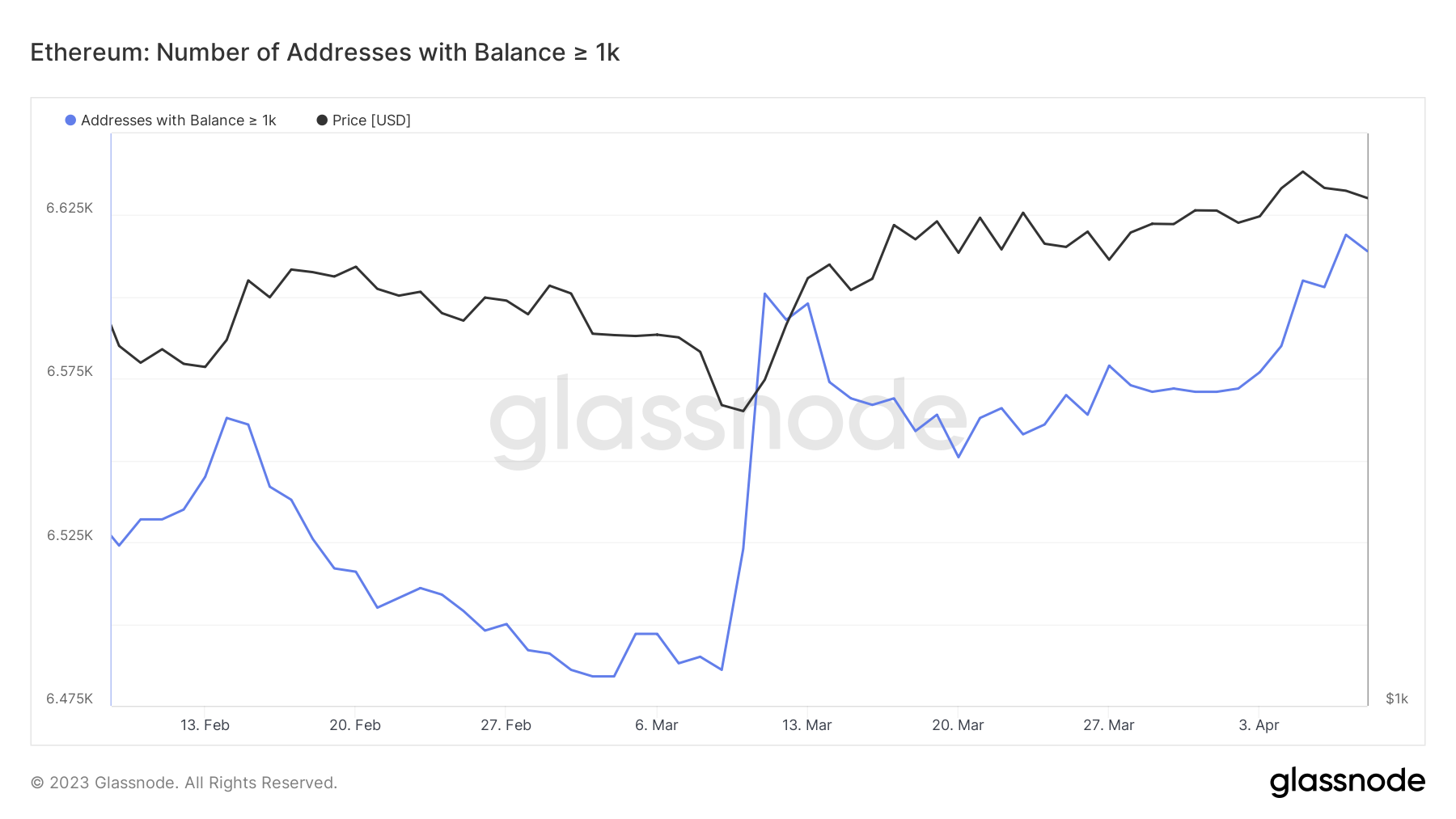

Smart money 🧠

The whales continue to sit on the sidelines after their first round of accumulation earlier this year.

We have seen a small increase in the >1,000 ETH whales as they welcomed 37 new addresses (+0.56%) to their group. On the other hand, the real big boys with >10,000 ETH saw 6 addresses (-0.51%) leave their cohort.

These small and insignificant changes suggest that whales continue to be patient after their initial round of buys at the start of this year. If they were to start selling en masse we’d be worried about this rally coming to an end.

Ethereum ecosystem 🗺️

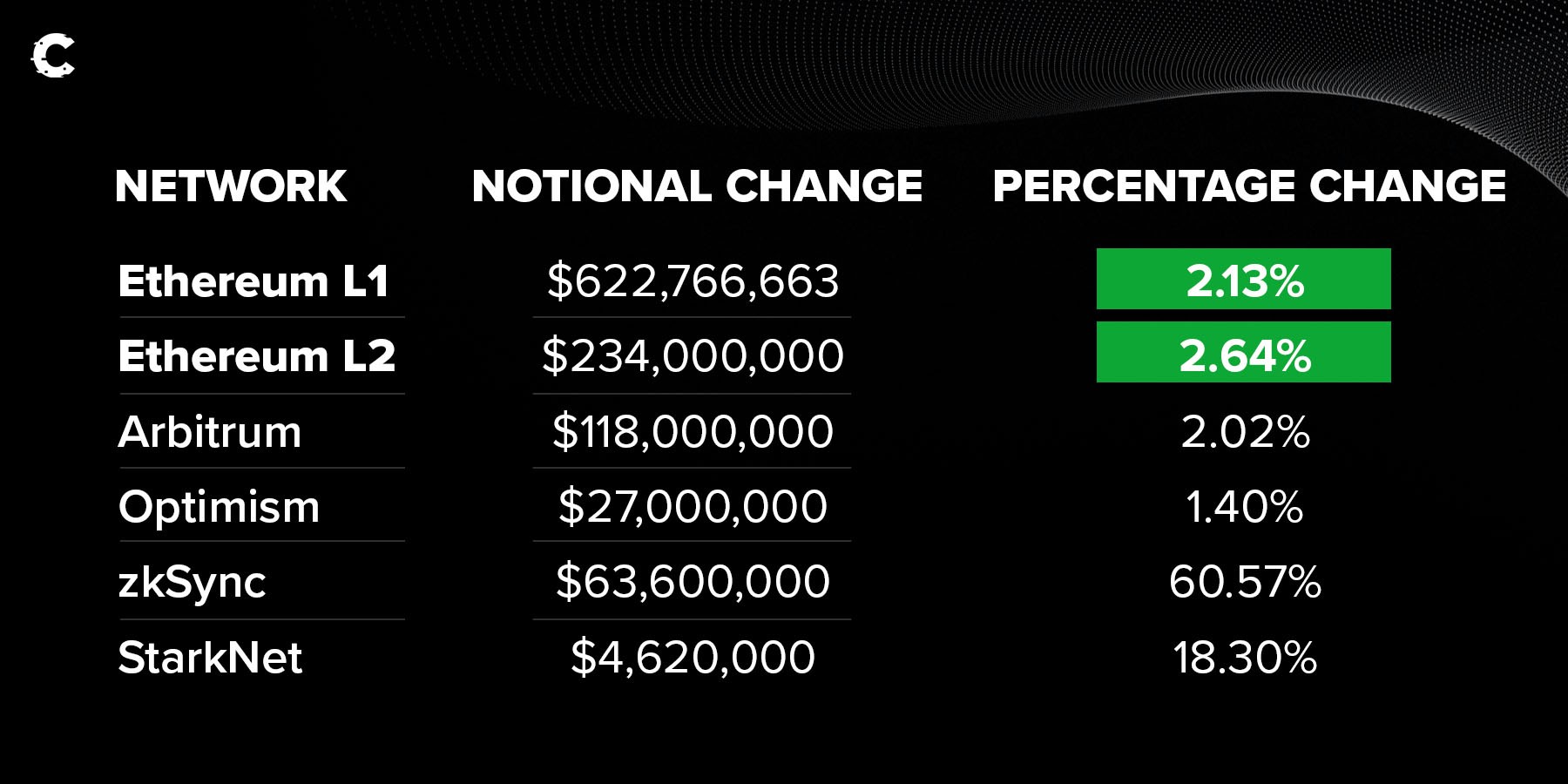

Decentralised Finance | DeFi 🏦

This is the only table you need to get your DeFi update 👇🏼

The DeFi scene remains relatively stable and unchanged since last week for the main participants (L1, Arbitrum, and Optimism). The main significant change can be seen with zkSync seeing a +60.57% increase in TVL. This highlights zkSync's growing adoption and potential success following the launch of its mainnet.

You can read more about DeFi updates in our digest here.

NFTs 🖼️

OpenSea struggles in the marketplace wars, launching OpenSea Pro to regain market share. However, NFT buyers' short attention spans and new entrants may cause Nakamigos prices to drop. Yuga Labs (Otherside), DeGods, and Iron Paw Gang are key projects to watch. For short-term gains, the mint-and-sell strategy remains the safest approach.You can dive deep into the world of NFTs here.

Cryptonary’s take 🎯

ETH remains on track for $2,200 so long as the market structure remains bullish (higher highs and higher lows).Many expect large selling pressures to ensue from the April 12 Shanghai Upgrade. However, we expect it to be much smaller for multiple reasons. This upgrade is crucial for the future of Ethereum and is likely to lead to increases in ETH’s price over the long term.

The ecosystem, DeFi, and NFTs remained quiet this week but the US Treasury did not, as it called DeFi a “national security threat”.

As always, thank you for reading 🙏🏼

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms