So, what’s happening this week?

The $ARBI airdrop put Arbitrum in the spotlight. $BTC’s strength thrusts BTC-Fi upwards. DWF Labs invests $20M in Synthetix, and a Chinese project takes the cake for raw gains.

Let’s dive in…

TLDR

- China is undergoing a period of loose economic policy. Tokens available to Chinese citizens are outperforming, with Conflux ($CFX) up over 2000% this year.

- The ARBI airdrop has finally arrived and will be released on March 23, priming the Arbitrum ecosystem for growth.

- Lido Finance plans to enable withdrawals of staked ether (stETH) in mid-May, allowing those who have staked their $ETH with Lido to finally withdraw it.

- $BTC dominance grew stronger this week, causing most altcoins to underperform, but DeFi on Bitcoin (BTC-Fi) has been thriving.

Disclaimer: Not financial nor investment advice. Any capital-related decisions you make are your responsibility and yours only.

DeFi overview

Total DeFi TVL (Total Value Locked) has remained relatively flat since last week. This is consistent with altcoins underperforming $BTC.

$BTC’s explosive surge from $20,000 has left the rest of the market behind. $BTC dominance has spiked, and it remains to be seen if and when altcoins will catch up. The banking crisis and uncertainty surrounding the financial system have led many investors to turn to $BTC as a safe-haven asset.

Let’s dive into the news!

Key developments

- DefiLlama forks as internal dispute unfolds: Following a dispute over plans to launch a token, the DeFi analytics dashboard DefiLlama was been forked by one of its employees over the weekend.

- Radiant V2 has gone live: Radiant, a lending market on Arbitrum, released version 2 of its platform. Users can now bridge their $RDNT and other assets between different chains and take advantage of benefits on any chain, turning Radiant into a multichain lending protocol. This new functionality is made possible thanks to LayerZero's technology.

- Lido Finance expects to enable withdrawals of staked ether (stETH) in mid-May,a few weeks after the activation of the Shanghai-Capella upgrade (which will enable Ethereum staking withdrawals). The team plans to complete audits of the on-chain code before enabling withdrawals.

- The Federal Deposit Insurance Corporation (FDIC) sells Signature Bank deposits and loans to Flagstar Bank, a subsidiary of New York Community Bancorp. This came just a week after Signature’s collapse. However, the deal does not include any crypto-related deposits.

- Coinbase exploring the launch of offshore crypto trading platform that would include perps. The new platform would be separate from Coinbase's main marketplace, and would cater to global clients. The discussions are confidential and are happening amid the US government’s crackdown on cryptocurrencies.

Hot narratives

$ARB goes live!

Finally, the Arbitrum airdrop is coming!On March 16 we were excited to see this tweet:

We’ve been banging the drum in our community for a long time, with a report released in March 2022 detailing how to qualify for both the $ARB and $OP (Optimism) airdrops.

Qualifying participants are set to receive between 625-10,250 $ARB, making this the biggest airdrop since $DYDX’s when traders walked away with over $10,000 in tokens.

You can check if you’re eligible here, and see the launch countdown here.

It’s not all about the free money though. Arbitrum’s token launch will have far reaching effects through DeFi.

As soon as the token goes live on March 23, holders will be able to vote on governance decisions.

This is huge for DeFi.

Arbitrum is a fundamental part of DeFi, with many of the largest dApps calling it home.

So decisions that are made by its governance are going to be vital.

We’ll be keeping a close eye on the governance forum and chats, as we expect them to be a source of valuable information.

Has there been an impact?

Total value locked (TVL) on Arbitrum has risen since the announcement.

Often, the opposite happens around airdrops, as investors who farmed the airdrop remove their funds.

A large part of this increase has been from exchanges. Users appear to be providing liquidity on Arbitrum ahead of the expected increase in trading.

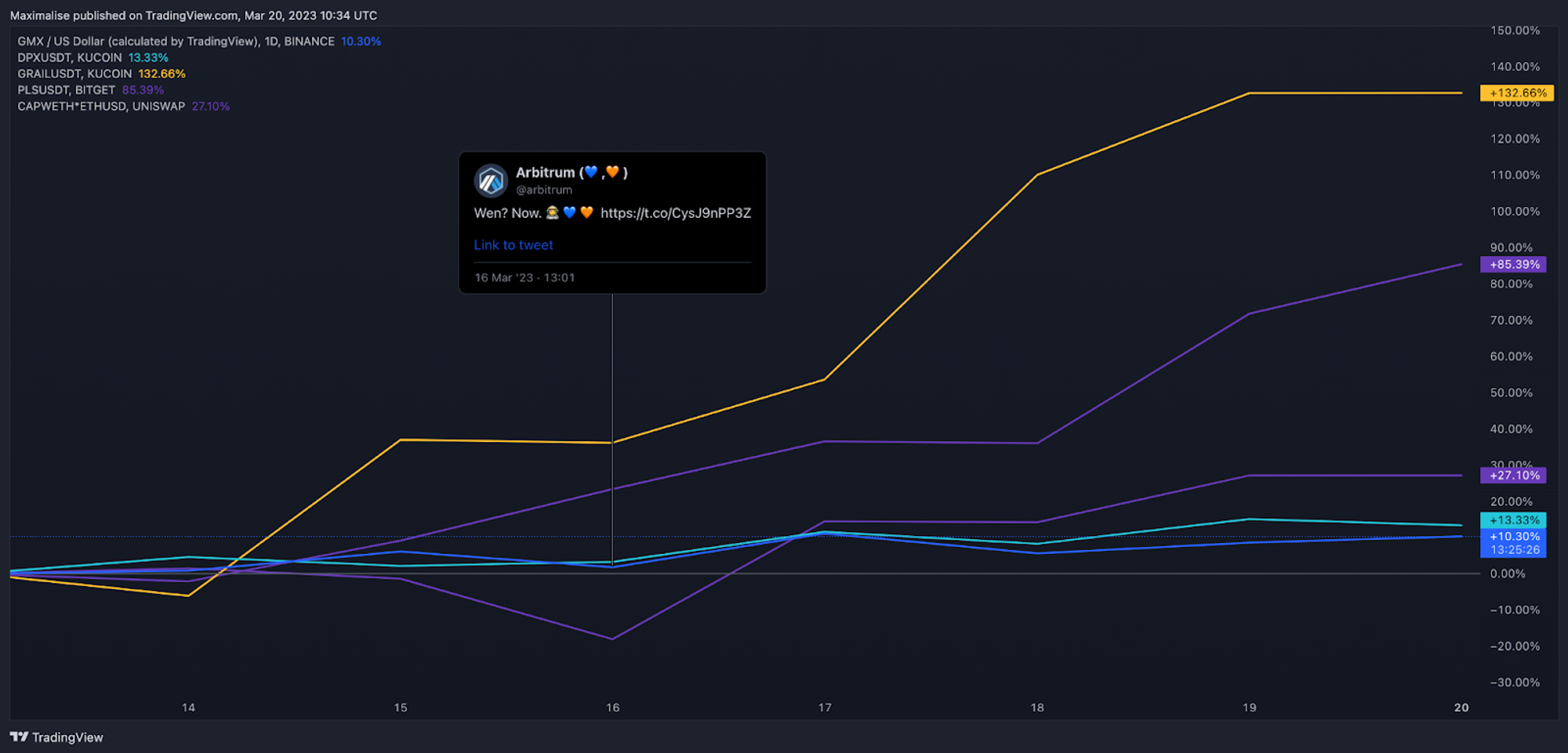

Ecosystem tokens are pumping

$GMX (4.7%), $DPX (10%), $GRAIL (94%), $PLS (140%), and $CAP all saw upside.

BTC-Fi: The rise of DeFi on Bitcoin

This week, $BTC’s dominance has grown, reaching a local high of 47.70%. While this has caused most altcoins to underperform, there’s one sector that has thrived: BTC-Fi.

Projects offering DeFi or other services, such as NFTs, on top of the Bitcoin network or layer 2s have grown in popularity. Investors willing to take on greater risk seek exposure to the strength of Bitcoin through these projects.

Let’s take a look…

Stacks ($STX)

Stacks is often referred to as the "Bitcoin layer for smart contracts." By using Stacks, developers can create new and innovative ways for people to use $BTC, such as lending, borrowing, and trading, without relying on centralised institutions.The total value locked on the network is relatively low, but as you can see, it has seen a steep rise from a low of around $7M at the start of January up to $34M now.

Thanks to the strength of $BTC, the $STX token has increased by 66% in the last seven days. Another important factor contributing to its strength is a recent improvement to the Stacks layer, which went live on March 20.

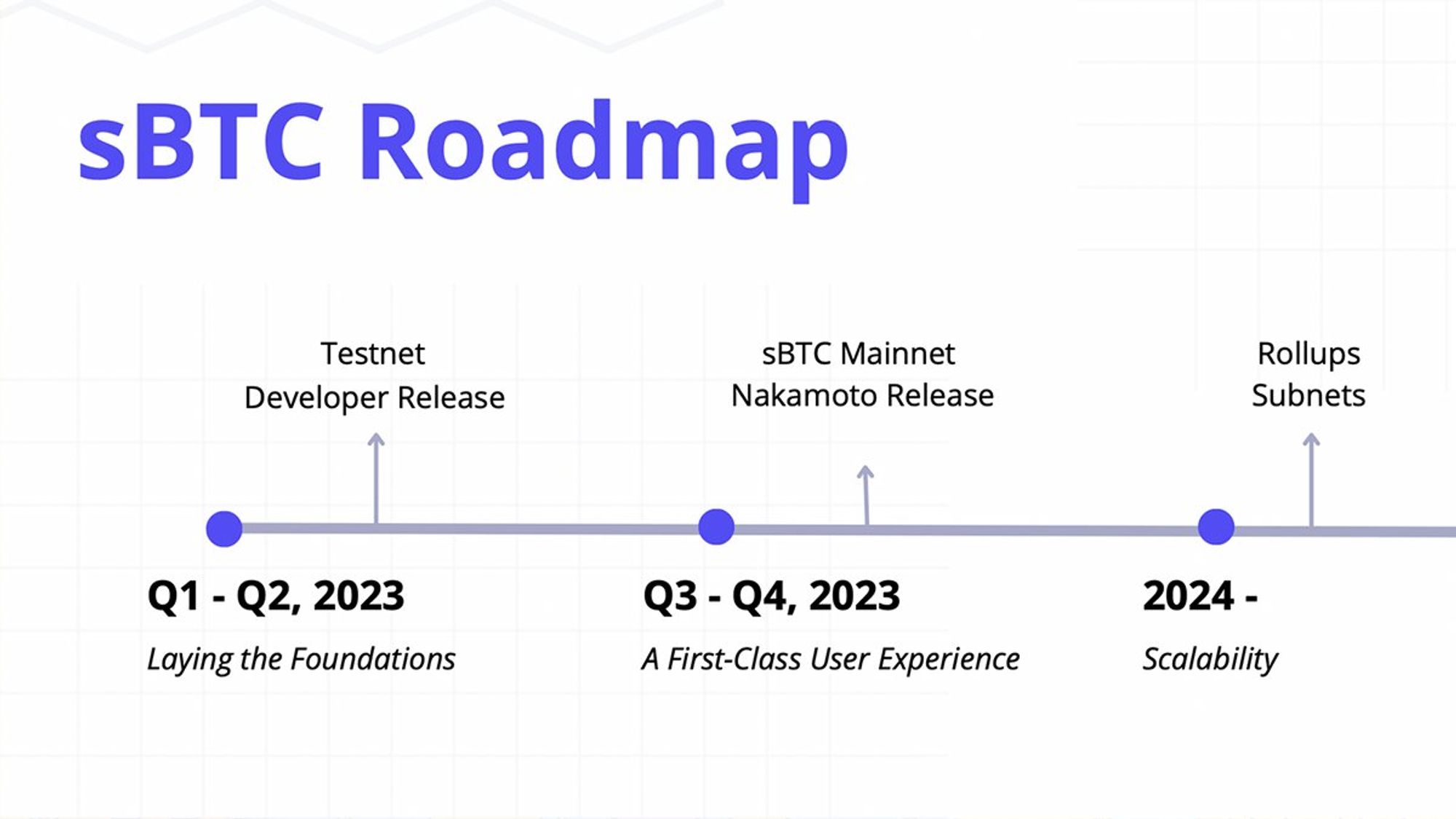

A roadmap for $sBTC has been released. This cryptocurrency mirrors the value of $BTC but operates on a separate blockchain using smart contracts, allowing it to be traded and used in dApps (decentralised apps).

Sovryn ($SOV)

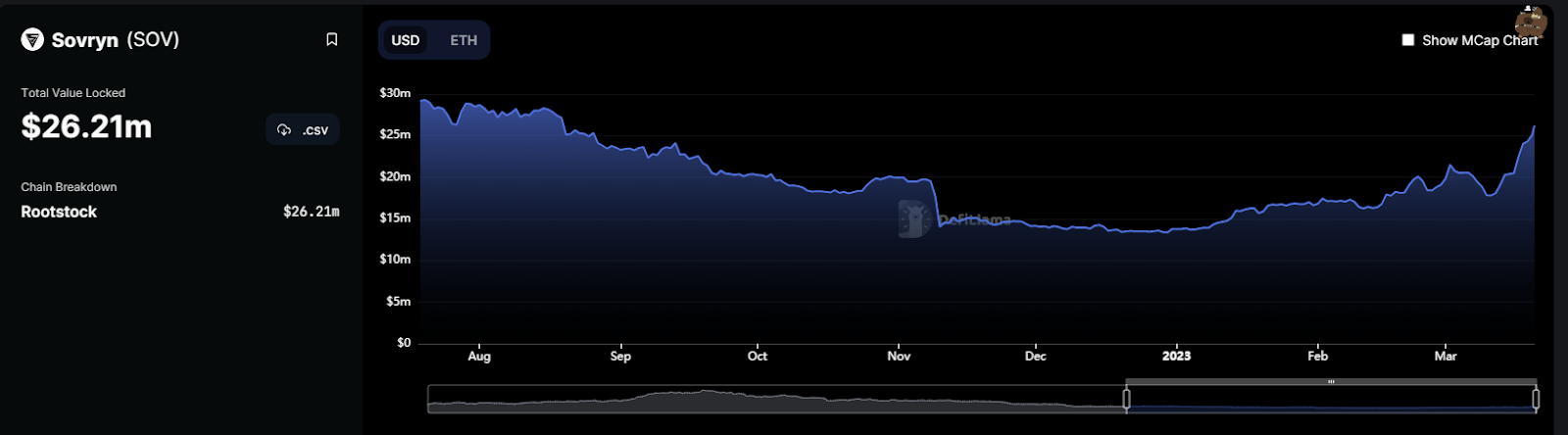

Sovryn is a platform for lending, borrowing and margin trading Bitcoin and other cryptocurrencies in a secure and permissionless way. It uses RSK sidechain technology (a Bitcoin sidechain which can support Ethereum smart contracts) on the Bitcoin blockchain, and gives users complete control over their funds.Its TVL is still relatively low, but has been increasing in recent weeks. It rose from a low of approximately $13M at the start of 2023 to $26M on the 20th March.

Sovryn raised $5.4M in October 2022 from Collider Ventures, Bering Waters, Bollinger Investment Group, and Balaji Srinivasan. With rising $BTC dominance, its native token $SOV has done well, jumping 70% over the preceding week to a $25M market cap.

Other notable BTC-Fi protocols:

BadgerDAO: is a decentralized autonomous organization (DAO) that aims to promote $BTC adoption on Ethereum. Recently, it announced a new product called $eBTC, which is a cryptocurrency built on the Ethereum network and exclusively backed by Liquid Staked ETH ($LSD).$ eBTC is a decentralized, synthetic token designed to mirror the price of $BTC.REN: is a decentralized protocol that aims to compete with centralised wBTC. It recently created a Swiss not-for-profit foundation called Ren Foundation and issued new $REN tokens. This is to ensure the continued development of Ren 2.0, following the bankruptcy of Alameda, which was responsible for the Ren 1.0 network.

The RSK Infrastructure Framework (RIF): is an open-source platform for building dApps on the Bitcoin blockchain. It offers a set of tools and protocols for developers to create and deploy smart contracts and dApps.

China x DeFi

Despite the generally negative stance on crypto adopted by the Chinese government, there are a few islands of activity. China and Hong Kong are governed under the “One Country, Two Systems” policy, and crypto is essentially regulated in the same manner. With Hong Kong set to become another crypto hub, there are two key ecosystems that are allowed access to the Chinese market:Neo ($NEO)

$NEO, often dubbed “Chinese Ethereum” has climbed by around 50% since the beginning of 2023.

Neo is one of a few crypto projects that can legally operate within China. The country is experiencing a period of loose economic policy, and the appetite for crypto exposure is strong. Chinese investors have very few options for crypto investment, so naturally $NEO is their go-to investment.

That said, $NEO’s gains are just a drop in the bucket compared to…

Conflux (CFX)

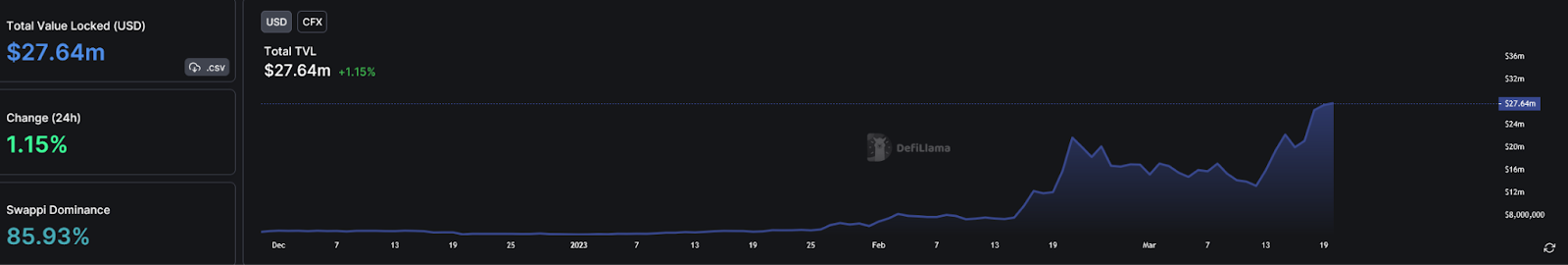

Need we say more? Registering a whopping 2,000%+ gain this year, to say $CFX has impressed is an understatement. Conflux is the REAL “Chinese Ethereum.” But there can only be one winner here. Conflux has a much smaller market cap than $NEO, which explains some of the gains.

Conflux’s TVL is up over 500% this year. And there’s a reason - it is the only blockchain that is regulatory-compliant in China. This is the great advantage that Conflux holds over Neo.

What’s next for China?

The Chinese crypto narrative is ongoing. Both Neo and Conflux have relatively small ecosystems with only 4-6 protocols built on each. However, the room for development is immense. With well over a billion people in China, the market is massive.Crypto investment corner

DWF Labs invests $20M in DeFi liquidity protocol SynthetixMarket maker and investment firm DWF Labs is making a $20M investment in on-chain liquidity and derivatives trading protocol Synthetix.

DWF Labs purchased $15M worth of Synthetix's native token $SNX on March 16, with a further purchase of $5M set to follow.

Note, we’ve previously written about our thesis on Synthetix in Dec 2020, and updated in Jan 2023.

Blockchain infrastructure developer Smooth raises $2M in seed funding

Blockchain startup Smooth Labs raised $2M in seed funding from NGC Ventures, Cogitent Ventures, ArkStream Capital, and Ian Balina's Token Metrics. Founded in Singapore in July 2021, Smooth Lab co-founders Wiger Wei and Lucie Chen are building blockchain infrastructure to increase transaction speeds and reduce wait times through the parallel execution of transactions.

The Smooth network is currently under development and will launch a testnet in Q3. The company plans to expand its team by hiring in engineering and business development.

Other News

- dYdX proposal to reduce trading rewards passes

- SeiNetwork updates on final testnet

- RibbonFinance DAO proposal to bootstrap Aevo with $1M

- RockX, a Singapore-based blockchain company, unveils institutional liquid staking platform

- Euler Finance to offer $1M reward as it reels from nearly $200M exploit

- Ledger launches browser extension to improve crypto wallet connectivity

- Sei Network updates on final testnet

- Conflux partners with Little Red Book, China’s answer to Facebook

Cryptonary’s take

Despite the TVL of DeFi remaining stagnant, the $ARBI airdrop has ignited a surge of in capital into Arbitrum DeFi. The same can be said for BTC-Fi, which is typically not a hot topic. However, with Bitcoin's increasing dominance, it may become a sector that attracts greater development, especially with the 2024 halving potentially playing a role later this year.With China in the process of reopening after a long COVID lockdown, Chinese investors are enjoying loose financial conditions. Tokens linked to China are likely to outperform, with $CFX being the prime example.

It’s certainly an interesting week for DeFi! All eyes are on $BTC –altcoins have a lot of catching up to do. Stay tuned for the next iteration of Cryptonary’s DeFi Digest!

And thanks for reading!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms