So, what’s happening this week?

Ethereum takes centre stage as Lido DAO and StakeWise update their protocols ahead of the Shanghai Upgrade (the next Ethereum upgrade). Who will come out on top?

Uniswap released a mobile wallet, and Perpetual Protocol launched its first vault, resulting in some bullish price action.

And the regulatory scrutiny over $BUSD heats up!

Let’s dive in…

TLDR

- Lido DAO and StakeWise are updating their protocols before Ethereum’s Shanghai upgrade.

- Kwenta (KWENTA) has risen 590%+ ahead of plans to launch leveraged ETFs (essentially leveraged baskets of assets, traded as one token).

- The regulatory scrutiny on $BUSD has benefited Liquity Protocol and TrueUSD.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

DeFi Overview

We’ve seen a bullish crossover, a technical indicator that signposts a potential trend change, for the first time in 20 months. Is this the start of a new bull trend? Could it mark the beginning of DeFi Summer 2.0?

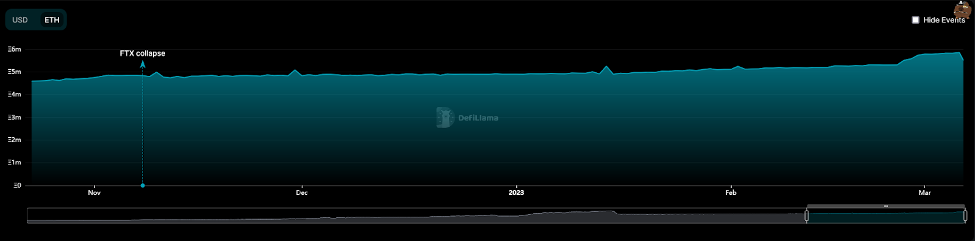

Total DeFi TVL (TVL: a measure of all assets staked/bonded/deposited with a protocol) has remained flat across all chains as the market corrected this week. Still, with BTC down ~10% in the last 2 weeks, this represents DeFi outperformance.

Let’s dive into the news!

Key News

- Ethereum Shanghai Fork Delayed: Initially set for mid-March, the Ethereum Fork has been pushed back to sometime in April.

- DeFi Hack Recovery Sets Dangerous Precedent as Oasis Reclaims $140M Stolen Crypto: The developers behind Oasis, the main gateway for DeFi lending protocol Maker, retrieved $140 million of stolen cryptocurrency from a hacker. However, their actions have raised questions about the security of DeFi protocols and the concept of immutability (Immutability refers to the idea that blockchain transactions cannot be changed once they have been recorded)

- DeFi Clash Could Leave Depositors Empty-Handed: Iron Bank, a DeFi lending protocol, has cut off the lending accounts of its long-time partner Alpha Homora due to $32 million of bad debt. Alpha Homora, allows users to earn yield on their crypto. They claim that the change caught them off guard and warn that depositors may lose their assets if the two protocols cannot reach an agreement.

- Uniswap has Released Their Own Mobile Wallet: It will allow users to swap assets seamlessly on their phone. With this move, Uniswap (currently serving upward of 400,000 monthly users) is opening itself to an entirely new audience.

- Perpetual Protocol (Perp) has Announced Their First Vault: Named Hot Tub, the first vault will earn yield for depositors. This is the first of many vaults, with more releases expected soon.You can sign up to early access for hot tub here.

Hot Narratives

Asset Management

Asset management is extremely early, even by DeFi standards. The protocols are new, the waters are untested, and the opportunities are exciting.However, this means there isn’t much data one can use to back investment decisions.

STFX, which only launched its token in January 2023, is the best-known protocol. Due to its early stage, it only has $2.9M lifetime trading volume.

Despite this, investors are catching on to the opportunity. Last week Factor DAO raised over $7.5M at IDO without a working product.

STFX raised $6M in January (after a $2M seed round), showing hunger for these solutions.

Sector Finance, who don’t yet have a token (this means there’s potential for an airdrop…) launched their vaults on Monday, achieving over $800k total value locked.

Existing projects, like Kwenta and Primitive, have caught on, and are expanding into asset management.

Primitive is launching a Portfolio tool, which can rebalance portfolios at preset intervals. This means when prices change, the tool will buy and sell assets, ensuring you always have a set % of each asset.

Kwenta (whose price has risen 596% this year) plans to launch leveraged ETFs. ETFs or exchange traded funds, hold a basket of assets in one investable token.

We expectfurther growth, with more asset management solutions continuing to appear. Whilst the risk is high, keeping a close eye on the sector will prove highly lucrative.

Decentralised Stablecoins

The SEC's recent crackdown on $BUSD had repercussions for the entire cryptocurrency market, leading Coinbase and Aave to withdraw their support for the stablecoin.As a result, investors are now seeking decentralised alternatives, which has led to a substantial shift in the stablecoin landscape. Two stablecoins that have emerged as clear winners in this regulatory dispute are Liquity Protocol and TrueUSD.

These stablecoins have witnessed a significant surge in usage this year, thanks to their decentralized nature which makesthem less susceptible to government crackdowns.

Liquity Protocol

Liquity Protocol is making waves in crypto, and for good reason. Recently, Aztec Network, a Layer 1 focused on privacy, announced its integration with Liquity Protocol. This is big news for the platform, as it opens up new opportunities for users to access the decentralised stablecoin in a private manner.

Adding to the excitement, Binance announced that it will list Liquity (LQTY) in the Innovation Zone which will permit certain users to trade newer cryptocurrency token offerings directly from their Binance account. This is a significant development for the platform, as it will provide greater liquidity and exposure to a wider audience.

Because of the listing on Binance and the growing interest in decentralized stablecoins, the token has outperformed ETH by 205%.

TrueFi

TrueFi has also been making headlines. Binance announced that it had minted 50 million True USD (TUSD/USD) stablecoins, causing a surge of interest in the platform.

As a result, TUSD has toppled decentralised finance protocol Frax Finance's native stablecoin FRX for the fifth place in market value. This growth represents a 6.24% increase in the last week.

$TRU has significantly outperformed $ETH, but it has also been quite volatile in recent months with massive surges to the upside and downside.

Liquid Staking

TVL across Liquid Staking (LS) protocols continues to grind up. Over $12B in ETH is now locked in LS - around 6.3% of the total ETH supply. With the Ethereum Shanghai upgrade postponed, LS protocols are expected to continue to gain ETH at an advanced rate. Subsequently, the LS bull run will be extended untill at least April, as opposed to mid-March.

Lido DAO (LDO)

Lido DAO is voting to initiate its V2 upgrade. The upgrade is intended to align with the wider Ethereum Shanghai upgrade (ETH withdrawals enabled). The fundamental changes are:

- Withdrawals Support: ETH stakers can withdraw with the Shanghai upgrade. This must be implemented in time for Shanghai.

- Staking Router: Upgrades to the user interface and back end of the staking router.

All systems are in top gear to get the protocol ready for Shanghai. For more information on Lido, click here.

Token performance has remained impressive, significantly outperforming ETH. However, weakness in the wider market has blunted the advance of LDO and other LS tokens.

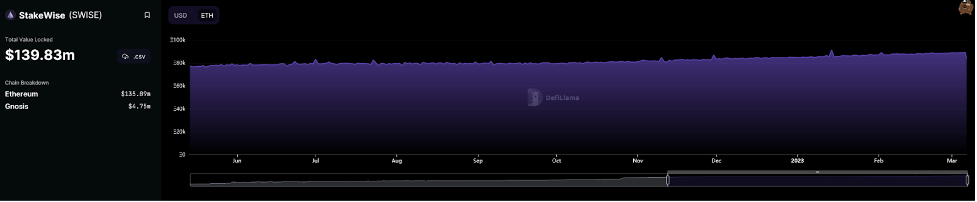

StakeWise (SWISE)

Like all LS protocols, StakeWise has been busy building too. They recently announced the launch of a testnet for StakeWise V3, the Atlantic testnet. Theprotocol hopes that a successful launch of V3 will bring in previously sidelined ETH holders. This will be done by offering attractive terms to stakers, such as slash-free bonding.

Poloniex announced a listing of SWISE. This represents the second CEX listing, and the first major exchange to list the token.

StakeWise has registered a low TVL gain by sector standards. Just 0.3% in the last 7 days, and 2.2% in the last 30 days.

Like most LS tokens, SWISE has been outperforming ETH. However, slow TVL growth compared to some of the other LS protocols has left the token lagging behind the competition. The StakeWise V3 testnet does not appear to have had a significant impact on token price. But, the upgrades are a net positive long-term.

Smart Money

Term Labs Raises $2.5M in Seed FundingTerm Labs. has raised a $2.5 million seed round, led by Electric Capital,in participation with Coinbase Ventures, Circle Ventures, Robot Ventures, MEXC Ventures, and angel investment from DeFi founders from Aura, Balancer, Hashlow and Llama.

The funds raised will be used to develop Term Finance (termfinance.io), a decentralized lending protocol that utilizes a unique auction model to support scalable fixed-rate/fixed-term lending.

Is Justin Sun selling his $TRU?

On March 5th, Justin Sun sent 28.8 million $TRU ($3.87M) to Binance.

While TrueUSD has gained traction in recent weeks, Justin Sun may have been looking to reduce his $TRU position.

Other News

- Level, a Binance decentralised exchange, has been gamed (exploited without hacking).

- Vaults.Pro rebrands to Valio.xyz.

- Rysk Beyond early access applications open.

- Dopex updates rDPX tokenomics, with a focus on synthetic assets.

- Uniswap allows users to buy NFTs with any crypto asset.

- Sushiswap live on BASE at launch, with plans to launch on Sei.

- STFX governance is live.

Cryptonary’s Take

The key narrative to watch will be Ethereum Shanghai Fork. Large quantities of ETH will be freed up, no longer locked in the contract. Liquid staking protocols will compete to attract ETH to their product. With the unlocks, competition will become even fiercer.Plus

Decentralised stablecoins are becoming increasingly popular. Regulatory scrutiny on centralised stablecoins has led to the “rediscovery” of decentralised alternatives. The usage of decentralised alternatives is set to increase.

An interesting week in DeFi - stay tuned for next week’s update!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms